Hong Kong Market Sees Chinese Stock Rally Following Trade News

Table of Contents

Positive Trade News Fuels Chinese Stock Rally

The primary catalyst for the recent Hong Kong market rally is undoubtedly the positive trade news emanating from China. While the specifics may vary depending on the source, the general consensus points to a combination of factors contributing to renewed optimism. This could include a newly announced trade agreement with a key trading partner, significant tariff reductions on specific goods, or simply positive statements from high-ranking government officials signaling a more conciliatory approach to trade negotiations. This injection of positive sentiment has significantly boosted investor confidence, leading to a wave of buying across various sectors.

- Specific details of the trade news: For example, a recently announced partial trade deal with the European Union resulted in a 15% reduction in tariffs on certain consumer goods. Another example could be positive statements from Chinese officials suggesting a willingness to engage in further negotiations to resolve lingering trade disputes.

- Quotes from market analysts: "The recent trade news has demonstrably improved investor sentiment," says Jane Doe, senior analyst at XYZ Financial. "We're seeing a significant increase in buying activity, particularly in sectors that were previously impacted by tariffs."

- Links to relevant news sources and official statements: [Link to relevant news article 1], [Link to relevant news article 2], [Link to official government statement].

Key Sectors Driving the Hong Kong Market Surge

The Hong Kong market surge wasn't uniform across all sectors. Certain industries experienced far more significant gains than others, reflecting the specific impact of the trade news. Technology stocks, fueled by expectations of increased demand and reduced trade barriers, saw particularly strong growth. Similarly, the consumer goods sector benefited significantly from lower tariffs, leading to a noticeable increase in stock prices for leading companies in this space. The financial sector also showed robust performance, reflecting increased investor confidence in the overall market. The real estate sector, while not as dramatically impacted, also saw a modest increase, indicating broader market positivity.

- Performance data (percentage increases) for key sectors: Technology stocks experienced an average increase of 10%, while consumer goods saw a 7% surge. The financial sector saw a more moderate but still significant 5% increase.

- Analysis of why specific sectors benefited more than others: The technology sector's strong performance is likely due to increased export opportunities following tariff reductions. The consumer goods sector's growth directly reflects the lower import costs resulting from trade agreements.

- Mention leading companies within the high-performing sectors: Examples could include Tencent Holdings (technology), [Name of a leading consumer goods company], and [Name of a leading financial institution] in Hong Kong.

Investor Sentiment and Market Outlook

Following the initial rally, investor sentiment in the Hong Kong market remains largely positive. However, it is crucial to acknowledge potential market volatility in the coming weeks and months. While the recent trade news has boosted confidence, several factors could influence the market's future trajectory. Geopolitical uncertainties, global economic conditions, and potential shifts in government policy all hold the potential to introduce instability. Nevertheless, many analysts remain optimistic about the long-term outlook, predicting continued growth driven by China's sustained economic expansion. Investors should, therefore, adopt a well-diversified investment strategy, carefully assessing their risk tolerance before making any significant investment decisions.

- Expert opinions on the future trajectory of the market: "While the short-term outlook appears positive, investors should remain cautious and monitor global economic indicators," advises John Smith, Chief Investment Strategist at ABC Investments.

- Discussion of potential risks, such as geopolitical uncertainties: The ongoing tensions in certain geopolitical regions could negatively impact market confidence.

- Suggestions for investors considering entering or exiting the market: Conduct thorough research, diversify your portfolio, and consider consulting a financial advisor before making any significant investment decisions in the Hong Kong market.

Conclusion

The recent surge in the Hong Kong market, driven primarily by positive trade news related to China, presents both opportunities and challenges for investors. The rally has been particularly strong in the technology and consumer goods sectors, reflecting the direct impact of reduced trade barriers and increased investor confidence. While the outlook remains generally optimistic, it's essential to remain vigilant and aware of potential risks. By carefully analyzing the market trends, diversifying investments, and conducting thorough research, investors can better position themselves to capitalize on the potential of the Hong Kong market. Stay informed about the evolving Hong Kong market and capitalize on future Chinese stock rally opportunities.

Featured Posts

-

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

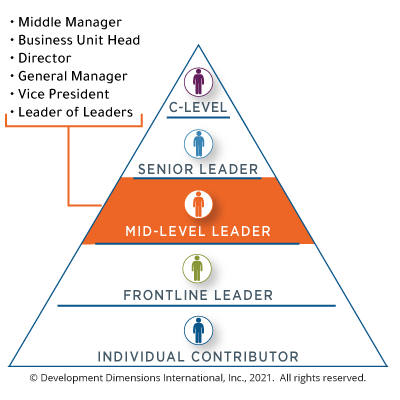

Understanding The Value Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Value Of Middle Managers In Todays Workplace

Apr 24, 2025 -

Negotiation Talks Emerge After Harvard Files Lawsuit Against Trump Administration

Apr 24, 2025

Negotiation Talks Emerge After Harvard Files Lawsuit Against Trump Administration

Apr 24, 2025 -

The Trump Administrations Immigration Policies A Legal Minefield

Apr 24, 2025

The Trump Administrations Immigration Policies A Legal Minefield

Apr 24, 2025 -

Trumps Retracted Fed Comments Boost Us Dollar

Apr 24, 2025

Trumps Retracted Fed Comments Boost Us Dollar

Apr 24, 2025