Trump's Economic Policies: A Difficult Inheritance For The Next Fed Chair

Table of Contents

The Tax Cuts and Jobs Act of 2017: A Double-Edged Sword

The Tax Cuts and Jobs Act of 2017, a cornerstone of Trump's economic agenda, significantly reduced both corporate and individual income tax rates. This resulted in a substantial short-term economic stimulus, boosting corporate profits and consumer spending. However, this stimulus came at a cost. The significant tax cuts dramatically increased the national debt, raising concerns about long-term fiscal sustainability.

The debate continues regarding the long-term effects of these tax cuts on economic growth and income inequality. While proponents argue they spurred investment and job creation, critics point to the widening gap between the rich and the poor, arguing that the benefits disproportionately favored high-income earners.

- Corporate tax rate reduction to 21%: This dramatic reduction was intended to boost corporate investment and competitiveness.

- Individual tax bracket changes: These changes lowered rates for many individuals but also phased out certain deductions, creating complexity and varied impacts.

- Increased national debt: The significant revenue loss associated with the tax cuts led to a substantial increase in the national debt, raising concerns about future economic stability.

- Debate on the effectiveness of stimulating long-term growth: The long-term impact of the TCJA remains a subject of ongoing economic analysis and debate, with varying conclusions drawn by different economists.

Deregulation and its Impact on Financial Stability

Another key aspect of Trump's economic policies was a significant rollback of financial regulations implemented after the 2008 financial crisis. The administration argued that these regulations were overly burdensome and hindered economic growth. However, critics warned that reduced oversight increased the risk of another financial crisis. The Dodd-Frank Act, designed to prevent future meltdowns, saw significant weakening under the Trump administration.

This deregulation impacted various sectors. The banking industry experienced reduced regulatory scrutiny, potentially leading to increased risk-taking by financial institutions. Environmental regulations were also significantly weakened, potentially increasing environmental risks and long-term costs.

- Reduced Dodd-Frank Act regulations: Weakening of consumer protection measures and reduced oversight of financial institutions.

- Impact on consumer protection: Less stringent regulations potentially left consumers more vulnerable to predatory lending practices and financial exploitation.

- Increased risk-taking by financial institutions: Reduced oversight may have encouraged greater risk-taking, potentially increasing the vulnerability of the financial system.

- Potential for future financial instability: The long-term consequences of reduced regulation are still unfolding, raising concerns about the stability of the financial system.

Trade Wars and Global Uncertainty

Trump's administration initiated a series of trade disputes, imposing tariffs on goods from various countries, particularly China. These trade wars significantly disrupted global supply chains, leading to increased prices for consumers and businesses. The uncertainty created by these trade policies also dampened investment and economic growth.

The impact on American businesses varied widely, with some benefiting from protectionist measures while others suffered from increased input costs and reduced export markets. The effects on consumers included higher prices for imported goods and uncertainty in the global marketplace.

- Trade disputes with China: A significant source of global economic uncertainty and disruption to supply chains.

- Impact on import and export prices: Tariffs increased the cost of imported goods, while export restrictions impacted the prices of domestically produced goods.

- Disruption of global supply chains: Trade wars created significant disruptions in global supply chains, impacting businesses worldwide.

- Uncertainty in the global economic outlook: The unpredictable nature of Trump's trade policies created significant uncertainty, hindering investment and economic growth.

Navigating Inflationary Pressures

The economic policies implemented during the Trump administration, coupled with global factors, contributed to rising inflation rates. The next Fed Chair will inherit this challenge and will need to carefully balance the need to control inflation with the desire to maintain economic growth. Supply chain disruptions caused by the trade wars, rising energy prices, and increased consumer demand all contribute to inflationary pressures.

- Rising energy prices: A significant contributor to overall inflation.

- Supply chain disruptions: Trade wars and other factors disrupted supply chains, leading to increased prices and shortages.

- Increased consumer demand: Strong consumer demand, fueled partly by earlier stimulus measures, put upward pressure on prices.

Conclusion

The economic landscape inherited by the next Fed Chair, significantly shaped by Trump's economic policies, presents a formidable challenge. Understanding the complexities of the Tax Cuts and Jobs Act, the effects of deregulation, and the lingering impact of trade wars is crucial for effective monetary policy. Successfully navigating inflationary pressures while fostering sustainable economic growth requires careful consideration of these long-term consequences. The next Fed Chair must develop a nuanced strategy to address these issues and ensure the long-term health and stability of the US economy. Further analysis of Trump's economic policies and their implications for future monetary policy is critical for informed decision-making. A deep understanding of Trump's economic policies is essential for navigating the current economic climate.

Featured Posts

-

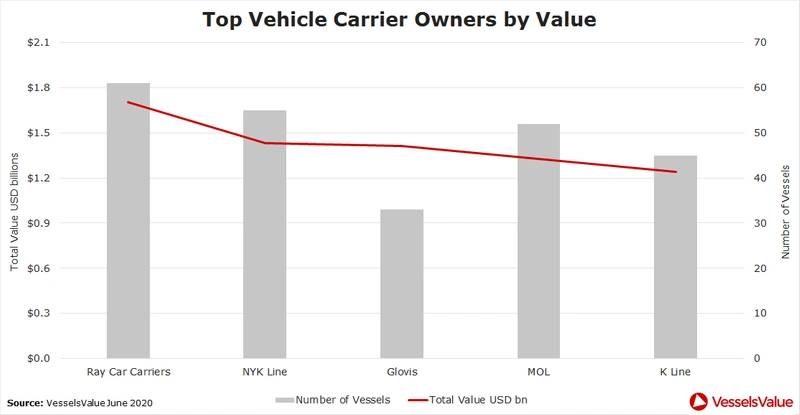

Auto Carrier Faces 70 Million Loss Due To Us Port Fee Increases

Apr 26, 2025

Auto Carrier Faces 70 Million Loss Due To Us Port Fee Increases

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Stance In Recent Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Stance In Recent Time Interview

Apr 26, 2025 -

From Scatological Data To Engaging Audio An Ai Driven Podcast Solution

Apr 26, 2025

From Scatological Data To Engaging Audio An Ai Driven Podcast Solution

Apr 26, 2025 -

Building The Future Of Design Microsofts Approach To Human Ai Integration

Apr 26, 2025

Building The Future Of Design Microsofts Approach To Human Ai Integration

Apr 26, 2025 -

Re Hired After Layoff Navigating The Offer

Apr 26, 2025

Re Hired After Layoff Navigating The Offer

Apr 26, 2025