U.S. Dollar Faces Steepest Decline Since Nixon Era: A 100-Day Assessment

Table of Contents

Factors Contributing to the Dollar's Decline

Several interconnected factors have fueled the recent decline of the U.S. dollar. These range from weakening domestic economic indicators to rising interest rates in other countries and escalating geopolitical instability.

Weakening U.S. Economic Indicators

The U.S. economy is showing signs of strain, impacting investor confidence and consequently, the dollar's value. Declining consumer confidence, coupled with persistent inflation, is creating a climate of uncertainty.

- Declining Consumer Confidence: A weakening consumer confidence index reflects reduced spending and a pessimistic outlook, negatively affecting economic growth and putting downward pressure on the dollar.

- Rising Inflation: Persistently high inflation erodes purchasing power and prompts concerns about the Federal Reserve's ability to control price increases. This fuels investor anxieties and leads to capital flight, weakening the dollar.

- Slowing GDP Growth: Slower-than-expected GDP growth signals a potential economic slowdown, further diminishing investor confidence in the U.S. economy and pushing down the dollar's value.

Bullet Points:

- Inflation rates: Currently hovering above the Federal Reserve's target.

- GDP figures: Showing signs of deceleration in recent quarters.

- Consumer Confidence Index: Experiencing a consistent downward trend.

- Unemployment data: While low, rising wage pressures contribute to inflationary pressures.

Rising Interest Rates in Other Countries

Higher interest rates in major economies outside the U.S. are attracting significant foreign investment, diverting capital away from dollar-denominated assets.

- Increased Interest Rate Differentials: Larger interest rate differentials between the U.S. and other countries make foreign investments more attractive, reducing demand for the dollar.

- Central Bank Policies: The actions of central banks globally, particularly in tightening monetary policy, influence interest rate differentials and impact currency exchange rates.

- Foreign Investment Flows: Capital is flowing towards higher-yielding assets in countries with robust monetary policies, diminishing the demand for the dollar.

Bullet Points:

- Interest rate differentials between US and other major economies (e.g., Eurozone, UK, Japan): Showing a widening gap.

- Central bank policies: Many central banks are aggressively raising interest rates to combat inflation.

- Foreign investment flows: A noticeable shift away from U.S. assets towards those offering higher returns.

Geopolitical Instability and its Influence

Global geopolitical uncertainties, particularly the war in Ukraine, are significantly impacting investor sentiment and contributing to the dollar's weakness.

- War in Ukraine and Global Market Volatility: The conflict has created significant uncertainty in global energy markets and supply chains, impacting economic growth and investor confidence worldwide.

- Escalating Global Tensions: Rising geopolitical risks often lead to capital flight as investors seek safer havens, putting pressure on the dollar.

- Sanctions and International Trade: Sanctions imposed on Russia have disrupted international trade and created further economic uncertainty, contributing to the dollar's decline.

Bullet Points:

- Geopolitical risk factors: The war in Ukraine, tensions in the Taiwan Strait, and other global conflicts.

- Sanctions impact: Disruption of supply chains and increased commodity prices.

- Capital flight: Investors are moving funds to perceived safer assets.

- Investor sentiment: Negative sentiment is prevalent due to geopolitical uncertainty.

Global Implications of a Weakening Dollar

The decline of the U.S. dollar has significant ramifications for the global economy, impacting emerging markets, international trade, and global investment strategies.

Impact on Emerging Markets

A weaker dollar increases debt servicing costs for emerging market nations that have borrowed heavily in U.S. dollars.

- Debt Burdens: Emerging market countries face higher costs to repay dollar-denominated debt, potentially leading to financial instability.

- Commodity Prices: Fluctuations in commodity prices, influenced by the dollar's value, significantly affect importing countries, especially those reliant on dollar-denominated trade.

- Currency Crises: The weakening dollar can trigger currency crises in vulnerable emerging markets.

Bullet Points:

- Debt servicing costs: Increasing for emerging markets with dollar-denominated debt.

- Commodity prices: Volatility in commodity prices due to dollar fluctuations.

- Currency volatility: Increased risk of currency crises in emerging markets.

- Emerging market crises: Potential for increased financial instability in developing economies.

Effects on International Trade

A weaker dollar makes U.S. exports more competitive but increases the cost of imports.

- US Exports and Imports: Increased exports boost the U.S. trade balance, while higher import costs impact consumers.

- US Competitiveness: A weaker dollar enhances the competitiveness of U.S. goods and services in global markets.

- Trade Balances: The impact on trade balances is complex, influenced by various factors beyond just currency exchange rates.

Bullet Points:

- Export/import data: Tracking changes in the volume of exports and imports.

- Trade balance figures: Monitoring the difference between exports and imports.

- US competitiveness: Assessing the impact on the competitiveness of U.S. goods and services.

Consequences for Global Investment

The weakening dollar is causing shifts in global investment flows and portfolio diversification strategies.

- Foreign Investment Flows: Changes in foreign investment into and out of the U.S. are directly influenced by the dollar's value.

- Portfolio Diversification: Global investors are adjusting their portfolio strategies to account for dollar volatility.

- Risk Appetite: The decline in the dollar is affecting global risk appetite, leading to potential shifts in investment strategies.

Bullet Points:

- Foreign investment data: Tracking inflows and outflows of foreign capital.

- Portfolio shifts: Analyzing adjustments made by investors to their investment portfolios.

- Risk appetite indicators: Monitoring changes in investor sentiment and risk tolerance.

Potential Future Scenarios for the U.S. Dollar

The future trajectory of the U.S. dollar depends on several interacting factors.

- Continued Decline: Further weakening is possible if economic indicators continue to decline and geopolitical uncertainty persists.

- Stabilization: The dollar may stabilize if the U.S. economy shows signs of recovery and geopolitical tensions ease.

- Recovery: A recovery is possible if the Federal Reserve effectively controls inflation and investor confidence improves.

Bullet Points:

- Economic forecasts: Analyzing various economic projections for the U.S. and global economies.

- Geopolitical risk assessments: Evaluating the likelihood of escalating or de-escalating geopolitical tensions.

- Potential policy responses: Considering the potential actions of the Federal Reserve and other central banks.

Conclusion

The recent steep decline of the U.S. dollar, reminiscent of the Nixon era, is a multi-faceted issue driven by a complex interplay of economic and geopolitical factors. This 100-day assessment underscores the significant ramifications of this weakening dollar, impacting everything from emerging markets and international trade to global investment strategies. Understanding the underlying factors contributing to the dollar's decline is paramount for successfully navigating the current economic uncertainty. Staying informed about changes in U.S. economic indicators, interest rate differentials, and geopolitical developments is crucial for both investors and businesses. Continuous monitoring of the U.S. dollar and its fluctuations is essential for effective strategic planning in these volatile times. Keep abreast of the latest developments in the U.S. dollar and its global impact to make sound financial decisions.

Featured Posts

-

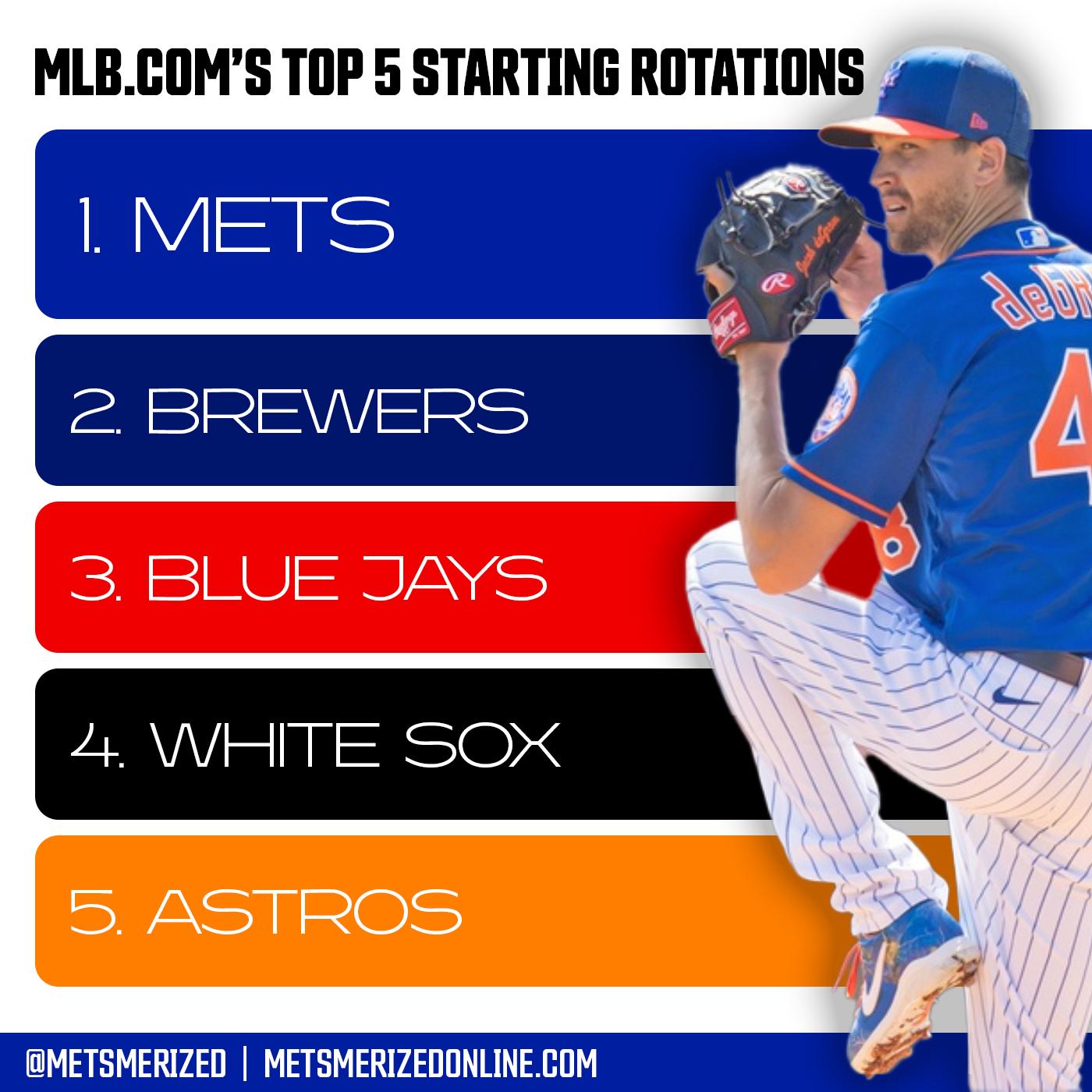

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 28, 2025

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 28, 2025 -

Your Guide To Buying Authentic 2025 New York Yankees Hats And Jerseys

Apr 28, 2025

Your Guide To Buying Authentic 2025 New York Yankees Hats And Jerseys

Apr 28, 2025 -

Actors And Writers Strike What It Means For Hollywood Productions

Apr 28, 2025

Actors And Writers Strike What It Means For Hollywood Productions

Apr 28, 2025 -

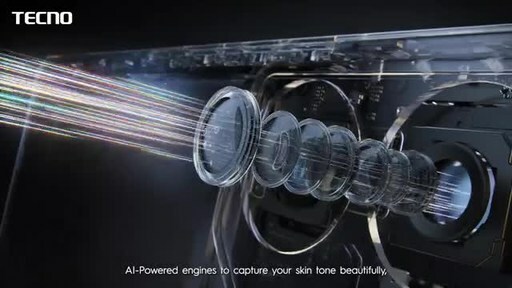

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

The Greatest Basketball Announcer Mike Breens Choice Is Marv Albert

Apr 28, 2025

The Greatest Basketball Announcer Mike Breens Choice Is Marv Albert

Apr 28, 2025