US Port Fees To Hit Auto Carrier With Up To $70 Million

Table of Contents

The $70 Million Penalty: Details and Implications

The Accusation

A major auto carrier faces a potential $70 million penalty due to alleged violations of US port regulations. The accusations involve multiple instances of non-compliance, primarily focused on missed deadlines for container processing and handling, and failure to adhere to specified procedures for reporting cargo information.

- Specific examples of violations: Failure to submit accurate manifests for over 1000 containers within the designated timeframe; repeated delays in unloading and processing imported vehicles, leading to port congestion; incorrect documentation regarding hazardous materials.

- Quantifiable data: The violations spanned a period of six months, impacting the efficient flow of over 5,000 vehicles through major US ports such as Los Angeles and Long Beach.

- Regulatory bodies involved: The investigation is being conducted by the Federal Maritime Commission (FMC) and the relevant port authorities.

Financial Impact on the Auto Carrier

A $70 million penalty represents a substantial financial blow for any auto carrier. The potential consequences are severe, potentially impacting the company's financial health and operational capabilities.

- Potential for layoffs: The financial strain could necessitate cost-cutting measures, including potential layoffs and reduced workforce.

- Reduced investment: The need to address the penalty may force the company to reduce or postpone planned investments in new technologies or infrastructure.

- Impact on stock price: For publicly traded companies, such a penalty would likely result in a significant negative impact on the stock price, eroding shareholder value and investor confidence.

- Potential bankruptcy scenarios: In a worst-case scenario, the financial burden could lead to bankruptcy or require significant restructuring of the company's operations.

Ripple Effects on the Automotive Industry

The penalty's ramifications extend far beyond the affected auto carrier. The entire automotive industry faces potential consequences.

- Increased shipping costs: To offset potential future penalties, auto carriers might increase shipping costs, which will be passed down the supply chain.

- Potential price hikes for consumers: Increased shipping costs will likely translate into higher prices for new vehicles, making them less affordable for consumers.

- Delays in vehicle deliveries: Continued port congestion and inefficiencies could lead to further delays in the delivery of new vehicles to dealerships and customers.

- Industry-wide lobbying efforts: The industry might intensify lobbying efforts to push for regulatory reform and address the underlying issues contributing to high US port fees.

Underlying Issues Contributing to High US Port Fees

Port Congestion and Inefficiency

Chronic port congestion is a major contributor to high US port fees. Several factors exacerbate the problem.

- Statistics on port wait times: Ships frequently experience significant delays waiting to unload, with average wait times exceeding several days in major ports.

- Container backlog numbers: Millions of containers remain backlogged at US ports, clogging terminals and hindering efficient operations.

- Examples of specific port bottlenecks: Inadequate infrastructure, limited space for container storage, and insufficient equipment contribute to these bottlenecks.

- Economic impact of port congestion: Congestion leads to lost revenue for businesses, delayed shipments, increased storage costs, and a general disruption of the supply chain, adding significant cost pressure.

Increasing Operational Costs

The rising operational costs at US ports significantly contribute to high fees.

- Breakdown of cost increases: Labor costs, maintenance expenses, security measures, and technology upgrades are primary factors driving up operational expenses.

- Comparison to costs in other countries: Compared to ports in other developed nations, US port costs are often significantly higher, reducing competitiveness.

- Passing on increased costs: Port authorities often pass these increased operational costs onto shippers, which inevitably affects the price of goods and vehicles.

Lack of Infrastructure Investment

Insufficient investment in US port infrastructure is a critical factor driving up costs and inefficiencies.

- Examples of needed infrastructure improvements: Deeper channels to accommodate larger vessels, improved rail connections for efficient inland transportation, enhanced technology for streamlined cargo handling, and modernized terminal facilities are all necessary.

- Government funding and policy: Increased government funding and strategically planned investments are essential to address the infrastructure deficit.

Potential Solutions and Future Outlook for US Port Fees

Investing in Modernization and Technology

Investing in automation, AI, and other advanced technologies can dramatically improve port efficiency and reduce operational costs.

- Examples of successful technological implementations: Automated container handling systems, real-time tracking technologies, and predictive analytics can optimize port operations.

- Potential return on investment: While upfront costs are significant, the long-term benefits in terms of reduced delays, increased throughput, and lower operational costs make technological investments worthwhile.

Improving Labor Relations and Efficiency

Improved labor relations and enhanced productivity are critical for efficient port operations.

- Potential strategies for collaboration: Open communication, collaborative problem-solving, and fair labor practices are crucial for fostering positive relationships.

- Impact of workforce training and skill development: Investing in workforce training and upskilling programs can increase efficiency and productivity.

Policy Changes and Regulatory Reform

Policy adjustments and regulatory reforms are needed to address the underlying issues driving high US port fees.

- Examples of potential legislative changes: Streamlining regulatory processes, promoting competition among port operators, and providing incentives for infrastructure investment are potential areas for legislative action.

- Potential political challenges: Implementing significant policy changes often faces political hurdles and requires consensus among various stakeholders.

Conclusion

The $70 million penalty levied against the auto carrier serves as a stark warning about the escalating costs and challenges facing the US automotive industry due to high US port fees. Addressing port congestion, improving infrastructure, and fostering efficient labor relations are crucial for reducing costs and ensuring the smooth flow of goods. Failure to act decisively risks further supply chain disruptions, increased vehicle prices, and a weakened competitive position for the US automotive sector. We need immediate action to reform US port fees and avoid similar situations in the future. Stay informed about developments concerning US port fees and their impact on the auto industry and advocate for changes that will ease the burden on businesses and consumers alike.

Featured Posts

-

Nfl Draft Green Bays First Round Preview And Predictions

Apr 26, 2025

Nfl Draft Green Bays First Round Preview And Predictions

Apr 26, 2025 -

Dow Futures Fluctuate Chinas Economic Support Pledge Amid Trade Tensions

Apr 26, 2025

Dow Futures Fluctuate Chinas Economic Support Pledge Amid Trade Tensions

Apr 26, 2025 -

Ukraines Nato Future A Skeptical View From Trump

Apr 26, 2025

Ukraines Nato Future A Skeptical View From Trump

Apr 26, 2025 -

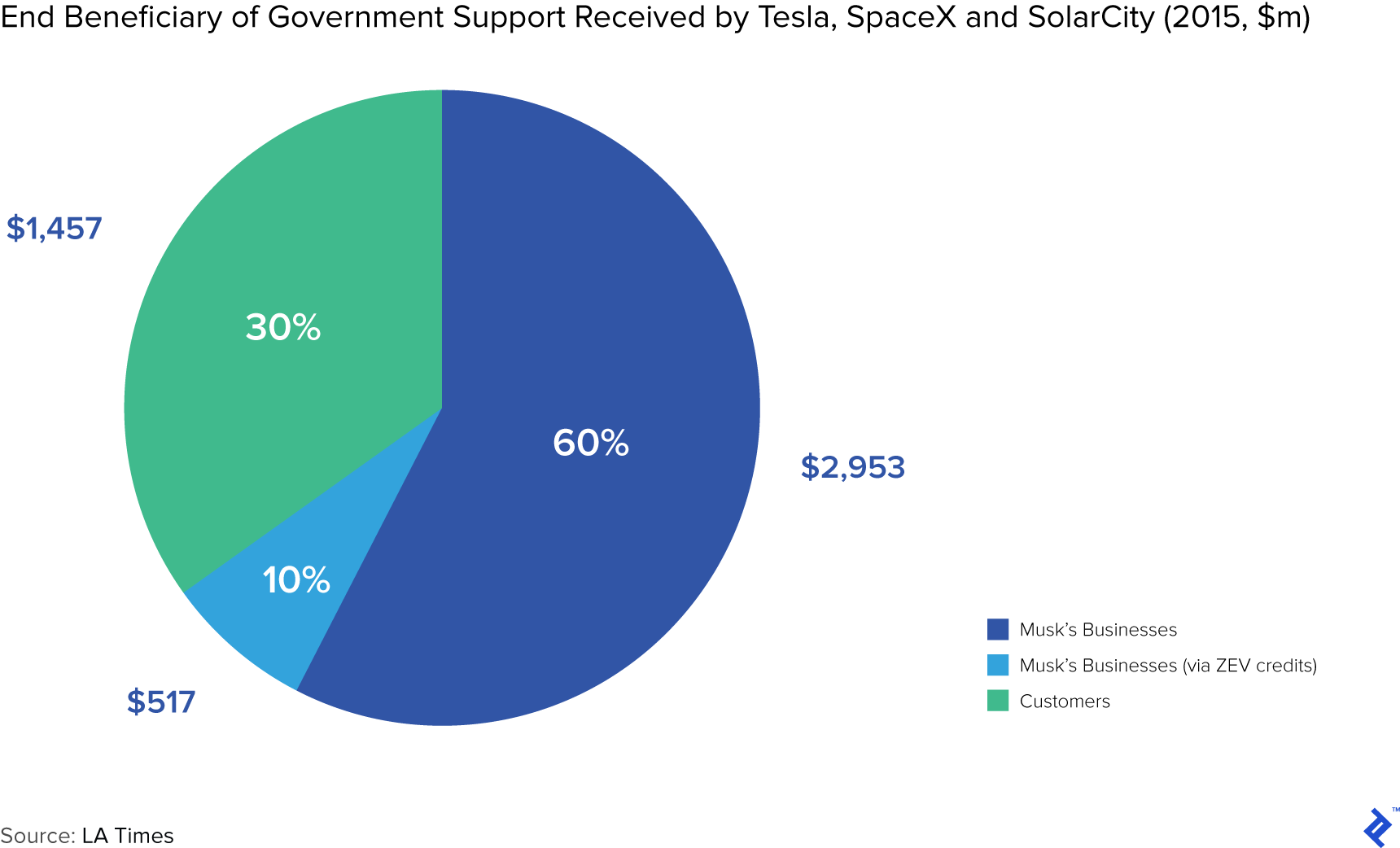

Gaining Access To Elon Musks Investments A Potential Side Hustle

Apr 26, 2025

Gaining Access To Elon Musks Investments A Potential Side Hustle

Apr 26, 2025 -

Green Bay Hosts The Nfl Drafts First Round What To Expect

Apr 26, 2025

Green Bay Hosts The Nfl Drafts First Round What To Expect

Apr 26, 2025