PFC Action: EoW Transfer Blocked Due To Deceptive Documents From Gensol Promoters

Table of Contents

The Allegations of Deceptive Documents

The PFC's intervention stems from concerns regarding the veracity of documents submitted by Gensol promoters in support of the EoW transfer. These allegations center around the deliberate misrepresentation of financial information crucial for the valuation and approval of the transfer.

Nature of the Deceptive Documents

The deceptive documents allegedly include:

- Overstated revenue figures: Gensol promoters are accused of inflating revenue numbers to portray a healthier financial position than reality.

- Inflated asset valuations: Assets are suspected to have been significantly overvalued, creating a misleading picture of Gensol's net worth.

- Missing liability disclosures: Crucial liabilities may have been omitted or understated, concealing the true extent of Gensol's financial obligations.

- Forged signatures: Authenticity of key signatures on documents is also under scrutiny by the PFC.

- Misrepresented assets: The nature and value of certain assets are under investigation for potential misrepresentation.

PFC's Response and Investigation

The PFC responded swiftly, launching a full-scale investigation into the matter. This includes:

- A formal statement released by the PFC: The statement publicly acknowledged the investigation and the concerns surrounding the deceptive documents.

- Freezing of assets: The PFC has reportedly frozen certain Gensol assets to prevent further dissipation of funds.

- Appointment of a special investigator: An independent investigator has been appointed to thoroughly examine the financial records and determine the extent of the alleged fraud.

- Potential penalties: Depending on the findings, Gensol promoters face potential penalties ranging from hefty fines to criminal charges. The timeline of the investigation is yet to be confirmed, but the PFC has emphasized its commitment to a thorough and expeditious process.

Impact on the EoW Transfer and Gensol's Future

The PFC action has cast a long shadow over the EoW transfer, creating significant uncertainty and repercussions for all stakeholders.

Immediate Consequences for Employees

Gensol employees eagerly awaiting the EoW transfer now face:

- Salary implications: The delay in the transfer could significantly impact employees' salaries and benefits.

- Employee morale and anxiety: The uncertainty surrounding the future of their employment is causing considerable stress and anxiety.

- Potential legal recourse: Employees may explore legal avenues to protect their rights and interests given the unforeseen circumstances.

Long-Term Implications for Gensol

The long-term consequences for Gensol are potentially severe:

- Potential loss of investors: The allegations of fraud will likely erode investor confidence, making it difficult to attract future investments.

- Damage to Gensol's brand reputation: The negative publicity surrounding this incident could severely damage Gensol's reputation and its ability to operate effectively.

- Difficulty securing future funding: Securing loans or further funding will be challenging in the wake of the allegations and ongoing investigation.

- Potential legal battles: Gensol may face prolonged and costly legal battles with affected parties.

Lessons Learned and Prevention of Similar Incidents

This situation highlights the critical need for robust measures to prevent similar incidents of financial fraud.

Due Diligence and Verification

Thorough due diligence and independent verification of all financial documents are paramount. This includes:

- Independent audits: Regular and rigorous independent audits are crucial to ensuring the accuracy of financial reporting.

- Background checks: Comprehensive background checks on key personnel involved in financial transactions are necessary.

- Verification of documentation: All documentation should be carefully verified for authenticity and accuracy by qualified professionals.

Strengthening Regulatory Frameworks

Strengthening regulatory frameworks is vital to deter financial fraud and protect stakeholders:

- Increased transparency requirements: More stringent transparency requirements for financial reporting will enhance accountability.

- More stringent penalties for fraud: Heavier penalties for fraudulent activities will act as a stronger deterrent.

- Improved collaboration between regulatory bodies: Enhanced collaboration between regulatory bodies will improve the effectiveness of investigations and enforcement.

Conclusion

The PFC's blocking of the Gensol EoW transfer due to allegedly deceptive documents from its promoters underscores the significant risks associated with financial fraud. The ongoing investigation will determine the full extent of the deception and its implications. The immediate impact on employees is substantial, and the long-term consequences for Gensol's business operations and reputation are significant. This case highlights the critical need for increased vigilance, robust due diligence, and strengthened regulatory frameworks to prevent similar incidents involving EoW transfers and other financial transactions. Stay informed about the ongoing PFC action and the Gensol promoter investigation. Report any suspicious activity to the appropriate authorities. Protecting your financial interests requires diligence and awareness of potential EoW transfer fraud.

Featured Posts

-

Es Alberto Ardila Olivares Una Garantia De Gol Un Analisis Objetivo

Apr 27, 2025

Es Alberto Ardila Olivares Una Garantia De Gol Un Analisis Objetivo

Apr 27, 2025 -

Amphibien Und Reptilien In Thueringen Verbreitung Arten Und Schutz

Apr 27, 2025

Amphibien Und Reptilien In Thueringen Verbreitung Arten Und Schutz

Apr 27, 2025 -

Indian Wells 2024 Eliminacion Temprana De Una De Las Favoritas

Apr 27, 2025

Indian Wells 2024 Eliminacion Temprana De Una De Las Favoritas

Apr 27, 2025 -

Cybercriminal Makes Millions From Office365 Executive Email Account Breaches

Apr 27, 2025

Cybercriminal Makes Millions From Office365 Executive Email Account Breaches

Apr 27, 2025 -

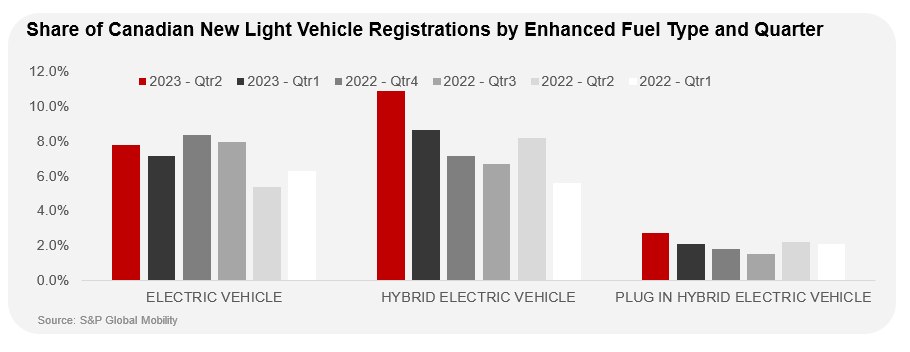

Ev Purchase Intentions Fall Among Canadian Consumers For Third Year

Apr 27, 2025

Ev Purchase Intentions Fall Among Canadian Consumers For Third Year

Apr 27, 2025