Economic Uncertainty: CEOs Warn Of Trump Tariff Fallout

Table of Contents

Rising Costs and Reduced Profit Margins

The most immediate consequence of Trump's tariffs is the dramatic increase in the cost of imported goods. This surge in input prices has significantly impacted production costs across numerous industries, squeezing profit margins and threatening the viability of many businesses.

Increased Input Prices

Tariffs, essentially taxes on imported goods, directly inflate the price of raw materials, components, and finished products sourced from abroad. This effect ripples through the supply chain, affecting businesses far beyond those directly involved in importing.

- Manufacturing: The automotive industry, for example, faced higher costs for imported steel and aluminum, leading to increased vehicle prices.

- Agriculture: Farmers experienced increased costs for imported fertilizers and machinery.

- Technology: The electronics industry saw higher prices for imported components, impacting the cost of consumer electronics.

Data reveals a significant increase in import prices across various sectors. For instance, some studies indicated a 15-20% increase in the cost of certain imported materials following the implementation of tariffs. CEO quotes from this period frequently highlighted these challenges, with many expressing concerns that rising costs were outpacing revenue growth. "The increased cost of imported steel has made it incredibly difficult to maintain our profit margins," stated one CEO in a 2018 interview.

Price Increases and Consumer Demand

The increased production costs don't stay confined to businesses. They inevitably translate into higher prices for consumers. This price inflation can lead to decreased consumer spending, further impacting economic growth.

- Price Hikes: Consumers saw noticeable price increases across various goods and services, from cars and appliances to clothing and food.

- Decreased Consumer Spending: Reduced consumer confidence, partly driven by price hikes and economic uncertainty, led to decreased spending.

- Impact on Consumer Goods: The impact was particularly noticeable in sectors reliant on imported components or raw materials.

Statistics from the period reveal a clear correlation between the implementation of tariffs and a slowdown in consumer spending, indicating a clear and negative impact on consumer confidence and overall demand.

Supply Chain Disruptions and Global Trade Tensions

Trump's tariffs didn't simply increase costs; they also significantly disrupted global supply chains and exacerbated existing international trade tensions.

Shifting Global Supply Chains

Businesses faced the Herculean task of adapting to a rapidly shifting global trade landscape. Many companies were forced to reconsider their sourcing strategies, potentially relocating manufacturing or seeking alternative suppliers.

- Relocation of Manufacturing: Some companies moved production to countries outside the scope of the tariffs to mitigate costs.

- Increased Complexity: Managing global supply chains became significantly more complex and expensive, requiring increased logistical planning and risk management.

- Strategic Adjustments: Businesses implemented various strategies, such as diversifying suppliers and renegotiating contracts, to mitigate the impact of tariff-related disruptions.

This reshuffling of global supply chains involved significant capital expenditure and logistical challenges, demonstrating the considerable disruption caused by the tariffs.

Deteriorating International Relations

The trade disputes fueled by these tariffs had far-reaching geopolitical consequences, further undermining business confidence and creating broader economic uncertainty.

- Strained Relationships: The US's relationships with key trading partners like China and the EU deteriorated significantly.

- Impact on Investment: International investment slowed down as businesses hesitated to commit capital in an environment of heightened trade uncertainty.

- Trade Agreements: Existing trade agreements were threatened, and the prospect of new agreements became more challenging.

Experts at the time warned that the long-term effects of these strained relationships could negatively impact global economic growth and cooperation for years to come.

Job Losses and Economic Slowdown

The combined effects of rising costs, supply chain disruptions, and reduced consumer demand led to concerns about job losses and an overall economic slowdown.

Impact on Employment

Reduced production, factory closures, and decreased consumer spending created a climate of economic uncertainty and threatened numerous jobs across various sectors.

- Vulnerable Sectors: Manufacturing, retail, and agriculture were particularly vulnerable to job losses.

- Job Loss Statistics: While pinpointing precise job losses directly attributable to tariffs is difficult, economic data from the period indicated a slowdown in job growth and some instances of job losses.

- Economist Opinions: Numerous economists at the time expressed concerns about the potential for a significant economic slowdown as a result of these trade policies.

Economic Growth Projections

The economic uncertainty stemming from these trade policies led to downward revisions in economic growth forecasts.

- GDP Growth: Estimates for GDP growth were revised downward, reflecting the negative impact of the tariffs.

- Differing Forecasts: Various economic institutions offered varied projections, but a general consensus pointed towards a slowdown in economic growth.

- Recessionary Concerns: Concerns were raised about the potential for a recession as the negative impacts of tariffs continued to accumulate.

Conclusion

The warnings sounded by CEOs during the period of Trump's tariffs clearly highlighted the significant economic uncertainty created by these policies. The resulting rising costs, supply chain disruptions, and deterioration of international relations contributed to reduced profit margins, job losses, and a general slowdown in economic growth. Understanding the impact of economic uncertainty and the lasting effects of these tariffs is crucial for businesses and policymakers alike. Further research into effective strategies to navigate such economic challenges and mitigate the long-term effects of protectionist trade policies is essential. Proactive strategies are necessary to build resilience and navigate this complex economic landscape, mitigating the risks associated with future economic uncertainty.

Featured Posts

-

Chat Gpt Maker Open Ai Targeted By Ftc An Analysis Of The Probe

Apr 26, 2025

Chat Gpt Maker Open Ai Targeted By Ftc An Analysis Of The Probe

Apr 26, 2025 -

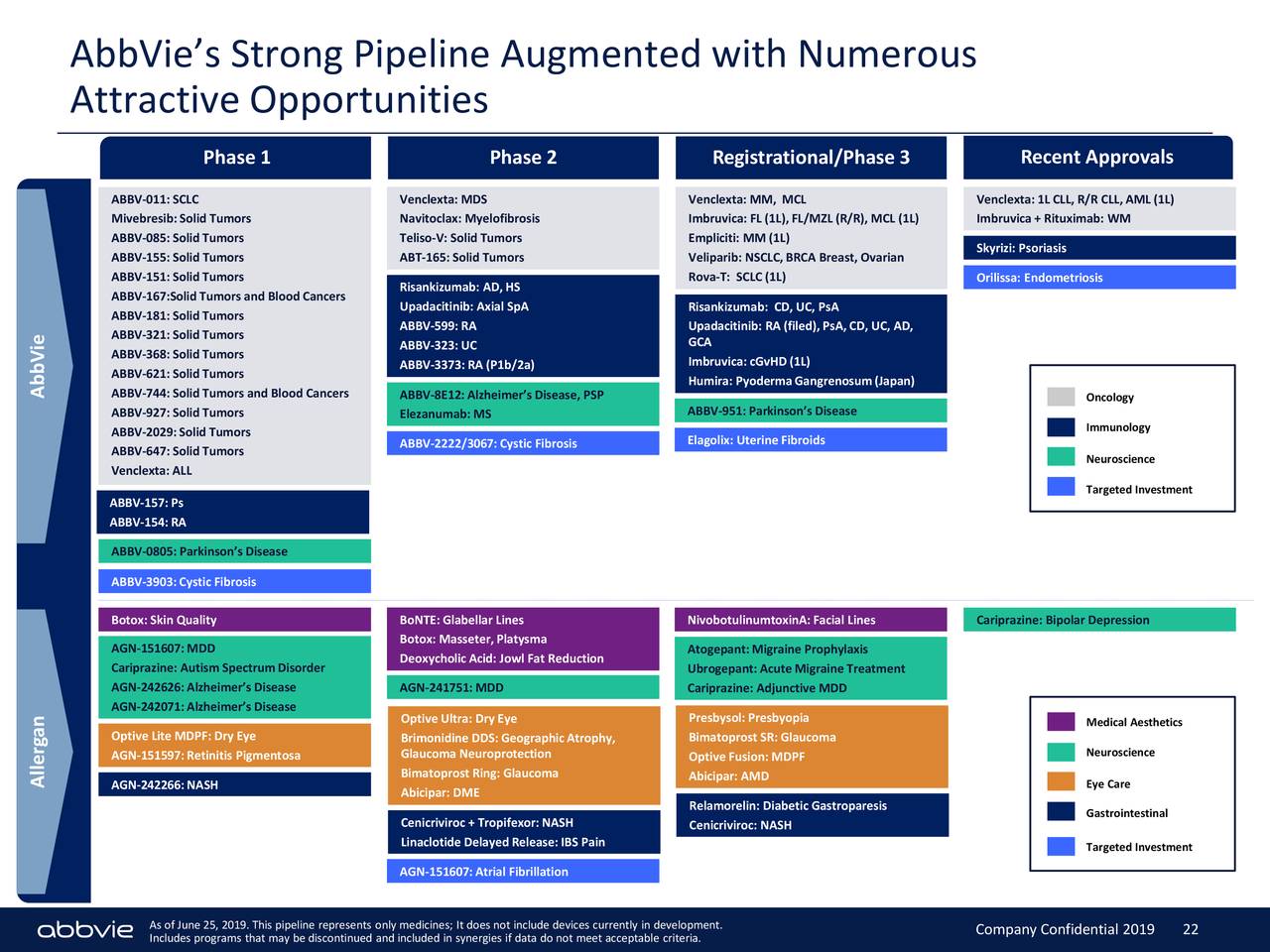

Strong Q Quarter Number Results For Abb Vie Abbv New Medications Drive Sales Beat And Increased Profit Forecast

Apr 26, 2025

Strong Q Quarter Number Results For Abb Vie Abbv New Medications Drive Sales Beat And Increased Profit Forecast

Apr 26, 2025 -

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025 -

Colgates Cl Financial Report Tariff Increases Weigh On Revenue And Earnings

Apr 26, 2025

Colgates Cl Financial Report Tariff Increases Weigh On Revenue And Earnings

Apr 26, 2025 -

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025