US Market Slumps As Emerging Market Stocks Rebound

Table of Contents

Factors Contributing to the US Market Slump

Several interconnected factors are contributing to the downturn in the US market, creating a challenging environment for investors.

Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes, aimed at curbing persistent inflation, are significantly impacting US stocks. Increased borrowing costs make it more expensive for companies to expand, leading to reduced investment and hiring. High inflation erodes consumer purchasing power, impacting corporate profits and slowing economic growth. Key economic indicators like the Consumer Price Index (CPI) and inflation rates remain stubbornly high, fueling investor uncertainty.

- Increased borrowing costs: Higher interest rates make loans more expensive for businesses, hindering expansion and investment.

- Reduced consumer spending: Inflation erodes purchasing power, leading to decreased consumer demand for goods and services.

- Decreased corporate investment: Higher interest rates and economic uncertainty lead to businesses delaying or canceling capital investments.

Geopolitical Uncertainty and Recession Fears

Global geopolitical instability, including ongoing conflicts and political tensions, contributes significantly to the US market slump. These events create uncertainty and risk aversion among investors, leading to capital flight from riskier assets. Coupled with persistent fears of a looming recession, this environment fosters a climate of caution and decreased market confidence.

- Supply chain disruptions: Global conflicts and political instability continue to disrupt supply chains, impacting production and increasing costs.

- Energy price volatility: Geopolitical events often exacerbate energy price fluctuations, further impacting inflation and economic growth.

- Investor risk aversion: Uncertainty surrounding geopolitical events and economic prospects drives investors towards safer, less volatile assets.

Tech Sector Correction

The technology sector, a significant driver of the US market in recent years, has experienced a significant correction. Overvaluation concerns, coupled with interest rate sensitivity and reduced investor confidence, have led to a sell-off in many tech giants. This correction, impacting major players, further contributes to the overall market downturn.

- Valuation concerns: Previously high valuations for many tech companies are now viewed as unsustainable in the current economic climate.

- Interest rate sensitivity: Tech companies often rely on debt financing; higher interest rates increase their borrowing costs.

- Reduced investor confidence: Uncertainty regarding future growth prospects has led to a decline in investor confidence in the tech sector.

Emerging Market Stock Rebound: Reasons for Growth

While the US market struggles, emerging markets are exhibiting surprising resilience and even growth. This rebound is driven by several key factors.

Stronger-Than-Expected Economic Growth in Certain Regions

Several emerging economies are experiencing robust growth, defying global economic headwinds. This growth is fueled by factors like increased domestic consumption, infrastructure development, and export-oriented strategies. Countries in Southeast Asia and parts of Africa, for example, are demonstrating particularly strong performance.

- Increased domestic demand: Growing middle classes in many emerging economies are driving strong domestic consumption.

- Export-oriented growth: Many emerging markets benefit from their role as exporters of commodities and manufactured goods.

- Government investment: Government investment in infrastructure and other key sectors is stimulating economic growth in certain regions.

Favorable Commodity Prices

Rising commodity prices are significantly benefiting emerging market economies rich in natural resources. This translates to increased export revenues, improved terms of trade, and higher government revenues, bolstering economic growth and investor confidence. The energy and mining sectors, in particular, are experiencing a significant boost.

- Increased export revenues: Higher commodity prices lead to increased export earnings for resource-rich emerging economies.

- Improved terms of trade: Favorable commodity prices improve the relative price of exports compared to imports.

- Government revenue increases: Higher commodity prices boost government revenues through taxes and royalties.

Relative Valuation Compared to US Market

Compared to the relatively overvalued US market, emerging markets often present more attractive valuations. Lower price-to-earnings (P/E) ratios and higher growth potential make them a compelling investment option for some investors seeking higher returns.

- Lower P/E ratios: Emerging market stocks often trade at lower P/E ratios than their US counterparts.

- Higher growth potential: Emerging economies often have higher growth potential compared to developed economies.

- Attractive dividend yields: Some emerging market companies offer attractive dividend yields, adding to their investment appeal.

Conclusion: Navigating the Shifting Market Landscape

The current market divergence, with the US market slumping while emerging markets rebound, highlights the complexities of global finance. Understanding the factors driving this split—rising interest rates, geopolitical uncertainty, a tech sector correction in the US versus stronger-than-expected economic growth, favorable commodity prices, and attractive valuations in emerging markets—is crucial for effective investment strategy. Investors should consider diversification strategies, potentially allocating a portion of their portfolio to emerging markets to mitigate risk and potentially capitalize on higher growth opportunities. Learn how to capitalize on emerging market opportunities during US market downturns by exploring the resources available on global investment strategies. Understand the dynamics between US market slumps and emerging market rebounds to make informed decisions in this evolving investment landscape.

Featured Posts

-

Luxury Car Sales In China Analyzing The Difficulties Faced By Brands Like Bmw And Porsche

Apr 24, 2025

Luxury Car Sales In China Analyzing The Difficulties Faced By Brands Like Bmw And Porsche

Apr 24, 2025 -

Tesla Q1 Profit Fall Political Backlash And Its Effect On The Company

Apr 24, 2025

Tesla Q1 Profit Fall Political Backlash And Its Effect On The Company

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Point Show And Cavs Skills Challenge Success

Apr 24, 2025

Nba All Star Weekend Herros 3 Point Show And Cavs Skills Challenge Success

Apr 24, 2025 -

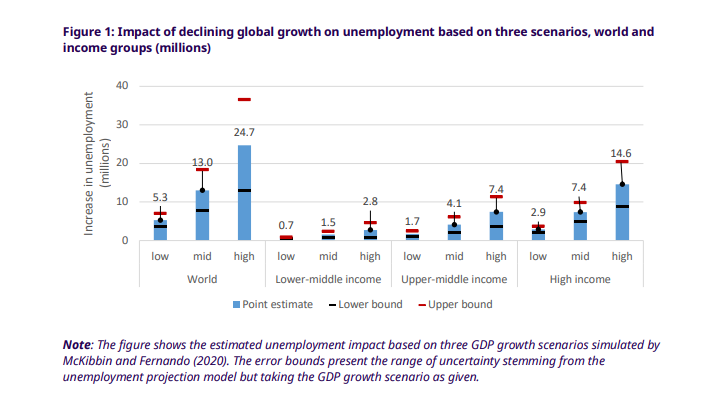

Rare Earth Supply Chain Issues Hamper Teslas Optimus Robot Development

Apr 24, 2025

Rare Earth Supply Chain Issues Hamper Teslas Optimus Robot Development

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025

Bold And The Beautiful Recap April 9 Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025