5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do's for Success in the Private Credit Market

Thoroughly Undertake Due Diligence

Due diligence is paramount in the private credit market. Before committing capital, a comprehensive risk assessment is crucial. This involves:

- In-depth Borrower Analysis: Scrutinize the borrower's financial statements, including balance sheets, income statements, and cash flow statements. Analyze their credit history, looking for patterns of delinquency or default. Thoroughly assess the management team's experience and track record.

- Independent Valuation of Collateral (if applicable): If the loan is secured by collateral, obtain an independent valuation to ensure it accurately reflects market value and adequately secures the loan.

- Legal Review of Loan Documentation and Security Agreements: Engage legal counsel specializing in private credit transactions to review all loan documents, ensuring they protect your interests and comply with all relevant regulations. Pay close attention to security agreements, covenants, and default provisions.

- Market Research: Conduct thorough market research to understand the competitive landscape and identify comparable transactions. This helps you benchmark the terms and conditions of the loan and assess its relative attractiveness.

Thorough due diligence minimizes credit risk and enhances your chances of a successful private credit investment.

Diversify Your Private Credit Portfolio

Portfolio diversification is a cornerstone of effective risk management in the private credit market. Don't put all your eggs in one basket. Consider:

- Sector Diversification: Spread your investments across various sectors (e.g., real estate, healthcare, technology) to reduce the impact of industry-specific downturns.

- Geographic Diversification: Diversify geographically to mitigate regional economic risks. Concentrating investments in a single region exposes your portfolio to localized economic shocks.

- Instrument Diversification: Utilize different types of private credit instruments, such as senior secured loans (lower risk, lower return), mezzanine debt (higher risk, higher return), and unitranche loans, to achieve a balanced risk-return profile.

Strategic diversification across sectors, geographies, and instruments strengthens your private debt strategies and improves overall portfolio resilience.

Develop Strong Relationships with Sponsors and Borrowers

Building strong relationships is vital for successful private credit investing. This involves:

- Transparency and Trust: Foster open and honest communication with sponsors and borrowers throughout the investment process.

- Proactive Communication: Maintain regular communication channels to address potential issues promptly and collaboratively. Early identification and resolution of problems are crucial.

- Strategic Networking: Actively network within the private credit industry to identify promising investment opportunities and gain valuable insights.

Strong relationships provide access to exclusive deals and facilitate smoother transactions, leading to better outcomes in your private credit investing journey.

Seek Professional Advice

Navigating the complexities of the private credit market often requires expert guidance. Consider:

- Legal Counsel: Engage legal counsel specializing in private credit transactions to ensure compliance with regulations and protect your interests.

- Financial Advisors: Consult with financial advisors experienced in alternative investments, including private debt strategies, to optimize your portfolio allocation and risk management.

- Independent Valuation Specialists: Utilize independent valuation specialists for collateral valuation and other assessments to ensure accuracy and objectivity.

Professional advice provides invaluable support and helps mitigate potential pitfalls in your private credit investments.

Don'ts for Success in the Private Credit Market

Overlook Risk Management

Risk management is critical in the private credit market. Avoid these pitfalls:

- Inadequate Due Diligence: Never underestimate the importance of thorough due diligence. Skipping this crucial step can lead to significant losses.

- Ignoring Red Flags: Don't ignore any red flags in the borrower's financial statements, credit history, or management team. A thorough assessment of all aspects of the investment is critical.

- Insufficient Risk Assessment: A comprehensive risk assessment, including credit risk, default risk, and liquidity risk, is essential before making any investment decision. Consider stress testing your investments under different economic scenarios.

Neglect Liquidity Considerations

Private credit investments are inherently illiquid. Keep in mind:

- Illiquidity Risk: Understand that private credit investments are typically not easily traded and may require a long-term investment horizon.

- Over-Concentration: Avoid over-concentrating your investments in illiquid assets. Diversification helps mitigate this risk.

- Long-Term Perspective: Have a long-term investment horizon and only invest capital you are comfortable not accessing for an extended period.

Underestimate Transaction Costs

Transaction costs in the private credit market can be substantial. Account for:

- All Fees: Factor in all relevant fees, including legal fees, administrative fees, arrangement fees, and other expenses. Ensure you have a clear understanding of all costs before investing.

- Tax Implications: Don't overlook potential tax implications associated with private credit investments. Consult with a tax professional to understand the tax treatment of your investments.

Ignore Market Cycles

Market cycles significantly impact private credit valuations. Avoid:

- Excessive Leverage: Avoid excessive leverage during periods of economic uncertainty, as this amplifies both potential gains and losses.

- Ignoring Downturns: Be prepared for potential market downturns. Consider stress testing your portfolio and having a contingency plan.

- Unrealistic Expectations: Avoid unrealistic return expectations, particularly during periods of economic expansion. Market cycles will inevitably reverse.

Conclusion

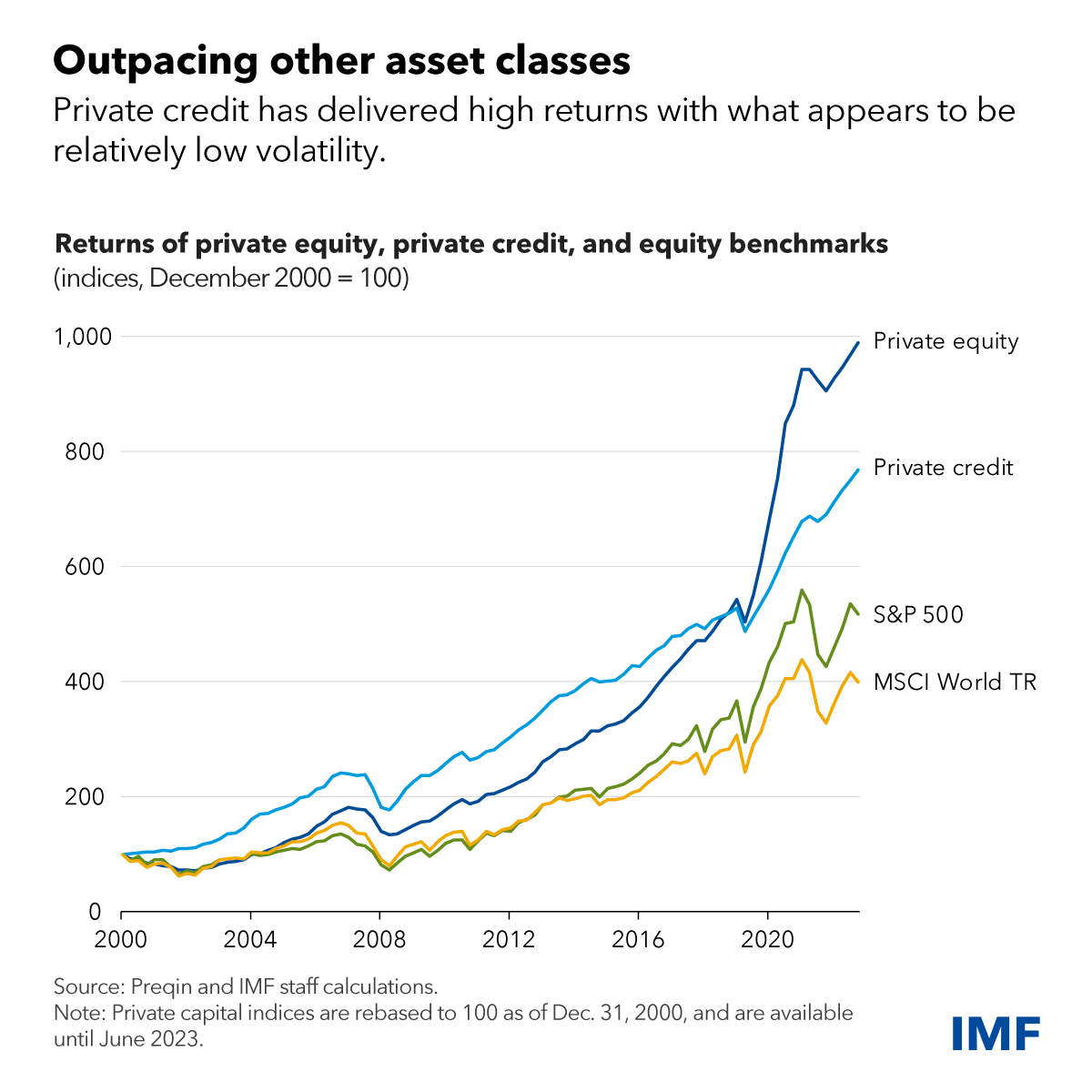

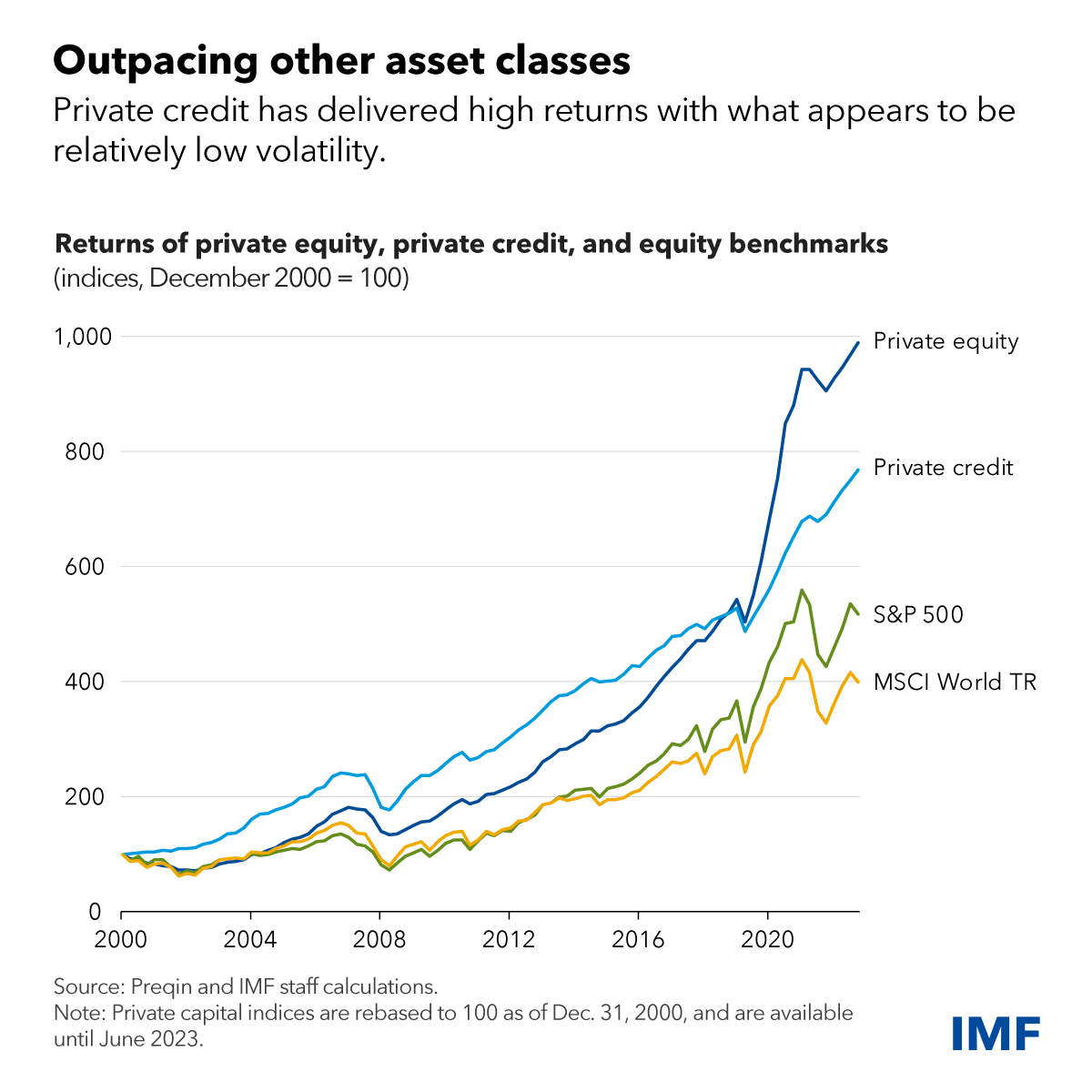

Success in the private credit market hinges on a careful balance between seizing opportunities and mitigating risks. By diligently following these five do's and don'ts—thorough due diligence, portfolio diversification, strong sponsor relationships, seeking expert advice, and proactively managing risk—you can significantly improve your chances of success in this dynamic investment landscape. By continuing to learn about the nuances of the private credit market and perhaps consulting with financial professionals specializing in alternative investments like private debt, you can effectively navigate this exciting space and optimize your private credit portfolio for superior returns.

Featured Posts

-

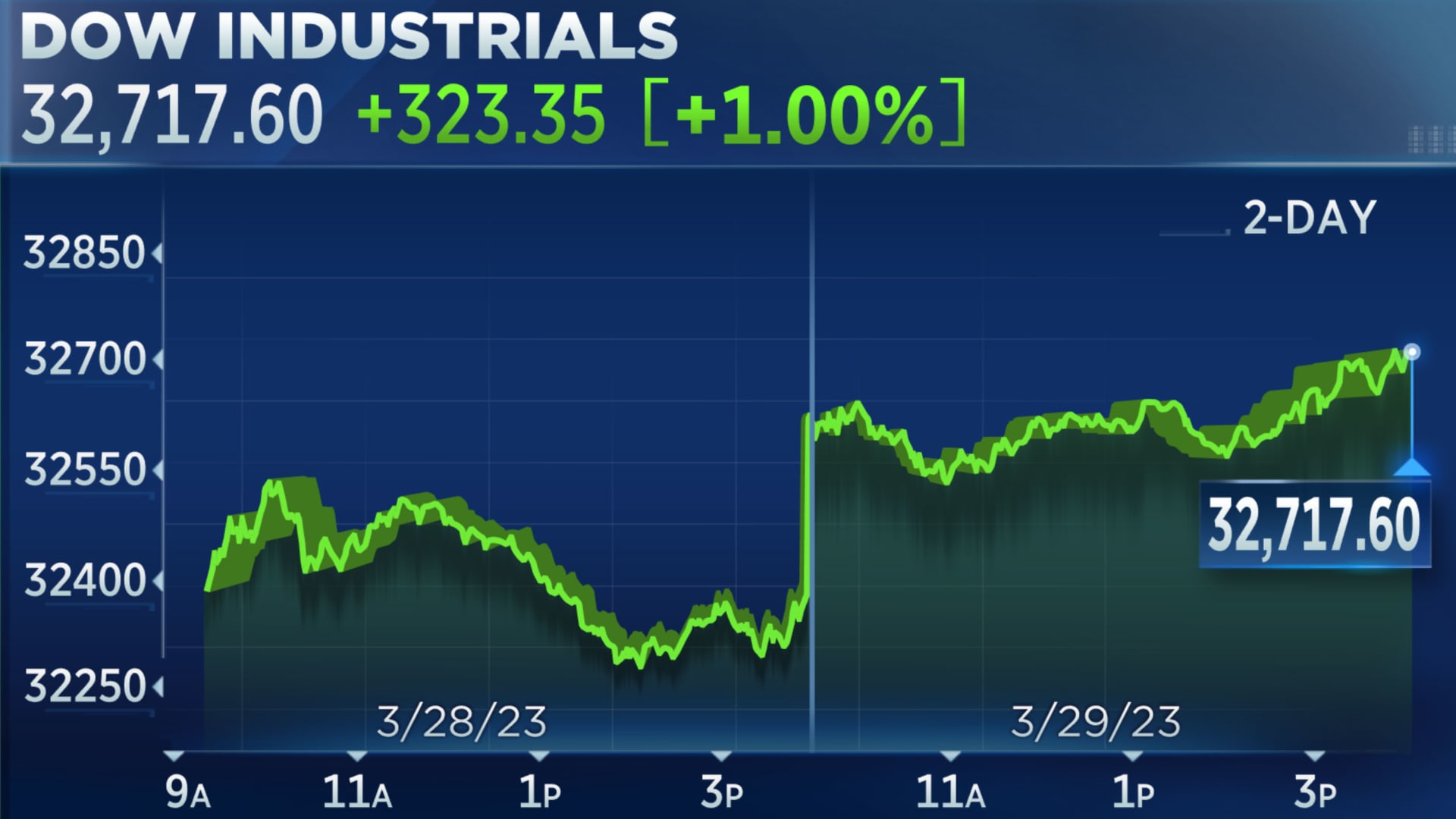

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

Five Point Plan From Canadian Auto Dealers To Counter Us Trade Threats

Apr 24, 2025

Five Point Plan From Canadian Auto Dealers To Counter Us Trade Threats

Apr 24, 2025 -

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025 -

Car Dealerships Continue To Oppose Mandatory Electric Vehicle Sales

Apr 24, 2025

Car Dealerships Continue To Oppose Mandatory Electric Vehicle Sales

Apr 24, 2025