Understanding High Stock Market Valuations: BofA's Take

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

Bank of America, a global leader in financial services and market analysis, offers valuable insights into the current market environment. While specific outlooks change frequently, BofA generally employs a combination of qualitative and quantitative analysis to gauge market sentiment and valuations. They utilize several key valuation metrics to assess whether current stock prices are justified. These include:

-

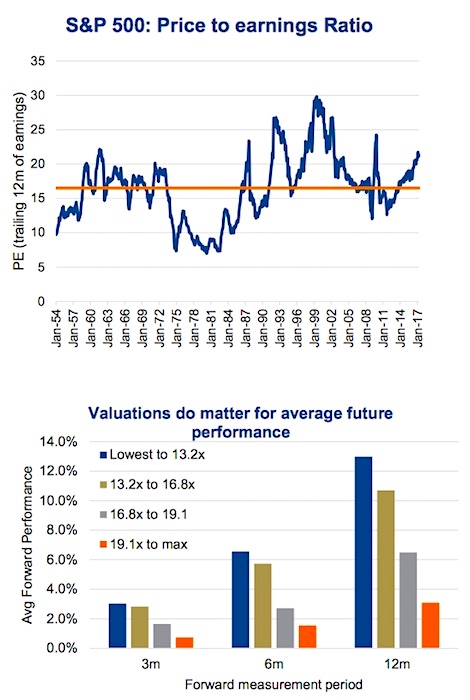

Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for future earnings growth. BofA analyzes P/E ratios across various sectors and compares them to historical averages to identify potential overvaluations or undervaluations.

-

Shiller P/E Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out short-term earnings fluctuations to provide a more stable measure of valuation. BofA often incorporates CAPE into its analysis to gain a long-term perspective on valuations.

-

Price-to-Sales Ratio (P/S Ratio): This ratio compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with negative earnings or high growth potential.

Bullet Points:

- Current P/E Ratio: As of [insert current date], the S&P 500's P/E ratio might be [insert current data] – BofA's interpretation of this would be [insert BofA's perspective, e.g., slightly above historical average, indicating potential for moderate correction]. Remember to replace bracketed information with actual current data.

- Comparison to Historical Averages: BofA's analysis will likely compare current P/E and CAPE ratios to their historical averages over the past 10, 20, or even 50 years to determine if current valuations are unusually high or low.

- Valuation Discrepancies: BofA will analyze valuation discrepancies across different sectors. For instance, technology stocks might have significantly higher P/E ratios than more cyclical industries due to different growth prospects.

Factors Contributing to High Stock Market Valuations (According to BofA)

BofA's analysis of high stock market valuations likely considers several interacting factors:

-

Low Interest Rates: Historically low interest rates make bonds less attractive, encouraging investors to seek higher returns in riskier assets, such as stocks. This increased demand drives up stock prices.

-

Quantitative Easing (QE): QE programs inject liquidity into the market, lowering borrowing costs and boosting asset prices. BofA's analysis will consider the impact of past and present QE initiatives on market valuations.

-

Corporate Earnings (or Lack Thereof): Strong corporate earnings growth can support higher stock valuations. However, if earnings growth doesn't keep pace with rising stock prices, it raises concerns about overvaluation. BofA's analysis will thoroughly examine the relationship between earnings and market prices.

-

Technological Innovation: The rapid pace of technological innovation drives growth in specific sectors, contributing to higher valuations for companies at the forefront of these advancements.

-

Geopolitical Factors: Global trade tensions, geopolitical instability, and other uncertainties can influence investor sentiment and market valuations.

Bullet Points:

- Low Interest Rate Example: BofA might highlight companies in sectors like real estate or infrastructure, which benefit significantly from low borrowing costs.

- QE Impact: The effect of QE on specific sectors, like technology or consumer discretionary, will be analyzed and explained.

- Earnings Growth Data: BofA will likely present data showing the correlation between earnings growth and stock price movements.

BofA's Predictions and Recommendations Regarding High Stock Market Valuations

BofA's outlook on future market performance and valuation levels will be based on their comprehensive analysis. Their recommendations for investors – buy, hold, sell, or diversify – will be driven by this outlook and considerations of risk.

Bullet Points:

- Projected Growth Rates: BofA might provide projected growth rates for different market sectors, based on their economic forecasts and assessments of company performance.

- Investment Strategies: BofA's recommendations may include specific investment strategies, such as sector rotation or focusing on companies with strong fundamentals and sustainable growth prospects.

- Market Corrections: BofA's analysis might highlight potential risks associated with current high valuations, including the possibility of market corrections or even bubbles.

Alternative Perspectives on High Stock Market Valuations

It's essential to acknowledge that different financial institutions and analysts may hold contrasting viewpoints on current market valuations. Some might argue that current valuations are justified by strong long-term growth prospects, while others may express concerns about overvaluation and the potential for a market correction. This section should include links to reports from other major financial institutions providing alternative perspectives.

Bullet Points:

- Valuation Models: Summarize the different valuation models used by other analysts (e.g., discounted cash flow analysis).

- Contrasting Opinions: Compare and contrast the predictions and opinions of other analysts with BofA's assessment.

- External Research: Provide links to research reports from other institutions like Goldman Sachs, JP Morgan, etc., for a balanced view.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis of high stock market valuations provides valuable insights into the complex interplay of economic factors influencing current market conditions. Understanding these factors, including low interest rates, QE policies, corporate earnings, technological innovation, and geopolitical events, is crucial for making informed investment decisions. While BofA's outlook offers guidance, it's essential to remember that market prediction is inherently uncertain.

Stay informed about high stock market valuations and learn more about BofA's expert insights to make strategic investment choices. Evaluating high stock market valuations requires a nuanced understanding of various factors, and expert analysis, like that provided by BofA, can significantly aid investors in navigating this complex landscape.

Featured Posts

-

Toxic Chemical Residue In Buildings Following Ohio Train Derailment

Apr 22, 2025

Toxic Chemical Residue In Buildings Following Ohio Train Derailment

Apr 22, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 22, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 22, 2025 -

The Pan Nordic Army A Combined Strength Of Swedish Tanks And Finnish Troops

Apr 22, 2025

The Pan Nordic Army A Combined Strength Of Swedish Tanks And Finnish Troops

Apr 22, 2025 -

Harvard And The Trump Administration A 1 Billion Funding Battle

Apr 22, 2025

Harvard And The Trump Administration A 1 Billion Funding Battle

Apr 22, 2025 -

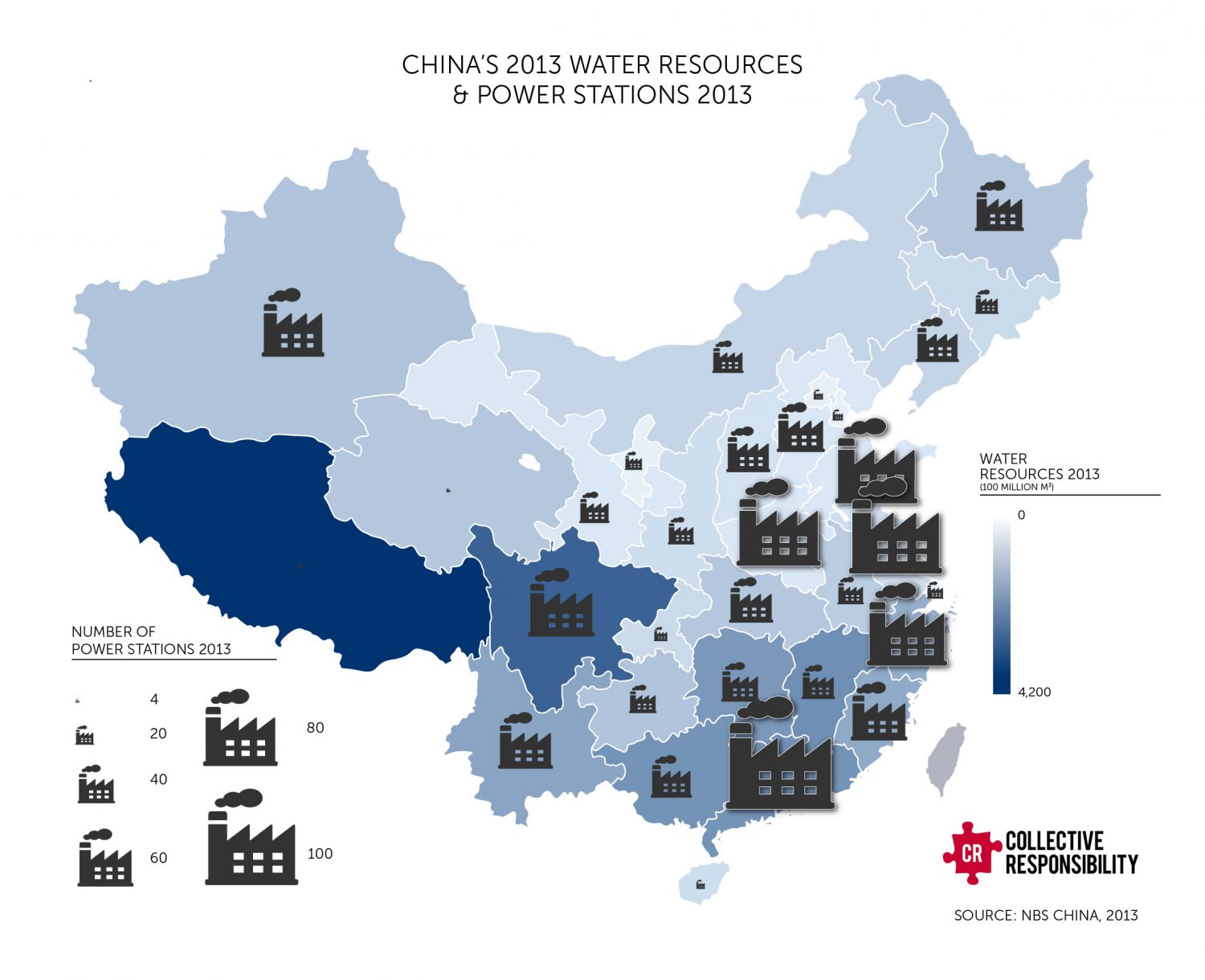

Bmw And Porsches China Challenges A Growing Trend

Apr 22, 2025

Bmw And Porsches China Challenges A Growing Trend

Apr 22, 2025