Trump's Influence On Bitcoin: A Market Analysis

Table of Contents

H2: Trump's Tweets and Bitcoin's Volatility

H3: Analyzing the Correlation

Donald Trump's frequent use of Twitter became a defining feature of his presidency. His unpredictable tweets often sent shockwaves through global markets, and the cryptocurrency world was no exception. While establishing a direct causal link is difficult, several instances suggest a correlation between Trump's pronouncements and Bitcoin price movements. For example, tweets concerning impending trade wars or regulatory changes frequently coincided with significant Bitcoin price swings.

- Specific examples of tweets and their immediate impact on Bitcoin: A tweet criticizing a particular country could lead to increased demand for Bitcoin as investors sought refuge from geopolitical uncertainty. Conversely, positive economic news might lead to a decline in Bitcoin's price as investors moved to traditional markets. Specific examples should be researched and cited with reliable sources for maximum impact.

- Statistical analysis (if available) showing correlation between Trump's activity and Bitcoin price changes: Quantitative studies analyzing the correlation between Trump's tweets and Bitcoin price movements could provide compelling evidence. This section would benefit from including charts and graphs illustrating this correlation (or lack thereof).

- Mention limitations of correlation analysis – not necessarily causation: It's crucial to emphasize that correlation does not equal causation. While a correlation may exist between Trump's tweets and Bitcoin price changes, this doesn't definitively prove a direct causal relationship. Other factors could be at play simultaneously. Keyword Integration: "Trump Bitcoin correlation," "Trump tweets Bitcoin price," "Bitcoin market volatility Trump."

H2: Regulatory Uncertainty Under Trump and Bitcoin

H3: The Impact of Regulatory Stances

The Trump administration's approach to cryptocurrency regulation was characterized by a degree of ambiguity. This regulatory uncertainty significantly affected investor sentiment and consequently, Bitcoin's price. The lack of clear guidelines created both opportunities and challenges for the cryptocurrency market.

- Mention specific regulatory actions or announcements (or lack thereof) under Trump's presidency: This section should delve into specific actions or statements made by the Trump administration regarding cryptocurrency regulation or taxation, noting their impact on the market.

- Analyze the impact of these actions on Bitcoin adoption and investment: Did regulatory uncertainty hinder or encourage Bitcoin adoption? How did it influence institutional investment in cryptocurrencies?

- Discuss the uncertainty surrounding cryptocurrency regulation and its effect on market stability: The lack of clarity around regulatory frameworks often created market volatility as investors reacted to speculation and rumors. Keyword Integration: "Bitcoin regulation Trump," "cryptocurrency regulation impact," "Trump administration Bitcoin policy."

H2: Geopolitical Events and Bitcoin's Safe Haven Status

H3: Trump's Foreign Policy and Bitcoin

Trump's foreign policy decisions, characterized by unpredictability and trade disputes, significantly influenced Bitcoin's perceived status as a safe-haven asset. During times of geopolitical instability, investors often turn to Bitcoin as a hedge against traditional market risks.

- Examples of geopolitical events during Trump's presidency and their effect on Bitcoin's price: This section would analyze the impact of specific events—e.g., trade wars, international sanctions, or diplomatic disputes—on Bitcoin's price and its role as a safe haven.

- Explain the concept of Bitcoin as a safe haven asset during times of uncertainty: Clarify why investors view Bitcoin as a safe haven asset, emphasizing its decentralized nature and immunity to traditional economic shocks.

- Analyze whether these events strengthened or weakened Bitcoin's position as a safe haven: Did the events during Trump's presidency reinforce or challenge Bitcoin's safe-haven status? Keyword Integration: "Bitcoin safe haven," "geopolitical risk Bitcoin," "Trump foreign policy Bitcoin."

H2: The Overall Economic Climate and Bitcoin

H3: Economic Policies and Bitcoin's Performance

Trump's economic policies, including tax cuts and trade wars, had a broad impact on the US economy and, consequently, on Bitcoin's performance. These policies influenced investor confidence and market sentiment, affecting the cryptocurrency market.

- Analyze the effect of specific economic policies on Bitcoin: Did tax cuts or trade wars stimulate or depress Bitcoin's price? How did these policies affect investor confidence in both traditional and cryptocurrency markets?

- Discuss the relationship between macroeconomic indicators and Bitcoin's performance: Explore the correlation between macroeconomic indicators (e.g., inflation, interest rates, GDP growth) and Bitcoin's price movements during Trump's presidency.

- Explain how investor confidence, influenced by Trump's economic policies, impacted the cryptocurrency market: How did shifts in investor confidence due to Trump's policies affect the flow of capital into and out of the cryptocurrency market? Keyword Integration: "Bitcoin economic impact," "Trump economic policies Bitcoin," "macroeconomic factors Bitcoin."

3. Conclusion

This analysis reveals a complex relationship between Trump's presidency and Bitcoin's price movements. While a direct causal link is difficult to establish definitively, there is evidence suggesting a correlation between his actions, pronouncements, and the cryptocurrency's volatility. Trump's tweets, regulatory uncertainty, foreign policy decisions, and economic policies all appear to have played a role in shaping the Bitcoin market during his tenure. The key takeaway is the significant impact global political events can have on the cryptocurrency market, highlighting the interconnectedness of seemingly disparate factors.

To fully understand the influence of political figures on Bitcoin, further research is essential. Explore the impact of other world leaders on Bitcoin's price and continue to monitor the dynamic relationship between politics and the cryptocurrency market. Stay informed about the ever-evolving world of Trump's influence on Bitcoin and the cryptocurrency market as a whole.

Featured Posts

-

Legal Setbacks For Trump Administrations Immigration Agenda

Apr 24, 2025

Legal Setbacks For Trump Administrations Immigration Agenda

Apr 24, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 24, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 24, 2025 -

Facebooks Fate Zuckerbergs Leadership During The Trump Era

Apr 24, 2025

Facebooks Fate Zuckerbergs Leadership During The Trump Era

Apr 24, 2025 -

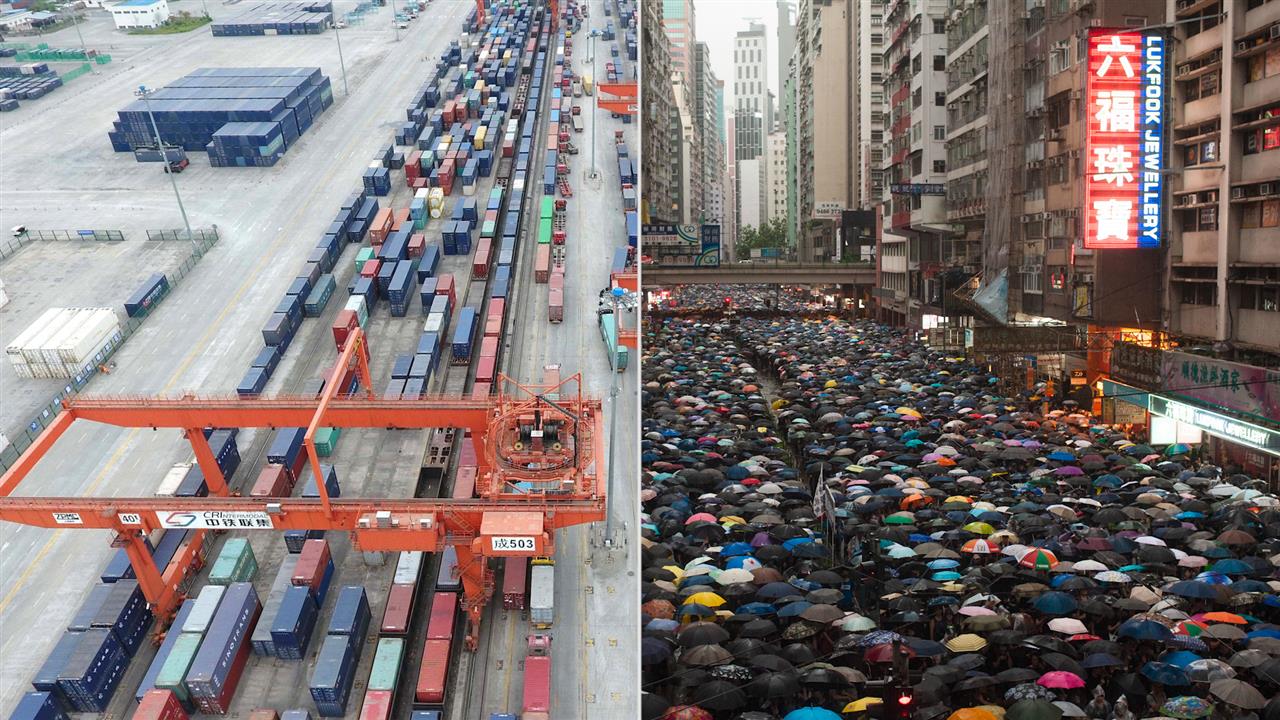

Hong Kongs Chinese Stock Market Responds To Trade Developments

Apr 24, 2025

Hong Kongs Chinese Stock Market Responds To Trade Developments

Apr 24, 2025 -

Is Open Ai Buying Google Chrome Analysis Of The Chat Gpt Ceos Remarks

Apr 24, 2025

Is Open Ai Buying Google Chrome Analysis Of The Chat Gpt Ceos Remarks

Apr 24, 2025