Sharp Drop In Tesla's Q1 Profit: The Musk Factor And Its Consequences

Table of Contents

Tesla's Aggressive Price Cuts: A Double-Edged Sword

Tesla's aggressive price cuts across its model lineup were a major contributor to the reduced Q1 profit. While intended to boost sales volume and secure a larger market share in the face of intensifying EV price competition, this strategy proved to be a double-edged sword. The rationale behind the cuts was clear: increase affordability to attract a wider range of buyers and maintain its lead in the rapidly expanding EV market.

However, this price war strategy came at a considerable cost. The immediate consequence was a significant reduction in Tesla's profit margins, eroding the company's previously high-profit image. This also impacted brand perception, blurring the lines between Tesla's luxury positioning and a more mass-market approach.

- Specific examples of price cuts: Tesla slashed prices on the Model 3 and Model Y by thousands of dollars in key markets.

- Comparison with competitors: While other EV manufacturers also adjusted prices, Tesla’s cuts were more dramatic and widespread, suggesting a more aggressive market share strategy.

- Impact on sales figures: While sales volumes increased, the impact on the bottom line was still negative, proving that increased volume alone can't offset dramatic margin compression.

The Tesla price war strategy highlighted the complexities of balancing volume growth with profitability in a fiercely competitive EV market.

The Impact of Elon Musk's Diversions and Controversies

Elon Musk's involvement with SpaceX and, most notably, his acquisition of Twitter, has undeniably diverted his attention and resources away from Tesla. This has raised concerns about Tesla's leadership and strategic focus. The constant stream of controversies surrounding Musk's public persona further impacted Tesla’s brand image and investor confidence.

- Specific examples of controversies: Musk’s controversial tweets and actions have led to negative media coverage impacting Tesla’s stock price.

- Negative media coverage: Negative press surrounding Musk often directly correlated with fluctuations in Tesla's stock price.

- Impact on employee morale: The uncertainty surrounding Musk’s leadership may have affected employee morale and potentially impacted retention rates.

The "Musk factor," therefore, isn't simply about his business acumen; it also encompasses the significant impact of his public image and distractions on Tesla's stability and investor perception.

Increased Competition in the Electric Vehicle Market

Tesla is no longer the sole player in the electric vehicle market. Established automakers like Ford and GM, along with emerging EV startups such as Rivian, are aggressively challenging Tesla’s dominance. This intensified competition forces Tesla to navigate a more crowded and competitive landscape.

- Key competitors and strategies: Competitors are leveraging their established infrastructure and brand recognition, offering competitive pricing and features.

- Technology and feature comparison: While Tesla still boasts advanced technology in some areas, competitors are rapidly closing the gap.

- Government subsidies and incentives: Government policies supporting EV adoption are also influencing the competitive dynamics, affecting both market share and profitability.

The increased EV competition is forcing Tesla to innovate and adapt at an accelerated pace to maintain its market leadership.

Macroeconomic Factors and Their Influence on Tesla's Performance

The global economic slowdown, persistent inflation, and ongoing supply chain disruptions significantly impacted Tesla's profitability during Q1. Rising interest rates further dampened consumer demand for large-ticket items, including electric vehicles.

- Impact on Tesla's operations: These macroeconomic factors resulted in production delays and increased input costs.

- Production and delivery timelines: Supply chain issues disrupted production and delivery, impacting sales volume and revenue.

- Mitigation strategies: Tesla is implementing strategies to mitigate the impact of these challenges, including streamlining its supply chain and adjusting production plans.

These external macroeconomic factors underline the challenges faced by all businesses, including Tesla, in navigating an increasingly uncertain global economic environment.

Sharp Drop in Tesla's Q1 Profit: Looking Ahead

The sharp drop in Tesla's Q1 profit is a result of a confluence of factors: aggressive price cuts impacting profit margins, the “Musk factor” impacting investor confidence and brand image, heightened competition in the EV market, and significant macroeconomic headwinds. While Tesla remains a major player in the EV sector, the company faces considerable challenges. The future outlook is uncertain, dependent on Tesla's ability to effectively navigate these complexities.

What are your predictions for Tesla's next quarterly profit report? How will Tesla address the sharp drop in its Q1 profit? Share your insights and analysis in the comments below.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 24, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 24, 2025 -

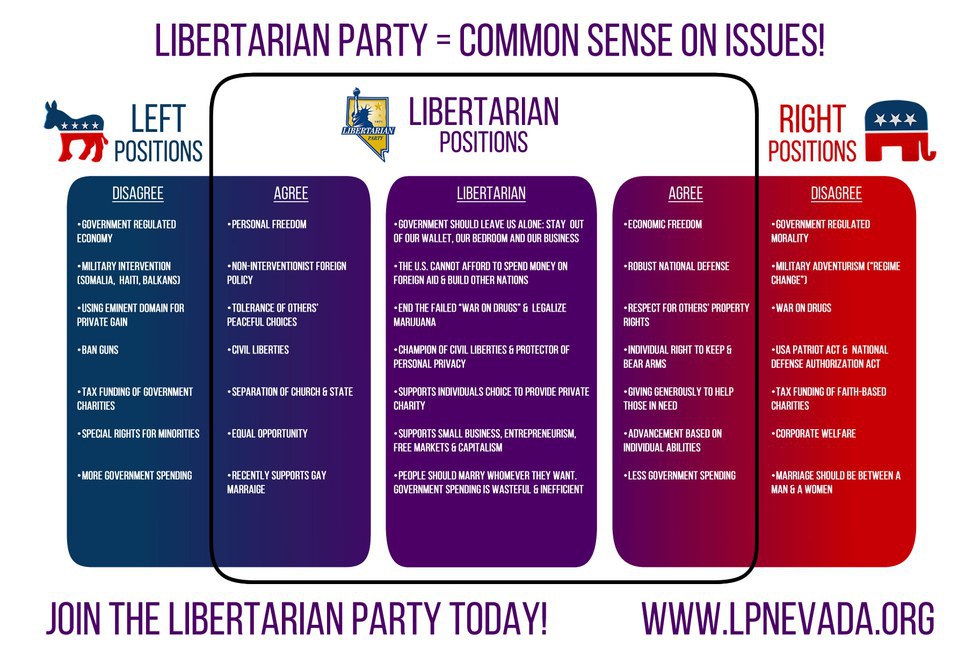

Liberal Party Platform Key Policies And Their Impact

Apr 24, 2025

Liberal Party Platform Key Policies And Their Impact

Apr 24, 2025 -

Review Lg C3 77 Inch Oled Tv Pros And Cons

Apr 24, 2025

Review Lg C3 77 Inch Oled Tv Pros And Cons

Apr 24, 2025 -

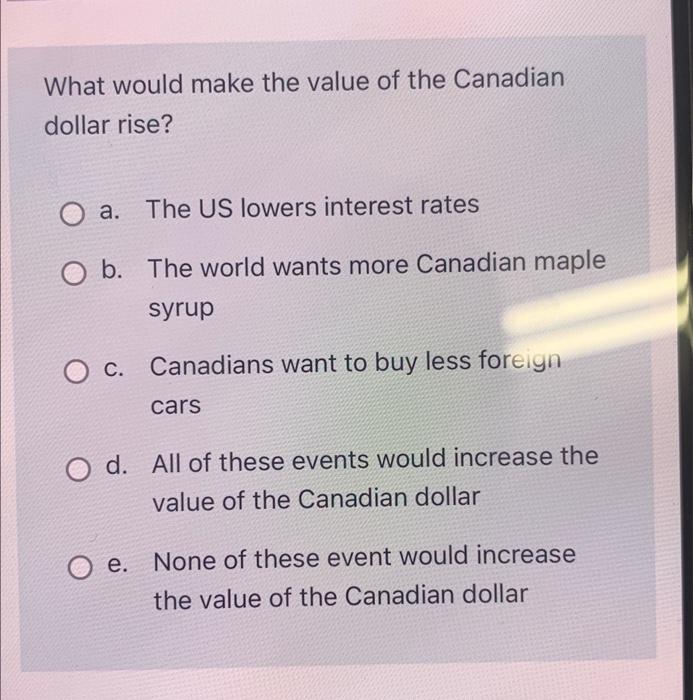

Understanding The Recent Decline In The Canadian Dollars Value

Apr 24, 2025

Understanding The Recent Decline In The Canadian Dollars Value

Apr 24, 2025 -

Reduced Consumer Spending A Challenge For Credit Card Issuers

Apr 24, 2025

Reduced Consumer Spending A Challenge For Credit Card Issuers

Apr 24, 2025