Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Argument Against Immediate Market Correction

BofA's analysis suggests that the current high stock market valuations aren't necessarily a harbinger of an imminent market correction. Their argument rests on several key pillars:

The Role of Low Interest Rates

Historically low interest rates play a significant role in influencing valuations, making higher price-to-earnings (P/E) ratios appear less alarming than they might otherwise seem.

- Quantitative Easing (QE): Years of quantitative easing by central banks have flooded markets with liquidity, driving down borrowing costs and making equities a more attractive investment compared to bonds. This increased demand for stocks directly contributes to higher valuations. BofA's research extensively highlights this correlation.

- Low Bond Yields: The low yields on government bonds make the relatively higher returns offered by equities, despite higher P/E ratios, more appealing to investors seeking returns. This shift in investor preference naturally pushes up stock prices.

- BofA's Analysis: BofA's reports consistently demonstrate a strong relationship between low interest rate environments and higher stock market valuations, suggesting that current levels, while high, are not unprecedented within this context. Specific data points from their research would need to be referenced here, drawing on specific BofA publications. (Note: Replace this with actual data and citations from BofA reports)

Strong Corporate Earnings and Growth Potential

BofA's assessment points to robust corporate earnings and positive growth prospects as key justifications for the current valuations.

- Strong Earnings Growth: Several sectors, particularly technology and consumer staples, have exhibited impressive earnings growth, bolstering overall market valuations. (Note: Insert specific sector examples and data from BofA reports here)

- Future Growth Predictions: BofA's analysts predict continued growth in specific sectors, projecting sustained earnings expansion that can support current valuations. (Note: Insert specific BofA predictions and data points here)

- Data on Earnings and Growth: (Note: Insert relevant data tables or charts from BofA reports showcasing earnings growth and projections.)

Long-Term Perspective vs. Short-Term Volatility

BofA emphasizes the importance of adopting a long-term investment horizon, urging investors to avoid being overly influenced by short-term market fluctuations.

- Long-Term Investment Strategy: Market corrections are a normal part of the investment cycle. Focusing on the long-term growth potential of underlying assets rather than short-term volatility is crucial. BofA advocates for this strategy.

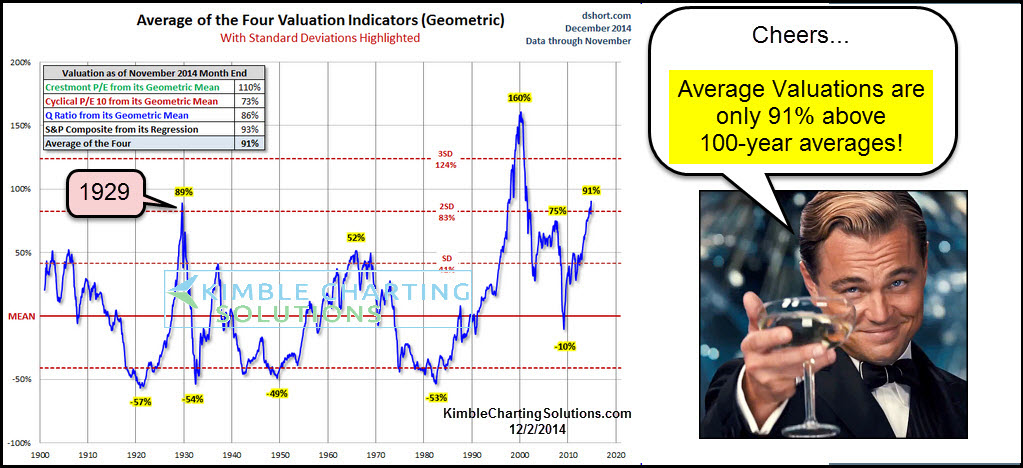

- Historical Context: Charts illustrating historical market performance reveal that past corrections have ultimately been followed by periods of significant recovery and growth. (Note: Insert relevant charts illustrating historical market performance here)

- Importance of Patience: BofA's message is clear: patience and a well-diversified portfolio are key to weathering short-term market turbulence.

Factors to Consider Despite High Valuations

While BofA's analysis suggests a less pessimistic outlook, it's crucial to acknowledge potential risks:

Inflation and Interest Rate Risks

Inflation and rising interest rates pose significant challenges to equity valuations.

- BofA's Inflation Assessment: BofA assesses the potential impact of inflation on corporate earnings and investor sentiment. (Note: Insert BofA's assessment of inflation risks and their impact on valuations here.)

- Interest Rate Hikes: The potential for future interest rate hikes by central banks could impact borrowing costs and reduce the attractiveness of equities. BofA's projections on interest rates should be included. (Note: Insert BofA's predictions on future interest rate hikes and their potential impact here.)

- Data on Inflation and Interest Rates: (Note: Insert relevant data graphs or tables illustrating inflation and interest rate projections.)

Geopolitical Uncertainty

Geopolitical events can significantly influence market sentiment and valuations.

- Impact of Geopolitical Events: BofA acknowledges the uncertainty introduced by geopolitical factors, such as international conflicts and trade tensions, which can trigger market volatility. (Note: Insert specific geopolitical events and their potential impact here.)

- BofA's Incorporation of Geopolitical Risks: BofA incorporates these risks into its valuation models, aiming to account for potential negative impacts on the market. (Note: Describe how BofA factors geopolitical risks into their analysis.)

- Examples and Data: (Note: Provide specific examples and relevant data, if available, on how geopolitical events might affect valuations.)

Sector-Specific Analysis

Even in a seemingly overvalued market, sector-specific due diligence remains vital.

- Importance of Diversification: Diversification across different sectors is crucial to mitigate risks. Investors should carefully consider the fundamentals of individual companies and their long-term growth potential.

- Focus on Strong Fundamentals: Concentrating on companies with strong fundamentals and growth potential, even within seemingly overvalued sectors, can be a prudent strategy.

- BofA's Sector Recommendations: (Note: If BofA highlights specific sectors as strong performers, mention them here, and provide examples of companies they might recommend.)

Conclusion

BofA's analysis suggests that while high stock market valuations are a reality, immediate panic may be unwarranted. Their argument hinges on several key factors: historically low interest rates, strong corporate earnings, and the importance of a long-term investment perspective. However, investors should remain vigilant about potential risks, including inflation, interest rate hikes, and geopolitical uncertainties. By considering these factors and engaging in thorough research and diversification, investors can navigate this market effectively.

Instead of being deterred by high stock market valuations, investors should adopt a well-informed approach. Conduct thorough research, diversify your portfolio based on sound financial strategies, and potentially consult with financial advisors to manage your investments wisely. Remember, a long-term perspective is paramount when evaluating high stock market valuations. Don't let fear dictate your investment decisions; make informed choices based on a solid understanding of the market and your own risk tolerance.

Featured Posts

-

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025 -

Blue Origins Rocket Launch A Subsystem Issue Causes Delay

Apr 22, 2025

Blue Origins Rocket Launch A Subsystem Issue Causes Delay

Apr 22, 2025 -

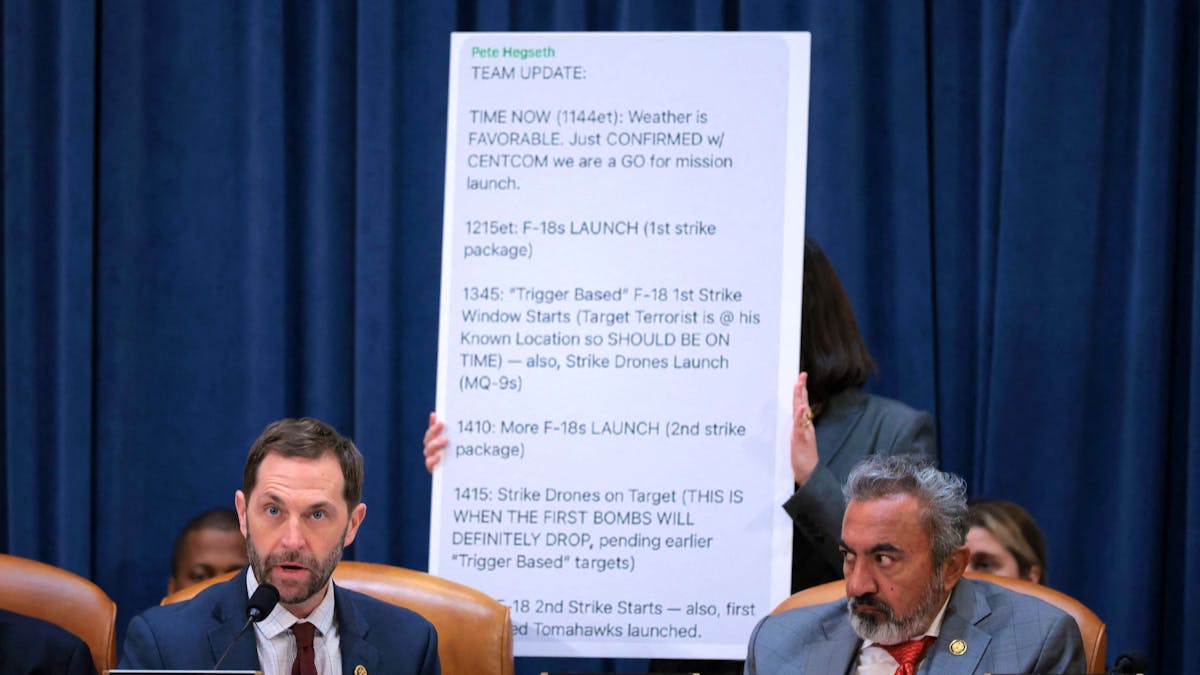

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025 -

Exclusive 1 Billion Funding Cut Planned For Harvard By Trump Administration

Apr 22, 2025

Exclusive 1 Billion Funding Cut Planned For Harvard By Trump Administration

Apr 22, 2025 -

San Franciscos Anchor Brewing Company To Close 127 Years Of History Ends

Apr 22, 2025

San Franciscos Anchor Brewing Company To Close 127 Years Of History Ends

Apr 22, 2025