Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

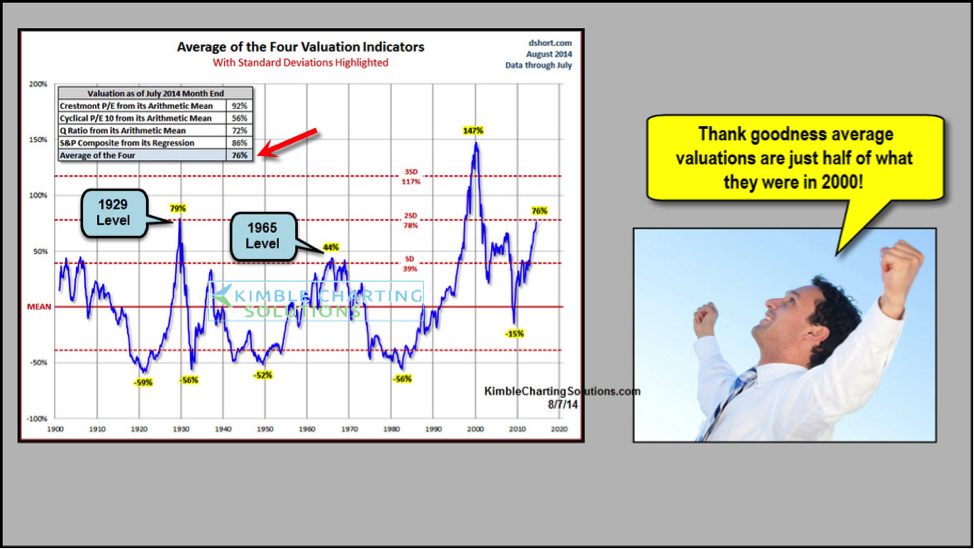

BofA's Assessment of Current Market Conditions

BofA's recent reports paint a nuanced picture of the current stock market. While acknowledging the elevated valuations, they haven't declared an outright overvalued market. Instead, their assessment suggests a market characterized by pockets of both overvaluation and undervaluation, requiring a more granular analysis. Their approach moves beyond simplistic metrics to consider underlying economic factors and sector-specific dynamics.

- Key indicators used by BofA: BofA's analysis incorporates a range of valuation metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, dividend yields, and forward earnings estimates. They also consider factors like interest rate sensitivity and growth potential.

- Sectors identified as potentially overvalued: While BofA doesn't publicly name specific stocks, their reports often highlight sectors like certain technology sub-sectors and growth stocks as potentially overvalued relative to their historical averages and future earnings expectations.

- BofA's prediction for future market performance: BofA's predictions are typically cautious, acknowledging the potential for market corrections due to elevated valuations and economic uncertainties. However, their outlook also highlights opportunities in undervalued sectors and specific stocks that demonstrate strong fundamentals and resilience.

Identifying Potential Risks Associated with High Valuations

Investing in a potentially overvalued market presents several significant risks:

- Risk of market correction or crash: High valuations inherently increase the likelihood of a market correction, potentially leading to substantial short-term losses. BofA's analyses often emphasize this risk, urging investors to prepare for potential volatility.

- Impact of rising interest rates on stock valuations: Rising interest rates typically lead to higher borrowing costs for companies, reducing profitability and potentially impacting stock valuations negatively. This is a crucial factor in BofA's assessment of the current market.

- Potential for lower returns compared to historically undervalued markets: Investing in an overvalued market generally translates to lower potential returns compared to investing when valuations are historically lower. BofA's analysis helps investors understand this trade-off.

- The impact of inflation on stock prices: Persistent inflation erodes purchasing power and can negatively influence corporate earnings, thus impacting stock prices. BofA incorporates inflation projections into their models when assessing market valuations.

BofA's Recommendations for Investors

BofA's recommendations for navigating the current market environment emphasize a cautious, yet opportunistic, approach:

- Diversification strategies: BofA strongly advocates for diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. This is a core principle in their investment guidance.

- Sector-specific recommendations: They often suggest favoring value stocks over growth stocks in the current environment, focusing on companies with strong fundamentals and consistent earnings. However, specific recommendations change based on their ongoing analyses.

- Importance of risk management and having a long-term investment plan: A well-defined investment strategy aligned with personal risk tolerance and long-term financial goals is paramount. BofA consistently emphasizes the need for a disciplined approach.

- Considering alternative investment options: BofA may suggest exploring alternative investments such as high-quality bonds or dividend-paying stocks as potential hedges against market volatility.

Understanding BofA's Methodology

BofA employs a sophisticated methodology combining quantitative and qualitative analyses to assess market valuations.

- Quantitative models used: They utilize various quantitative models, including discounted cash flow (DCF) analysis, relative valuation models, and econometric forecasting.

- Qualitative factors considered: Beyond quantitative data, BofA incorporates qualitative factors such as industry trends, regulatory changes, and geopolitical events into their assessments.

- Data sources used for analysis: Their analysis draws upon a wide range of data sources, including financial statements, industry reports, macroeconomic data, and proprietary research.

Addressing Investor Concerns: A BofA Perspective

BofA's analysis suggests a market characterized by varying valuations across sectors, highlighting potential risks associated with overvalued segments. Their recommendations emphasize diversification, risk management, and a long-term perspective. Key risks include market corrections driven by high valuations and the impact of rising interest rates. Opportunities exist for investors who can identify undervalued sectors and companies with strong fundamentals.

Addressing your investor concerns regarding high stock market valuations requires careful consideration of BofA's insights and your personal financial goals. Conduct thorough research, consult with a financial advisor, and develop a robust investment strategy based on a comprehensive understanding of current market conditions. Remember, actively managing your portfolio and staying informed about BofA's ongoing analyses are critical for navigating the complexities of high stock market valuations.

Featured Posts

-

The Bold And The Beautiful Spoilers Latest On Liams Health Crisis

Apr 24, 2025

The Bold And The Beautiful Spoilers Latest On Liams Health Crisis

Apr 24, 2025 -

Trumps Cuts And The Increased Risk Of Tornadoes This Season

Apr 24, 2025

Trumps Cuts And The Increased Risk Of Tornadoes This Season

Apr 24, 2025 -

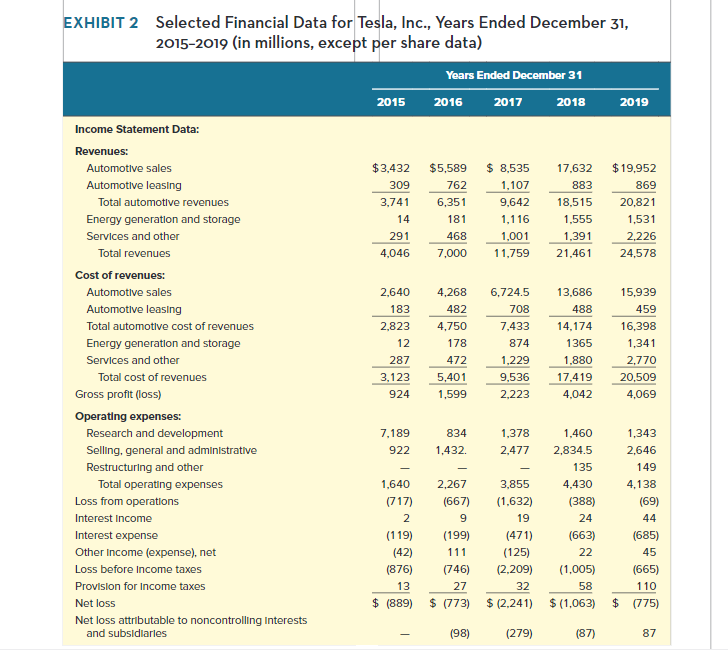

Analyzing Teslas 71 Net Income Decrease In The First Quarter

Apr 24, 2025

Analyzing Teslas 71 Net Income Decrease In The First Quarter

Apr 24, 2025 -

Remembering Jett Travolta A Photo Tribute On His Birthday

Apr 24, 2025

Remembering Jett Travolta A Photo Tribute On His Birthday

Apr 24, 2025 -

Soft Bank And Tether Partner With Cantor In Potential 3 Billion Crypto Spac

Apr 24, 2025

Soft Bank And Tether Partner With Cantor In Potential 3 Billion Crypto Spac

Apr 24, 2025