Bitcoin (BTC) Rally: Trade And Fed Concerns Subside

Table of Contents

Easing Trade Tensions Boost Bitcoin (BTC) Price

Recent positive developments in US-China trade negotiations have significantly impacted investor sentiment. The reduction in uncertainty surrounding global trade has boosted risk appetite, positively affecting the cryptocurrency market, and Bitcoin (BTC) in particular. This is because Bitcoin, often considered a hedge against geopolitical uncertainty, sees increased demand when investors seek alternative assets.

- Decreased trade war fears lead to increased investor confidence: When trade tensions ease, investors feel more secure about the global economic outlook, leading them to allocate more capital to riskier assets, including Bitcoin (BTC).

- Correlation between global economic stability and Bitcoin's price: Historically, Bitcoin's price has shown a correlation with global economic stability. Periods of increased uncertainty often lead to Bitcoin price dips, while periods of stability often result in price appreciation.

- Positive trade news impacting the BTC price: Specific instances of positive trade news, such as the signing of "Phase One" trade deals, have demonstrably correlated with positive shifts in Bitcoin (BTC) price. These events signal a lessening of global trade uncertainty, boosting investor confidence and demand.

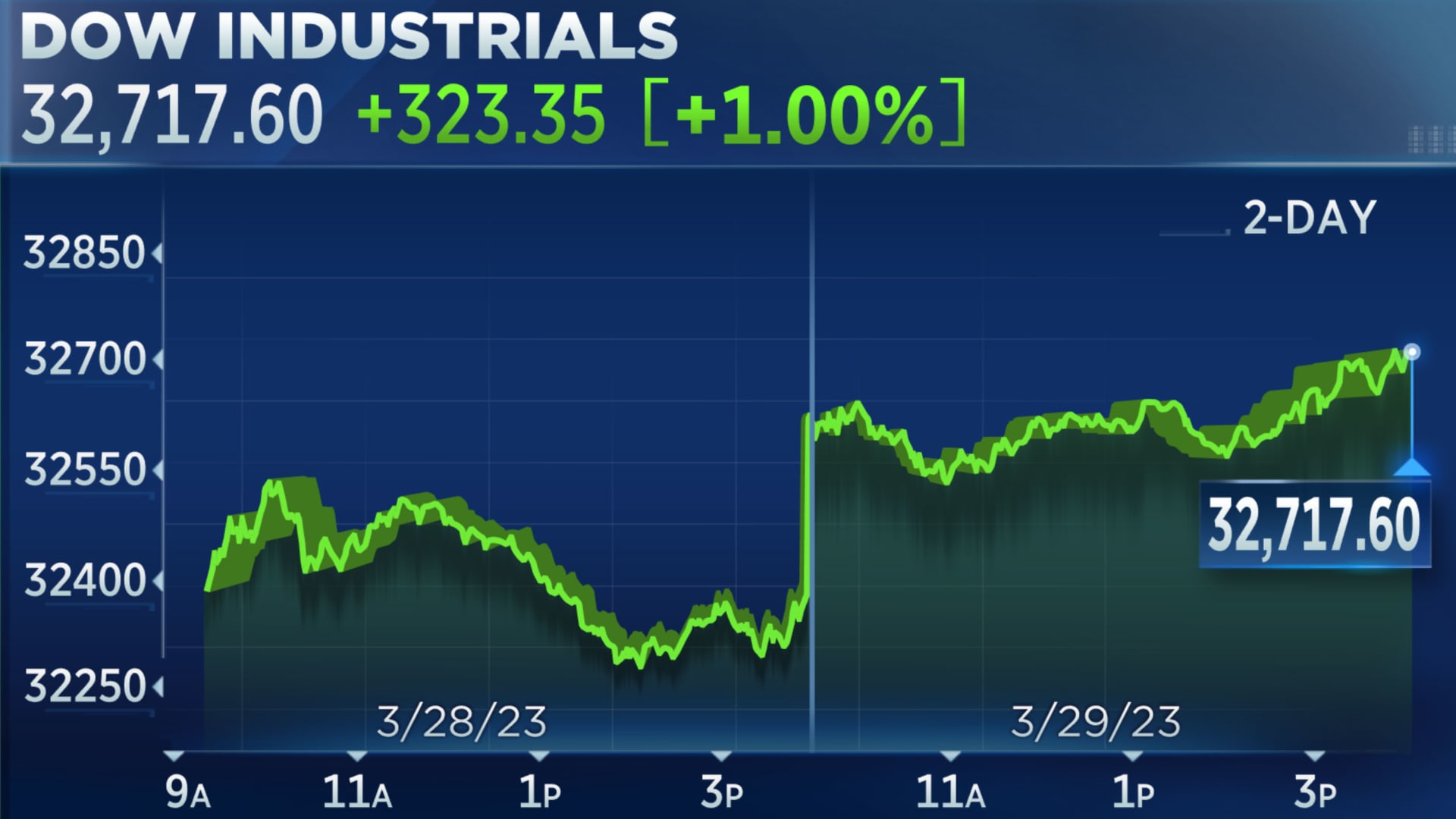

- Visual representation of price movements: [Insert chart or graph showing Bitcoin (BTC) price increase correlating with positive trade news].

Federal Reserve's Stance and its Influence on Bitcoin (BTC)

The Federal Reserve's recent decisions regarding interest rates have also played a significant role in the Bitcoin (BTC) rally. A less hawkish (less aggressive) stance by the Fed, suggesting potentially lower interest rate hikes or even rate cuts, is generally considered beneficial for risk assets like Bitcoin.

- Relationship between interest rates and investor appetite for riskier investments: Higher interest rates typically make traditional investments like bonds more attractive, reducing the appeal of riskier assets like Bitcoin. Conversely, lower interest rates can make Bitcoin (BTC) a more appealing investment.

- Lower interest rates and increased investment in Bitcoin: When interest rates are low, investors are more likely to seek higher-yielding investments, and Bitcoin (BTC), with its potential for significant returns, becomes a more attractive option.

- Expert opinions supporting this connection: Numerous financial analysts have commented on the inverse relationship between interest rates and the price of Bitcoin (BTC), supporting the idea that a less hawkish Fed contributes positively to the cryptocurrency's price.

Increased Institutional Interest in Bitcoin (BTC)

The growing interest from institutional investors in Bitcoin (BTC) is a crucial factor driving the current rally. This influx of capital from large financial players adds legitimacy and stability to the market.

- Impact of Grayscale Bitcoin Trust and other significant institutional investors: The Grayscale Bitcoin Trust, for example, has seen significant inflows, representing a substantial increase in institutional holdings of Bitcoin (BTC). Other institutional investors, including some large corporations and hedge funds, are also steadily increasing their exposure to Bitcoin.

- Role of custody solutions and regulatory clarity: The development of secure custody solutions and increasing regulatory clarity in certain jurisdictions are making it easier and safer for institutional investors to participate in the Bitcoin market.

- News related to ETFs or other regulated Bitcoin investment vehicles: The ongoing discussion surrounding Bitcoin ETFs (exchange-traded funds) and other regulated investment vehicles is further driving institutional interest, as it promises increased accessibility and liquidity.

Technical Analysis of the Bitcoin (BTC) Rally

While fundamental factors are crucial, technical analysis provides further insight into the Bitcoin (BTC) rally's potential trajectory.

- Key technical indicators: Indicators like moving averages, the Relative Strength Index (RSI), and trading volume are suggesting sustained upward momentum for Bitcoin (BTC) in the short to medium term. [Insert chart or graph illustrating these indicators].

- Potential support and resistance levels: Technical analysis helps identify potential price support and resistance levels, which can help predict short-term price movements. [Insert chart or graph showing support and resistance levels].

- Concise explanation for non-technical readers: The technical indicators point to a continuation of the upward trend, although price corrections are always a possibility in the volatile cryptocurrency market.

Conclusion

The recent Bitcoin (BTC) rally is a confluence of factors: reduced trade tensions, a more dovish Federal Reserve stance, and increased institutional investment. These elements have combined to create a positive environment for Bitcoin price appreciation. This suggests a stronger overall market sentiment towards Bitcoin (BTC) and the cryptocurrency market as a whole.

Capitalize on the current Bitcoin (BTC) rally by staying informed about market trends. Explore the potential of Bitcoin (BTC) investment today – but always remember to conduct thorough research and consider your own risk tolerance. [Optional: Include links to relevant resources, such as reputable news sources or educational materials about Bitcoin investing].

Featured Posts

-

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025 -

Indias Stock Market Surge Understanding The Forces Behind Niftys Gains

Apr 24, 2025

Indias Stock Market Surge Understanding The Forces Behind Niftys Gains

Apr 24, 2025 -

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025 -

How Middle Management Drives Productivity And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Productivity And Employee Satisfaction

Apr 24, 2025 -

Herros 3 Pointer Perfection And Cavaliers Skills Challenge Win At Nba All Star

Apr 24, 2025

Herros 3 Pointer Perfection And Cavaliers Skills Challenge Win At Nba All Star

Apr 24, 2025