Chinese Buyout Firm's Potential Sale Of Chip Tester UTAC

Table of Contents

UTAC's Significance in the Semiconductor Ecosystem

UTAC plays a vital role in the semiconductor industry, specializing in the production of advanced chip testing equipment. Their offerings are crucial for ensuring the quality and functionality of integrated circuits (ICs) before they reach the market. UTAC boasts a considerable market share, particularly in the high-end segment, and is recognized for its innovative testing technologies, including advanced algorithms and high-throughput systems.

-

Technological Leadership: UTAC's proprietary testing methodologies and cutting-edge equipment give them a competitive edge. They consistently push the boundaries of what's possible in chip testing, enabling faster and more accurate testing processes.

-

Key Customers and Partnerships: UTAC works with leading semiconductor manufacturers worldwide, including several prominent companies in the United States, Asia, and Europe. These strategic partnerships provide UTAC with valuable market insight and opportunities for ongoing innovation.

-

Market Dominance: UTAC holds a significant market share in the global semiconductor testing equipment market, placing them as a key player influencing pricing, innovation, and supply chain dynamics within the semiconductor ecosystem. Their influence is felt across various chip types, from memory chips to microprocessors.

Reasons Behind the Potential Sale of UTAC

The potential sale of UTAC by the Chinese buyout firm is likely driven by a confluence of factors, primarily focused on maximizing financial returns and adapting to shifting market dynamics.

-

Maximizing Investment Returns: Private equity firms, by their nature, seek to generate substantial returns on their investments within a defined timeframe. The sale of UTAC may represent an opportune moment to realize a significant profit and re-allocate capital to other promising ventures.

-

Market Conditions and Economic Climate: The current global economic climate, including fluctuating semiconductor demand and supply chain challenges, might influence the buyout firm's decision to divest from UTAC. A sale could be seen as a way to secure a return before market volatility further impacts profitability.

-

Strategic Portfolio Restructuring: The buyout firm might be strategically repositioning its investment portfolio, divesting from mature assets like UTAC to invest in more rapidly growing sectors of the technology industry. This would be a common strategy in the private equity space.

-

Regulatory and Geopolitical Pressures: Growing geopolitical tensions and increased regulatory scrutiny surrounding foreign investment in the semiconductor industry could also contribute to the decision. The sale might be perceived as a way to mitigate potential risks associated with ongoing regulatory changes.

Potential Buyers and Market Implications of UTAC Sale

Several entities could be interested in acquiring UTAC, given its significant position in the chip testing market.

-

Strategic Acquisition Targets: Large semiconductor manufacturers looking to vertically integrate their operations or bolster their testing capabilities would be logical buyers. Similarly, other major tech firms requiring sophisticated testing solutions for their products could also pursue UTAC.

-

Private Equity Interest: Other private equity firms or investment groups could also be interested in acquiring UTAC, intending to further develop the company and potentially resell it at a higher valuation later.

-

Market Implications: The sale will likely trigger significant changes in the semiconductor testing market. The new owner's strategies might lead to adjustments in pricing, increased competition, and potential shifts in technological innovation and supply chain partnerships. The impact on Chinese influence within the semiconductor sector also warrants careful consideration.

Geopolitical Considerations and Regulatory Scrutiny

The sale of UTAC will undoubtedly face scrutiny due to its geopolitical implications.

-

National Security Concerns: Governments worldwide may closely examine the acquisition, focusing on national security aspects related to technology transfer and the potential influence of the acquiring entity on the global semiconductor supply chain.

-

Regulatory Hurdles: Regulatory approvals from multiple countries might be required, potentially leading to a lengthy and complex approval process, subject to intense scrutiny of the transaction’s implications.

-

Intellectual Property Protection: The safeguarding of UTAC’s intellectual property will be a paramount consideration, as this technology holds significant strategic value.

Conclusion

The potential sale of UTAC by a Chinese buyout firm presents a multifaceted scenario with far-reaching implications for the global semiconductor industry. This decision reflects complex economic forces and strategic calculations, promising a significant reshaping of the chip testing market. The ultimate outcome will considerably impact competition, technology development, and the intricate geopolitical dynamics of the semiconductor industry. Stay informed about this evolving situation, as the future of UTAC and the Chinese buyout firm's investment strategy unfolds. Follow our updates for more insights into the dynamics of the semiconductor testing market and the evolving role of Chinese investment in this critical sector. Learn more about the significant impact of Chinese buyout firms on global technology.

Featured Posts

-

Crack The Code 5 Essential Dos And Don Ts For Private Credit Jobs

Apr 24, 2025

Crack The Code 5 Essential Dos And Don Ts For Private Credit Jobs

Apr 24, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai Through Alterya Purchase

Apr 24, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Through Alterya Purchase

Apr 24, 2025 -

Village Roadshows 417 5 Million Alcon Deal Approved Key Details

Apr 24, 2025

Village Roadshows 417 5 Million Alcon Deal Approved Key Details

Apr 24, 2025 -

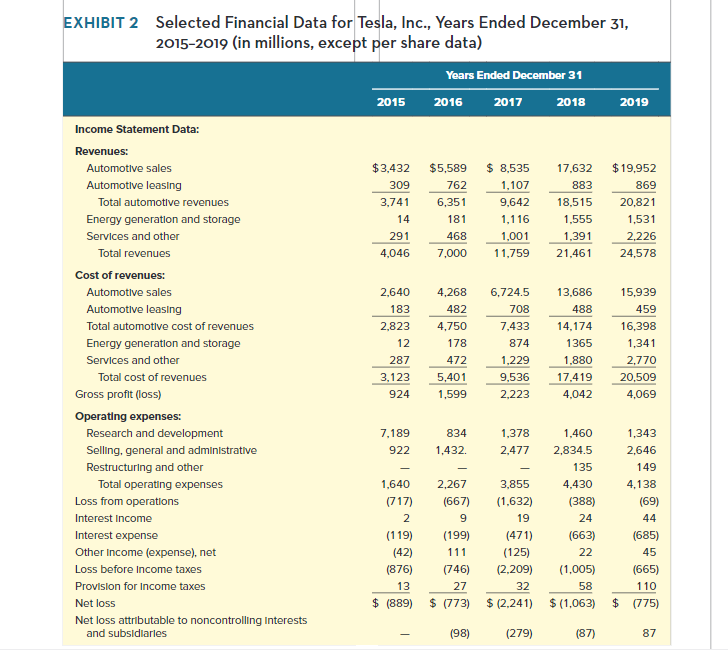

Analyzing Teslas 71 Net Income Decrease In The First Quarter

Apr 24, 2025

Analyzing Teslas 71 Net Income Decrease In The First Quarter

Apr 24, 2025 -

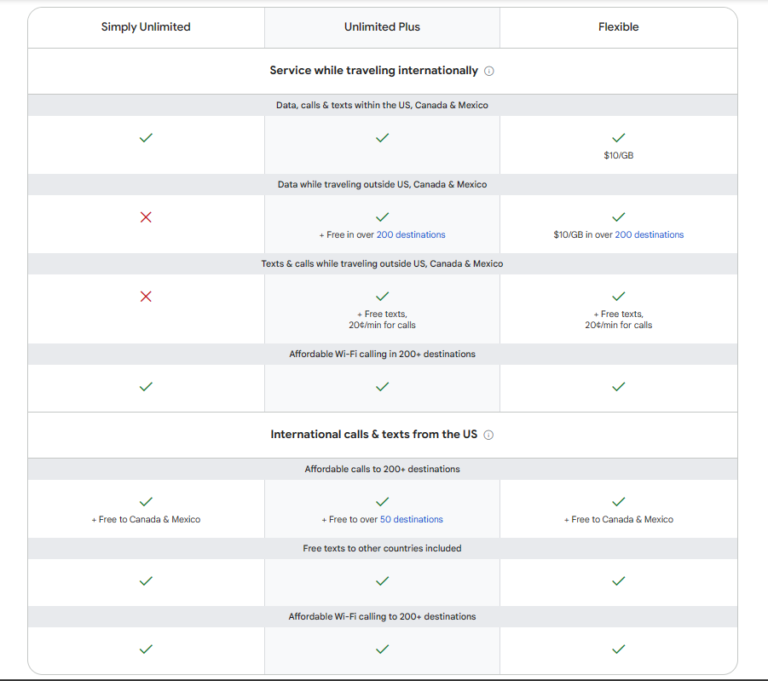

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025