Building A Fiscally Responsible Canada: A Plan For The Future

Table of Contents

Sustainable Economic Growth and Job Creation

A strong economy is the cornerstone of fiscal responsibility. To achieve a truly fiscally responsible Canada, we must prioritize sustainable economic growth and job creation. This involves strategic investments and policy changes to bolster various sectors.

Investing in Innovation and Technology

Canada needs to become a global leader in innovation. This requires significant investment in research and development (R&D) and support for our entrepreneurs. Key initiatives include:

- Increased funding for STEM education and training programs: Investing in our future workforce through robust STEM (Science, Technology, Engineering, and Mathematics) education is crucial for fostering innovation and technological advancement. This means increased funding for universities, colleges, and vocational training programs focusing on in-demand skills.

- Streamlined regulatory processes for new businesses: Red tape hinders entrepreneurship. Simplifying regulations and reducing bureaucratic hurdles will encourage new business formation and job creation, contributing to a healthier Canadian economy and a more fiscally responsible future.

- Tax credits for companies investing in R&D and adopting green technologies: Incentivizing companies to invest in research and development, particularly in sustainable technologies, will drive innovation, create jobs, and promote a greener economy – all crucial elements of a fiscally responsible Canada.

Diversifying the Canadian Economy

Over-reliance on specific sectors leaves Canada vulnerable to economic shocks. Diversification is key to long-term stability. We need to:

- Support for small and medium-sized enterprises (SMEs) in diverse sectors: SMEs are the backbone of the Canadian economy. Providing targeted support, including access to financing and mentorship programs, is crucial for fostering growth across various sectors.

- Targeted infrastructure investments to support economic diversification: Investing in infrastructure that supports emerging industries, such as renewable energy and advanced manufacturing, will create jobs and attract investment, building a more resilient and fiscally responsible Canada.

- Trade agreements to expand market access for Canadian goods and services: Expanding access to global markets is vital for economic growth. Negotiating and implementing fair and beneficial trade agreements will help Canadian businesses thrive and contribute to a stronger economy.

Responsible Government Spending and Debt Management

Responsible spending is paramount to building a fiscally responsible Canada. This requires careful prioritization and efficient resource allocation.

Prioritizing Essential Services

Healthcare, education, and social safety nets are essential. However, we must ensure these services are delivered efficiently and effectively. This means:

- Implementing evidence-based budgeting to improve efficiency and effectiveness: Moving away from arbitrary spending decisions and towards evidence-based budgeting will ensure that resources are allocated where they will have the greatest impact, leading to better outcomes and fiscal responsibility.

- Reducing administrative overhead and eliminating duplication of services: Streamlining government operations and eliminating redundancies can free up significant resources for essential services, contributing to a more fiscally responsible Canada.

- Investing in preventative healthcare to reduce long-term costs: Investing in preventative healthcare measures will lead to lower healthcare costs in the long run, creating a more sustainable and fiscally responsible healthcare system.

Strategic Infrastructure Investments

Infrastructure investments must be strategic, focusing on projects with high economic returns and long-term benefits. This includes:

- Public-private partnerships to leverage private sector expertise and capital: Public-private partnerships can leverage the expertise and capital of the private sector to deliver large-scale infrastructure projects efficiently and effectively, contributing to fiscal responsibility.

- Thorough cost-benefit analysis before committing to large infrastructure projects: Every major infrastructure project requires a thorough cost-benefit analysis to ensure it aligns with overall fiscal objectives and provides value for money.

- Focus on sustainable and resilient infrastructure design: Building sustainable and resilient infrastructure will reduce long-term maintenance costs and ensure that infrastructure assets remain functional for decades, promoting long-term fiscal responsibility.

Fair and Efficient Tax System

A fair and efficient tax system is crucial for generating the revenue needed to fund essential services while promoting economic growth.

Tax Reform for Equity and Growth

Tax reform should aim for both equity and growth. This requires:

- Closing tax loopholes and addressing tax evasion aggressively: Closing tax loopholes and cracking down on tax evasion will increase government revenue and ensure fairness across all taxpayers, contributing to a more fiscally responsible Canada.

- Simplifying the tax code to reduce compliance costs for businesses and individuals: A simpler tax code reduces compliance costs for both businesses and individuals, freeing up resources and encouraging economic activity.

- Consideration of progressive tax policies to address income inequality: Progressive tax policies can help address income inequality while generating revenue for essential social programs, contributing to a fairer and more fiscally responsible society.

Enhanced Tax Collection

Improving tax collection is vital for maximizing government revenue. This includes:

- Investing in modern tax administration technology: Investing in modern technology will improve the efficiency and effectiveness of tax collection, reducing administrative costs and maximizing revenue.

- Strengthening enforcement of tax laws: Stronger enforcement of tax laws will deter tax evasion and ensure that all taxpayers contribute their fair share, leading to increased revenue and greater fiscal responsibility.

- Collaboration with international partners to combat tax evasion and avoidance: Working with international partners to combat tax evasion and avoidance will help prevent the erosion of the Canadian tax base and ensure a more fiscally responsible future.

Conclusion

Building a fiscally responsible Canada demands a concerted effort from all levels of government and the private sector. By implementing the strategies outlined above—prioritizing sustainable economic growth, managing government spending responsibly, and ensuring a fair and efficient tax system—we can secure a stable and prosperous future for our nation. A fiscally responsible Canada is not merely an aspiration; it is a necessity for ensuring the well-being of future generations. Let's work together to build a stronger, more prosperous, and fiscally responsible Canada. Join the conversation and contribute to the ongoing dialogue about creating a truly fiscally responsible Canada.

Featured Posts

-

Nba 3 Point Contest 2024 Herros Triumph Over Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Herros Triumph Over Hield

Apr 24, 2025 -

Is Open Ai Buying Google Chrome Analysis Of The Chat Gpt Ceos Remarks

Apr 24, 2025

Is Open Ai Buying Google Chrome Analysis Of The Chat Gpt Ceos Remarks

Apr 24, 2025 -

Apr 24, 2025

Apr 24, 2025 -

Is The Lg C3 77 Inch Oled Worth The Hype A Review

Apr 24, 2025

Is The Lg C3 77 Inch Oled Worth The Hype A Review

Apr 24, 2025 -

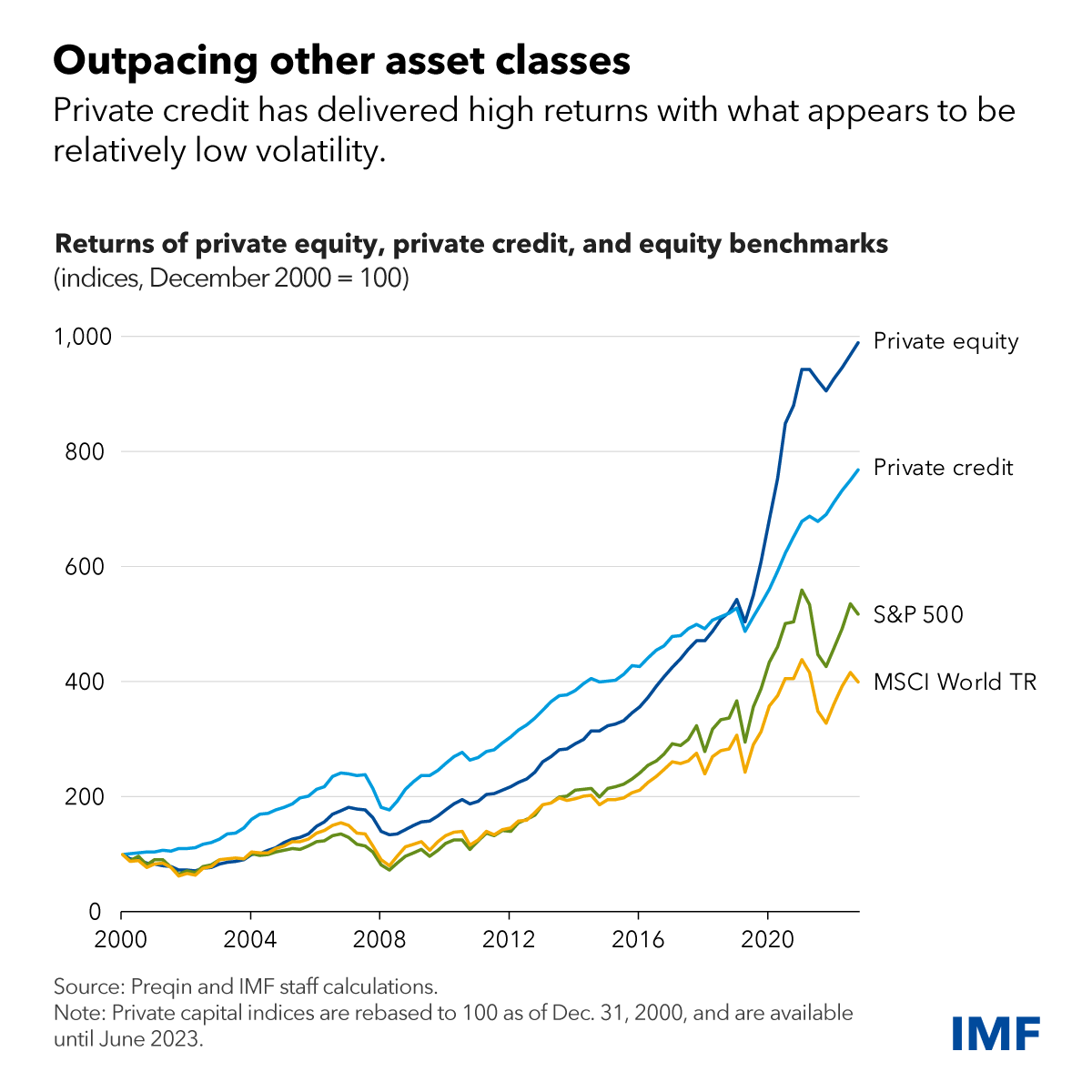

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025