Trade War Weighs On Eurozone: Simkus Suggests Further ECB Action

Table of Contents

The Impact of the Trade War on the Eurozone Economy

The ongoing trade war is inflicting significant damage on the Eurozone economy through multiple channels. The imposition of tariffs and retaliatory measures has led to a considerable decline in exports, particularly impacting export-oriented sectors. This decreased export performance is a major contributor to the slowdown in economic growth.

- Decreased exports due to tariffs and retaliatory measures: The automotive industry, for example, has been severely affected by tariffs imposed by the US and China, leading to reduced sales and production cuts across the Eurozone.

- Increased import costs, leading to higher prices for consumers and businesses: Tariffs on imported goods are driving up prices, squeezing consumer spending and reducing business profitability. This inflationary pressure further complicates the ECB's policy response.

- Disruption of global supply chains, affecting production and delivery times: The trade war has created uncertainty and logistical challenges, disrupting supply chains and impacting production schedules across various industries.

- Reduced business investment due to uncertainty and weaker demand: Businesses are hesitant to invest due to the prevailing economic uncertainty, leading to a further dampening effect on growth.

- Falling consumer confidence impacting spending and overall economic activity: Concerns about job security and rising prices are negatively affecting consumer confidence, leading to a decrease in overall spending.

Weakening Economic Indicators

The impact of the trade war is clearly visible in key economic indicators. GDP growth has slowed considerably across several Eurozone countries, falling below expectations in recent quarters. Inflation, while showing some signs of picking up, remains stubbornly below the ECB's target of "close to, but below, 2%". Unemployment figures, while generally low, are showing signs of stagnation, indicating a weakening labor market. Charts depicting these trends underscore the seriousness of the situation and the urgent need for intervention.

Simkus's Proposed ECB Actions

Dr. Simkus argues that the ECB needs to take more aggressive action to counter the negative consequences of the trade war. Her proposals include a combination of monetary policy tools aimed at stimulating economic activity and mitigating the impact of the trade-related shocks.

- Further interest rate cuts: Dr. Simkus suggests lowering interest rates further into negative territory to incentivize borrowing and investment. She acknowledges the potential limitations of negative interest rates but believes that the current situation warrants such a drastic step.

- Renewed quantitative easing (QE) program: She advocates for a renewed QE program, involving the purchase of government bonds and other assets by the ECB, to inject liquidity into the financial system and lower long-term interest rates.

- Targeted liquidity injections: Dr. Simkus suggests targeted liquidity injections to specific sectors heavily affected by the trade war, such as the automotive and manufacturing industries, to provide immediate relief and prevent widespread job losses.

Alternatives to ECB Action

While monetary policy plays a crucial role, Dr. Simkus also acknowledges the limitations of ECB action alone. She emphasizes the need for complementary fiscal policy measures by Eurozone governments. This could involve targeted government spending on infrastructure projects, investment incentives for businesses, and support for affected industries. Furthermore, she highlights the importance of structural reforms to boost long-term economic growth and enhance the Eurozone's resilience to external shocks.

Alternative Perspectives and Criticisms

While Dr. Simkus's proposals have gained traction, they have also faced criticism from some quarters. Some economists argue that further interest rate cuts would have limited effectiveness and might even lead to unintended consequences, such as asset bubbles and increased financial instability. Others suggest that relying solely on monetary policy is insufficient and that fiscal stimulus is crucial to address the root causes of the economic slowdown. The effectiveness of QE in the current environment is also debated, with concerns that it might not translate into increased investment and economic growth. Moreover, some critics point out the potential risks associated with further increasing the ECB's balance sheet.

Conclusion

The escalating trade war poses a significant threat to the Eurozone's economic stability. This article has highlighted the detrimental effects of the trade war on the Eurozone economy – decreased exports, increased import costs, supply chain disruptions, and reduced investment – and analyzed Dr. Simkus's proposed ECB interventions, including further interest rate cuts, renewed quantitative easing, and targeted liquidity injections, along with alternative perspectives and potential criticisms. The situation demands decisive action. Understanding the potential impact and proposed solutions is crucial for navigating this challenging period. Continue to follow developments in the Eurozone and the ECB's response to the ongoing trade war for further insights and analysis. Stay informed about the latest news regarding the ECB's monetary policy and its implications for the Eurozone economy. The future of the Eurozone hinges on effective responses to this global trade conflict.

Featured Posts

-

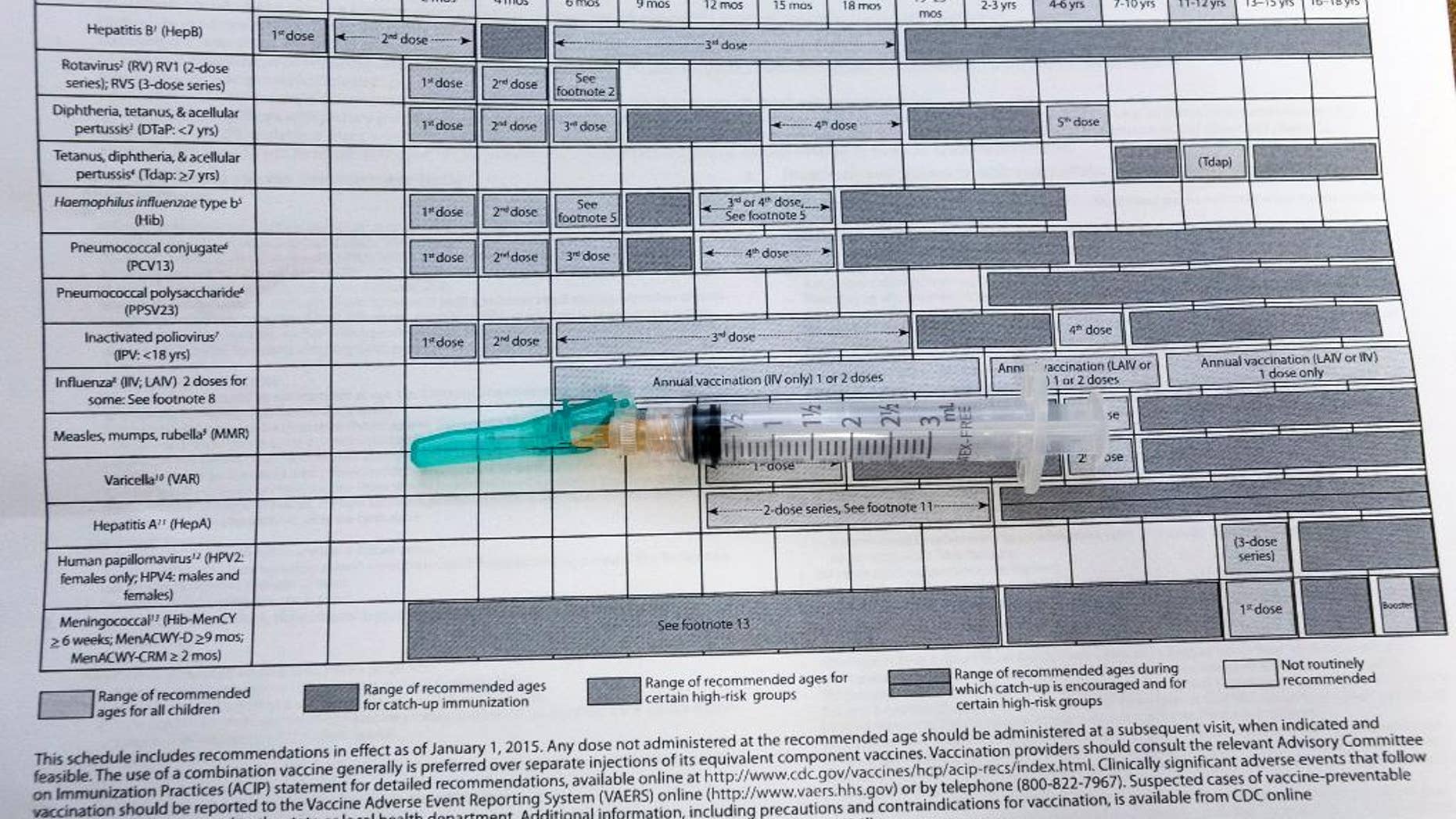

New Vaccine Study Examining The Cdcs Controversial Hire

Apr 27, 2025

New Vaccine Study Examining The Cdcs Controversial Hire

Apr 27, 2025 -

Juliette Binoche Appointed Head Of Cannes Jury

Apr 27, 2025

Juliette Binoche Appointed Head Of Cannes Jury

Apr 27, 2025 -

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025 -

Possession 1981 Exploring The Dualities Of Sister Faith And Sister Chance

Apr 27, 2025

Possession 1981 Exploring The Dualities Of Sister Faith And Sister Chance

Apr 27, 2025 -

Get The Look Ariana Grandes New Hair And Tattoo Style

Apr 27, 2025

Get The Look Ariana Grandes New Hair And Tattoo Style

Apr 27, 2025