Trade War Fears Fuel Gold Price Surge: Is Bullion A Safe Investment?

Table of Contents

Understanding the Link Between Trade Wars and Gold Prices

The Safe Haven Effect

Geopolitical uncertainty, particularly trade wars, significantly impacts investor sentiment. When markets become volatile, investors often seek the safety of assets perceived as stable and less susceptible to market fluctuations. Gold, with its long history as a store of value, fits this description perfectly. This "flight to safety" drives up demand for gold, directly influencing the gold price surge we're witnessing.

- Increased Market Volatility: Trade wars create unpredictable market conditions, causing investors to seek stability.

- Flight to Safety: Investors move funds from riskier assets like stocks and bonds into perceived safe havens.

- Decreased Confidence in Riskier Assets: Uncertainty about future economic performance reduces confidence in traditionally higher-yielding investments.

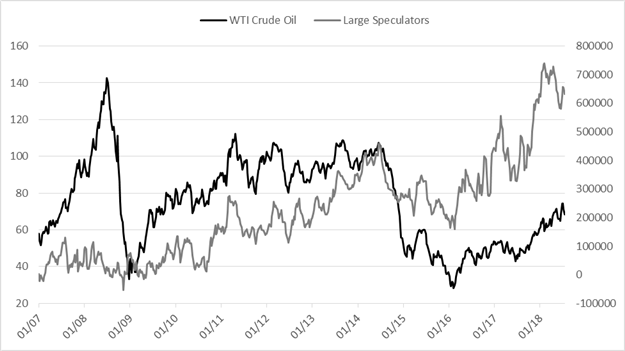

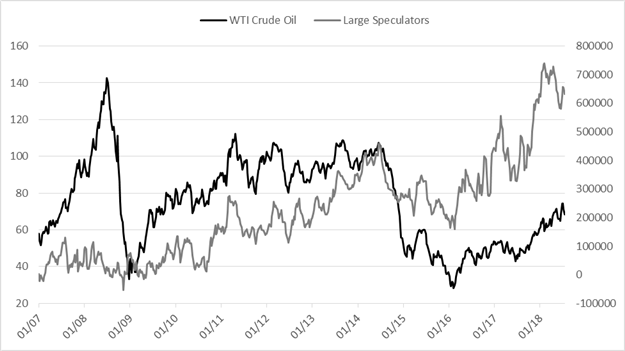

A clear correlation exists between escalating trade tensions and gold price increases. For instance, periods of heightened trade war rhetoric between major economies have historically coincided with significant gains in gold prices.

Currency Devaluation and Gold's Role

Trade wars often lead to currency fluctuations. When a nation engages in protectionist trade policies, its currency can weaken against others. Gold, being a non-fiat currency, acts as a hedge against such devaluation. Its value isn't tied to any single government or economy, making it an attractive asset during periods of currency instability.

- Weakening Dollar: Trade wars can weaken the US dollar, making gold, typically priced in dollars, more affordable for investors using other currencies.

- Hedging Against Currency Risk: Gold offers a way to protect investments from losses due to currency fluctuations.

- Diversification Benefits: Including gold in a portfolio can diversify holdings and reduce overall risk.

Inflationary Pressures

Trade wars often contribute to inflationary pressures. Tariffs and trade barriers increase the cost of imported goods, disrupting supply chains and driving up consumer prices. Gold is frequently considered an inflation hedge, as its value tends to rise with inflation.

- Increased Import Costs: Tariffs imposed during trade wars increase the price of imported goods.

- Supply Chain Disruptions: Trade barriers can create bottlenecks in global supply chains, leading to shortages and higher prices.

- Impact on Consumer Prices: Ultimately, these factors contribute to an overall increase in the cost of living.

Gold Bullion as a Safe Investment: Pros and Cons

Advantages of Investing in Gold Bullion

Investing in gold bullion offers several compelling advantages:

- Tangible Asset: Unlike digital assets, gold bullion is a physical asset you can possess.

- Historically Preserved Value: Gold has maintained its value throughout history, serving as a reliable store of wealth.

- Diversification Benefits: Gold's low correlation with other asset classes makes it an excellent portfolio diversifier.

- Hedge Against Inflation and Currency Fluctuations: Gold protects against the erosion of purchasing power caused by inflation and currency devaluation.

- Relatively Low Correlation with Other Asset Classes: Gold's price movements are often independent of stocks and bonds, making it a valuable tool for risk management.

Disadvantages of Investing in Gold Bullion

While gold bullion offers many advantages, it's crucial to consider its drawbacks:

- No Yield: Unlike bonds or dividend-paying stocks, gold bullion doesn't generate income.

- Price Volatility: Although less volatile than some assets during uncertainty, gold prices can still fluctuate significantly.

- Storage Costs: Securing gold bullion requires safe storage solutions, which can incur costs.

- Potential for Theft or Loss: Physical gold requires careful protection against theft or loss.

- Gold ETFs: Consider alternatives like gold ETFs for easier access and reduced storage concerns.

Alternative Gold Investments

Besides gold bullion, other investment options provide exposure to the gold market:

- Gold ETFs (Exchange-Traded Funds): These funds track the price of gold, offering liquidity and easier accessibility.

- Gold Mining Stocks: Investing in companies that mine gold provides leverage to gold price movements.

- Gold Mutual Funds: These funds pool investments in various gold-related assets, including bullion and mining stocks.

Strategies for Investing in Gold Bullion

Determining Investment Allocation

Determining the appropriate allocation of gold in your portfolio depends on your risk tolerance and investment goals. A financial advisor can help you determine a suitable percentage based on your individual circumstances. Generally, a small allocation (5-10%) is a common starting point for diversification.

Where to Buy Gold Bullion

Purchasing gold bullion requires careful selection of reputable dealers. Look for dealers with established reputations, transparent pricing, and secure delivery methods. Consider dealing with larger institutions or those with certifications and guarantees.

Storage and Security

Safeguarding your gold bullion investment is paramount. Options include:

- Home Safes: For smaller investments, a high-quality home safe is a possibility, but consider insurance.

- Bank Vaults: Banks offer secure storage options, but fees may apply.

- Specialized Storage Facilities: Companies specialize in storing precious metals, offering high security and insurance.

Conclusion: Is Gold Bullion Right for Your Investment Portfolio?

The recent gold price surge, driven by trade war fears, highlights gold's enduring role as a safe haven asset. While investing in gold bullion offers several advantages, including diversification and inflation hedging, it's essential to weigh the potential disadvantages, such as lack of yield and storage concerns. By carefully considering your risk tolerance, investment goals, and exploring alternative investment vehicles like gold ETFs, you can determine if gold bullion is a suitable addition to your investment strategy. Secure your investment portfolio with gold, hedge against trade war risks with gold, and consider diversifying with gold bullion today to mitigate the economic uncertainties of a volatile global market.

Featured Posts

-

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025 -

Fox News Faces Defamation Lawsuit From Jan 6 Figure Ray Epps

Apr 26, 2025

Fox News Faces Defamation Lawsuit From Jan 6 Figure Ray Epps

Apr 26, 2025 -

The Trump Administrations Influence On European Ai Policy

Apr 26, 2025

The Trump Administrations Influence On European Ai Policy

Apr 26, 2025 -

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025 -

The Role Of Human Creativity In The Ai Revolution A Microsoft Perspective

Apr 26, 2025

The Role Of Human Creativity In The Ai Revolution A Microsoft Perspective

Apr 26, 2025