India Market Analysis: Nifty's Strong Performance And Future Outlook

Table of Contents

H2: Nifty 50's Recent Performance and Key Drivers

The Nifty 50's impressive run is underpinned by the exceptional performance of several key sectors. Understanding these drivers is crucial for gauging the index's future trajectory.

H3: Growth Sectors Fueling Nifty's Rise

Several sectors have significantly contributed to the Nifty 50's rise. These include:

- Indian IT Sector Growth: The Indian IT sector has witnessed phenomenal growth, exceeding expectations. Global demand for IT services, coupled with technological advancements and strategic acquisitions, has propelled this sector's performance, contributing significantly to the Nifty 50's gains (estimated growth of X%).

- Financial Services in India: The financial services sector, encompassing banking, insurance, and NBFCs, has also shown robust growth. Government initiatives promoting financial inclusion and a recovering economy have boosted this sector's performance (estimated growth of Y%).

- Pharmaceutical Industry India: The Indian pharmaceutical industry, a significant player in the global market, has experienced considerable growth driven by increased domestic demand and exports (estimated growth of Z%).

H3: Impact of Macroeconomic Factors

Macroeconomic indicators play a significant role in shaping the Nifty 50's performance.

- Indian GDP Growth: India's consistent GDP growth, despite global headwinds, has instilled investor confidence, bolstering the Nifty's upward trajectory.

- Inflation Rate India: While inflation remains a concern, the Reserve Bank of India's (RBI) proactive monetary policy measures have helped manage inflationary pressures, contributing to market stability.

- Reserve Bank of India Policy: The RBI's policy decisions, including interest rate adjustments, significantly impact borrowing costs and investor sentiment, influencing the Nifty 50's performance.

- FPI Investment in India: Significant Foreign Portfolio Investment (FPI) inflows reflect global investors' positive outlook on the Indian economy and the Nifty 50's potential.

H3: Role of Global Factors

Global events inevitably impact the Indian stock market.

- Global Market Impact on Nifty: Global economic uncertainties and geopolitical tensions can create volatility in the Nifty 50. However, India's relatively strong macroeconomic fundamentals have helped cushion the impact of some global headwinds.

- Geopolitical Risks India: While geopolitical risks remain, India's strategic positioning and diversification efforts have mitigated some potential negative consequences on the Nifty 50.

- Global Economic Outlook India: The global economic outlook, particularly growth in major economies, influences investor sentiment and capital flows into the Indian market, affecting the Nifty 50.

H2: Challenges and Risks Facing the Nifty 50

Despite its robust performance, the Nifty 50 faces several potential challenges.

H3: Potential Headwinds

- Nifty Risks: Rising inflation, although currently managed, could pose a significant risk if it spirals out of control.

- Market Volatility India: Global uncertainties and unexpected events can trigger market volatility, impacting the Nifty 50.

- Inflation Impact on Nifty: Persistent high inflation could erode investor confidence and negatively impact corporate earnings, affecting the Nifty's growth.

H3: Geopolitical Risks and their Impact

- Geopolitical Risk Assessment India: Escalating geopolitical tensions in the region or globally could impact investor sentiment and capital flows, affecting the Nifty 50's performance.

- India's Global Relations: The stability of India's global relationships plays a crucial role in maintaining investor confidence and promoting economic growth.

- Nifty Geopolitical Sensitivity: The Nifty 50's sensitivity to geopolitical risks necessitates a careful assessment of global events and their potential impact on the Indian economy.

H2: Future Outlook for the Nifty 50

Predicting the future with certainty is impossible, but based on the current analysis, we can offer a reasoned outlook.

H3: Growth Projections and Predictions

While precise figures are difficult to predict, the Nifty 50 is expected to continue its growth trajectory, albeit with potential periods of consolidation. Further growth is anticipated, driven by continued strong domestic demand and sustained foreign investment. However, careful monitoring of macroeconomic indicators and global events remains crucial. (Note: Specific growth projections would require more detailed quantitative analysis).

H3: Investment Strategies and Recommendations

Investors should adopt a diversified investment strategy, spreading investments across different sectors to mitigate risk. Regular portfolio rebalancing and risk management are essential. Thorough research and understanding of individual company fundamentals are critical before making any investment decisions in the Indian stock market. This includes understanding the inherent risks associated with investing in the Nifty 50 and the Indian market as a whole.

3. Conclusion

The Nifty 50 has demonstrated remarkable strength, propelled by robust sectorial growth and positive macroeconomic indicators. However, challenges such as inflation and geopolitical risks must be carefully considered. Maintaining a balanced perspective, incorporating both the positive and negative factors, is crucial for assessing the future outlook of the Nifty 50. Stay informed about the latest developments impacting the Nifty 50 and make well-informed investment decisions based on a thorough understanding of the market. Continue your research into the Nifty 50 and the dynamics of the Indian stock market for a comprehensive view.

Featured Posts

-

Bethesda Confirms Oblivion Remastered Now Available

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Now Available

Apr 24, 2025 -

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Arent A Threat

Apr 24, 2025

Bof A Reassures Investors Why High Stock Market Valuations Arent A Threat

Apr 24, 2025 -

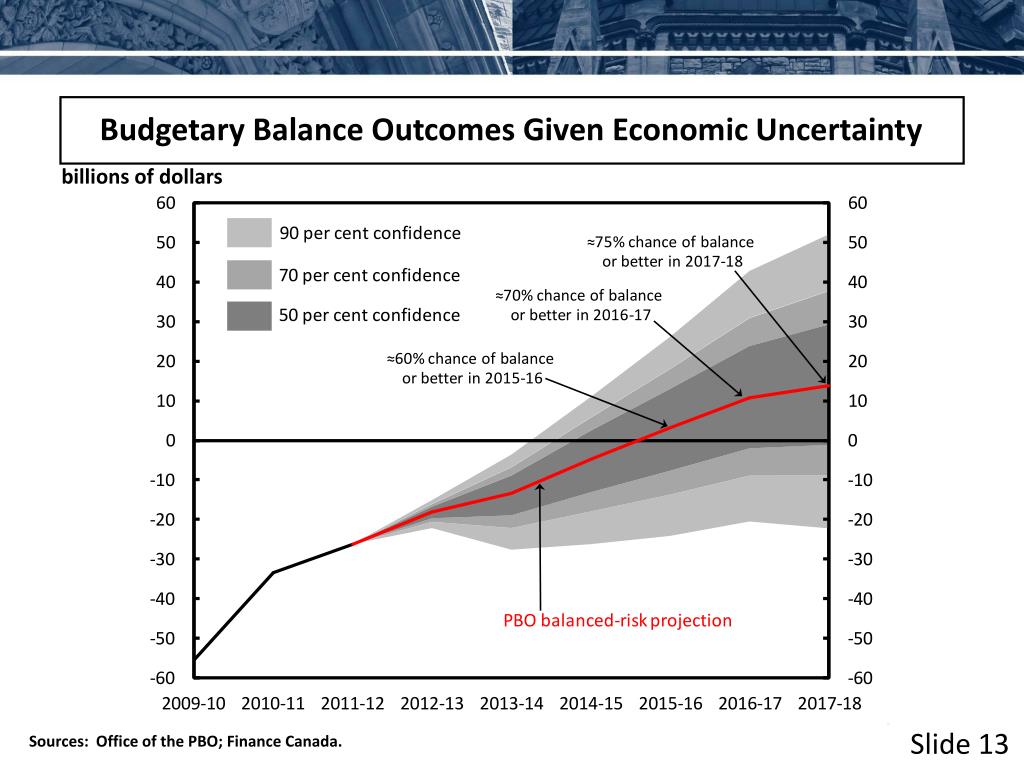

Addressing Canadas Fiscal Challenges A Vision For Responsible Governance

Apr 24, 2025

Addressing Canadas Fiscal Challenges A Vision For Responsible Governance

Apr 24, 2025 -

Navigating Geopolitical Risks Teslas Optimus Robot And Chinas Rare Earth Dependence

Apr 24, 2025

Navigating Geopolitical Risks Teslas Optimus Robot And Chinas Rare Earth Dependence

Apr 24, 2025