Understanding The Recent Decline In The Canadian Dollar's Value

Table of Contents

The Role of Interest Rate Differentials

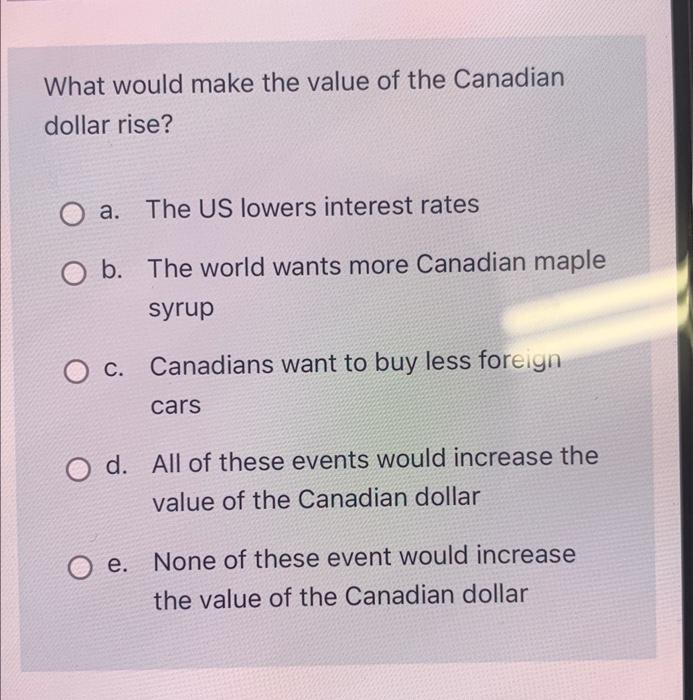

The Canadian dollar's value is significantly impacted by interest rate differentials between Canada and other major economies, primarily the United States. Changes in interest rates influence investor sentiment and capital flows, directly affecting the CAD/USD exchange rate and the overall strength of the Canadian currency.

Bank of Canada's Monetary Policy

The Bank of Canada's monetary policy plays a crucial role in determining the CAD's value. Interest rate hikes generally strengthen the currency, attracting foreign investment seeking higher returns. Conversely, interest rate cuts can weaken the loonie as investors seek better returns elsewhere.

- Interest rates and currency value are inversely related: Higher interest rates attract foreign investment, increasing demand for the Canadian dollar and pushing its value up.

- Inflation significantly influences interest rate decisions: The Bank of Canada aims to maintain price stability, and high inflation often necessitates interest rate increases to cool down the economy.

- Recent Bank of Canada announcements have directly impacted the CAD: For example, [insert example of a recent Bank of Canada announcement and its effect on the CAD exchange rate]. These announcements often cause short-term volatility in the CAD/USD exchange rate.

US Interest Rates and the USD

The US Federal Reserve's monetary policy significantly influences the CAD/USD exchange rate. When US interest rates rise, the US dollar tends to strengthen, often leading to a weakening of the Canadian dollar as investors move their capital to higher-yielding US assets.

- Comparison of Canadian and US interest rate environments is crucial: Analyzing the difference between the two helps understand the flow of capital and its effect on the exchange rate.

- Decisions by the US Federal Reserve have a ripple effect on the CAD: A rate hike in the US can lead to a decrease in demand for the Canadian dollar.

- "Flight to safety" during times of global uncertainty often strengthens the USD: This phenomenon further weakens the Canadian dollar as investors seek the perceived safety of the US dollar.

Commodity Prices and Their Influence

Canada's economy is significantly reliant on commodity exports, particularly oil. Fluctuations in global commodity prices directly impact the Canadian dollar's value.

Impact of Oil Prices

Oil prices have a strong correlation with the Canadian dollar's value. As a major oil exporter, Canada benefits from high oil prices, leading to increased demand for the Canadian dollar. Conversely, low oil prices weaken the currency.

- Oil exports are a cornerstone of the Canadian economy: A significant portion of Canada's export revenue comes from oil, making the CAD highly sensitive to oil price changes.

- Historical examples show the direct relationship between oil prices and the CAD: [Insert examples of past oil price changes and their subsequent impact on the CAD].

- Global oil supply and demand significantly influence the CAD: Geopolitical events or changes in global energy consumption patterns directly affect oil prices and subsequently, the Canadian dollar.

Other Commodity Prices

While oil is the dominant factor, other Canadian exports like lumber, metals, and agricultural products also influence the CAD's value. Changes in the global demand for these commodities affect Canada's export revenue and, consequently, the Canadian dollar.

- Global commodity markets influence the Canadian dollar: Increased global demand for Canadian commodities strengthens the CAD, while decreased demand weakens it.

- Diversification of the Canadian economy is lessening but not eliminating the commodity price dependence: While Canada is diversifying its economy, its reliance on commodity exports still makes the CAD sensitive to global commodity price fluctuations.

Geopolitical Factors and Global Economic Uncertainty

Global economic conditions and geopolitical events significantly impact investor sentiment and risk appetite, directly influencing the Canadian dollar's value.

Global Economic Slowdown

A global economic slowdown or recession often leads to a decline in the Canadian dollar's value as investors seek safer assets in more stable economies. Uncertainty about future economic growth makes investors less willing to invest in riskier currencies like the CAD.

- Global trade wars or tensions negatively impact the Canadian economy and the CAD: Trade disputes can disrupt supply chains and reduce global demand for Canadian goods, leading to currency depreciation.

- Investor sentiment and risk aversion are major factors: During times of uncertainty, investors tend to move towards safer haven currencies, weakening the CAD.

Geopolitical Risks

Geopolitical risks and events create uncertainty in the global markets, often leading to a decline in the Canadian dollar's value. These events can trigger a "flight to safety," pushing investors towards more stable currencies.

- Examples of past geopolitical events that impacted the CAD: [Insert examples of such events and their impact].

- Uncertainty resulting from geopolitical risks negatively affects investor confidence: This decreased confidence leads to a decrease in demand for the Canadian dollar.

Conclusion

The recent decline in the Canadian dollar's value is a complex issue stemming from the interplay of interest rate differentials between Canada and the US, fluctuations in global commodity prices (especially oil), and broader geopolitical uncertainty and global economic slowdowns. Understanding these interconnected factors is crucial for navigating the current economic landscape.

Key Takeaways: The CAD's value is sensitive to Bank of Canada and US Federal Reserve monetary policies, global commodity prices, and international economic and political events. These factors often work in tandem, influencing the loonie's performance against other major currencies.

Call to Action: Understanding the factors impacting the Canadian dollar's value is crucial for making informed financial decisions. Stay informed about economic news and changes in the CAD exchange rate to effectively manage your financial future. For up-to-date information on the CAD exchange rate, visit [link to a reputable financial news website].

Featured Posts

-

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025 -

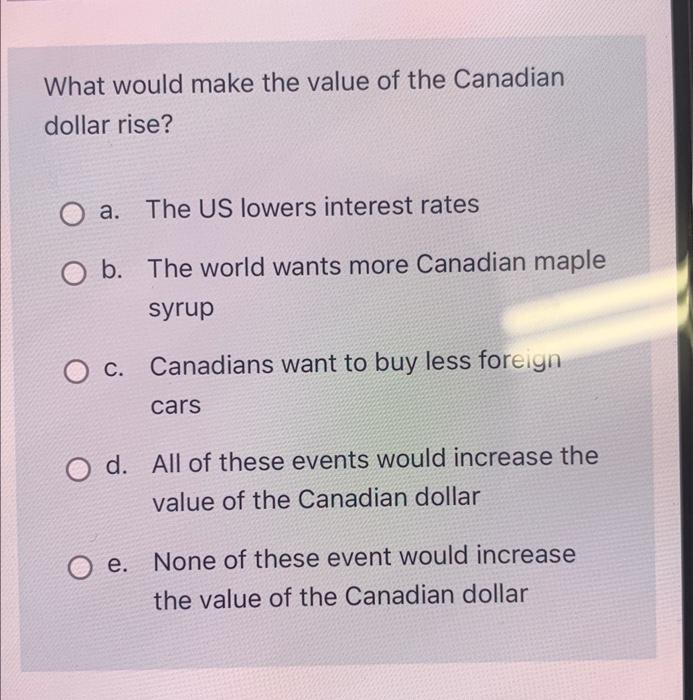

Tracking The Market Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025

Tracking The Market Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 24, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 24, 2025 -

Canada Needs Fiscal Responsibility A Critical Analysis Of Liberal Policies

Apr 24, 2025

Canada Needs Fiscal Responsibility A Critical Analysis Of Liberal Policies

Apr 24, 2025 -

Open Ais Interest In Google Chrome A Chat Gpt Ceos Revelation

Apr 24, 2025

Open Ais Interest In Google Chrome A Chat Gpt Ceos Revelation

Apr 24, 2025