$3 Billion Crypto SPAC: Cantor, Tether, And SoftBank Explore Merger

Table of Contents

The Players Involved: A Trio of Financial Powerhouses

This potential $3 billion crypto SPAC merger brings together three industry giants, each contributing unique expertise and resources. Understanding their individual strengths reveals the potential synergy driving this ambitious undertaking. The key players are:

-

Cantor Fitzgerald: A leading global financial services firm with extensive experience in investment banking, capital markets, and trading. Their involvement brings invaluable expertise in structuring and executing complex financial transactions, particularly crucial for a SPAC merger of this magnitude. Their deep understanding of regulatory landscapes is also a significant asset.

-

Tether: The world's largest stablecoin issuer, Tether plays a vital role in bridging the gap between the volatile cryptocurrency market and the more stable traditional financial system. Its inclusion lends significant credibility and stability to the proposed SPAC, reassuring investors concerned about the inherent risks of digital assets.

-

SoftBank: A renowned Japanese multinational conglomerate and technology investment firm, SoftBank is known for its substantial investments in disruptive technologies and its strategic partnerships across diverse sectors. Their participation signifies a massive injection of capital and strategic guidance, bolstering the merger's potential for success. Their track record of successful investments in the tech sector further enhances the appeal of this crypto merger.

The Potential Benefits of the $3 Billion Crypto SPAC Merger

The potential benefits of this $3 billion crypto SPAC merger extend far beyond the immediate players. The combined strengths of Cantor, Tether, and SoftBank could unlock substantial advantages for the cryptocurrency market as a whole:

-

Increased Market Capitalization: A successful merger could significantly boost the market capitalization of the target cryptocurrency company, potentially elevating its profile and attracting greater investor interest. This increased market cap could influence the entire crypto market.

-

Enhanced Liquidity and Trading Volume: Access to broader capital markets through this SPAC merger would likely improve liquidity and increase trading volume for the combined entity. Greater liquidity makes the asset more attractive to a wider range of investors.

-

Accelerated Innovation: The pooling of resources and expertise from these financial powerhouses could fuel accelerated innovation within the blockchain technology space. This could lead to the development of new and improved crypto technologies and applications.

-

Attracting Institutional Investors: The involvement of established financial institutions like Cantor and SoftBank could act as a significant catalyst for increased institutional investment in cryptocurrencies. This increased institutional participation is key to the legitimization and growth of the crypto market.

Addressing Potential Risks and Challenges

While the potential benefits are considerable, the $3 billion crypto SPAC merger also faces several significant challenges and risks:

-

Regulatory Scrutiny: The cryptocurrency market is subject to increasing regulatory scrutiny worldwide. Navigating the complex and evolving regulatory landscape is a critical hurdle for the success of this merger. Uncertainty surrounding crypto regulations poses a significant risk.

-

Market Volatility: The inherent volatility of the cryptocurrency market presents a considerable risk to investors. The success of the merger depends on managing this volatility effectively.

-

Potential Conflicts of Interest: The involvement of multiple large players with potentially overlapping interests necessitates careful management to avoid conflicts of interest. Transparency and clear governance structures are crucial.

Implications for the Future of Crypto Investment

The proposed $3 billion crypto SPAC merger carries profound implications for the future of crypto investment:

-

Increased Institutional Adoption: A successful merger could act as a significant endorsement of cryptocurrencies, encouraging further institutional adoption and mainstream acceptance.

-

Shifting Investment Strategies: The merger might trigger a shift in investment strategies, with more institutional investors allocating capital to the crypto market.

-

Long-term Growth Potential: This merger could signal a new phase of significant long-term growth potential for the entire cryptocurrency industry, potentially fostering further innovation and development. This could also lead to increased investment in other blockchain technologies.

Conclusion

The potential $3 billion crypto SPAC merger involving Cantor, Tether, and SoftBank marks a potential turning point for the cryptocurrency market. This collaboration of financial giants offers immense potential for accelerating innovation, significantly boosting market capitalization, and attracting substantial institutional investment. While inherent risks and challenges exist, the potential rewards could fundamentally reshape the landscape of crypto investment. Stay informed about developments surrounding this groundbreaking $3 billion crypto SPAC and explore the diverse investment opportunities within the dynamic world of digital assets. Learn more about the evolving world of $3 billion crypto SPAC mergers and discover how you can participate in this exciting sector.

Featured Posts

-

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Nepoznata Prica Tarantino I Travolta Film Koji Je Ostao Neviden

Apr 24, 2025

Nepoznata Prica Tarantino I Travolta Film Koji Je Ostao Neviden

Apr 24, 2025 -

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025 -

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025 -

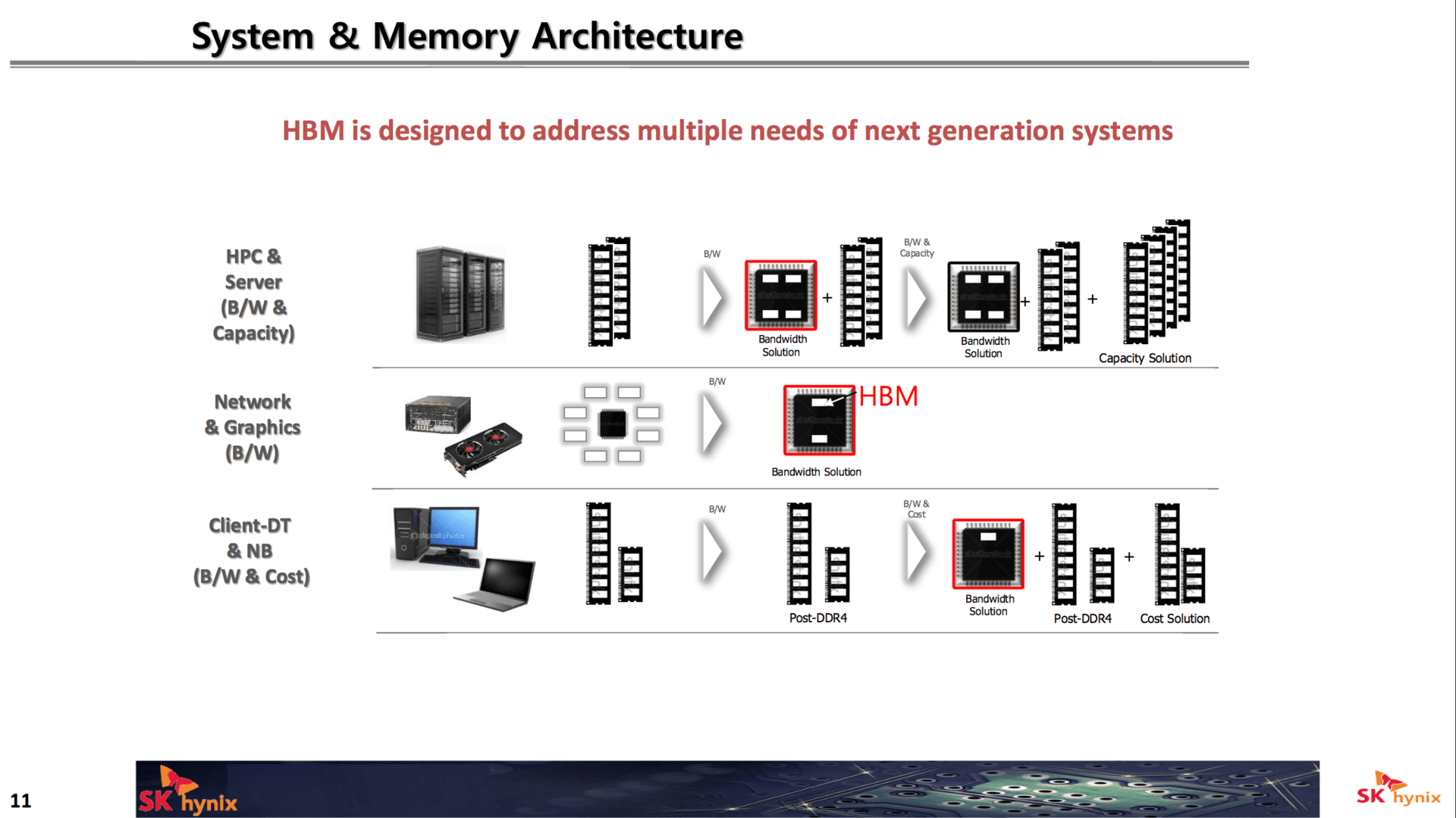

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025