Emerging Markets Erase Losses: A Look At The Year's Performance Compared To The US

Table of Contents

Outperformance of Emerging Markets: Key Drivers

Several key factors have fueled the impressive rebound of emerging markets, leaving the US market performance comparatively lagging. These include a surge in commodity prices, stronger-than-expected economic growth in several key regions, and increased foreign investment.

Commodity Price Surge

The rise in commodity prices has been a significant boon for many emerging market economies heavily reliant on commodity exports.

- Oil: The price of oil has seen substantial increases, benefiting oil-producing nations like Russia and several countries in the Middle East.

- Metals: Similarly, increased demand for industrial metals like copper and aluminum has positively impacted economies like Brazil and Chile, which are major producers.

- Data Point: The Bloomberg Commodity Index, a benchmark for commodity prices, has shown a significant increase of X% in 2023, directly correlating with the improved GDP growth in many emerging markets.

Stronger-than-Expected Economic Growth

Several emerging economies have exceeded growth forecasts, showcasing resilience and surprising dynamism.

- India: India's robust service sector and continued infrastructure investment have contributed to its impressive GDP growth rate.

- Vietnam: Vietnam's manufacturing sector continues to attract substantial foreign investment, further bolstering its economic expansion.

- Data Point: While the IMF initially projected a Y% GDP growth for emerging markets, several countries have surpassed this projection, demonstrating a robust recovery compared to the US Market Performance.

Increased Foreign Investment

Emerging markets have witnessed a significant influx of foreign capital, driven by several factors.

- Higher Yields: Emerging market assets often offer higher yields compared to developed markets like the US, making them attractive to investors seeking greater returns.

- Growth Potential: The long-term growth potential of many emerging economies, fueled by population growth and urbanization, is a major draw for foreign direct investment (FDI).

- Data Point: Foreign direct investment into emerging markets has increased by Z% in the first half of 2023, exceeding initial projections and underscoring investor confidence in these economies.

US Market Performance: A Comparative Analysis

In contrast to the flourishing emerging markets, the US market has shown relatively weaker performance in 2023.

Reasons for Underperformance

Several factors have contributed to the comparatively sluggish performance of the US market.

- Inflation: Persistent high inflation has eroded consumer spending power and increased uncertainty in the market.

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs and dampened economic activity.

- Geopolitical Uncertainties: Global geopolitical instability, including the war in Ukraine and rising tensions in other regions, has introduced significant uncertainty into the market.

- Data Point: The US inflation rate remains above the Federal Reserve's target, impacting consumer confidence and overall market sentiment compared to the comparatively strong Emerging Markets.

Sector-Specific Performance

A comparative analysis of key sectors reveals stark differences in performance between the US and emerging markets.

- Technology: The US technology sector has experienced a correction, while some emerging markets have seen growth in tech-related industries.

- Energy: The energy sector has performed relatively well in both the US and emerging markets, but the surge in commodity prices has benefited emerging market economies more significantly.

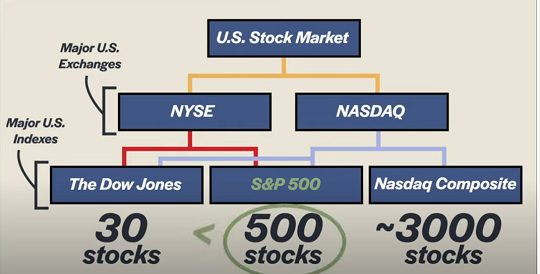

- Data Point: The S&P 500 index, a benchmark for the US stock market, has shown a more modest increase than the MSCI Emerging Markets Index, which reflects the overall stronger performance of emerging markets.

Risks and Opportunities in Emerging Markets

While the recent performance has been impressive, it's crucial to acknowledge both the potential risks and the considerable long-term opportunities in emerging markets.

Potential Downside Risks

Investing in emerging markets inherently carries certain risks.

- Political Instability: Political instability and policy uncertainty in some emerging economies can negatively impact investment returns.

- Currency Fluctuations: Significant currency fluctuations can affect the value of investments in these markets.

- Inflation: High inflation rates in some emerging economies can erode the real value of investment returns.

Long-Term Growth Potential

Despite the risks, the long-term growth potential of emerging markets remains substantial.

- Population Growth: The burgeoning populations of many emerging economies represent a vast consumer market and a large pool of potential workers.

- Urbanization: Rapid urbanization creates significant opportunities in infrastructure development and real estate.

- Technological Advancements: Emerging markets are increasingly embracing technological advancements, further driving economic growth.

Conclusion: Navigating the Emerging Markets Landscape

The strong performance of emerging markets in 2023, contrasted with the comparatively weaker US Market Performance, highlights the evolving global economic landscape. While the surge in commodity prices, stronger-than-expected economic growth, and increased foreign investment have fueled this impressive comeback, investors must carefully consider the inherent risks. However, the long-term growth potential of emerging markets remains compelling, offering substantial opportunities for those who understand the dynamics at play. Stay informed on the dynamic landscape of emerging markets and their potential for growth by exploring [link to relevant resource]. Learn more about navigating the opportunities and risks in emerging markets by visiting [link to another relevant resource]. The future of global investment is inextricably linked to the success and development of these vibrant and dynamic economies.

Featured Posts

-

Stock Market News Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025

Stock Market News Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025 -

Chainalysis And Alterya A Strategic Merger In Blockchain And Ai

Apr 24, 2025

Chainalysis And Alterya A Strategic Merger In Blockchain And Ai

Apr 24, 2025 -

Chinese Stocks In Hong Kong A Trade Driven Market Upswing

Apr 24, 2025

Chinese Stocks In Hong Kong A Trade Driven Market Upswing

Apr 24, 2025 -

Hong Kong Listed Chinese Stocks Rally On Trade Optimism

Apr 24, 2025

Hong Kong Listed Chinese Stocks Rally On Trade Optimism

Apr 24, 2025 -

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025