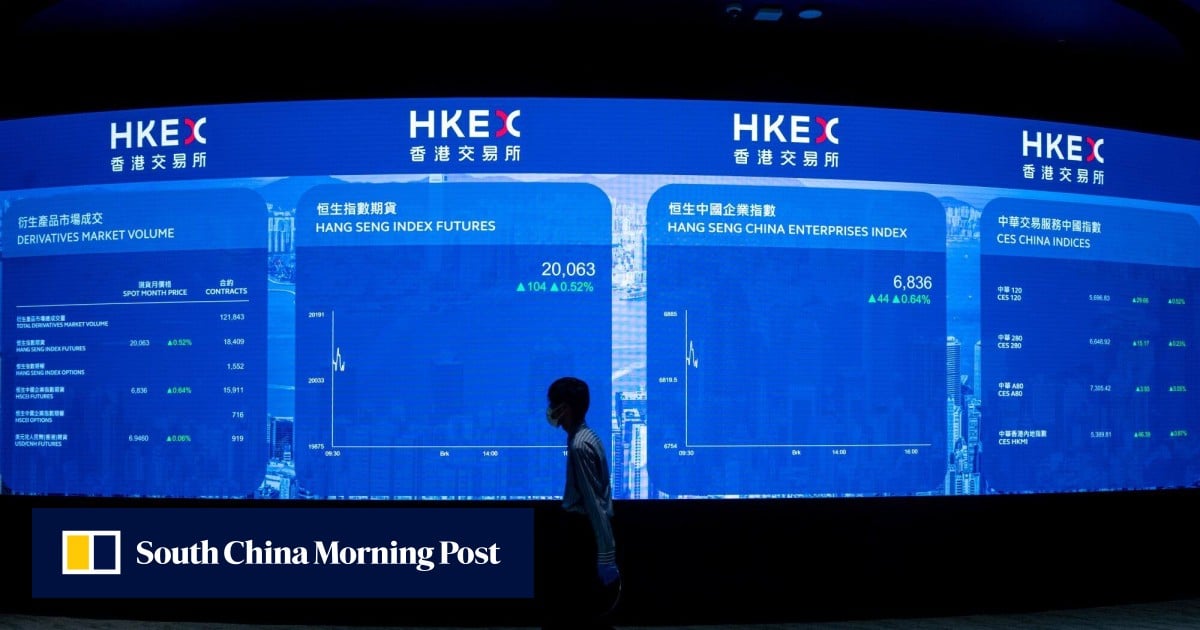

Increased Investment In Chinese Stocks Listed In Hong Kong

Table of Contents

Attractive Valuation and Growth Potential of Chinese Companies

Many believe that some Chinese companies listed on the HKEX offer compelling investment opportunities due to their relatively lower valuations compared to their US-listed counterparts. This presents a chance to capitalize on potentially undervalued Chinese stocks. The potential for Hong Kong stock market growth is substantial, particularly within booming sectors like technology, consumer goods, and financials. These sectors are experiencing explosive growth, fueled by China's expanding middle class and ongoing technological advancements.

- Lower P/E ratios compared to US-listed equivalents: Several analyses show that certain Chinese companies listed in Hong Kong have significantly lower price-to-earnings ratios than their American Depository Receipt (ADR) counterparts, suggesting potentially undervalued assets.

- Access to rapidly expanding Chinese consumer market: Investing in Hong Kong-listed Chinese companies offers direct access to one of the world's largest and fastest-growing consumer markets. This provides significant growth potential for businesses catering to this expanding demographic.

- Potential for high returns on investment in specific sectors: The technology sector, in particular, presents exciting opportunities for high returns, with numerous Chinese tech stocks showing impressive growth trajectories. However, careful sector-specific research is essential.

- Diversification opportunities within the Chinese economy: Investing in a diverse portfolio of Hong Kong-listed Chinese companies allows investors to diversify their holdings across various sectors and mitigate overall portfolio risk.

Hong Kong's Strategic Advantages as a Financial Hub

Investing in Chinese companies through the HKEX offers several key advantages. Hong Kong's established legal framework, transparent regulatory environment, and robust market infrastructure make it a preferred gateway for international investors. This is particularly appealing when compared to the complexities of investing directly in mainland China. The ease of access and relatively lower barriers to entry make HKEX investment a more attractive proposition for many.

- Stable political and economic environment: Hong Kong offers a relatively stable political and economic environment, providing a more predictable investment landscape than some other emerging markets.

- Transparent and well-regulated market: The HKEX adheres to high regulatory standards, ensuring transparency and investor protection. This contributes to greater investor confidence.

- Access to international capital flows: Hong Kong's position as a global financial center facilitates easier access to international capital flows, making it easier for companies to raise capital and for investors to participate.

- Lower transaction costs compared to other markets: Transaction costs in the HKEX are generally lower than in some other major global markets, potentially improving overall investment returns.

Government Policies and Initiatives Supporting Market Growth

The Hong Kong and Chinese governments have implemented various policies and initiatives to stimulate international investment in China and encourage the growth of the HKEX. These measures are designed to attract foreign investment, boost market liquidity, and improve investor confidence. Recent regulatory changes have aimed to streamline processes and improve transparency, further enhancing the appeal of the market.

- Initiatives to improve market liquidity: The Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) have implemented several initiatives aimed at boosting market liquidity, including measures to attract more market makers.

- Measures to attract foreign institutional investors: The government actively promotes Hong Kong as a premier investment destination, offering various incentives to attract foreign institutional investors.

- Policies promoting the listing of Chinese companies in Hong Kong: Various policies encourage Chinese companies to list on the HKEX, expanding the range of investment opportunities available to international investors.

- Regulatory reforms aimed at improving investor confidence: Ongoing regulatory reforms aim to enhance transparency, improve corporate governance, and strengthen investor protection, leading to increased investor confidence.

Risks and Considerations for Investors in Chinese Stocks Listed in Hong Kong

While the potential rewards of increased investment in Chinese stocks listed in Hong Kong are significant, investors must also be aware of potential risks. These include geopolitical uncertainties, regulatory changes, currency fluctuations, and market volatility. Thorough risk management in Chinese stocks is crucial for mitigating potential losses.

- Geopolitical tensions and trade disputes: Geopolitical tensions between China and other countries, including trade disputes, can significantly impact market performance.

- Regulatory changes impacting specific sectors: Changes in Chinese government regulations can affect specific sectors disproportionately, potentially leading to significant price fluctuations.

- Currency fluctuations and exchange rate risks: Fluctuations in the Chinese Yuan (RMB) against other currencies can impact investment returns for international investors.

- Market volatility and potential for capital loss: The Chinese stock market can be highly volatile, and investors should be prepared for potential capital losses.

Conclusion

The increased investment in Chinese stocks listed in Hong Kong is driven by a confluence of factors, including attractive valuations, the strategic advantages of the HKEX, and supportive government policies. While the potential for high returns is undeniable, investors must also carefully consider the inherent risks. Conducting thorough due diligence, understanding the potential for both significant gains and losses, and implementing effective risk management in Chinese stocks are crucial before making any investment decisions. To learn more about the exciting opportunities and potential challenges related to increased investment in Chinese stocks listed in Hong Kong, and to explore investment strategies within this dynamic market, conduct further research and consult with a qualified financial advisor.

Featured Posts

-

Miami Heats Herro Crowned Nba 3 Point Champion Beats Buddy Hield

Apr 24, 2025

Miami Heats Herro Crowned Nba 3 Point Champion Beats Buddy Hield

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Wildfire Betting A Reflection Of Our Times Los Angeles Focus

Apr 24, 2025

Wildfire Betting A Reflection Of Our Times Los Angeles Focus

Apr 24, 2025 -

Canada Election Conservatives Pledge Lower Taxes Fiscal Responsibility

Apr 24, 2025

Canada Election Conservatives Pledge Lower Taxes Fiscal Responsibility

Apr 24, 2025 -

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025

Why Pope Franciss Papal Ring Will Be Destroyed After His Death

Apr 24, 2025