Will Minnesota Film Tax Credits Attract More Productions?

Table of Contents

Keywords: Minnesota film tax credits, film production Minnesota, movie tax credits Minnesota, television production Minnesota, Minnesota film industry, economic impact of film tax credits, film incentives Minnesota

Minnesota's film industry is striving to grow, and a key component of its strategy is the state's film tax credit program. But are these Minnesota film tax credits truly effective in attracting more productions? This article delves into the current state of the program, analyzes its economic impact, explores challenges and opportunities, and offers a glimpse into the future of film production in Minnesota.

The Current State of Minnesota's Film Tax Credit Program

Minnesota's film tax credit program offers a valuable incentive for film and television productions choosing locations. While specific details are subject to change (always check the official Minnesota Film Office website for the most up-to-date information), the program generally provides a percentage credit against qualifying expenses incurred within the state.

-

Eligible Productions: The program typically covers a wide range of productions, including feature films, television series, commercials, documentaries, and even music videos.

-

Qualifying Expenses: These usually include production costs such as crew salaries, location fees, equipment rentals, and post-production services. However, specific limitations and exclusions apply.

-

Annual Cap: A cap on the total amount of credits awarded annually exists, which can impact the number of large-scale productions the state can accommodate.

-

Recent Changes: The program has undergone revisions throughout its history. Keeping abreast of these changes is crucial for producers considering Minnesota as a filming location.

The program's history reveals periods of both robust use and periods of slower uptake, reflecting broader economic trends and changes in the film industry itself. Analyzing historical data on credit applications and the number of productions that utilized the credits provides valuable insight into its effectiveness.

Analyzing the Economic Impact of Film Tax Credits in Minnesota

The economic impact of Minnesota film tax credits extends far beyond the immediate spending by production companies. The program fosters a ripple effect across various sectors of the state's economy.

-

Job Creation: Film productions create numerous direct jobs for actors, crew members, and production staff. Indirectly, jobs are also generated in supporting industries like hospitality, transportation, and local businesses supplying goods and services.

-

Revenue Generation: Local businesses, from hotels and restaurants to equipment rental companies and catering services, benefit significantly from the influx of spending associated with film productions.

-

Tourism Impact: Filming in unique Minnesota locations can boost tourism as fans seek out the places where their favorite movies or shows were filmed.

-

Economic Modeling: Studies assessing the return on investment (ROI) of the film tax credit program can help determine its overall effectiveness and identify areas for improvement.

Compared to states with more established and potentially more generous film incentive programs (like Georgia or New York), Minnesota’s program may face challenges in attracting the largest productions. A thorough comparative analysis can pinpoint areas where Minnesota’s program excels and where improvements could be made.

Challenges and Opportunities for Growth

Despite its potential, Minnesota's film tax credit program faces certain challenges:

-

Insufficient Funding: The annual cap on credits might limit the program’s ability to attract larger, budget-heavy productions that could provide substantial economic benefits.

-

Bureaucratic Hurdles: A complex application process could discourage some producers from applying, reducing the program's effectiveness.

-

Competition from Other States: Minnesota competes with other states offering attractive film incentives, making it essential to remain competitive.

-

Improving the Program: Suggestions for improvements include increasing funding, streamlining the application process, and enhancing marketing efforts to better attract productions.

Collaborations with other sectors, such as tourism and education, could create synergies and further strengthen the film industry’s presence within the state. Highligting Minnesota’s unique natural landscapes, historical sites, and urban settings in promotional materials for film producers is crucial to attract a wider range of productions.

Future Outlook for Film Production in Minnesota

The future of film production in Minnesota hinges on the continued development and effectiveness of its film tax credit program. Optimistic scenarios involve increased funding, improved marketing, and streamlined processes leading to a significant increase in productions and a substantial boost to the state's economy.

-

Optimistic Scenarios: Increased film activity, more diverse productions, significant job growth, and heightened tourism.

-

Pessimistic Scenarios: Insufficient funding might lead to a lack of competitiveness, resulting in fewer large-scale productions selecting Minnesota. This scenario can be mitigated by proactive adjustments to the program.

-

Attracting Specific Productions: Targeting niche markets, such as independent films or documentaries, could increase the number of productions attracted.

-

Marketing and Promotion: A robust marketing campaign targeting production companies is essential to highlighting Minnesota's advantages.

Minnesota possesses unique selling points: its diverse landscapes, skilled workforce, and supportive infrastructure all present opportunities for attracting film productions. Strategic promotion of these assets will greatly enhance the program's success.

Conclusion

Minnesota's film tax credits represent a significant investment in the state's economic future. While the program offers potential benefits, its effectiveness relies on several factors. Continued evaluation, adjustments based on data analysis, and proactive marketing are crucial to ensuring that the Minnesota film tax credits attract more productions. Further investment in and refinement of the program is necessary to create a sustainable and robust film industry within the state, fostering economic growth and enhancing Minnesota’s national and international profile. Investing in Minnesota film tax credits is an investment in Minnesota's future.

Featured Posts

-

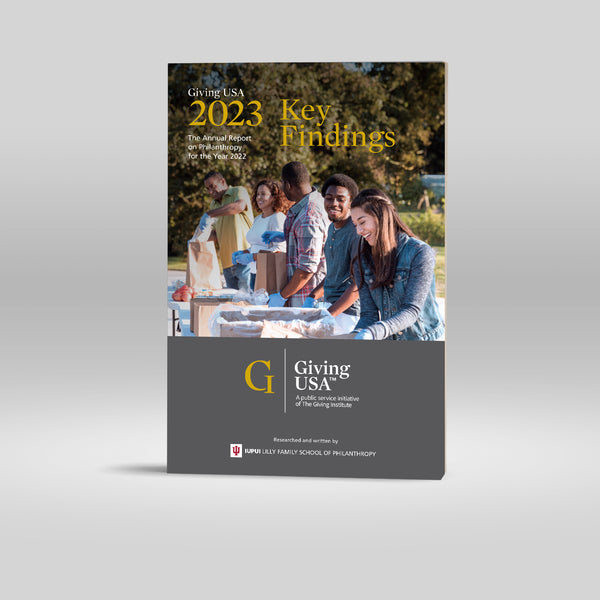

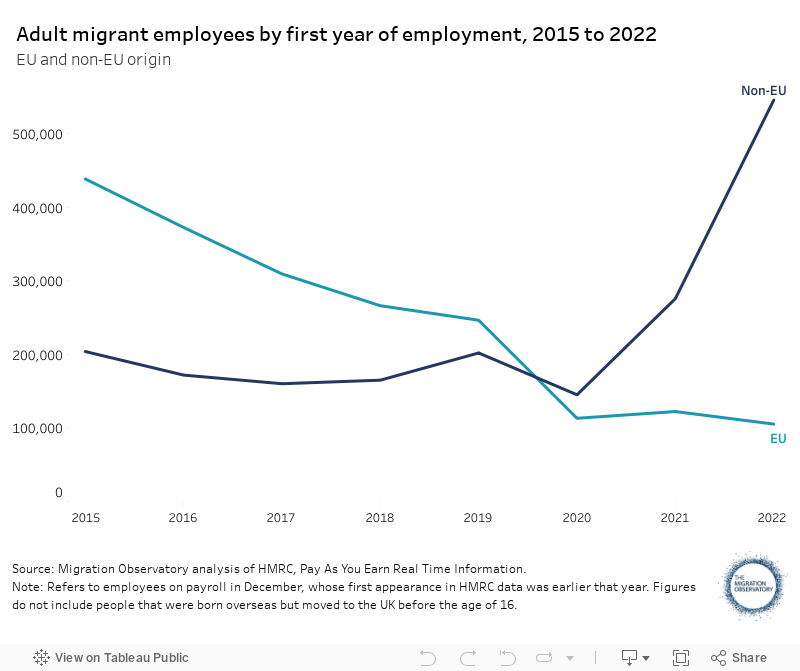

Higher Paying Jobs Attract Minnesota Immigrants Key Findings From A Recent Study

Apr 29, 2025

Higher Paying Jobs Attract Minnesota Immigrants Key Findings From A Recent Study

Apr 29, 2025 -

New Study Reveals Upward Mobility For Minnesota Immigrants In The Job Market

Apr 29, 2025

New Study Reveals Upward Mobility For Minnesota Immigrants In The Job Market

Apr 29, 2025 -

Wrong Way Crash On Minnesota North Dakota Border Kills Texas Driver

Apr 29, 2025

Wrong Way Crash On Minnesota North Dakota Border Kills Texas Driver

Apr 29, 2025 -

Minnesota Governor Faces Showdown Over Transgender Athlete Ban

Apr 29, 2025

Minnesota Governor Faces Showdown Over Transgender Athlete Ban

Apr 29, 2025 -

Winning Names Revealed Minnesotas Snow Plow Naming Contest Results

Apr 29, 2025

Winning Names Revealed Minnesotas Snow Plow Naming Contest Results

Apr 29, 2025