US Economic Growth To Slow Considerably: Deloitte's Prediction

Table of Contents

Deloitte's Key Findings and Methodology

Deloitte's prediction forecasts a considerable decrease in US GDP growth. While the exact percentage varies depending on the timeframe considered (Deloitte's report should specify this), the firm projects a significantly lower rate compared to previous years and initial projections for the current year. This forecast isn't a mere guess; it's the result of rigorous analysis using sophisticated economic modeling techniques. Deloitte's methodology likely incorporates a blend of econometric models, analyzing key economic indicators such as consumer spending, inflation rates, and manufacturing output. Extensive data analysis, including surveys of business leaders and consumers, further refines the prediction.

- Projected GDP growth rate for the next [insert time period, e.g., 12 months]: [Insert Deloitte's projected percentage from their report]. This represents a [percentage] decrease compared to [previous period's growth rate].

- Impact on key economic sectors: The slowdown is expected to disproportionately affect certain sectors. Manufacturing, heavily reliant on global supply chains, faces significant headwinds. Consumer spending, already impacted by inflation, is likely to further moderate. Investment in new projects may also decrease as businesses adopt a more cautious approach.

- Regional variations in predicted growth: The impact of the slowdown is unlikely to be uniform across the US. Some regions might experience a sharper decline than others, depending on their industrial composition and exposure to the factors driving the slowdown.

- Comparison with previous growth forecasts and actual results: Deloitte’s forecast should be compared to its previous predictions and to the actual GDP growth figures reported in previous periods to assess the accuracy of its models and highlight any significant deviations.

Underlying Factors Contributing to the Slowdown

Several intertwined factors contribute to Deloitte's prediction of a US economic slowdown. Understanding these factors is critical to navigating the challenges ahead.

- Persistent inflation and its impact on consumer spending: High inflation erodes purchasing power, forcing consumers to cut back on discretionary spending. This reduced demand impacts businesses' revenue and investment decisions.

- The Federal Reserve's monetary policy and rising interest rates: The Federal Reserve's efforts to combat inflation through interest rate hikes increase borrowing costs for businesses and consumers, dampening investment and economic activity. This is a crucial component of Deloitte's "Deloitte economic outlook".

- Ongoing global supply chain challenges: Disruptions to global supply chains continue to constrain production, driving up prices and limiting the availability of goods and services.

- Geopolitical instability and its effects on the economy: Global conflicts and geopolitical tensions create uncertainty, impacting trade, investment, and commodity prices.

- Decreased consumer confidence: Concerns about inflation, job security, and the overall economic outlook lead to reduced consumer confidence, further dampening spending.

Implications for Businesses and Investors

The predicted economic slowdown presents significant challenges and opportunities for businesses and investors.

- Increased challenges for businesses in securing funding: Higher interest rates make it more expensive for businesses to borrow money, hindering expansion plans and potentially leading to financial distress for some.

- Potential for reduced consumer demand and sales: Lower consumer spending directly impacts businesses' revenue, forcing them to adapt their strategies and potentially reduce workforce.

- Need for businesses to adapt their strategies to navigate the slowdown: Businesses must develop robust contingency plans, optimize operations, and explore new market opportunities to mitigate the impact of the slowdown.

- Opportunities for investors in specific sectors: While some sectors may struggle, others might thrive. Investors need to carefully assess the risks and opportunities in different sectors to build resilient portfolios.

- Importance of risk mitigation and diversification: Diversification is key to mitigating risk in a volatile market. Investors should diversify their portfolios across different asset classes and geographies to weather the economic storm.

Government Policy Responses and Their Potential Impact

Government policy responses will play a crucial role in shaping the severity and duration of the economic slowdown.

- Potential government spending initiatives: Fiscal stimulus measures, such as increased government spending on infrastructure or social programs, could boost aggregate demand and mitigate the impact of the slowdown.

- Further adjustments to interest rates by the Federal Reserve: The Federal Reserve might continue to adjust interest rates based on inflation and economic growth data, attempting to strike a balance between controlling inflation and avoiding a sharp recession.

- Potential impact of government policies on inflation and growth: The effectiveness of government policies in addressing both inflation and promoting growth is crucial. There is a delicate balance to achieve.

- Effectiveness of different policy options: The effectiveness of different policy options depends on various factors, including the severity of the slowdown and the specific economic conditions at the time.

Conclusion: Navigating the Predicted Slowdown in US Economic Growth

Deloitte's prediction of considerably slower US economic growth highlights the need for proactive planning and adaptation. The key factors driving this slowdown—persistent inflation, rising interest rates, supply chain issues, geopolitical uncertainty, and decreased consumer confidence—demand a comprehensive and nuanced response. The implications for businesses are significant, necessitating strategic adjustments to navigate reduced consumer demand and secure funding. Investors, too, must adopt a cautious and diversified approach to mitigate risks. Understanding the full implications of this forecast is crucial for both businesses and investors. Download Deloitte's full report to understand the implications for your business and develop strategies to navigate this predicted slowdown in US economic growth. Prepare for the slowdown: Consult with financial experts to create a resilient investment strategy.

Featured Posts

-

Wta Abu Dhabi Bencics Triumphant Return

Apr 27, 2025

Wta Abu Dhabi Bencics Triumphant Return

Apr 27, 2025 -

How Ariana Grandes Stylist Achieved Her New Look

Apr 27, 2025

How Ariana Grandes Stylist Achieved Her New Look

Apr 27, 2025 -

Ecb Seeks To Simplify Banking Regulation With New Task Force

Apr 27, 2025

Ecb Seeks To Simplify Banking Regulation With New Task Force

Apr 27, 2025 -

World No 1 Sinners Doping Case Resolved

Apr 27, 2025

World No 1 Sinners Doping Case Resolved

Apr 27, 2025 -

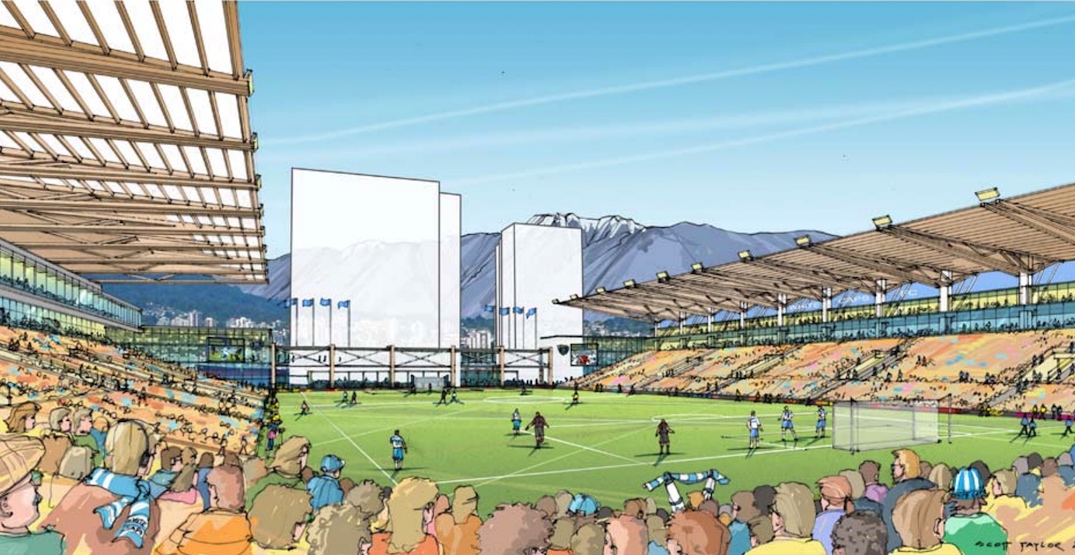

Whitecaps Eye New Stadium At Pne Fairgrounds Talks Underway

Apr 27, 2025

Whitecaps Eye New Stadium At Pne Fairgrounds Talks Underway

Apr 27, 2025