Are High Stock Market Valuations A Concern? BofA's Analysis

Table of Contents

BofA's Key Findings on Current Market Valuations

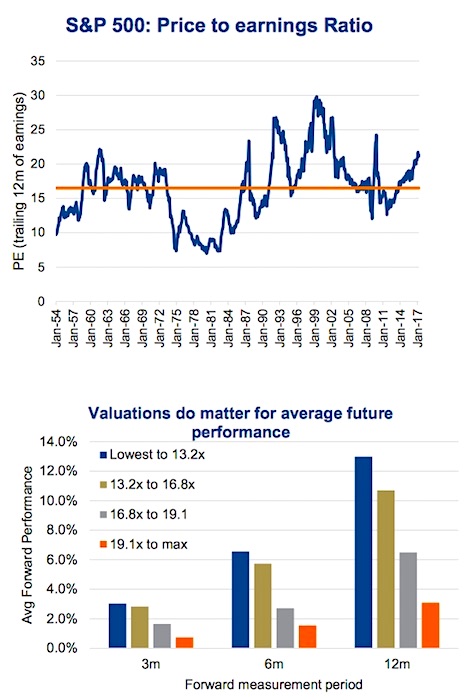

BofA's assessment of current market valuations paints a nuanced picture. While acknowledging the historically high levels, their analysis doesn't necessarily signal an impending crash. Instead, the report suggests a more cautious approach is warranted. The analysis considers various metrics to determine overall market valuation.

- Specific Data Points: BofA's report cited elevated Price-to-Earnings (P/E) ratios across several key indices, exceeding historical averages for certain sectors. Price-to-Sales (P/S) ratios also showed elevated levels compared to long-term averages, suggesting a premium is being placed on future growth potential. Specific data points from the report should be included here, referencing the actual BofA publication for accuracy. For example, "The report highlighted that the S&P 500's forward P/E ratio stands at X, significantly higher than the long-term average of Y." (Replace X and Y with actual data from the BofA report).

- Sector-Specific Analysis: BofA likely highlighted specific sectors showing particularly high or low valuations. For instance, the tech sector might be identified as relatively overvalued compared to more cyclical industries. Detailed analysis of these sectors with supporting data from the report is crucial here.

- Source: [Insert Citation of BofA's Report or Publication Here]

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the currently high stock market valuations. Understanding these factors is crucial for assessing the sustainability of these valuations.

- Low Interest Rates: Historically low interest rates, maintained by central banks globally, reduce the cost of borrowing for corporations and stimulate investment, driving up asset prices. This makes bonds less attractive, pushing investors towards higher-yielding assets such as stocks.

- Quantitative Easing (QE): Central banks' QE programs injected massive liquidity into the markets, fueling demand for stocks and other assets. This increased money supply helped prop up valuations.

- Strong Corporate Earnings (or Expectations): Robust corporate earnings, or strong expectations for future earnings growth, underpin higher stock prices as investors project increased profitability.

- Technological Advancements: Innovation and technological advancements constantly fuel expectations of future growth, attracting investment and driving valuations higher in related sectors.

- Investor Sentiment: Optimistic investor sentiment and a "fear of missing out" (FOMO) can also inflate stock prices beyond what fundamentals alone might justify. This factor is heavily influenced by media coverage and overall market psychology.

Potential Risks Associated with High Valuations

High stock market valuations inevitably carry potential risks. Investors must acknowledge these possibilities when making investment decisions.

- Increased Market Volatility: High valuations often precede periods of increased market volatility. Small negative news or unexpected economic events can trigger significant price swings.

- Potential for a Correction or Crash: Extremely high valuations are inherently unsustainable in the long run. A market correction, or even a more severe crash, becomes more likely as valuations stray further from historical norms.

- Reduced Investment Returns: Investing in highly valued assets carries a higher risk of lower future returns compared to investing in undervalued assets. Investors may experience less growth in the future, and high valuations can limit upside potential.

BofA's Recommendations for Investors

Given the high stock market valuations, BofA likely advocates for a cautious and diversified approach.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the overall portfolio's risk. BofA’s report will likely emphasize this as a crucial risk management strategy.

- Strategic Asset Allocation: Adjusting the portfolio's allocation based on individual risk tolerance and time horizon is essential. This may involve shifting towards less risky assets or increasing cash holdings.

- Cautious Approach: BofA may advise investors to avoid aggressive investing strategies in the current environment. A more conservative approach, prioritizing capital preservation over high growth, might be recommended.

- Alternative Investment Strategies: The report might also suggest exploring alternative investments, like commodities or infrastructure, which could potentially offer diversification benefits and hedge against market volatility.

Long-Term vs. Short-Term Investment Strategies

Investment strategies should differ significantly based on the investor's time horizon.

- Long-Term Investors: Long-term investors (those with a time horizon of 10 years or more) might be less concerned about short-term market fluctuations and can ride out corrections. Their strategy could focus on value investing, seeking undervalued assets for long-term growth.

- Short-Term Investors: Short-term investors are more sensitive to market volatility and may need to adopt a more defensive strategy, perhaps by increasing their cash position or focusing on less volatile assets.

Conclusion

BofA's analysis on high stock market valuations highlights the importance of a cautious yet strategic approach to investing. While not necessarily predicting an imminent market crash, the report suggests that current valuations are elevated and present increased risk. Understanding these risks and implementing a diversified portfolio, aligned with individual risk tolerance and time horizon, is paramount. The potential for reduced returns and increased volatility necessitates careful consideration of asset allocation and investment strategies. Understanding BofA's analysis on high stock market valuations is crucial for informed investment decisions. Take control of your financial future by reviewing your portfolio and adjusting your strategy based on this insightful report and by consulting with a financial advisor.

Featured Posts

-

Ai Digest Transforming Repetitive Documents Into A Compelling Podcast

Apr 22, 2025

Ai Digest Transforming Repetitive Documents Into A Compelling Podcast

Apr 22, 2025 -

Stock Market Pain Investors Brace For Further Losses

Apr 22, 2025

Stock Market Pain Investors Brace For Further Losses

Apr 22, 2025 -

Understanding High Stock Market Valuations Bof As Take

Apr 22, 2025

Understanding High Stock Market Valuations Bof As Take

Apr 22, 2025 -

The Pan Nordic Army A Combined Strength Of Swedish Tanks And Finnish Troops

Apr 22, 2025

The Pan Nordic Army A Combined Strength Of Swedish Tanks And Finnish Troops

Apr 22, 2025 -

Protests Against Trump A Cross Country Perspective

Apr 22, 2025

Protests Against Trump A Cross Country Perspective

Apr 22, 2025