Nifty's Bull Market: A Deep Dive Into The Driving Forces In India's Market

Table of Contents

Strong Economic Fundamentals

India's consistently strong economic fundamentals have played a pivotal role in the Nifty's bull market. Several key factors contribute to this robust foundation:

Robust GDP Growth

India's GDP growth rates have consistently outperformed many global economies, significantly boosting investor confidence.

- Impressive Figures: India's GDP growth has consistently hovered above 7% in recent years, with projections suggesting continued robust growth. This sustained expansion demonstrates a resilient and dynamic economy.

- Key Contributing Sectors: The IT sector, manufacturing, and services sectors have been major contributors to this growth, showcasing the diversification of the Indian economy.

- Positive Outlook: Experts predict continued strong GDP growth, fueled by increasing domestic demand and government initiatives. This positive outlook further reinforces the bullish sentiment surrounding the Nifty 50.

Keywords: India GDP growth, Nifty 50 growth drivers, economic indicators India

Rising Domestic Consumption

A burgeoning middle class and increased consumer spending are critical drivers of India's economic growth and, subsequently, the Nifty's performance.

- Expanding Middle Class: The rapidly expanding middle class represents a significant increase in disposable income, translating into higher consumer spending across various sectors.

- Shifting Consumption Patterns: Changes in consumption patterns, including increased spending on discretionary items and experiences, further fuel economic growth.

- Government Support: Government policies aimed at boosting domestic demand and promoting inclusive growth have also played a crucial role in stimulating consumer spending.

Keywords: Indian consumer spending, domestic demand India, Nifty 50 consumer staples

Government Initiatives and Reforms

Government policies and reforms have significantly improved the business environment and investor sentiment in India.

- Landmark Reforms: The implementation of the Goods and Services Tax (GST) and liberalization of Foreign Direct Investment (FDI) policies have streamlined processes and attracted substantial foreign investment.

- Infrastructure Development: Massive investments in infrastructure development, including roads, railways, and digital connectivity, are creating a more conducive environment for businesses to thrive.

- Ease of Doing Business: Initiatives aimed at simplifying regulations and improving the ease of doing business have boosted investor confidence and encouraged entrepreneurship.

Keywords: India economic reforms, government policies Nifty 50, infrastructure investment India

Global Macroeconomic Factors

While domestic factors are crucial, global macroeconomic trends also significantly impact the Nifty's performance.

Foreign Institutional Investor (FII) Inflows

Foreign Institutional Investors (FIIs) have played a substantial role in driving the Nifty's upward trajectory.

- Significant Inflows: FIIs have been pouring billions of dollars into the Indian stock market, attracted by India's relatively strong economic fundamentals and growth prospects.

- Global Uncertainty: Global economic uncertainties have often driven investors towards the perceived safety and growth potential of the Indian market.

- Potential Risks: While FII inflows are positive, it's crucial to acknowledge the potential risks associated with their volatility. Geopolitical events and global market fluctuations can impact these flows.

Keywords: FII investment India, foreign portfolio investment Nifty, global capital flows India

Global Economic Recovery

The global economic recovery, while uneven, has indirectly contributed to India's market strength.

- Global Demand: Increased global demand for Indian goods and services, particularly in sectors like IT and pharmaceuticals, has boosted export earnings and corporate profits.

- Global Risks: However, global economic slowdown, geopolitical tensions, or rising interest rates in major economies could negatively impact the Nifty's performance.

- Navigating Global Headwinds: Understanding global economic trends is crucial for investors to navigate potential risks and capitalize on opportunities.

Keywords: global economic outlook India, Nifty 50 global impact, international market trends

Sector-Specific Performance

The Nifty's bull run isn't uniform across all sectors; certain sectors have significantly outperformed others.

IT Sector Boom

The Indian IT sector has been a major driver of the Nifty's growth.

- Global Demand: Strong global demand for IT services, driven by digital transformation and cloud adoption, has fueled the growth of Indian IT companies.

- Leading Players: Leading Indian IT firms have benefited significantly from this surge in demand, contributing significantly to the Nifty's gains.

- Future Outlook: The IT sector's positive outlook continues, driven by ongoing digitalization and technological advancements.

Keywords: Indian IT sector growth, Nifty 50 IT stocks, technology sector India

Other Key Performing Sectors

Beyond IT, other sectors have also contributed to the Nifty's rise.

- Financials: The financial sector, including banking and insurance, has shown strong performance, driven by improving credit growth and increased financial inclusion.

- Pharmaceuticals: The pharmaceutical sector has also witnessed substantial growth, driven by increasing demand for generic drugs and robust export performance.

- Consumer Goods: The consumer goods sector has also played a significant role, reflecting the rising purchasing power of India's growing middle class.

Keywords: Nifty 50 financial stocks, pharmaceutical sector India, Indian banking sector

Conclusion

The Nifty's bull market is a confluence of strong domestic economic fundamentals, supportive government policies, and favorable global macroeconomic conditions. While specific sectors like IT have been significant drivers, the overall positive momentum reflects India's growing economic strength and attractiveness to investors. Understanding these driving forces is crucial for navigating the Indian stock market effectively. To stay informed about the continuing trends impacting the Nifty 50 and India’s bullish market, continue to follow our analysis and insights on Nifty's performance and market dynamics. Learn more about investing strategies in the Indian market and understanding Nifty's future trajectory.

Featured Posts

-

Spot Market Intervention The Eus Approach To Phasing Out Russian Gas

Apr 24, 2025

Spot Market Intervention The Eus Approach To Phasing Out Russian Gas

Apr 24, 2025 -

Understanding The Crucial Role Of Middle Management In Organizations

Apr 24, 2025

Understanding The Crucial Role Of Middle Management In Organizations

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025 -

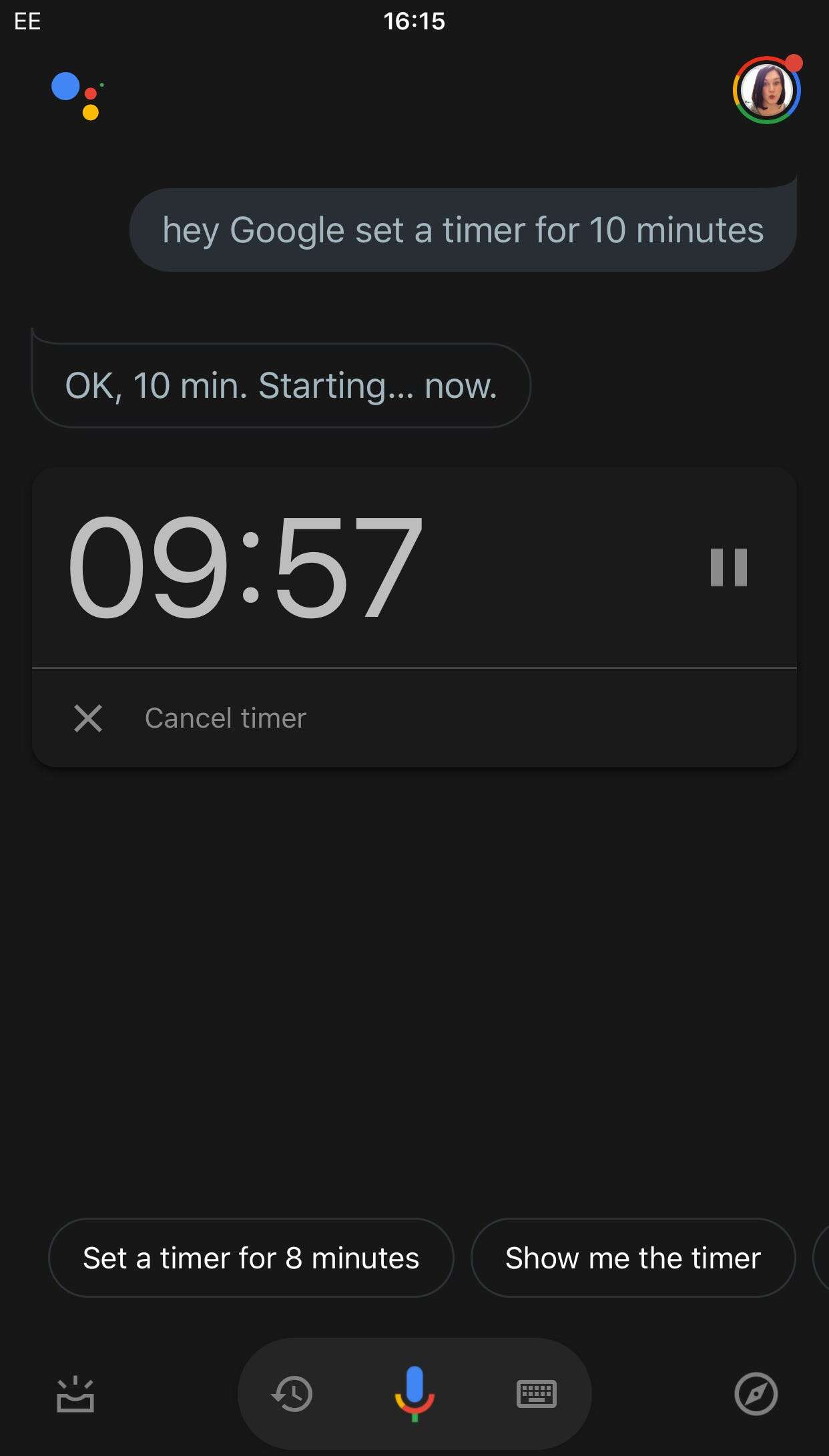

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 24, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 24, 2025