Canada Needs Fiscal Responsibility: A Critical Analysis Of Liberal Policies

Table of Contents

Excessive Government Spending and its Impact

The Liberal government's commitment to expansive social programs and ambitious infrastructure projects, while laudable in their intentions, raises questions regarding their overall fiscal sustainability and impact on the national debt.

Increased Social Programs and their Cost

The expansion of social programs, such as the Canada Child Benefit (CCB) and increased healthcare initiatives, has significantly increased government spending.

- Canada Child Benefit: While aimed at reducing child poverty, the CCB represents a substantial annual budgetary commitment. The cost-effectiveness of achieving poverty reduction through this program, as opposed to other potential approaches, needs further scrutiny.

- Expanded Healthcare Initiatives: Increased funding for healthcare is crucial, yet careful consideration of cost-effectiveness and long-term financial planning is essential. This includes exploring innovative models to control costs and ensure sustainable healthcare delivery.

The cost of these initiatives, while intended to improve the well-being of Canadians, must be weighed against the potential long-term consequences of increased government debt. Data on program efficacy and return on investment is crucial to determine if the benefits outweigh the fiscal burden. Without careful analysis and evidence-based decision-making, unintended consequences like inflationary pressures and reduced private sector investment are possible.

Infrastructure Spending: A Necessary Investment or Overspending?

Significant investments in infrastructure are essential for long-term economic growth. However, the Liberal government's approach to infrastructure spending requires careful examination. Many projects have faced cost overruns and delays, raising concerns about their fiscal prudence and value for money.

- Cost Overruns: Analyzing the frequency and magnitude of cost overruns on major infrastructure projects is crucial for assessing the efficiency of government procurement and project management.

- Project Delays: Delays in project completion lead to increased costs and reduced economic benefits. A thorough investigation into the causes of delays is needed to improve future project planning and execution.

- Alternative Financing: Exploring public-private partnerships (P3s) and other innovative financing mechanisms could potentially reduce the financial burden on taxpayers.

Transparency and accountability in infrastructure spending are paramount. Data on project costs, timelines, and economic impact should be readily available and subjected to rigorous independent audits.

Taxation Policies and their Effectiveness

The Liberal government's taxation policies play a significant role in shaping Canada's fiscal landscape. Examining their effectiveness requires a nuanced understanding of their impact on various economic sectors.

Impact of Tax Increases (if any) on Economic Growth

While specific tax increases may vary over time, the overall impact of taxation levels on economic growth requires careful analysis.

- Impact on Investment: High tax rates can discourage investment, leading to slower economic growth and reduced job creation.

- Impact on Job Creation: A balanced tax system is essential to promoting economic activity, and tax policy must be carefully calibrated to avoid stifling entrepreneurship and job creation.

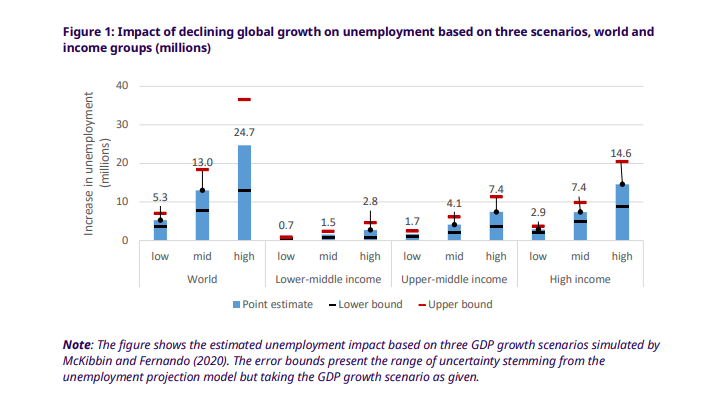

- GDP Growth & Unemployment Rates: Economic indicators such as GDP growth and unemployment rates provide crucial insights into the effectiveness of taxation policies.

Analyzing the relationship between tax rates, economic growth, and employment is critical for formulating effective and sustainable fiscal policies.

Tax Revenue Projections and Fiscal Sustainability

The government's tax revenue projections are crucial for developing realistic budgets and ensuring fiscal sustainability.

- Reliability of Projections: The accuracy of revenue projections is essential. Unrealistic projections can lead to unsustainable spending and increased debt.

- Discrepancies Between Projected and Actual Revenues: Analyzing the discrepancies between projected and actual revenue helps assess the accuracy of the government's economic forecasting and fiscal modeling.

- Long-Term Sustainability of the Tax System: A review of the long-term sustainability of the tax system is crucial to ensure the government can meet its financial obligations in the future.

Transparency and independent analysis of tax revenue projections are essential for building public trust and fostering informed policy debate.

Debt Accumulation and its Long-Term Consequences

Canada's growing national debt presents a significant challenge to long-term fiscal sustainability.

Current Levels of National Debt and Deficit

Understanding the current levels of national debt and deficit is critical for assessing the country’s fiscal health. Comparing these figures to historical data and those of other developed nations provides valuable context. Data visualization (charts and graphs) can make this information more accessible and easily understood.

The Impact of High Debt on Future Generations

The burden of high national debt falls not only on current taxpayers but also on future generations. This necessitates a responsible approach to fiscal management. The impact on future generations includes:

- Increased Interest Payments: Higher debt leads to increased interest payments, diverting funds from essential social programs and infrastructure investments.

- Reduced Social Programs: The increasing cost of servicing the national debt can force governments to reduce spending on essential services.

- Slower Economic Growth: High debt levels can stifle economic growth, impacting employment opportunities and living standards.

Careful planning is crucial to mitigate the long-term impact of debt accumulation.

Alternative Fiscal Strategies for Debt Reduction

Addressing Canada's growing debt requires a multi-pronged approach encompassing fiscal prudence and economic growth strategies.

- Spending Cuts: Identifying areas for spending reduction without compromising essential services requires careful analysis and prioritization.

- Tax Reforms: Revisiting the tax system to ensure fairness and efficiency while stimulating economic growth is vital.

- Increased Economic Growth: Promoting economic growth through investments in innovation, education, and infrastructure can increase tax revenues and reduce the debt-to-GDP ratio.

Implementing a comprehensive strategy that incorporates these elements is crucial for achieving long-term fiscal stability.

Conclusion: A Call for Fiscal Prudence and Responsible Governance in Canada

This analysis demonstrates a need for greater fiscal responsibility in Canada. The current level of government spending, coupled with potential revenue shortfalls, threatens the nation's long-term economic stability. Excessive government spending on social programs and infrastructure projects, while well-intentioned, requires careful cost-benefit analysis to ensure value for money and long-term sustainability. The government’s taxation policies must be designed to promote economic growth without excessively burdening taxpayers. Furthermore, Canada’s growing national debt poses a significant risk to future generations.

Canadians must demand fiscal responsibility from their elected officials. Contact your Member of Parliament and express your concerns about the government's spending policies. Advocate for greater transparency and accountability in government finances. The future of Canada's economy depends on a commitment to responsible fiscal management. Let's work together to build a fiscally sound and prosperous future for all Canadians.

Featured Posts

-

Fewer Border Crossings White House Reports Decline At Canada U S Border

Apr 24, 2025

Fewer Border Crossings White House Reports Decline At Canada U S Border

Apr 24, 2025 -

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

Apr 24, 2025

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

Apr 24, 2025 -

Canadian Dollar Weakness A Deeper Dive Into Recent Currency Fluctuations

Apr 24, 2025

Canadian Dollar Weakness A Deeper Dive Into Recent Currency Fluctuations

Apr 24, 2025 -

Us Market Slumps As Emerging Market Stocks Rebound

Apr 24, 2025

Us Market Slumps As Emerging Market Stocks Rebound

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis

Apr 24, 2025