X's Financial Re-evaluation: Debt Sale Data Shows Company Evolution

Table of Contents

Analyzing the Debt Sale Data

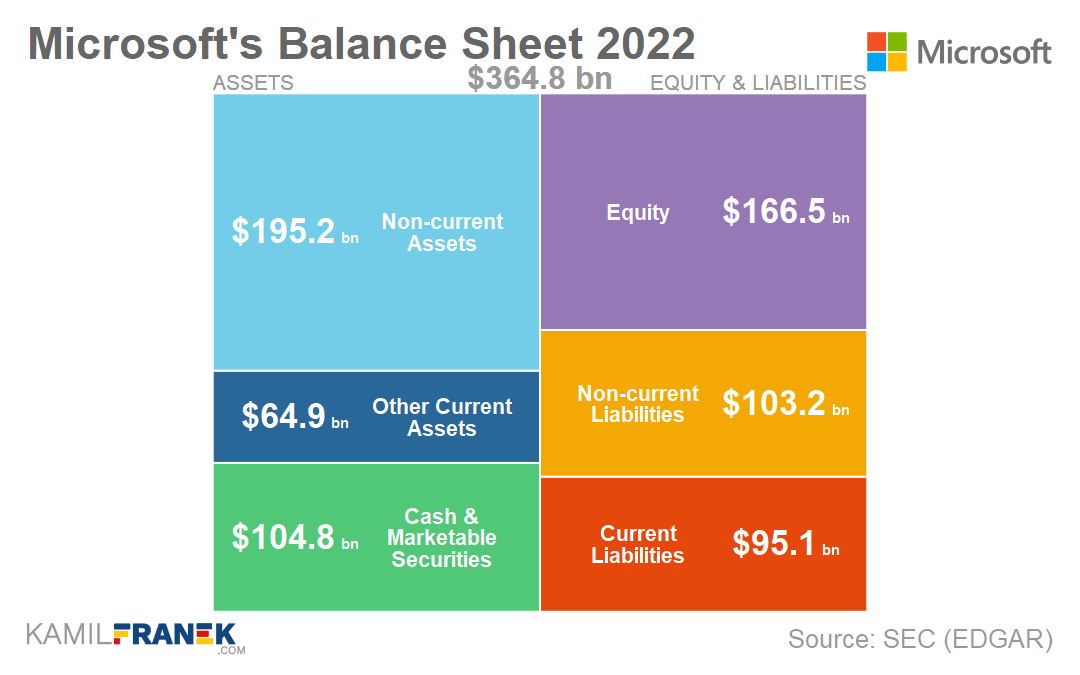

The specifics of X's debt sale offer crucial insights into the company's financial restructuring. While precise figures may be subject to confidentiality agreements, publicly available information suggests a substantial transaction. Reports indicate that X successfully sold [Insert approximate amount or range] in [Type of debt, e.g., high-yield bonds, term loans]. The buyer(s), [Mention buyer(s) if publicly known, otherwise state "remain undisclosed,"] acquired the debt under terms that [Describe sale terms, e.g., "provided X with favorable repayment conditions"]. This transaction directly impacts X's balance sheet by reducing its overall liabilities.

- Total debt sold: [Insert amount or range, if available. Otherwise, use descriptive terms like "substantial portion," "significant amount"]

- Type of debt: [Specify the type of debt, e.g., high-yield bonds, bank loans, commercial paper]

- Buyer(s) and their motivations: [Describe buyer profile if known. If unknown, speculate on potential buyer motivations – e.g., "opportunistic investors seeking high-yield returns," "hedge funds specializing in distressed debt"]

- Sale price and terms: [Describe the sale price and terms, focusing on aspects relevant to X's financial health. For example, "The sale was completed at a discounted rate, reflecting the current market conditions for [Type of debt]," or "The terms included favorable repayment schedules, allowing X to allocate more capital to growth initiatives."]

- Immediate impact on X's liabilities: A significant decrease in short-term or long-term debt obligations, leading to improved financial flexibility.

Impact on X's Financial Health

The long-term consequences of this debt sale are likely to be profoundly positive for X's financial health. By reducing its debt burden, X can achieve several key improvements:

- Changes in debt-to-equity ratio: A lower debt-to-equity ratio indicates improved financial stability and reduced risk.

- Reduction in interest expense: Lower interest payments free up capital for reinvestment in growth initiatives or return to shareholders.

- Improved liquidity position: The reduced debt load enhances X's ability to meet its short-term obligations and navigate unexpected economic downturns.

- Potential credit rating upgrades: A stronger balance sheet could lead to improved credit ratings from agencies like Moody's and S&P, resulting in lower borrowing costs in the future.

- Increased investor confidence: A successful debt reduction strategy usually boosts investor confidence, potentially leading to higher stock valuations.

Strategic Implications of the Re-evaluation

X's debt sale isn't merely a financial maneuver; it's a strategic decision deeply intertwined with the company's long-term vision. This financial restructuring:

- Alignment with company's long-term strategy: The debt sale likely aligns with X's strategic goals, such as focusing on expansion into new markets, investing in research and development, or pursuing acquisitions.

- Opportunities for future investments and growth: By freeing up capital, the company can now allocate resources to high-growth opportunities previously constrained by its debt load.

- Potential for mergers and acquisitions: The improved financial health strengthens X's position for potential mergers and acquisitions, enabling it to consolidate market share or expand into new segments.

- Enhanced operational efficiency: The reduced financial burden allows X to focus on operational efficiency improvements and cost reduction strategies.

Assessing the Risks and Opportunities

While the debt sale presents numerous opportunities, it's crucial to acknowledge potential risks. The opportunity cost of alternative strategies must be considered, as well as potential challenges associated with the restructuring process. External factors such as economic downturns or changes in market conditions could also impact the long-term success of this restructuring. However, the proactive nature of X's financial re-evaluation and the positive initial outcomes suggest a well-calculated and potentially transformative strategy.

Conclusion

X Corporation's debt sale represents a significant step in its financial re-evaluation, demonstrating a commitment to long-term stability and growth. The reduction in debt, the improved liquidity, and the potential for future strategic initiatives paint a picture of a company actively shaping its destiny. This financial restructuring underscores X's strategic vision and its potential for significant future success. Stay informed about X's financial re-evaluation and learn more about X's company evolution by subscribing to our newsletter or following X's official financial reporting channels. Witness firsthand the transformative impact of this strategic debt reduction journey.

Featured Posts

-

The Impact Of Xs Debt Sale A Look At The Companys Financial Changes

Apr 28, 2025

The Impact Of Xs Debt Sale A Look At The Companys Financial Changes

Apr 28, 2025 -

Aaron Judge Welcomes Child With Samantha Bracksieck

Apr 28, 2025

Aaron Judge Welcomes Child With Samantha Bracksieck

Apr 28, 2025 -

World Leaders Pay Respects At Pope Francis Funeral

Apr 28, 2025

World Leaders Pay Respects At Pope Francis Funeral

Apr 28, 2025 -

Le Bron James On Richard Jeffersons Espn Appearance

Apr 28, 2025

Le Bron James On Richard Jeffersons Espn Appearance

Apr 28, 2025 -

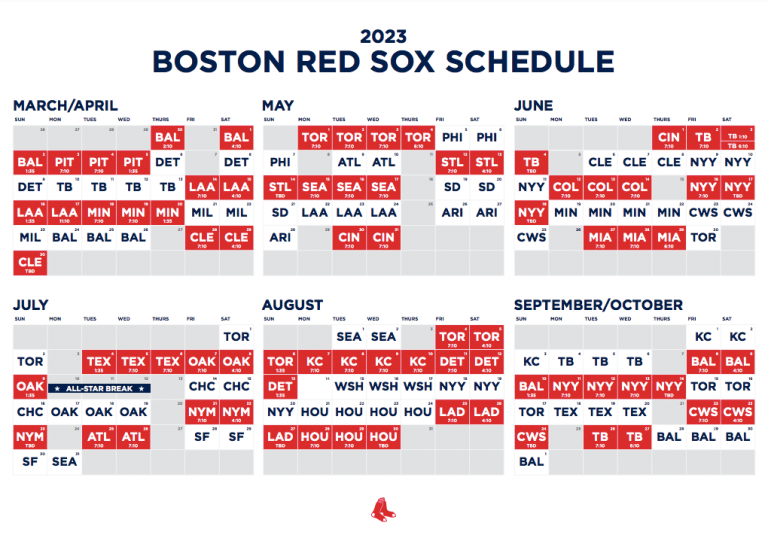

Red Sox Breakout Season Identifying The Next Big Contributor

Apr 28, 2025

Red Sox Breakout Season Identifying The Next Big Contributor

Apr 28, 2025