Impact Of Trump's Statement On US Stock Futures

Table of Contents

Immediate Market Response to Trump's Statements

Unexpected statements from Trump, whether via tweets, press conferences, or interviews, often caused immediate and dramatic reactions in US stock futures. The speed and scale of these reactions are amplified by algorithmic trading and high-frequency trading (HFT) strategies. These automated systems react to news in milliseconds, often leading to significant short-term price swings.

- Examples of significant short-term fluctuations: The announcement of unexpected tariffs on imported goods frequently caused sharp drops in related sectors. Conversely, positive news regarding tax cuts or deregulation could lead to rapid increases.

- Speed and magnitude of fluctuations: The market's response is often instantaneous, with futures contracts reacting within seconds of a statement's release. The magnitude of these swings can vary considerably, depending on the content of the statement and the prevailing market sentiment.

- Varied sectoral impact: Different sectors react differently. For example, statements impacting trade policy would heavily influence manufacturing and agricultural futures, while announcements on financial regulations might impact the financial sector futures more significantly. This sectoral impact is crucial in understanding the full scope of market response to Trump's statements and their cascading effects. Keywords: Real-time Market Reactions, Algorithmic Trading, High-Frequency Trading, Sectoral Impact.

Analyzing the Long-Term Effects on US Stock Futures

While immediate reactions are dramatic, the long-term impact of Trump's statements on investor sentiment and overall market trends is equally important. The duration and intensity of these long-term effects depend on several factors, including the nature of the statement, the prevailing economic conditions, and the media's interpretation and coverage.

- Historical data analysis: Examining past market shifts following similar political events provides valuable insights. Analyzing trends before, during, and after specific Trump statements allows for a more comprehensive understanding of their long-term implications.

- Investor confidence: Political uncertainty, often fueled by unpredictable presidential pronouncements, can significantly erode investor confidence. This can lead to decreased investment, slower economic growth, and prolonged periods of market instability.

- Media's role: The way the media frames and interprets Trump's statements greatly influences investor perceptions. Sensationalized or negative reporting can exacerbate market anxieties, while balanced reporting can help mitigate the impact. Keywords: Long-Term Market Trends, Investor Sentiment, Political Uncertainty, Market Confidence.

Predicting Future Market Movements Based on Trump's Statements

Predicting the market's reaction to future statements remains a significant challenge. The inherent unpredictability of political events and the complexities of the global economy make accurate forecasting exceedingly difficult.

- Unpredictability of political events: Unexpected policy shifts, sudden announcements, or changes in political alliances all add to market uncertainty. It’s impossible to anticipate every possible statement and its subsequent market impact.

- Economic conditions: The overall economic climate significantly influences the market's response to political statements. A strong economy might absorb negative news better than a weaker one.

- Limitations of past patterns: While analyzing past patterns is useful, relying solely on historical data to predict future movements is unreliable. Each situation is unique, and unexpected factors can significantly alter the outcome. Keywords: Market Prediction, Forecasting, Political Risk, Economic Indicators.

The Role of Specific Policy Announcements

Announcements concerning specific policies, such as trade deals (trade policy), tax reforms (tax policy), or changes in monetary policy, often have a disproportionate effect on different sectors. For instance, the announcement of new tariffs typically impacts import-heavy sectors more negatively than sectors focused on domestic production. Similarly, tax cuts can boost investor confidence and lead to increased investment in certain sectors. Understanding the nuanced implications of fiscal policy and monetary policy pronouncements is key to analyzing market reactions. Keywords: Trade Policy, Tax Policy, Fiscal Policy, Monetary Policy.

Conclusion: Navigating the Uncertainties: Trump's Impact on US Stock Futures and Future Strategies

Trump's statements had a profound and often unpredictable impact on US stock futures, causing both short-term volatility and longer-term shifts in market trends. Predicting the market's reaction to future political pronouncements remains challenging. However, by carefully analyzing historical data, understanding the role of investor sentiment and media influence, and keeping abreast of current economic indicators, investors can better navigate the uncertainties. To master the impact of Trump's statements and understand the impact of future presidential pronouncements on US stock futures, stay updated on political developments and their potential consequences. Continue researching and monitoring the impact of political statements to make informed investment decisions and refine your investment strategies and risk management techniques. Keywords: Investment Strategies, Risk Management, Market Analysis, Political Risk Assessment.

Featured Posts

-

Tyler Herro Wins 3 Point Contest Heat Star Shines Cavs Duo Dominates Skills Challenge

Apr 24, 2025

Tyler Herro Wins 3 Point Contest Heat Star Shines Cavs Duo Dominates Skills Challenge

Apr 24, 2025 -

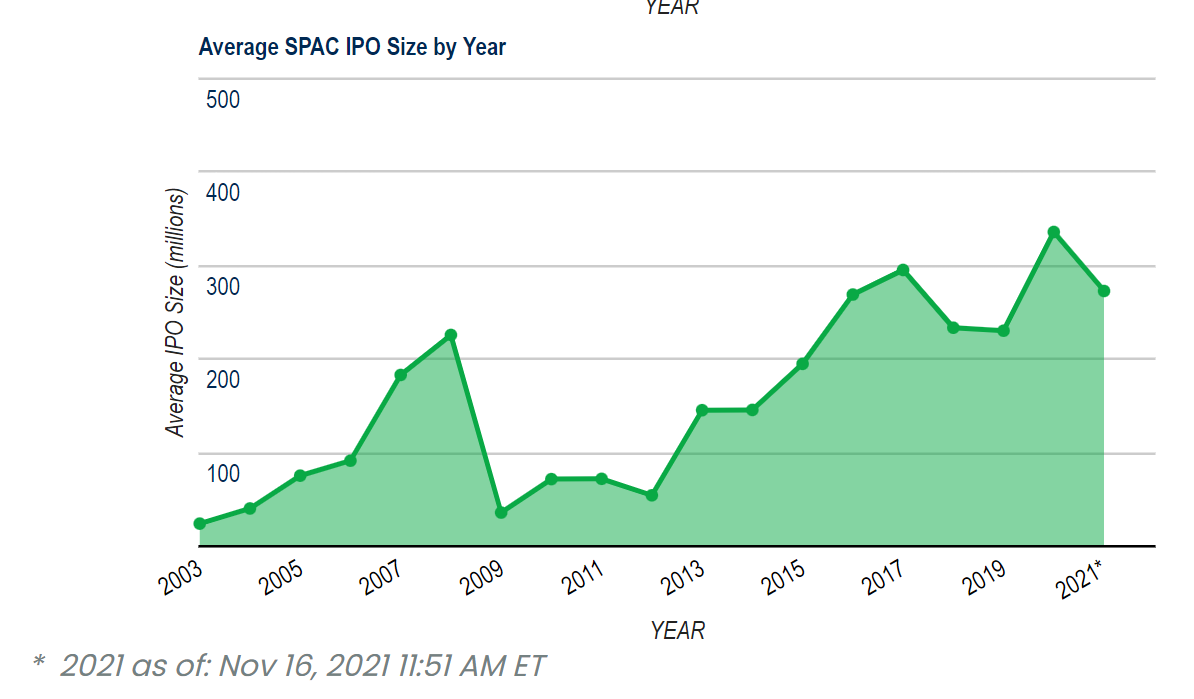

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

Exclusive High Rollers John Travoltas New Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travoltas New Action Movie Poster And Photo Preview

Apr 24, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times

Apr 24, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu Shines In New Fashion Cover

Apr 24, 2025

John Travoltas Daughter Ella Bleu Shines In New Fashion Cover

Apr 24, 2025