Considerable US Growth Slowdown Predicted By Deloitte

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Several interconnected factors contribute to Deloitte's prediction of a considerable US growth slowdown. Understanding these is crucial for effective mitigation strategies.

Inflationary Pressures

Persistent inflation is a primary driver of the anticipated slowdown. Rising prices erode consumer purchasing power, leading to decreased demand for goods and services. This, in turn, impacts business investment and overall economic activity.

- Rising interest rates: The Federal Reserve's efforts to curb inflation through interest rate hikes increase borrowing costs for businesses and consumers, dampening investment and spending.

- Supply chain disruptions: Ongoing global supply chain issues continue to contribute to higher prices and reduced availability of goods, fueling inflationary pressures.

- Energy prices: Volatile energy prices, exacerbated by geopolitical events, significantly impact production costs for businesses and household budgets, further contributing to inflation.

These factors are interconnected. For example, supply chain disruptions increase production costs, leading to higher prices, which in turn fuels inflation and necessitates further interest rate hikes by the Federal Reserve, creating a negative feedback loop that hinders economic growth. Deloitte's report (specific data citation needed here if available) highlights the severity of these interconnected pressures.

Geopolitical Uncertainty

Global instability, particularly the war in Ukraine, significantly impacts the US economy. The resulting uncertainty affects investor confidence and disrupts global supply chains.

- Energy price volatility: The war has caused significant volatility in energy prices, impacting businesses' operating costs and consumer spending.

- Supply chain disruptions: The conflict has further exacerbated existing supply chain issues, leading to shortages and higher prices for various goods.

- Investor uncertainty: Geopolitical instability creates uncertainty for investors, leading to reduced investment in the US economy.

These geopolitical factors contribute to economic instability and reduced growth by creating uncertainty and disrupting established trade relationships and supply chains. This uncertainty makes long-term planning difficult for businesses and discourages investment.

Tightening Monetary Policy

The Federal Reserve's aggressive monetary policy, aimed at curbing inflation, is also contributing to the predicted slowdown. While necessary to combat inflation, tightening monetary policy carries potential negative consequences.

- Interest rate hikes: Higher interest rates increase borrowing costs, making it more expensive for businesses to invest and expand.

- Quantitative tightening: The reduction of the Federal Reserve's balance sheet further reduces liquidity in the market, potentially slowing down economic activity.

Aggressive monetary policy, while aiming to control inflation, risks slowing economic growth too sharply, potentially leading to a recession. The delicate balancing act the Federal Reserve faces is a significant factor in Deloitte's forecast.

Potential Impacts of the Slowdown on Businesses

The predicted slowdown carries several potential negative impacts on businesses, requiring proactive adaptation strategies.

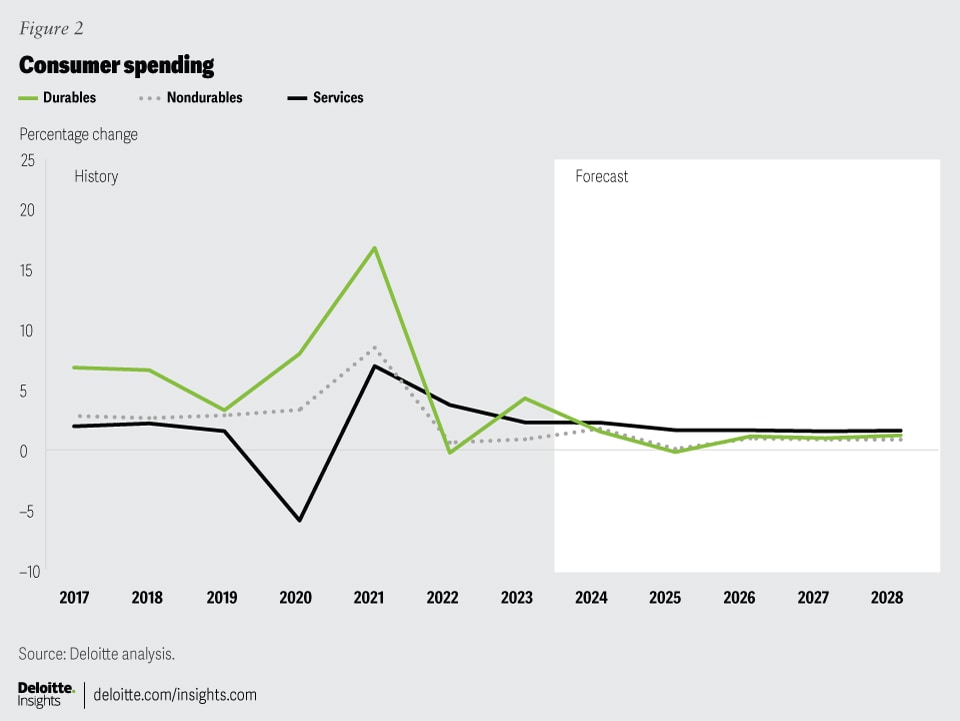

Reduced Consumer Spending

A slowing economy leads to reduced consumer spending, impacting businesses reliant on consumer demand.

- Decreased demand for goods and services: Consumers, facing higher prices and reduced purchasing power, cut back on non-essential spending.

- Potential for retail sector contraction: Businesses in the retail sector, particularly those selling discretionary goods, are particularly vulnerable to decreased consumer spending.

Businesses must adapt to lower consumer spending by focusing on cost-cutting measures, efficient inventory management, and exploring new market segments or product lines.

Investment Uncertainty

Economic uncertainty discourages business investment and expansion plans.

- Delayed capital expenditures: Businesses may postpone or cancel investments in new equipment, technology, and facilities.

- Reduced hiring: Companies may freeze or reduce hiring to conserve resources.

- Potential for layoffs: In a severe slowdown, businesses may resort to layoffs to cut costs.

Risk assessment and strategic planning become paramount in this environment. Businesses need to carefully evaluate investment opportunities and ensure financial stability.

Increased Financial Risk

A slowdown increases the risk of business failures and financial distress.

- Difficulty securing loans: Lenders become more cautious, making it harder for businesses to obtain financing.

- Rising debt burdens: Existing debt becomes more burdensome as revenues decline.

Proactive financial management is crucial. Businesses should focus on improving cash flow, managing debt effectively, and exploring alternative financing options.

Strategies for Navigating the Slowdown

Businesses can take several steps to mitigate the impact of the predicted slowdown and build resilience.

Diversification and Resilience

Building a diversified and resilient business model is crucial for weathering economic storms.

- Expanding into new markets: Diversifying geographically reduces dependence on a single market.

- Developing new products/services: Offering a wider range of products and services reduces reliance on any one segment.

- Strengthening supply chains: Robust and diversified supply chains reduce vulnerability to disruptions.

Learning from successful businesses that navigated past economic downturns provides valuable insights into effective strategies.

Cost Optimization and Efficiency

Improving operational efficiency and reducing costs are critical in a slowing economy.

- Streamlining processes: Identifying and eliminating inefficiencies can significantly reduce costs.

- Automating tasks: Automation can improve productivity and reduce labor costs.

- Negotiating better supplier contracts: Securing favorable terms with suppliers can lower input costs.

Careful analysis of operating costs and the implementation of cost-saving measures are essential for preserving profitability.

Proactive Financial Planning

Robust financial planning and risk management are paramount during economic uncertainty.

- Cash flow forecasting: Accurate forecasting allows businesses to anticipate potential cash shortages.

- Debt management: Careful management of debt levels reduces financial risk.

- Securing lines of credit: Establishing access to credit provides a safety net in case of unforeseen circumstances.

Regular financial reviews and adaptations of financial plans in response to changing economic conditions are crucial for navigating the slowdown successfully.

Conclusion

Deloitte's prediction of a considerable US growth slowdown underscores the need for proactive strategies. Inflationary pressures, geopolitical uncertainty, and tightening monetary policy all contribute to this challenging economic environment. Don't let the predicted US growth slowdown catch you unprepared. Implement the strategies outlined above—diversification, cost optimization, and proactive financial planning—to build resilience and navigate this challenging economic environment successfully. Prepare for a potential period of slower US growth and adapt your business strategy accordingly. Learn more about mitigating the risks of a US growth slowdown and develop a robust action plan today.

Featured Posts

-

Analyzing The China Market Why Bmw And Porsche Face Headwinds

Apr 27, 2025

Analyzing The China Market Why Bmw And Porsche Face Headwinds

Apr 27, 2025 -

Jannik Sinner And The Doping Allegations Full Story

Apr 27, 2025

Jannik Sinner And The Doping Allegations Full Story

Apr 27, 2025 -

Trade War Weighs On Eurozone Simkus Suggests Further Ecb Action

Apr 27, 2025

Trade War Weighs On Eurozone Simkus Suggests Further Ecb Action

Apr 27, 2025 -

Best Free Movies And Tv Shows Available On Kanopy

Apr 27, 2025

Best Free Movies And Tv Shows Available On Kanopy

Apr 27, 2025 -

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

Apr 27, 2025

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

Apr 27, 2025