US Stock Market Attracts Record Canadian Investment: Trade War Implications

Table of Contents

The Rise of Canadian Investment in US Stocks

Several factors contribute to the significant increase in Canadian investment in the US stock market.

Diversification Strategies

Canadian investors are increasingly looking south to diversify their portfolios. The Canadian economy, traditionally reliant on resource sectors, presents inherent risks. Diversifying into the larger and more diverse US market mitigates this risk.

- Reduced reliance on Canadian resource-based economy: Fluctuations in commodity prices directly impact Canadian resource stocks. US stocks offer diversification away from this volatility.

- Access to a wider range of investment opportunities: The US market boasts a vast array of companies across diverse sectors like technology, healthcare, and consumer goods, offering Canadian investors significantly more options than the Canadian market.

- Potential for higher returns compared to Canadian markets: Historically, the US market has shown higher growth potential, attracting investors seeking potentially higher returns on their investments.

- Hedging against Canadian dollar fluctuations: Investing in US dollars can act as a hedge against fluctuations in the Canadian dollar, protecting the value of Canadian investors' portfolios.

Favorable US Market Conditions

Despite trade tensions, the US market remains attractive to foreign investors, including Canadians.

- Relatively strong economic growth in the US: The US economy generally exhibits robust growth, creating a favorable environment for investment.

- Large and liquid markets offering greater trading opportunities: The size and liquidity of the US stock market ensure easy entry and exit, facilitating efficient trading for Canadian investors.

- Abundant investment options across various sectors: A wide range of sectors and investment styles provides Canadian investors with choices to align with their risk tolerance and investment goals.

- Availability of sophisticated investment tools and resources: Access to advanced financial tools, research, and analysis makes investing in the US market more streamlined and efficient.

Low Interest Rates in Canada

Low interest rates in Canada have pushed investors towards higher-yield assets in the US.

- Search for better returns on investment: Low interest rates on Canadian bonds and savings accounts make US equities a more attractive alternative for higher returns.

- Increased appetite for riskier, higher-potential assets: Seeking higher yields often involves accepting higher risk, leading Canadian investors to explore riskier, higher-growth assets in the US market.

- Shift from fixed-income investments to equities: As fixed-income investments offer lower returns in a low-interest-rate environment, investors shift towards equities to potentially offset inflation and increase their returns.

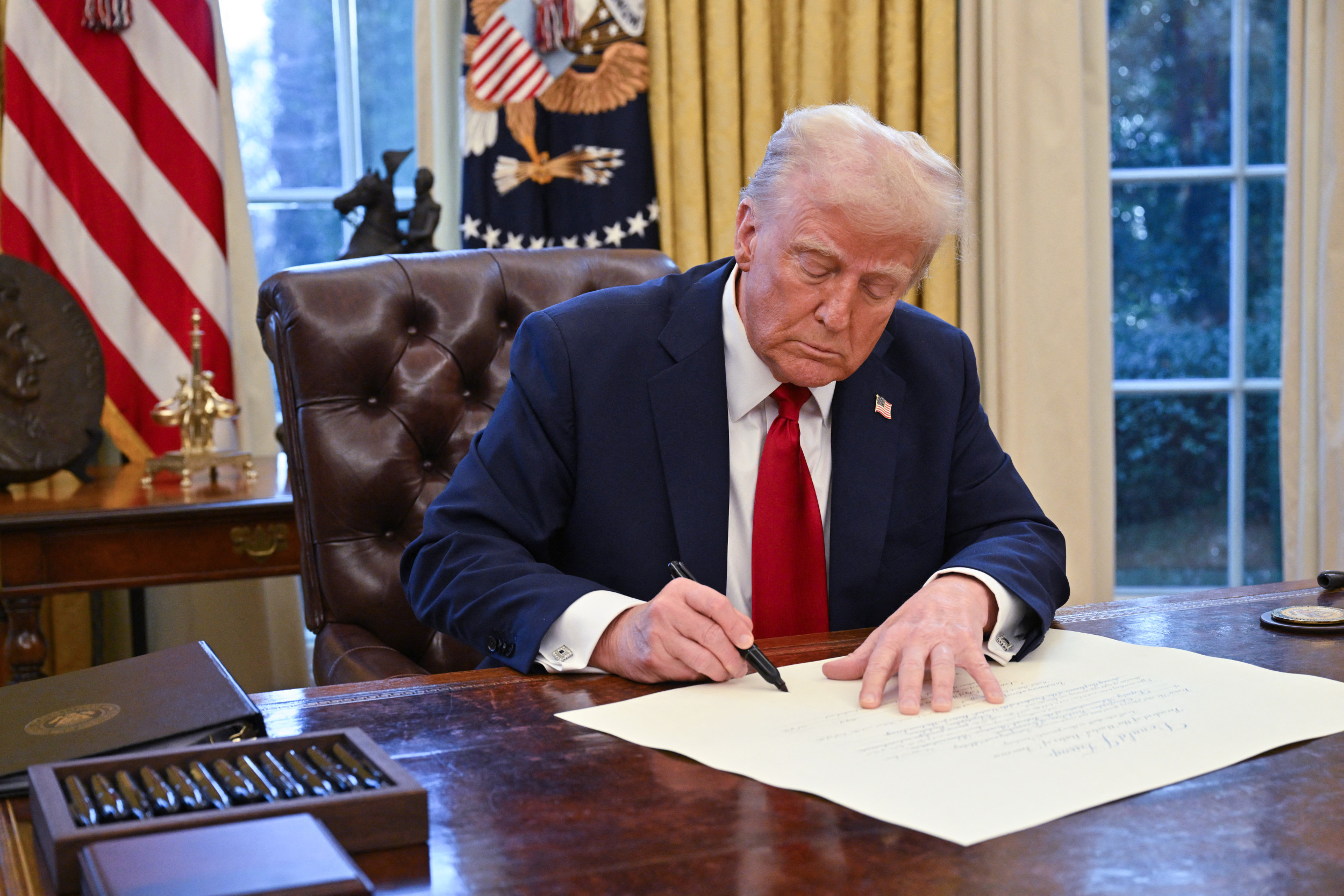

Trade War Implications on Canadian Investment

The ongoing trade disputes between the US and other countries, including indirect impacts on Canada, introduce uncertainty and potential risks to Canadian investment in US stocks.

Uncertainty and Volatility

Trade wars create market volatility, impacting investor confidence and investment decisions.

- Impact on specific sectors heavily reliant on cross-border trade: Sectors significantly impacted by tariffs and trade restrictions experience increased volatility.

- Potential for increased investment costs due to tariffs and trade barriers: Tariffs and trade barriers can increase the cost of goods and services, impacting corporate profitability and potentially reducing investment returns.

- Increased risk assessment by investors: Investors must carefully assess the risks associated with trade wars when making investment decisions.

Strategic Adjustments by Investors

Canadian investors are adapting their investment strategies to mitigate the risks associated with trade wars.

- Diversification across different sectors and asset classes: Investors spread their investments across various sectors and asset classes to reduce their exposure to any single risk.

- Increased focus on risk management and hedging strategies: Sophisticated hedging techniques and risk management strategies are employed to minimize potential losses.

- Close monitoring of trade developments and policy changes: Investors closely follow trade negotiations and policy changes to assess their potential impact on investments.

Long-Term Outlook

The long-term impact of trade wars on Canadian investment in the US stock market remains uncertain.

- Potential for increased investment if trade tensions ease: A resolution of trade disputes could lead to increased investor confidence and further investment.

- Potential for reduced investment if trade wars escalate: Escalating trade tensions could negatively impact investor confidence and lead to reduced investment.

- Need for careful monitoring and adaptable investment strategies: Canadian investors need to continuously monitor the situation and adjust their investment strategies accordingly.

Conclusion

Record Canadian investment in the US stock market reflects a complex interplay of factors, including diversification strategies, favorable US market conditions, and low Canadian interest rates. While the ongoing trade war introduces uncertainty and volatility, Canadian investors are adapting their strategies to navigate this environment. The future direction of this investment trend hinges significantly on the resolution of trade disputes and the evolving economic landscape. Understanding these implications is crucial for Canadian investors making decisions about their US stock market exposure. Continue to monitor the situation and adjust your investment strategy accordingly to make informed decisions about Canadian investment in the US stock market.

Featured Posts

-

Posthaste Impact How Trumps Tariffs Hit Canadian Consumers

Apr 23, 2025

Posthaste Impact How Trumps Tariffs Hit Canadian Consumers

Apr 23, 2025 -

Anonsirovan Noviy Merch Pavel Pivovarov I Aleksandr Ovechkin

Apr 23, 2025

Anonsirovan Noviy Merch Pavel Pivovarov I Aleksandr Ovechkin

Apr 23, 2025 -

Mlb Player Props And Best Bets Today Jazz Strikes In Steeltown

Apr 23, 2025

Mlb Player Props And Best Bets Today Jazz Strikes In Steeltown

Apr 23, 2025 -

Baseball Power Rankings Fan Graphs Perspective March 27 April 6

Apr 23, 2025

Baseball Power Rankings Fan Graphs Perspective March 27 April 6

Apr 23, 2025 -

New York Yankees Opening Day Victory Formula For Success Revealed

Apr 23, 2025

New York Yankees Opening Day Victory Formula For Success Revealed

Apr 23, 2025