India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Strong Corporate Earnings Drive Nifty's Rise

Robust corporate earnings are a primary driver behind the Nifty's impressive ascent. Many Indian companies are reporting strong profit growth, bolstering investor sentiment and fueling the stock market rally. This positive "Nifty 50 performance" reflects the underlying strength of the Indian economy.

- Key Sectors Leading the Charge: The IT, FMCG (Fast-Moving Consumer Goods), and Banking sectors have shown particularly impressive performance.

- Examples of Stellar Earnings:

- Reliance Industries reported record profits driven by its energy and telecom businesses.

- Infosys and TCS, leading IT companies, exceeded earnings expectations, benefiting from global demand.

- HDFC Bank and ICICI Bank showcased robust loan growth and improved asset quality.

- This surge in "corporate earnings" and "profit growth" is directly translating into higher stock valuations and contributing significantly to the overall market strength. The robust performance reflects not just the resilience of individual companies but also the health of the broader Indian economy.

Positive Government Policies Fueling Economic Growth

Government initiatives are playing a crucial role in fostering a positive economic outlook, further bolstering the "India Market Buzz." Strategic investments in infrastructure development and digitalization are boosting investor confidence.

- Key Government Initiatives:

- The significant investment in infrastructure projects under the National Infrastructure Pipeline is creating jobs and stimulating economic activity.

- The "Digital India" initiative is promoting digital transformation across various sectors, enhancing efficiency and productivity.

- Pro-business reforms are simplifying regulations and attracting both domestic and foreign investments.

- These "government policies" and "economic reforms," coupled with increased "infrastructure spending," are creating a favorable environment for businesses to thrive and investors to feel confident about the long-term prospects of the Indian market. The resulting improvement in "investor confidence" is a key factor in the current bullish trend.

Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows are playing a vital role in driving up the Nifty index. Increased FII investment reflects the growing confidence in India's economic growth potential and attractive valuations.

- Reasons for Increased FII Investment:

- India's relatively strong economic growth compared to other global economies.

- Attractive valuations of Indian stocks compared to their global peers.

- Positive government policies and improving macroeconomic indicators are attracting significant foreign capital.

- The substantial "FII inflows" and "foreign investment" are boosting "market capitalization" and contributing significantly to the overall strength of the Indian stock market. This influx of foreign capital underscores the global confidence in India's "economic growth."

Improving Macroeconomic Indicators

Positive trends in key macroeconomic indicators are further strengthening the bullish market outlook. Improved GDP growth, controlled inflation, and declining unemployment are all contributing to a positive narrative.

- Positive Macroeconomic Trends:

- India's GDP growth is showing resilience, exceeding expectations.

- Inflation is gradually coming under control, creating a stable macroeconomic environment.

- The unemployment rate is showing signs of improvement, indicating a strengthening labor market.

- These improving "macroeconomic indicators," including "GDP growth," "inflation rate," and "unemployment rate," signify "economic stability" and further reinforce the positive "India Market Buzz." This positive economic environment contributes directly to the sustained "Nifty's Bullish Run."

Conclusion: Riding the Wave of India's Market Buzz: Nifty's Positive Trajectory

The Nifty's bullish run is a result of a confluence of positive factors: strong corporate earnings, supportive government policies, significant FII inflows, and improving macroeconomic indicators. These "positive trends" are creating a vibrant and dynamic "India Market Buzz." While potential risks and challenges always exist, the current momentum suggests a positive trajectory for the Indian market. To stay informed about the ongoing "India Market Buzz" and the "Nifty's Bullish Run," subscribe to reputable financial newsletters, follow market analysis from leading experts, and consult with a qualified financial advisor to make informed investment decisions. Continue exploring the exciting "positive trends" shaping the future of the Indian economy!

Featured Posts

-

How Effective Middle Management Drives Employee Engagement And Business Results

Apr 24, 2025

How Effective Middle Management Drives Employee Engagement And Business Results

Apr 24, 2025 -

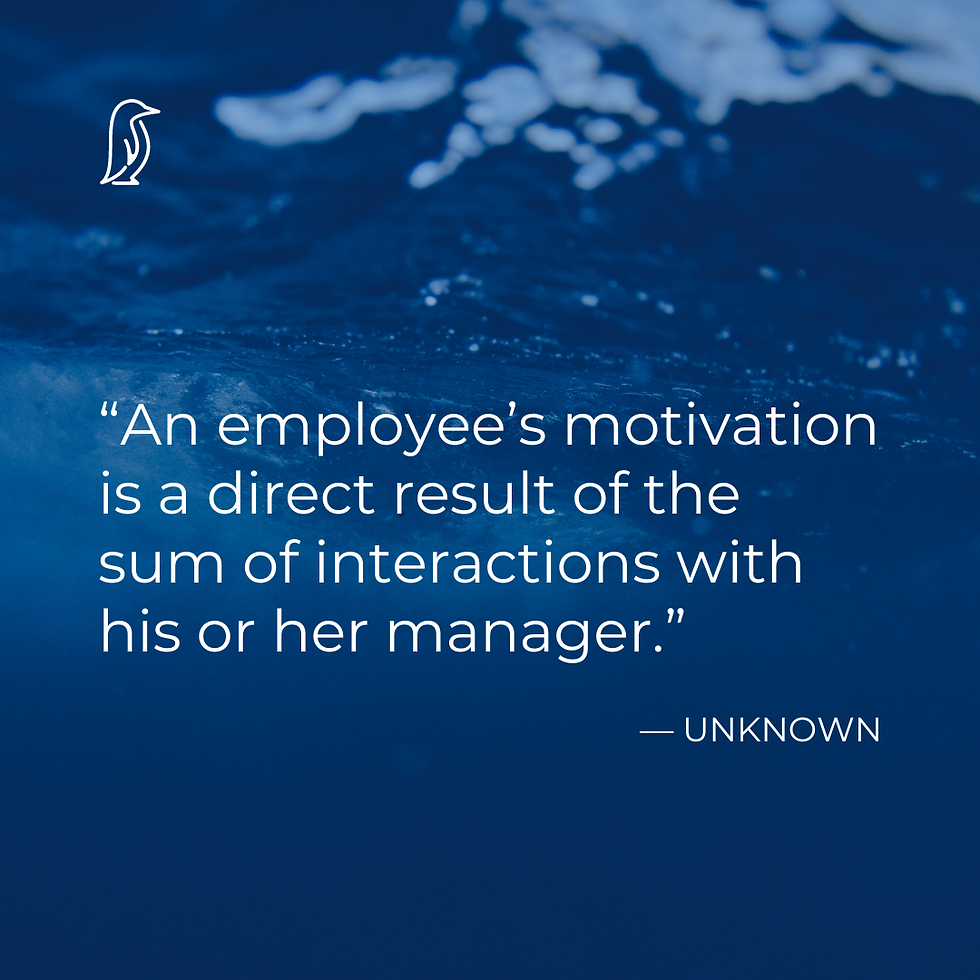

Increased Investment In Chinese Stocks Listed In Hong Kong

Apr 24, 2025

Increased Investment In Chinese Stocks Listed In Hong Kong

Apr 24, 2025 -

The Bold And The Beautiful April 16 Hopes Concerns Liams Actions And Bridgets Discovery

Apr 24, 2025

The Bold And The Beautiful April 16 Hopes Concerns Liams Actions And Bridgets Discovery

Apr 24, 2025 -

The Rare Earth Factor How Chinas Policies Affect Teslas Optimus Robot Timeline

Apr 24, 2025

The Rare Earth Factor How Chinas Policies Affect Teslas Optimus Robot Timeline

Apr 24, 2025 -

Klaus Schwab And The Wef An Exclusive Look At The Ongoing Investigation

Apr 24, 2025

Klaus Schwab And The Wef An Exclusive Look At The Ongoing Investigation

Apr 24, 2025