The Stock Market's Upward Trend: A Risky Proposition For Investors?

Table of Contents

Understanding the Current Stock Market Upward Trend

Identifying the Drivers of Growth

Several factors contribute to the current market rise. Understanding these drivers is crucial for assessing the trend's sustainability.

-

Economic indicators: Strong GDP growth, low unemployment rates, and controlled inflation often fuel market optimism. Positive economic data boosts investor confidence, leading to increased investment and higher stock prices. Conversely, rising inflation can erode purchasing power and impact investor sentiment negatively.

-

Government policies: Fiscal policies like tax cuts or infrastructure spending can stimulate economic activity and boost stock prices. Monetary policies, such as interest rate adjustments by central banks, significantly influence market behavior. Low interest rates generally encourage borrowing and investment, fueling market growth.

-

Technological advancements: Breakthroughs in technology, particularly in sectors like artificial intelligence, biotechnology, and renewable energy, often attract significant investment, driving sector-specific and overall market growth. Innovation creates new opportunities and drives economic expansion.

-

Investor sentiment: Market psychology plays a significant role. Periods of optimism and confidence can lead to a self-fulfilling prophecy of rising prices, while fear and uncertainty can trigger sell-offs, potentially leading to market corrections. Understanding investor sentiment is crucial for anticipating market shifts.

Analyzing the Sustainability of the Upward Trend

Assessing the long-term viability of the current market conditions requires a careful analysis of several key factors:

-

Valuations: High price-to-earnings ratios (P/E ratios) and other valuation metrics can indicate overvaluation, increasing the risk of a market correction. It’s vital to compare current valuations to historical averages and industry benchmarks.

-

Market cycles: The stock market is cyclical, experiencing periods of growth (bull markets) and decline (bear markets). Understanding historical market cycles provides context and helps assess the likelihood of a future correction. Identifying where we are in the current cycle is crucial for informed investment decisions.

-

Geopolitical risks: Global events like wars, trade disputes, and political instability significantly impact market stability. These unpredictable factors can trigger sudden market downturns, regardless of underlying economic strength.

Evaluating the Risks Associated with Investing in an Upward Trend

The Risk of Market Corrections

Even in an upward trend, the stock market is susceptible to sudden and sharp downturns known as market corrections.

-

Market volatility: Volatility refers to the degree of price fluctuation in the market. High volatility increases the risk of significant losses in a short period. Understanding and managing volatility is critical for any investor.

-

Identifying warning signs: Several indicators can signal an impending correction, including overbought conditions, declining market breadth (fewer stocks participating in the upward trend), and increased volatility. Careful monitoring of these indicators can help prepare for potential downturns.

-

Risk mitigation strategies: Diversification across various asset classes (stocks, bonds, real estate), hedging strategies (using derivatives to protect against losses), and stop-loss orders (automatic sell orders to limit potential losses) are effective risk mitigation strategies.

The Risk of Overvaluation

Investing in overvalued assets can lead to significant losses when the market corrects.

-

Bubble formation: Market bubbles occur when asset prices rise far beyond their intrinsic value, driven by speculation and hype. These bubbles eventually burst, leading to sharp price declines.

-

Identifying overvalued stocks: Analyzing fundamental data (earnings, revenue, debt levels), comparing valuations to industry peers, and considering future growth prospects are crucial for identifying potentially overvalued stocks.

-

The importance of fundamental analysis: Thorough due diligence and fundamental analysis are essential to avoid investing in overvalued assets and mitigate potential losses during a market correction.

Developing a Sound Investment Strategy in a Rising Market

Diversification and Risk Management

A well-diversified portfolio is crucial for managing risk and maximizing returns.

-

Asset allocation: Allocating assets across different asset classes (e.g., stocks, bonds, real estate) helps reduce overall portfolio volatility and protect against losses in any single asset class.

-

Portfolio diversification: Diversifying across different sectors (technology, healthcare, energy) and geographies helps reduce risk and enhance potential returns.

-

Regular portfolio review: Regularly reviewing and adjusting your portfolio based on market conditions, your risk tolerance, and your financial goals is essential for long-term success.

Long-Term Investing vs. Short-Term Gains

A long-term investment horizon offers significant advantages over chasing short-term gains.

-

Time horizon and risk tolerance: Your investment strategy should align with your investment time horizon and your risk tolerance. Long-term investors can withstand short-term market fluctuations better than those focused on short-term gains.

-

Compounding returns: The power of compounding allows your investments to grow exponentially over time, significantly enhancing long-term returns.

-

Emotional discipline: Avoiding impulsive decisions driven by short-term market fluctuations is critical for long-term investment success.

Conclusion

The stock market's upward trend presents both exciting opportunities and significant risks. While the potential for substantial gains is real, a cautious approach with a well-defined strategy is paramount. Understanding the drivers of growth, identifying potential pitfalls such as market corrections and overvaluation, and adopting a diversified, long-term investment approach are vital for navigating this dynamic market successfully. Don't let the allure of the current stock market upward trend lead to impulsive decisions. Instead, conduct thorough research, develop a sound investment plan tailored to your individual risk tolerance and financial goals, and remember that a deep understanding of the stock market's upward trend is key to long-term investment success.

Featured Posts

-

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025 -

Stock Market Today Dow Futures Decline Dollar Weakens Amid Trade Tensions

Apr 22, 2025

Stock Market Today Dow Futures Decline Dollar Weakens Amid Trade Tensions

Apr 22, 2025 -

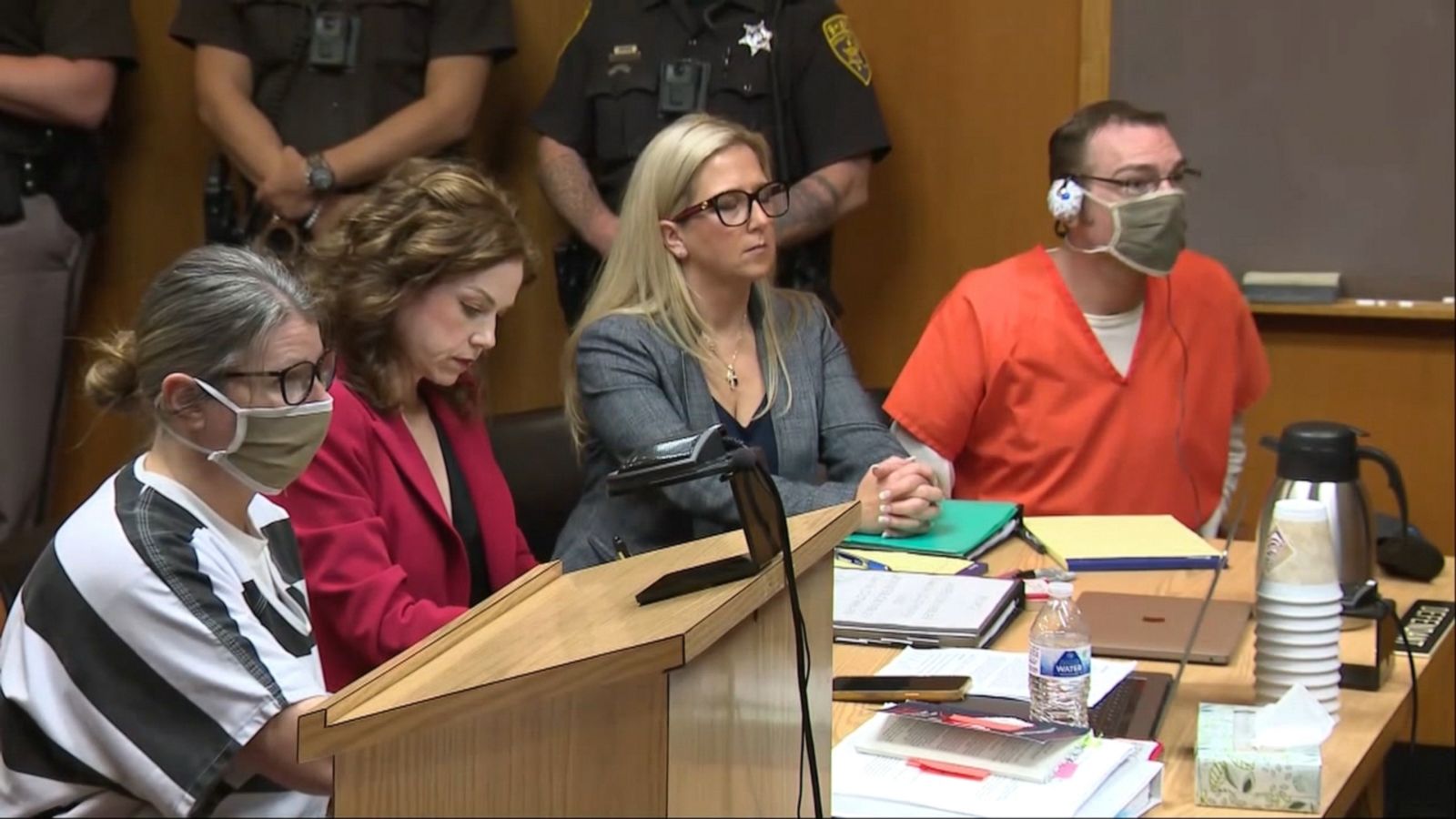

Lab Owners Guilty Plea Faked Covid 19 Test Results During Pandemic

Apr 22, 2025

Lab Owners Guilty Plea Faked Covid 19 Test Results During Pandemic

Apr 22, 2025 -

Pandemic Fraud Lab Owner Convicted For Falsified Covid Test Results

Apr 22, 2025

Pandemic Fraud Lab Owner Convicted For Falsified Covid Test Results

Apr 22, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

Apr 22, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

Apr 22, 2025