Ackman: Time Favors US, Hurts China In Trade Conflict

Table of Contents

Ackman's Argument: The US's Long-Term Economic Strength

Ackman's bullish stance on the US's position in the US-China trade war rests on several pillars of long-term economic strength. He likely points to the US's inherent advantages, arguing that these will ultimately outweigh any short-term disruptions caused by the trade conflict.

Technological Superiority

The US boasts a significant lead in several crucial technological sectors, giving it a decisive edge in the long-term competition.

- Semiconductors: The US dominates the design and manufacturing of advanced semiconductors, critical components for everything from smartphones to supercomputers.

- Artificial Intelligence (AI): American companies are at the forefront of AI research and development, possessing a crucial advantage in this rapidly evolving field.

- Biotechnology: The US leads in biotechnology innovation, with significant implications for healthcare and other industries.

This technological dominance translates into a long-term economic advantage. The US possesses the capacity to innovate and develop new technologies at a faster pace than China, ensuring future growth and competitiveness even amidst trade tensions. This advantage will likely become even more pronounced as technology continues to reshape global industries.

Resilient Domestic Economy

The US economy exhibits considerable resilience and adaptability, capable of weathering economic shocks better than many of its global counterparts.

- Robust Consumer Spending: Strong domestic consumer spending provides a substantial buffer against external economic pressures.

- Innovation Capacity: The US's entrepreneurial spirit and dynamic innovation ecosystem enable quick adaptation to changing economic conditions.

Unlike China, which relies heavily on exports, the US possesses a more diversified economy, reducing its vulnerability to external trade disruptions. Further bolstering this resilience is the strength of the US dollar, which remains a dominant currency in global trade, providing stability and facilitating international transactions. This inherent strength allows the US to absorb shocks from the trade conflict more effectively than China.

China's Challenges: Short-Term Gains, Long-Term Pain

While China might enjoy some short-term gains, Ackman likely argues that the long-term consequences of the trade conflict will significantly disadvantage the Chinese economy.

Dependence on Exports

China's economic model is heavily reliant on exports, particularly to the US. This dependence creates significant vulnerability in the face of trade restrictions.

- Export Dependency Statistics: A significant portion of China's GDP is directly tied to exports, making it highly sensitive to tariff increases and trade barriers. (Specific statistics should be inserted here, referencing reputable sources).

Tariffs and trade restrictions directly impact China's export-oriented growth strategy, potentially leading to reduced global demand for Chinese goods and slowing economic growth. This dependency is a major weakness in the context of the ongoing trade war.

Internal Economic Pressures

Beyond the external pressures of the trade conflict, China faces significant internal economic challenges that exacerbate its vulnerabilities.

- High Debt Levels: China's high levels of corporate and government debt create systemic risks and limit its ability to respond effectively to economic shocks.

- Aging Population: A rapidly aging population will strain China's social security system and potentially slow economic growth in the coming decades.

These internal pressures, compounded by the trade conflict, pose significant risks to China's economic stability and potentially contribute to social and political instability.

Technological Dependence

Despite significant strides in technological advancement, China remains dependent on foreign technology and expertise in crucial sectors.

- Semiconductor Manufacturing: China lags behind the US in advanced semiconductor manufacturing capabilities.

- Software and AI: While making progress, China still faces challenges in competing with US dominance in software and AI.

US sanctions and trade restrictions further limit China's access to crucial technologies, hindering its ability to achieve technological self-sufficiency in the short term. This technological dependence represents a significant weakness in the long-term strategic competition with the US.

Conclusion: Navigating the US-China Trade Conflict: A Long Game Favoring the US

In summary, Ackman's argument hinges on the US's technological superiority, economic resilience, and China's vulnerabilities in the face of the prolonged US-China trade war. He likely believes that while short-term economic fluctuations are inevitable, time is a key factor favoring the US in this long game.

While some might counter that China's vast market and potential for internal growth could offset these challenges, Ackman's analysis likely considers the structural limitations and potential risks outlined above. The situation is undoubtedly complex, and unforeseen events could alter the trajectory of this conflict.

However, Ackman's perspective provides a valuable framework for understanding the potential long-term implications of the US-China trade war. To gain a deeper understanding of this complex issue, we encourage readers to delve deeper into US-China trade war analysis, exploring Bill Ackman's predictions and the long-term economic outlook from reputable sources and financial publications. A thorough examination of these factors will offer a more nuanced perspective on the future of this critical geopolitical and economic conflict.

Featured Posts

-

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Pfc Action Eo W Transfer Blocked Due To Deceptive Documents From Gensol Promoters

Apr 27, 2025

Pfc Action Eo W Transfer Blocked Due To Deceptive Documents From Gensol Promoters

Apr 27, 2025 -

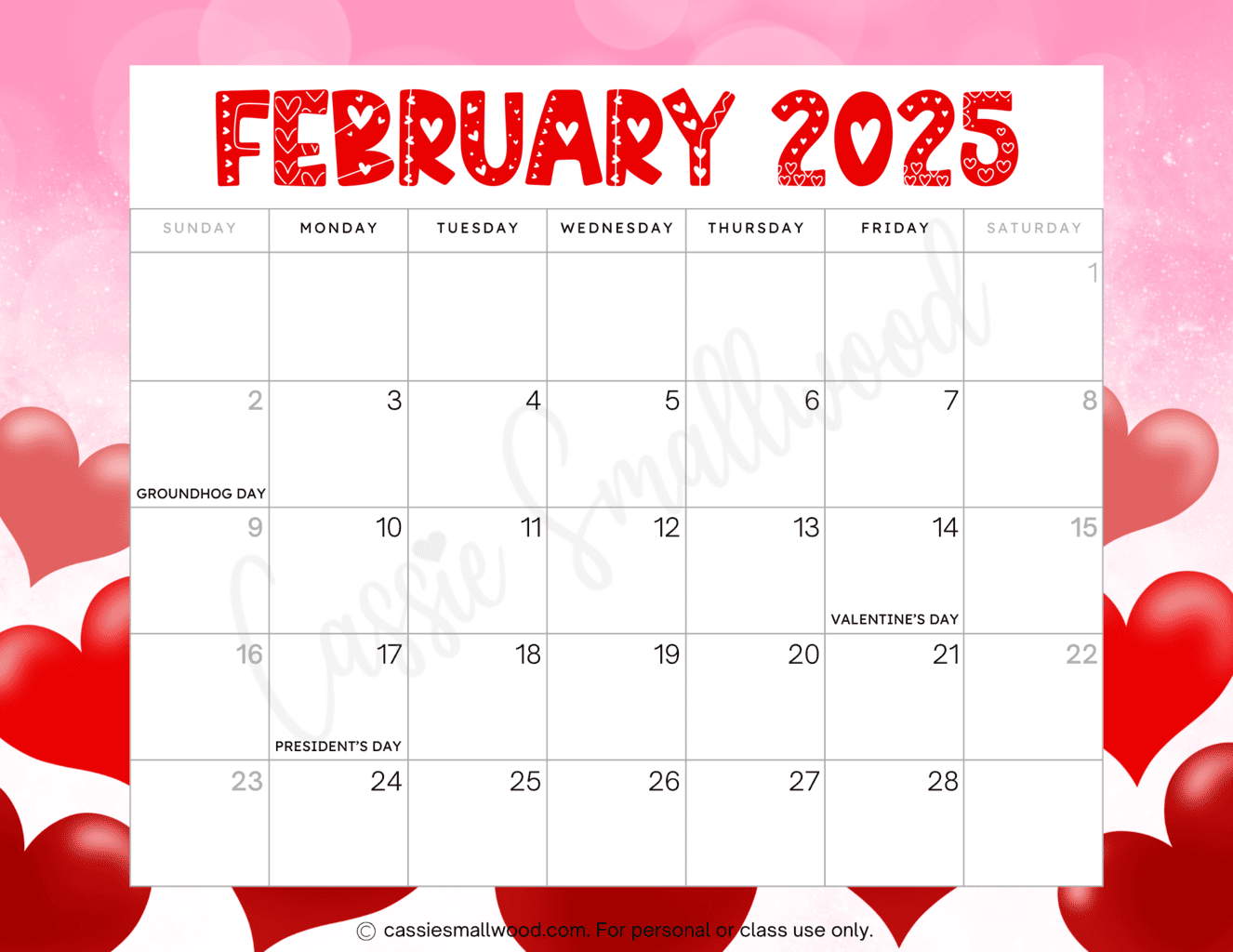

Planning Your Happy Day February 20 2025

Apr 27, 2025

Planning Your Happy Day February 20 2025

Apr 27, 2025 -

Celebrity Style Understanding Ariana Grandes Hair And Tattoo Choices

Apr 27, 2025

Celebrity Style Understanding Ariana Grandes Hair And Tattoo Choices

Apr 27, 2025 -

Cerundolo Avanza A Cuartos De Final En Indian Wells Ausencias De Fritz Y Gauff Marcan El Torneo

Apr 27, 2025

Cerundolo Avanza A Cuartos De Final En Indian Wells Ausencias De Fritz Y Gauff Marcan El Torneo

Apr 27, 2025