Where To Invest: A Map Of The Country's Promising Business Locations

Table of Contents

Thriving Metropolitan Areas: Investment Hotspots in Major Cities

Major cities often represent prime locations for investment, offering a concentration of resources and opportunities. These economic powerhouse locations boast diverse industries, skilled workforces, and robust infrastructure, making them attractive for businesses of all sizes.

Economic Powerhouses:

- City A: Known for its strong financial sector, City A consistently ranks high in GDP growth. Key industries include finance, technology, and media. Job growth averages 3% annually, with average household income exceeding $80,000.

- City B: A global hub for manufacturing and logistics, City B benefits from its strategic location and extensive port facilities. Key industries include automotive, aerospace, and manufacturing. It boasts a highly skilled workforce and consistently attracts significant foreign direct investment.

- City C: A burgeoning tech center, City C has seen explosive growth in the tech sector, attracting numerous startups and established tech companies. Key industries include software development, biotechnology, and clean energy. Job growth in the tech sector averages 5% annually.

Infrastructure and Accessibility:

These metropolitan area growth centers are further enhanced by superior infrastructure. Infrastructure investment in these areas is substantial, providing businesses with:

- International Airports: Multiple international airports offering seamless global connectivity.

- High-Speed Rail: Efficient and convenient high-speed rail links to other major cities, improving transportation and logistics.

- Fiber Optic Networks: Extensive fiber optic networks providing high-speed internet access crucial for businesses in the digital age. These accessible locations offer unparalleled connectivity.

Emerging Regional Economies: Opportunities Beyond the Cities

While major cities offer established markets, significant investment opportunities also exist in rapidly developing secondary cities. These up-and-coming locations present a compelling case for investors seeking high growth potential at potentially lower costs.

Growth in Secondary Cities:

- City D: This city's recent growth is fueled by government incentives and a newly developed industrial park attracting manufacturing and logistics companies.

- City E: City E’s proximity to abundant natural resources has driven significant economic expansion, particularly in the energy and agriculture sectors.

- City F: This city is experiencing a renaissance due to substantial investments in infrastructure and a focus on attracting high-tech industries. This is a great example of regional economic growth.

Government Incentives and Support:

Many secondary cities offer government incentives to attract investment. These business support programs can include:

- Tax Breaks: Significant tax reductions for businesses establishing operations in designated areas.

- Grants and Subsidies: Financial assistance for infrastructure development and job creation.

- Simplified Regulatory Processes: Streamlined procedures for obtaining permits and licenses. These are key factors when considering secondary city investment.

Niche Industry Clusters: Specialized Locations for Targeted Investments

Some regions specialize in specific industries, creating innovation hubs and attracting businesses seeking a skilled workforce and access to specialized resources. Where to invest becomes clearer when considering these niche opportunities.

Tech Hubs and Innovation Centers:

- Region X: Known as a major tech investment destination, Region X attracts tech giants and startups alike due to its strong university presence, venture capital funding, and a highly skilled workforce.

- Region Y: A burgeoning center for biotechnology, Region Y benefits from its world-class research institutions and a supportive regulatory environment. These factors significantly enhance the startup ecosystems in these regions.

Manufacturing and Industrial Centers:

- Region Z: A long-established manufacturing investment location, Region Z boasts a robust supply chain, highly skilled labor, and access to key raw materials. Key industries include automotive, heavy machinery, and food processing. This region is ideal for businesses focusing on supply chain optimization.

- Region W: This region specializes in advanced manufacturing, with a focus on robotics and automation, making it an attractive destination for companies seeking cutting-edge technology. Investing in industrial parks in this region offers excellent opportunities.

Conclusion: Making Informed Investment Decisions: Where to Invest Your Capital

This exploration of where to invest highlights the diverse opportunities available across different regions and industry sectors. From the economic powerhouses of major cities to the emerging economies of secondary cities and the specialized clusters of niche industries, the key is to carefully consider your investment goals, risk tolerance, and the specific advantages of each location. Understanding regional economic growth and the availability of government incentives are critical for successful investment. To find the best places to invest for profitable investment locations, conduct thorough due diligence, analyze market trends, and evaluate the long-term potential of each area. Consider consulting with financial advisors or economic development agencies to gather more detailed information before making investment decisions. Remember to assess infrastructure investment and transportation access in each location. Ultimately, smart investment decisions about where to invest your capital lay the groundwork for significant returns.

Featured Posts

-

Trump Administration Immigration Policies Face Legal Challenges

Apr 24, 2025

Trump Administration Immigration Policies Face Legal Challenges

Apr 24, 2025 -

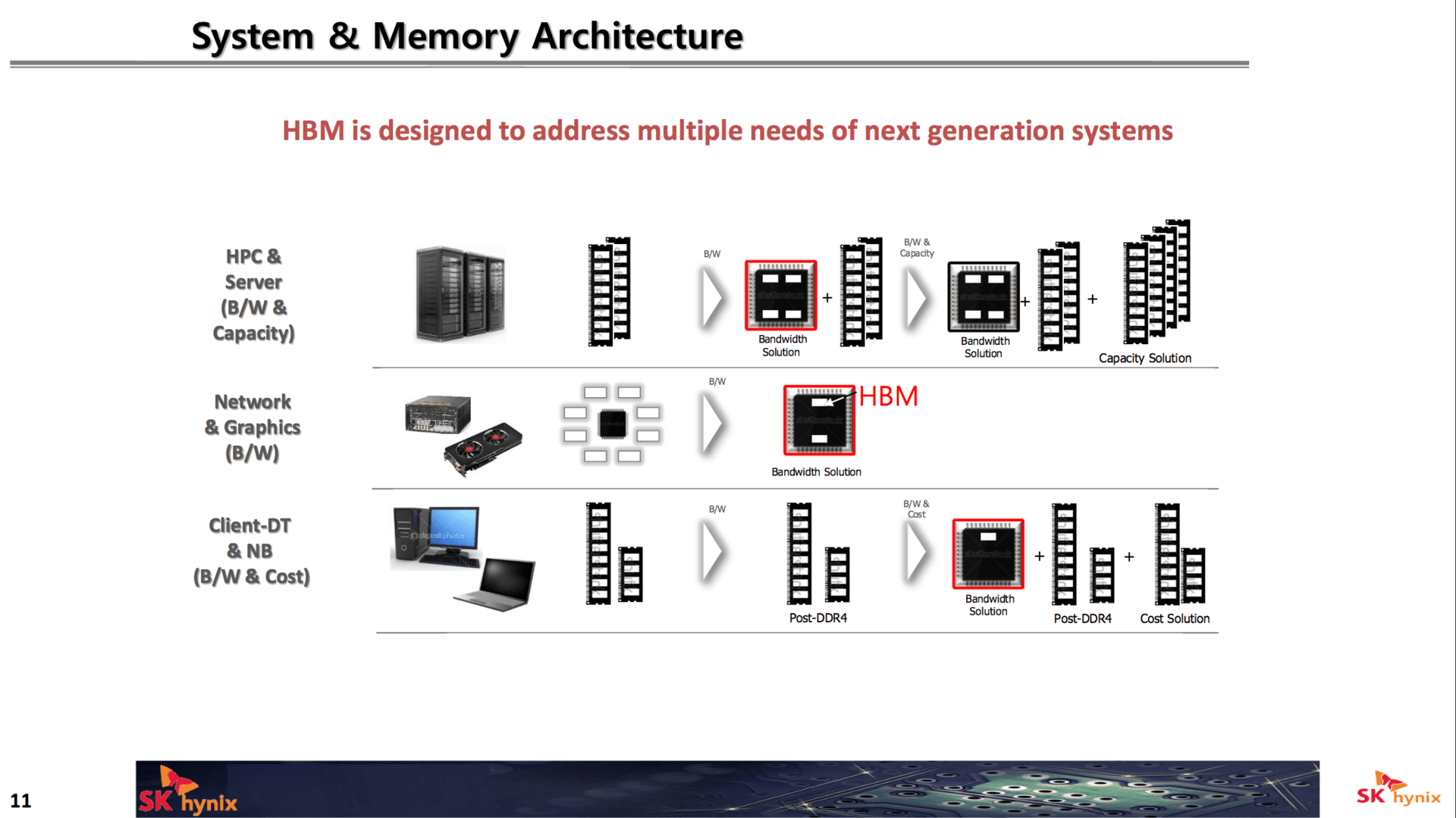

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025 -

Trump Administration Cuts Heighten Tornado Season Dangers

Apr 24, 2025

Trump Administration Cuts Heighten Tornado Season Dangers

Apr 24, 2025 -

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

Apr 24, 2025

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

Apr 24, 2025 -

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025