Canada's Conservatives: Tax Cuts And Deficit Reduction Plan

Table of Contents

Proposed Tax Cuts

The Conservative Party's plan includes significant tax cuts aimed at stimulating the Canadian economy and boosting disposable income. These cuts are targeted at both individuals and corporations.

Personal Income Tax Reductions

The Conservatives propose reducing personal income tax rates across various brackets. While the exact percentages may vary depending on the specific election platform, the general aim is to provide tax relief for a broad range of income earners.

- Lower brackets: Reductions in the lower income tax brackets are intended to benefit middle-class families, increasing their disposable income and potentially stimulating consumer spending. Specific percentage reductions would need to be examined in their official platform.

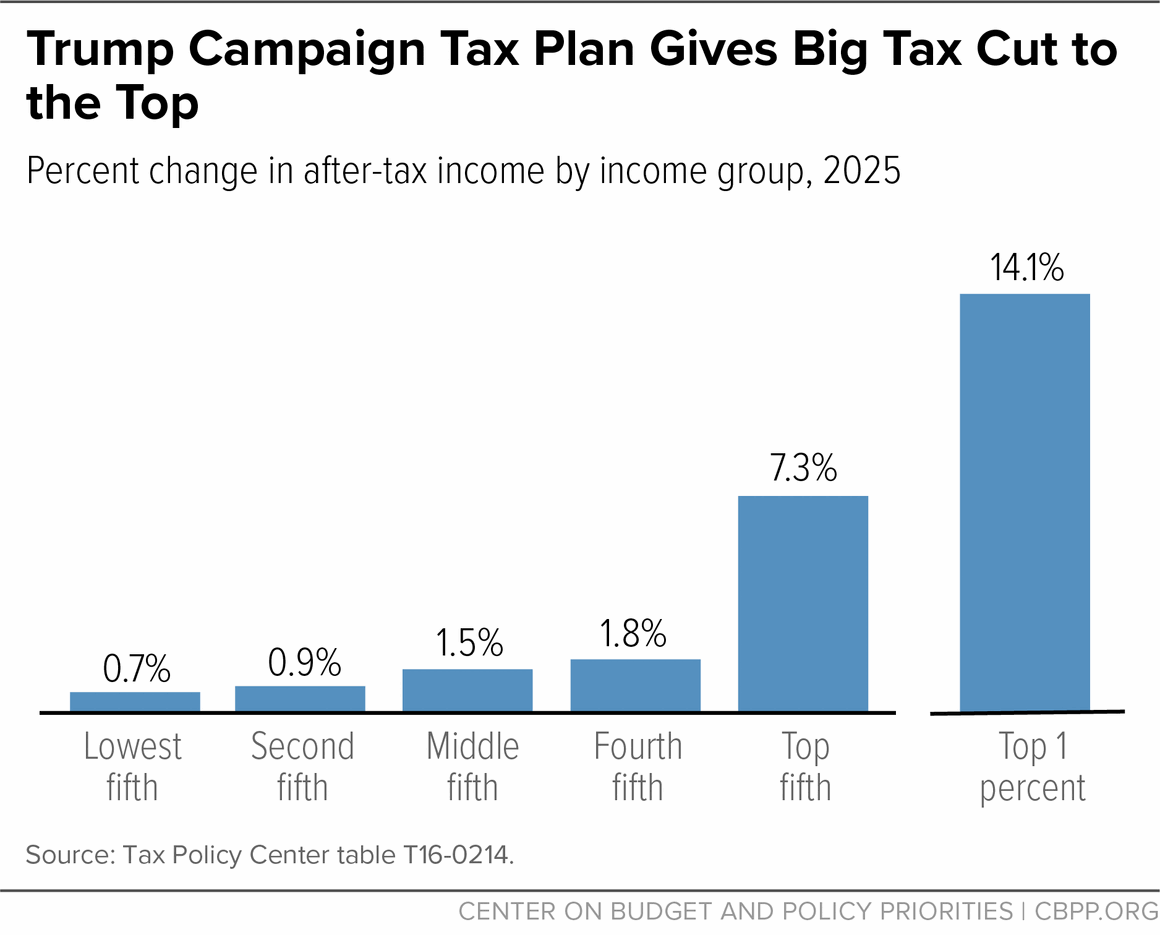

- Higher brackets: Proposed cuts to higher income tax brackets are aimed at encouraging investment and job creation. However, the degree of these cuts and their impact on income inequality is a subject of ongoing debate.

- Tax Credits and Deductions: The party may also propose adjustments to existing tax credits and deductions, further enhancing the impact of the tax cuts. These could include changes to the child tax benefit, or expanded deductions for specific expenses. Details on these changes would need to be sourced from official party documents.

The potential impact on disposable income and consumer spending is significant. Increased disposable income could lead to higher consumer demand, stimulating economic growth. However, the extent of this stimulus will depend on factors such as consumer confidence and overall economic conditions.

Corporate Tax Rate Cuts

A central element of the Conservative tax plan involves lowering the corporate tax rate. The proposed reduction aims to enhance business investment and create jobs by making Canada more competitive on the global stage.

- International Comparison: The proposed corporate tax rate will likely be compared to those of other G7 countries, emphasizing the Conservatives' goal of creating a more business-friendly environment.

- Impact on SMBs: The impact of corporate tax cuts on small and medium-sized businesses (SMBs) is a key consideration. Lower tax burdens could free up capital for investment, expansion, and job creation within this critical sector of the Canadian economy.

- Offsetting Measures: Any potential revenue loss from corporate tax cuts needs to be addressed. The party may propose offsetting measures such as increased efficiency in government spending or targeted tax increases in other areas. Details on these offsetting mechanisms will be crucial in assessing the overall impact of the plan.

Deficit Reduction Strategies

The Conservative Party aims to reduce the national deficit through a combination of spending cuts, increased efficiency, and economic growth strategies.

Spending Cuts

To achieve deficit reduction, the Conservatives will likely propose cuts to government spending across various departments and programs.

- Targeted Programs: Specific examples of programs targeted for cuts would need to be identified from their official policy documents. These might include areas perceived as less essential or where inefficiencies are identified.

- Quantifiable Data: The party will need to provide quantifiable data to demonstrate the projected savings from these cuts. Transparency and clear articulation of these savings are critical for public accountability.

- Social and Economic Consequences: It's essential to assess the potential social and economic consequences of these spending cuts. Critics may argue that cuts to social programs could negatively impact vulnerable populations and hinder social progress. A thorough cost-benefit analysis is necessary.

Increased Efficiency and Program Review

Improving government efficiency and eliminating waste is another key component of the deficit reduction plan.

- Streamlining Programs: Initiatives to streamline government programs and eliminate duplication will be central to this approach. This includes reviewing program effectiveness and consolidating similar services.

- Identifying Areas for Improvement: The methodology used to identify areas for improvement will be scrutinized. The party needs to demonstrate a clear and transparent process for identifying and addressing inefficiencies.

- Challenges and Risks: Implementing efficiency measures can face challenges, including resistance from various stakeholders and potential unintended consequences.

Economic Growth Strategies

The Conservatives typically plan to stimulate economic growth to increase tax revenue and thereby reduce the deficit.

- Targeted Sectors: Economic growth strategies often focus on specific sectors such as energy, technology, and manufacturing. Policies to support these sectors might include deregulation, investment incentives, and infrastructure development.

- Job Creation and GDP Growth: The party will project the impact of these growth strategies on job creation and GDP growth. Independent economic analysis will be needed to validate these projections.

Projected Economic Impact

Analyzing the potential economic impact of the Conservative plan requires considering independent analyses and government projections.

Independent Analysis

Independent economic analyses, from sources such as the Parliamentary Budget Officer or reputable think tanks, offer an unbiased assessment of the Conservative plan. These analyses should consider both potential benefits and risks. Examining a range of independent assessments provides a more balanced perspective.

Government Projections

The Conservative Party will present its own projections for deficit reduction, economic growth, and job creation. It is crucial to compare these projections with independent analyses to assess their credibility.

Comparison with Alternative Plans

Comparing the Conservative plan with those proposed by other political parties highlights key differences and potential outcomes. This comparative analysis helps voters understand the various approaches to economic management and their potential implications.

Conclusion

This article has examined the core components of the Canadian Conservative Party's plan for tax cuts and deficit reduction, analyzing its proposed tax changes, spending cuts, and projected economic impact. While promising significant reductions in the deficit and increased economic activity, the plan also faces potential challenges and criticism regarding the impact of spending cuts on essential social programs. The success of the plan hinges on the accuracy of its growth projections and the effective implementation of its efficiency measures.

Understanding the nuances of Canada's Conservatives' tax cuts and deficit reduction plan is vital for informed voting. Further research into independent analyses and detailed policy documents is encouraged to fully grasp the implications of this critical aspect of their platform. Learn more about the Conservative Party’s economic platform [link to relevant website] to make an informed decision on Canada’s economic future.

Featured Posts

-

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy Explained

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

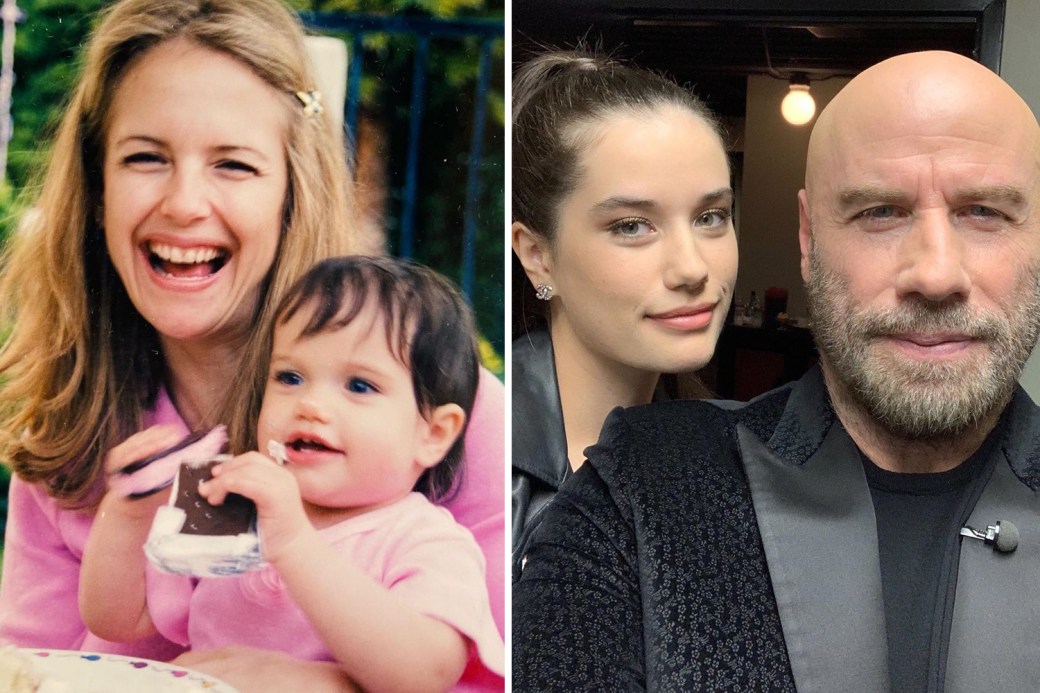

A Fathers Memory John Travoltas Birthday Post For Jett Travolta

Apr 24, 2025

A Fathers Memory John Travoltas Birthday Post For Jett Travolta

Apr 24, 2025 -

Bitcoin Btc Rally Trade And Fed Concerns Subside

Apr 24, 2025

Bitcoin Btc Rally Trade And Fed Concerns Subside

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025