Trump's Retracted Fed Comments Boost US Dollar

Table of Contents

The Initial Market Reaction to Trump's Comments

President Trump's comments criticized the Fed's monetary policy, expressing concerns about interest rate hikes and their potential impact on economic growth. He suggested the Fed was acting against the interests of the US economy, potentially hindering growth and job creation. These statements, delivered with characteristic bluntness, sent shockwaves through financial markets.

The immediate impact on the US dollar was a noticeable appreciation. The currency saw a sharp increase in value against several major currencies, reflecting a flight to safety as investors reacted to the uncertainty introduced by Trump's pronouncements.

- The USD/EUR pair saw a significant drop, indicating a strengthening dollar.

- Similarly, the USD/JPY pair experienced a notable increase, further illustrating the dollar's rise.

- Trading volumes spiked dramatically, showing heightened market activity and volatility in response to the news.

- Major news outlets like the Wall Street Journal and Bloomberg reported significant market fluctuations.

The Retraction and its Market Impact

Following the initial market turmoil, President Trump retracted his previous statements, clarifying his position or perhaps walking back his criticism of the Fed. While the reasons behind the retraction remain subject to speculation, it is likely a combination of pressure from advisors concerned about market instability and recognition of the potential negative consequences of his initial comments.

The market responded to the retraction with a degree of volatility, but the impact was less dramatic than the initial surge. While the dollar did see some decrease from its peak, it largely held onto its gains. This suggests that while Trump's initial comments had a significant immediate impact, their retraction partially mitigated the effect.

- The post-retraction market saw a dampening of volatility compared to the initial reaction.

- Investor confidence, while shaken, didn't completely collapse after the retraction.

- The impact on investor sentiment towards the US economy was less severe than initially feared.

- The event underscored the interconnectedness of political rhetoric and market dynamics.

Underlying Factors Contributing to the Dollar's Strength

While Trump's comments played a significant role in the initial market reaction, several other factors contributed to the US dollar's relative strength. These factors demonstrate that the influence of political announcements is frequently intertwined with broader economic and geopolitical trends.

Macroeconomic factors played a substantial role. The relatively strong performance of the US economy, compared to some of its international counterparts, supported a higher demand for the dollar.

- Positive US economic indicators, including GDP growth, further contributed to the dollar's strength.

- Compared to the Eurozone or Japan, the US economy showed relatively stronger performance, making the dollar more attractive.

- Geopolitical factors, such as ongoing trade tensions, might have influenced safe-haven flows into the US dollar.

The Role of Market Speculation and Sentiment

Market speculation significantly amplified the initial reaction to Trump's comments. Traders, anticipating potential policy changes or further intervention from the administration, reacted swiftly. This highlights the importance of market psychology and how expectations shape price movements in the foreign exchange market.

- Market sentiment played a crucial role in both the initial surge and subsequent correction of the dollar.

- Traders often overreact to news events, particularly those with significant political implications.

- Understanding market sentiment is crucial for interpreting price movements in the forex market.

Conclusion

Trump's retracted comments regarding the Federal Reserve's actions provide a compelling case study of the complex interplay between political pronouncements, market sentiment, and currency fluctuations. The initial surge in the US dollar's value, followed by a partial correction after the retraction, underscores the significant impact that political uncertainty can have on financial markets. While Trump's comments were the catalyst for the initial dramatic movement, underlying economic and geopolitical factors also contributed to the dollar's relative strength. Understanding these interconnected forces is crucial for navigating the complexities of the global financial landscape. Stay informed on how future Fed announcements or political statements might affect the US dollar—understanding this complex relationship is key to successful investing. Want to understand the intricate relationship between political statements and US dollar fluctuations? Subscribe to our newsletter today!

Featured Posts

-

Los Angeles Wildfires And The Problem Of Disaster Betting Markets

Apr 24, 2025

Los Angeles Wildfires And The Problem Of Disaster Betting Markets

Apr 24, 2025 -

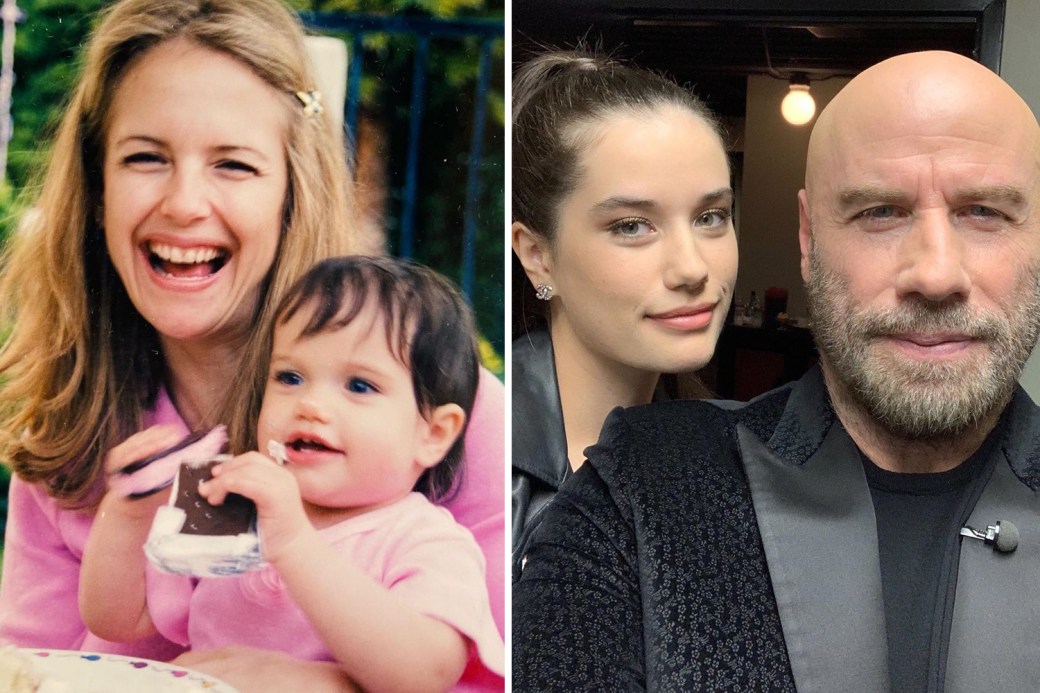

A Fathers Memory John Travoltas Birthday Post For Jett Travolta

Apr 24, 2025

A Fathers Memory John Travoltas Birthday Post For Jett Travolta

Apr 24, 2025 -

People Betting On La Wildfires A Troubling Trend

Apr 24, 2025

People Betting On La Wildfires A Troubling Trend

Apr 24, 2025 -

The Closure Of Anchor Brewing Company 127 Years Of Brewing History

Apr 24, 2025

The Closure Of Anchor Brewing Company 127 Years Of Brewing History

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liams Collapse After Explosive Bill Confrontation

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After Explosive Bill Confrontation

Apr 24, 2025