Wall Street Finds Refuge In Netflix As Big Tech Faces Headwinds

Table of Contents

Big Tech's Headwinds: A Perfect Storm?

The current downturn in Big Tech is a multifaceted issue, encompassing several interconnected challenges. The combination of these factors has created a "perfect storm," impacting investor confidence and driving a search for alternative investment opportunities. Keywords: Big Tech downturn, tech stock correction, inflation, interest rates, recession fears, regulatory scrutiny, antitrust concerns.

- Inflationary Pressures: Soaring inflation has squeezed consumer spending, reducing discretionary income available for tech products and services. This impacts demand for both hardware and software, slowing revenue growth for many tech giants.

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes aim to combat inflation, but they also increase borrowing costs for tech companies, hindering expansion and impacting valuations. Higher interest rates make future earnings less valuable, leading to lower stock prices.

- Recession Fears: Growing concerns about a potential recession are further dampening investor sentiment. In times of economic uncertainty, investors often move away from riskier growth stocks, including many in the tech sector.

- Regulatory Scrutiny and Antitrust Concerns: Increased regulatory scrutiny and antitrust investigations are adding to the challenges faced by Big Tech. These legal battles can be expensive and time-consuming, diverting resources and potentially impacting future growth. Companies like Google, Facebook (Meta), and Amazon have all faced significant regulatory pressure in recent years.

- Intensifying Competition: The tech sector is fiercely competitive, with new entrants and established players constantly vying for market share. This intense competition puts pressure on pricing and profitability, affecting the bottom lines of even the largest tech companies.

Bullet Points:

- Meta (formerly Facebook) experienced a significant stock price decline in 2022, reflecting concerns about slowing user growth and increased competition.

- The Nasdaq Composite, a tech-heavy index, experienced a substantial correction in 2022, highlighting the broader downturn in the sector.

- Experts predict continued volatility in the tech sector, with the potential for further corrections depending on macroeconomic factors.

Netflix's Unexpected Resilience: A Safe Haven?

While Big Tech grapples with headwinds, Netflix has demonstrated surprising resilience, becoming a haven for investors seeking stability. Keywords: Netflix stock performance, subscriber growth, streaming market growth, content strategy, competition in streaming, advertising revenue.

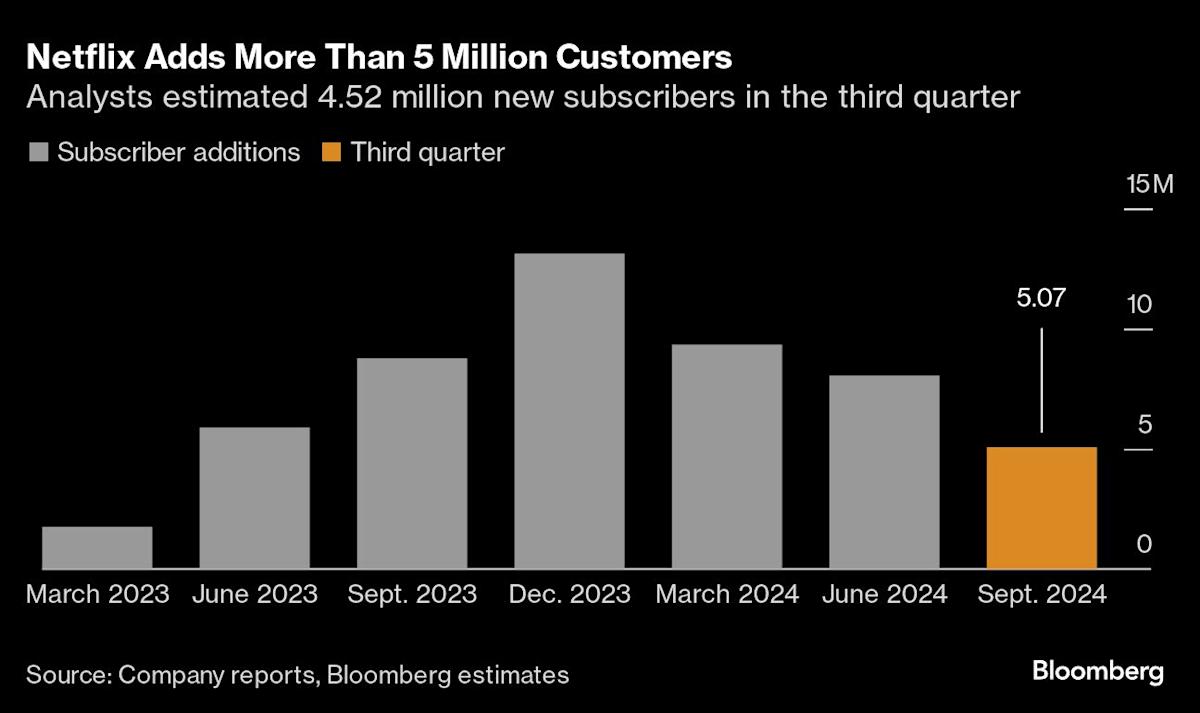

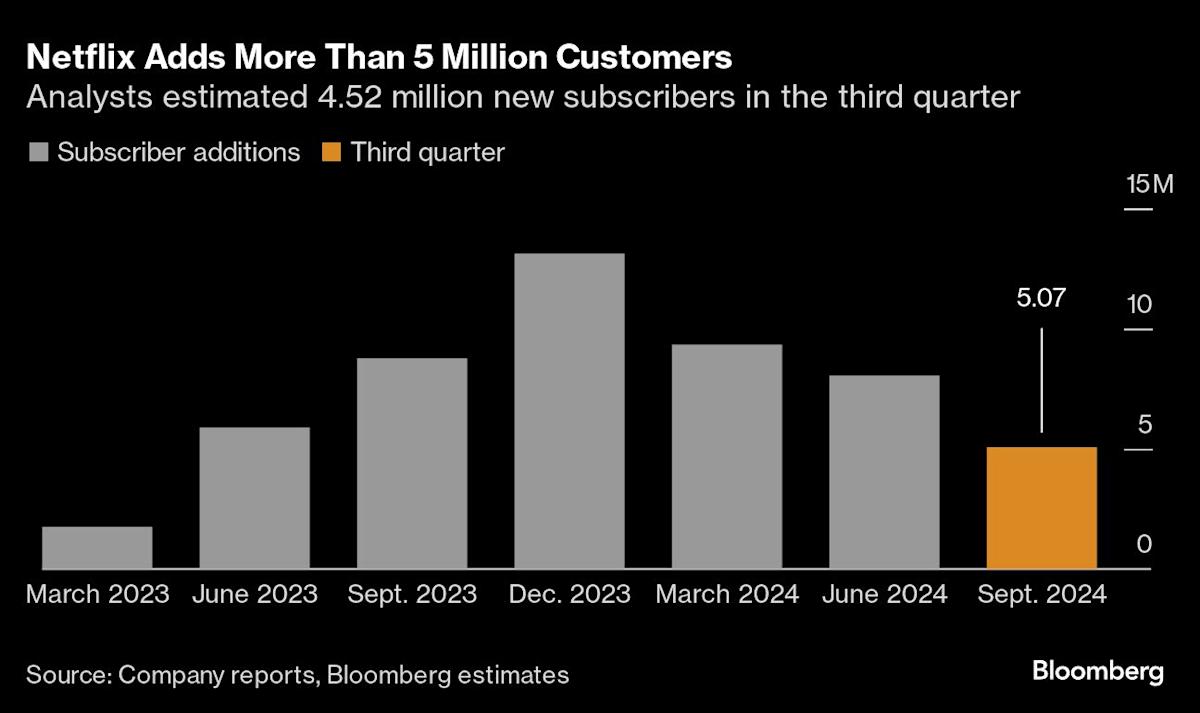

- Stronger-Than-Expected Subscriber Growth: Despite initial concerns, Netflix has shown consistent subscriber growth, exceeding expectations in several quarters. This indicates continued demand for its streaming service, even in a challenging economic environment.

- Successful Advertising-Supported Tier: The introduction of a cheaper, ad-supported tier has broadened Netflix's appeal to a wider audience, driving subscriber growth and increasing revenue streams.

- Effective Content Strategy: Netflix's investment in diverse and high-quality programming continues to attract and retain subscribers. A diverse content library is crucial in a competitive streaming market.

- Growth of the Global Streaming Market: The overall streaming market is still experiencing significant growth globally, presenting opportunities for expansion and increased market share for established players like Netflix.

Bullet Points:

- Netflix's recent financial reports have highlighted positive trends in subscriber growth and revenue.

- Compared to some other streaming services, Netflix has shown greater resilience in the face of economic headwinds.

- Netflix's strategy of investing heavily in original content has proved successful in attracting and retaining subscribers.

Diversification and Risk Mitigation: Why Wall Street is Choosing Streaming

Investors are increasingly viewing Netflix as a means of diversifying their portfolios and mitigating the risks associated with the tech downturn. Keywords: Portfolio diversification, risk management, investment strategy, defensive stocks, sector rotation, alternative investments.

- Defensive Stock: In uncertain economic times, investors often seek "defensive stocks"—companies less vulnerable to economic downturns. Netflix, with its relatively stable subscriber base and recurring revenue model, is viewed as such a stock.

- Counter-Cyclical Investment: The entertainment sector, including streaming services, can be counter-cyclical. During economic downturns, people may increase their consumption of entertainment as a form of escapism, bolstering demand for streaming services.

- Less Vulnerability to Macroeconomic Headwinds: Compared to some areas of the tech sector heavily reliant on capital expenditure and new technology adoption, streaming services are often less susceptible to immediate macroeconomic shifts.

Bullet Points:

- There's evidence of investors shifting funds from tech stocks into streaming and entertainment stocks, seeking better returns.

- Analysts predict continued long-term growth in the streaming industry, making it an attractive investment sector.

- Investing in Netflix offers a potentially better risk-reward profile compared to some of the more volatile tech stocks.

The Future of Streaming and Investment Strategies

The future of the streaming industry holds immense potential, but also presents challenges. Keywords: Future of streaming, investment outlook, long-term growth, market predictions, streaming stocks, growth stocks.

- Long-Term Growth Potential: The global streaming market is expected to continue expanding significantly in the coming years, driven by increasing internet penetration and rising demand for on-demand entertainment.

- Challenges and Opportunities: Increased competition, content costs, and potential regulatory changes remain challenges. However, opportunities exist for innovation, such as advancements in personalized recommendations, interactive content, and new revenue models.

- Investment Recommendations: Investors should consider a diversified portfolio that includes exposure to the streaming sector, but carefully assess individual companies and their risk profiles.

Bullet Points:

- Market analysts predict a continued battle for market share amongst major streaming platforms, with winners and losers emerging.

- Technological innovations such as the metaverse and improved AR/VR experiences could revolutionize the streaming landscape.

- A well-diversified portfolio should include a range of investments, minimizing reliance on any single sector.

Conclusion

Wall Street's shift towards Netflix reflects a broader trend: a search for refuge from the headwinds impacting Big Tech. Netflix’s resilience, fueled by subscriber growth, strategic content, and a diversified revenue model, highlights the growing appeal of the streaming sector. The relative stability of streaming, compared to the volatile tech market, provides investors with a compelling alternative, offering portfolio diversification and risk mitigation opportunities. While market volatility persists, understanding the dynamics of this shift and exploring investment options within the streaming sector, including further research into Netflix and other streaming stocks, is crucial for informed decision-making. Learn more about navigating the complexities of the market and exploring strategic investments in the streaming sector today.

Featured Posts

-

Reds Losing Streak Extends To Three Games 1 0 Each Time

Apr 23, 2025

Reds Losing Streak Extends To Three Games 1 0 Each Time

Apr 23, 2025 -

Record Breaking Game Yankees Hit 9 Home Runs Led By Aaron Judge

Apr 23, 2025

Record Breaking Game Yankees Hit 9 Home Runs Led By Aaron Judge

Apr 23, 2025 -

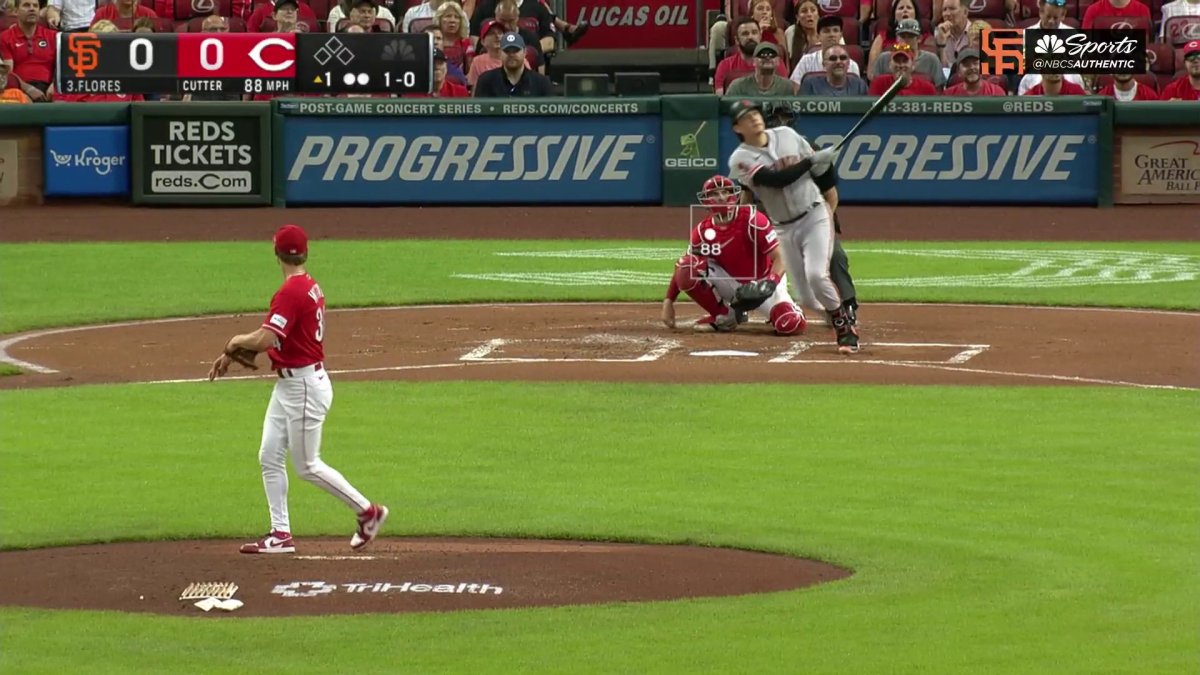

Flores And Lee Power Giants To Win Against Brewers

Apr 23, 2025

Flores And Lee Power Giants To Win Against Brewers

Apr 23, 2025 -

Cole Ragans Shines As Royals Bullpen Dominates Brewers

Apr 23, 2025

Cole Ragans Shines As Royals Bullpen Dominates Brewers

Apr 23, 2025 -

Mets And Yankees Closer Search Lupica Highlights The Difficulty

Apr 23, 2025

Mets And Yankees Closer Search Lupica Highlights The Difficulty

Apr 23, 2025