Bullion's Rise Amidst Trade Wars: A Detailed Analysis Of Gold Prices

Table of Contents

The Safe-Haven Appeal of Gold During Trade Wars

Gold has long been recognized as a safe-haven asset, a store of value that holds its worth even during periods of economic and geopolitical turmoil. This inherent characteristic makes it particularly attractive during times of heightened uncertainty, such as trade wars.

- Increased uncertainty in global markets drives investors towards gold. When trade disputes escalate, investors often seek refuge in assets perceived as less risky. Gold, with its historical stability, becomes a preferred destination for capital flight.

- Gold's lack of correlation with other assets makes it an attractive hedge. Unlike stocks and bonds, which often fall in value during times of economic stress, gold often moves independently, providing diversification benefits to a portfolio.

- Historical instances demonstrate gold's rise during geopolitical uncertainty. Numerous examples throughout history, including the 1970s oil crisis and the 2008 financial crisis, showcase a strong positive correlation between geopolitical instability and gold price increases.

- Central bank gold reserves play a significant role. Central banks worldwide hold substantial gold reserves, influencing the market. Their buying and selling activities can significantly impact gold prices, particularly during times of global economic uncertainty. This reinforces gold's position as a trusted asset.

Impact of Currency Devaluation on Bullion Prices

Trade wars frequently lead to currency devaluation. When countries engage in protectionist measures, it can disrupt international trade flows and negatively affect a nation's currency. This devaluation directly impacts bullion prices.

- Mechanism of currency devaluation in trade disputes: Trade wars often involve tariffs and other trade restrictions that disrupt supply chains and reduce exports, weakening the affected country's currency.

- Weaker currencies increase the demand for gold (priced in USD): As a currency weakens, the price of gold (typically denominated in US dollars) becomes more expensive in that currency, making it relatively more attractive to local investors.

- Examples of currency devaluation during trade wars: Historical analysis of past trade disputes reveals clear instances where involved countries experienced currency weakness, boosting demand for gold as a safe haven and inflation hedge.

- Interplay between inflation and gold prices: Currency devaluation often leads to inflation. Gold has historically served as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines. This makes gold investment an attractive strategy during periods of inflationary pressures.

Increased Investment Demand for Gold ETFs and Bullion

The rise in gold prices during trade wars is also fueled by increased investment in gold Exchange Traded Funds (ETFs) and physical bullion.

- Ease and accessibility of investing in gold through ETFs: Gold ETFs offer investors a convenient and cost-effective way to gain exposure to gold without the need to physically store the metal. This accessibility contributes to increased investment demand during times of uncertainty.

- Institutional investors drive up demand: Large institutional investors, including pension funds and hedge funds, often increase their gold holdings during periods of market volatility, further boosting demand.

- Correlation between trade war anxieties and ETF inflows: Data clearly shows a positive correlation between escalating trade tensions and increased inflows into gold ETFs, demonstrating the growing preference for gold as a safe haven asset during trade wars.

- Physical bullion investment trends: During trade wars, investors also increasingly seek physical gold bars and coins, signifying a preference for tangible assets that can serve as a reliable store of value.

Analyzing the Correlation Between Trade Wars and Gold Prices (Data and Charts)

[Insert relevant data and charts here. For example, a chart comparing gold price movements with key trade war events, such as the imposition of tariffs or trade restrictions. The chart should visually demonstrate a positive correlation between escalating trade tensions and rising gold prices.]

This data highlights a clear trend: periods of heightened trade war activity tend to be followed by significant increases in gold prices. The upward trend reflects the safe-haven buying and the impact of currency fluctuations during such periods.

Conclusion: Understanding the Bullion Market and Trade Wars

This analysis reveals a strong correlation between trade wars and the rise in gold prices. This rise is primarily driven by the safe-haven appeal of gold, the impact of currency devaluation on bullion prices, and the surge in investment demand for gold ETFs and physical bullion. Understanding the dynamics of the bullion market is crucial during times of global economic uncertainty. Investors need to comprehend how trade wars, currency fluctuations, and inflation can impact their portfolios.

Stay informed about the latest developments in the bullion market and how trade wars may impact gold prices. Consider incorporating gold into your investment strategy for a diversified portfolio and to mitigate risks associated with global trade tensions. Careful consideration of gold as part of a broader investment strategy, including gold ETFs and physical bullion, can offer valuable protection against the uncertainties inherent in a global economy impacted by trade wars.

Featured Posts

-

Understanding The Karen Read Murder Case Timeline

Apr 26, 2025

Understanding The Karen Read Murder Case Timeline

Apr 26, 2025 -

La Fire Victims Face Exploitative Rent Hikes Claims Reality Star

Apr 26, 2025

La Fire Victims Face Exploitative Rent Hikes Claims Reality Star

Apr 26, 2025 -

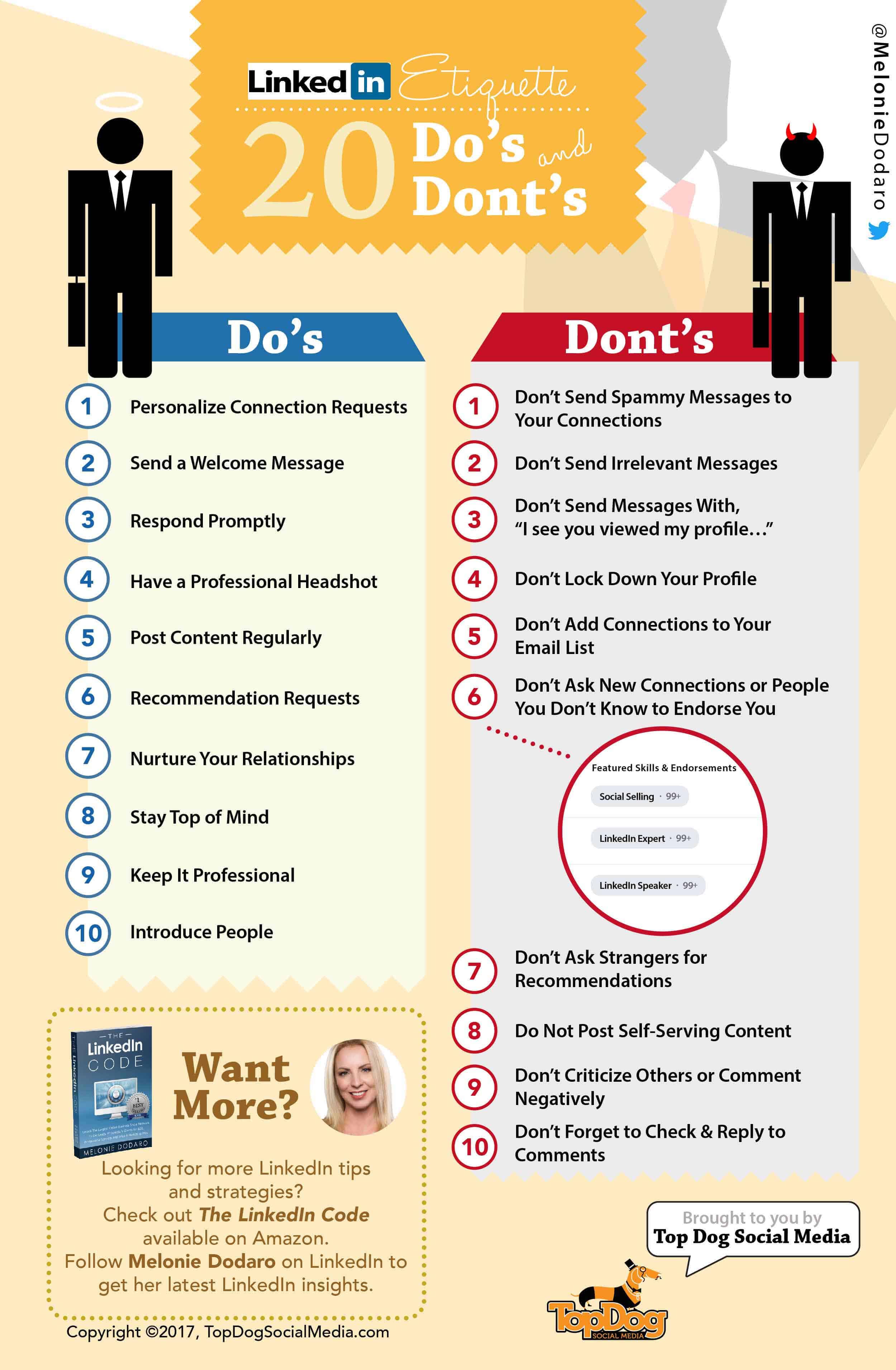

Private Credit Jobs 5 Dos And Don Ts To Get Hired

Apr 26, 2025

Private Credit Jobs 5 Dos And Don Ts To Get Hired

Apr 26, 2025 -

Will Ahmed Hassanein Break Barriers In The Nfl Draft

Apr 26, 2025

Will Ahmed Hassanein Break Barriers In The Nfl Draft

Apr 26, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 26, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 26, 2025