Analyzing Tesla's 71% Net Income Decrease In The First Quarter

Table of Contents

The Impact of Price Cuts on Tesla's Profitability

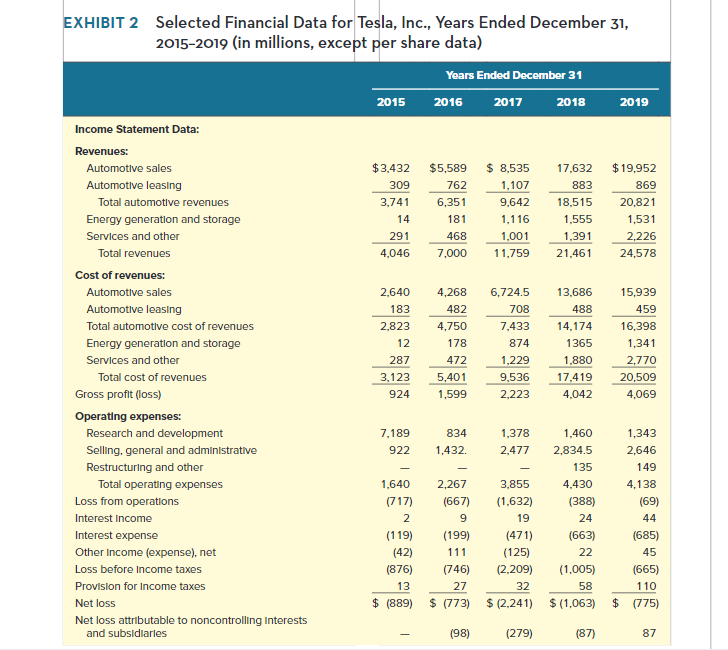

Tesla's aggressive price cuts in Q1 2024 directly impacted its profitability. This strategy, while aiming for increased sales volume, significantly reduced profit margins per vehicle.

Reduced Vehicle Margins

- Average Price Reduction: Tesla implemented average price reductions of approximately 10-20% across its model lineup in Q1 2024, depending on the specific model and region. This varied based on market conditions and competitive pressures.

- Impact on Revenue per Unit: The price cuts directly translated to a significant decrease in revenue generated per vehicle sold. Financial reports indicate a considerable drop in revenue per unit compared to Q4 2023 figures. Precise figures are subject to the release of Tesla's official Q1 2024 financial statements.

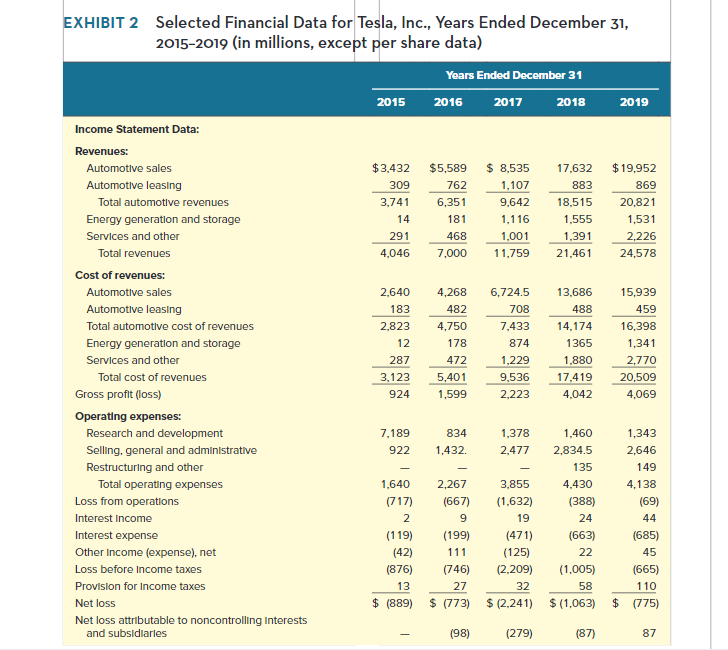

- Margin Comparison: Comparing Q1 2024 margins to previous quarters reveals a dramatic compression. The reduced margins, even with increased sales volume, couldn't offset the loss per unit. Analysts predict a continued margin squeeze unless pricing strategies are adjusted or production costs are brought down.

The Strategy Behind the Price Cuts

The rationale behind Tesla's pricing strategy is multifaceted. While boosting sales volume was a key objective, it was also a reactive measure to increasing competition.

- Intensified Competition: The EV market is becoming increasingly crowded with established automakers launching their own compelling EV models and new startups disrupting the landscape. This heightened competition necessitates aggressive pricing strategies to maintain market share.

- Market Share Data: While precise Q1 2024 market share data requires further analysis, early indications suggest a slight decrease in Tesla's market share, partially offsetting the impact of higher sales volume from the price cuts. The full impact of the price changes on Tesla's market share remains to be seen.

- Tesla's Q1 2024 Sales Figures: Tesla reported a considerable increase in sales volume in Q1 2024 compared to the previous quarter. However, the substantial drop in per-unit revenue negated much of the positive effect on overall profitability.

Rising Production Costs and Supply Chain Challenges

Escalating production costs and supply chain disruptions significantly contributed to Tesla's reduced net income.

Raw Material Inflation

- Battery Component Prices: The prices of lithium, cobalt, nickel, and other critical battery components continued their upward trend in Q1 2024, significantly impacting Tesla's manufacturing expenses. Supply chain issues exacerbated this inflation.

- Impact on Production Costs: The rise in raw material prices directly increased the overall cost of producing each Tesla vehicle, further compressing profit margins. This inflation is affecting not only Tesla, but the entire automotive industry.

- Cost of Production Analysis: Analysts predict a need for innovative battery technologies and supply chain diversification to mitigate the impact of fluctuating raw material prices on future profitability.

Supply Chain Disruptions

- Geopolitical Factors: Geopolitical instability and ongoing global trade tensions can disrupt supply chains, delaying the delivery of crucial components and increasing production costs.

- Bottlenecks: While Tesla has not publicly reported significant supply chain bottlenecks in Q1 2024, industry-wide challenges remain a persistent threat.

Increased Competition in the EV Market

The burgeoning EV market is characterized by intensified competition, impacting Tesla's financial performance.

Growing Number of Competitors

- Established Automakers: Traditional automakers like Ford, GM, Volkswagen, and others are aggressively investing in EV development and production, rapidly increasing the number of competitive models available.

- New EV Startups: Numerous new EV startups are entering the market, introducing innovative technologies and designs that further intensify competition. These disruptors are often more agile than established companies.

- Competitive Landscape: This fierce competitive landscape compels Tesla to adopt strategies like aggressive price cuts to maintain its market leadership.

Impact on Market Share and Pricing

- Market Share Comparison: Q1 2024 saw a minor decrease in Tesla’s market share compared to the previous quarter, a consequence of the heightened competitive environment. Competitors successfully captured more customers with more competitive pricing.

- Pricing Strategies: The increase in competition forced Tesla to adjust its pricing strategy, leading to the significant price cuts discussed earlier, which ultimately impacted profitability.

Other Contributing Factors

Beyond price cuts, production costs, and competition, other factors played a role in Tesla's Q1 2024 financial performance.

Regulatory Changes and Governmental Policies

Changes in government regulations and policies related to EV incentives, emissions standards, and other areas can significantly impact a company's profitability and operations. Such policy shifts should always be considered when analyzing financial results.

Investments in Infrastructure and Research & Development

Tesla's substantial investments in charging infrastructure (Supercharger network expansion) and ongoing research & development (new battery technologies, autonomous driving systems) impact short-term profitability. These long-term investments are crucial for maintaining competitiveness but reduce short-term net income.

Conclusion

Tesla's 71% net income decrease in Q1 2024 resulted from a complex interplay of factors. Aggressive price cuts, aimed at boosting sales volume in a highly competitive market, significantly reduced profit margins. Simultaneously, rising raw material costs, supply chain challenges, and intensified competition from established automakers and new EV startups all contributed to the downturn. The large investments in infrastructure and R&D further impacted short-term profitability.

The long-term implications remain uncertain. The success of Tesla's price cuts will depend on whether they translate into substantial market share gains that outweigh the reduced margins. To improve future profitability, Tesla may need to explore innovative cost-reduction strategies, optimize its supply chain, further enhance its vehicle technology, and potentially revisit its pricing approach.

Keep analyzing Tesla's financial performance, particularly focusing on its Q2 2024 earnings report, to gain a clearer understanding of the company's long-term trajectory and its response to the challenges it faces. Stay updated on Tesla's Q2 2024 earnings report and continue to monitor the evolving dynamics of the electric vehicle market and Tesla's response.

Featured Posts

-

Teslas Optimus Robot Development Slowed By Chinas Rare Earth Restrictions

Apr 24, 2025

Teslas Optimus Robot Development Slowed By Chinas Rare Earth Restrictions

Apr 24, 2025 -

Tesla Q1 Earnings Net Income Down 71 Amidst Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Down 71 Amidst Political Headwinds

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025

Bold And The Beautiful Recap April 9 Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025 -

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 24, 2025

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 24, 2025