Simkus Signals Further ECB Rate Cuts Due To Trade Tensions

Table of Contents

Simkus's Predictions and Rationale

Simkus, a respected figure in economic forecasting, anticipates further reductions in the ECB's key interest rates within the next quarter. He projects a decrease of at least 25 basis points, potentially more depending on the severity and duration of the ongoing trade disputes. His rationale centers on several key economic indicators reflecting a weakening Eurozone economy.

Simkus's forecast is grounded in the following observations:

-

Weakening Eurozone GDP growth projections: Recent data suggests a significant slowdown in Eurozone GDP growth, falling below initial projections for the year. This contraction is partly attributed to decreased consumer and business confidence.

-

Diminishing business investment due to uncertainty: The ongoing trade war and related uncertainty have led many businesses to postpone investment decisions, impacting job creation and overall economic activity.

-

Potential deflationary pressures: The decrease in demand and subdued price growth raise concerns about deflation, a scenario where the ECB would likely respond with further rate cuts.

-

Impact of global trade slowdown on Eurozone exports: The trade war's impact on global trade is negatively affecting Eurozone exports, a significant component of its economy. Reduced demand from major trading partners dampens economic growth.

Simkus supports his analysis by referencing reports from the European Commission, the IMF, and other reputable economic institutions, all pointing towards a bleaker-than-expected Eurozone economic outlook in the coming months.

The Impact of Trade Tensions on the Eurozone Economy

Escalating trade conflicts, particularly the US-China trade war, are inflicting significant damage on the Eurozone economy. These trade tensions operate through several channels:

-

Reduced export demand: Tariffs and trade restrictions imposed by major trading partners directly reduce demand for Eurozone exports, particularly in sectors heavily reliant on international trade.

-

Increased input costs for businesses: Trade disputes lead to higher costs for businesses, impacting their profitability and competitiveness. This is particularly true for businesses relying on imported raw materials or intermediate goods.

-

Uncertainty impacting investment decisions: The unpredictable nature of trade policies creates uncertainty, discouraging businesses from making long-term investments and hindering economic expansion.

-

Decline in consumer spending: Trade wars can contribute to higher prices for goods and services, reducing consumer purchasing power and dampening consumer confidence.

For example, the automotive industry in Germany, a major Eurozone economy, has been significantly impacted by the trade disputes, facing both reduced export demand and increased costs for imported parts.

ECB's Current Monetary Policy and Potential Responses

The ECB's current monetary policy stance involves maintaining near-zero interest rates and ongoing quantitative easing (QE) programs. However, the predicted economic slowdown and escalating trade tensions might prompt further actions.

Potential responses by the ECB include:

-

Potential for further quantitative easing programs: The ECB may expand its QE programs to inject more liquidity into the market and stimulate lending and investment.

-

Considerations regarding negative interest rates: While already in negative territory for some rates, the ECB might consider pushing interest rates further into negative territory, although this strategy has shown diminishing returns and potential drawbacks.

-

Challenges in stimulating economic growth in a global trade war context: The ECB faces significant challenges in effectively stimulating economic growth when the primary driver of the slowdown is external—namely, the global trade war—rather than domestic factors.

-

Potential political pressures on the ECB: The ECB’s decisions are subject to significant political pressure, making navigation of this challenging economic climate even more complex.

Alternative Economic Perspectives and Counterarguments

While Simkus's prediction of further ECB rate cuts is compelling, alternative viewpoints exist. Some economists argue that the Eurozone economy is more resilient than projected and capable of weathering the current trade tensions.

Counterarguments to Simkus's predictions include:

-

Arguments for a more resilient Eurozone economy: Some analysts point to the Eurozone's strong internal market and relatively low debt levels as factors mitigating the impact of external shocks.

-

Potential for a quicker resolution of trade tensions: A faster-than-expected resolution to the trade disputes could significantly improve the economic outlook, reducing the need for further rate cuts.

-

Unforeseen positive economic developments: Unanticipated positive economic developments, such as technological breakthroughs or increased investment from other regions, could offset the negative effects of trade tensions.

Economists at institutions like the Bundesbank, for example, have voiced more optimistic projections, emphasizing the resilience of the German economy and its potential to drive Eurozone growth.

Conclusion: Simkus's Signals and the Future of ECB Rate Cuts

Simkus's prediction of further ECB rate cuts is largely based on the weakening Eurozone GDP growth, diminished business investment due to trade uncertainties, and potential deflationary pressures. The ongoing trade tensions significantly exacerbate these challenges. Further rate cuts, while potentially stimulating short-term growth, also carry risks, including diminishing returns from negative interest rates and potential inflationary pressures down the line. The likelihood of further rate cuts hinges heavily on the evolution of trade tensions and the overall performance of the Eurozone economy. To stay abreast of the latest developments concerning ECB interest rate decisions and their impact on the Eurozone economic outlook, and the ongoing trade war impact, subscribe to our newsletter or follow reputable financial news sources. Stay informed to navigate this dynamic economic landscape effectively.

Featured Posts

-

Nosferatu The Vampyre A Now Toronto Detour Worth Taking

Apr 27, 2025

Nosferatu The Vampyre A Now Toronto Detour Worth Taking

Apr 27, 2025 -

Motherhood And Victory Belinda Bencics Return To The Wta

Apr 27, 2025

Motherhood And Victory Belinda Bencics Return To The Wta

Apr 27, 2025 -

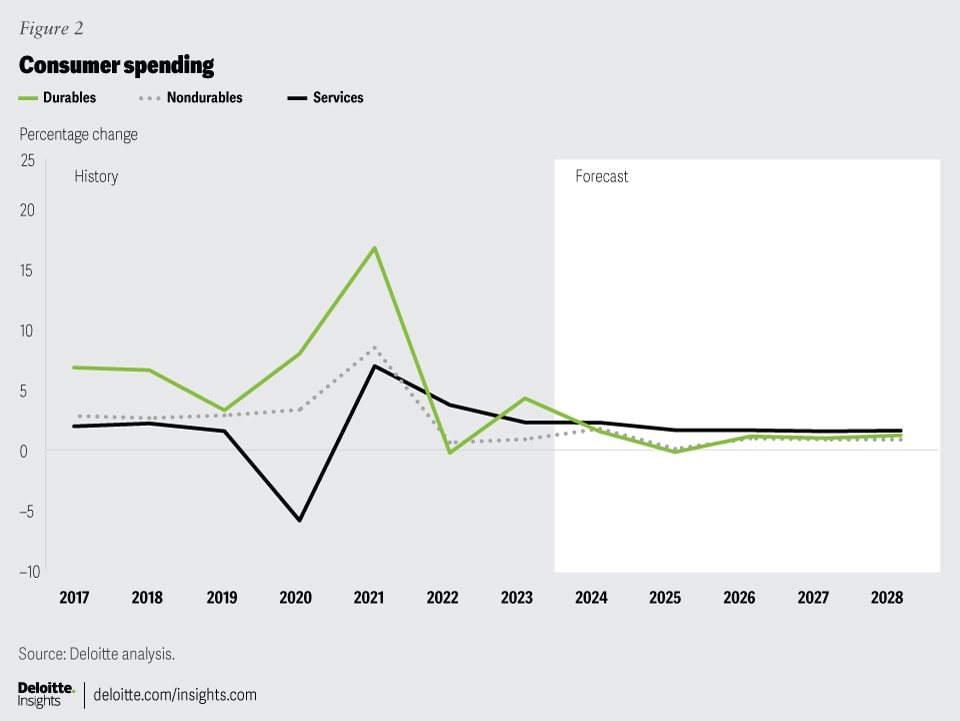

Considerable Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025

Considerable Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025 -

Ecb Task Force Aims To Simplify Complex Banking Rules

Apr 27, 2025

Ecb Task Force Aims To Simplify Complex Banking Rules

Apr 27, 2025 -

Professional Analysis Ariana Grandes Bold New Look

Apr 27, 2025

Professional Analysis Ariana Grandes Bold New Look

Apr 27, 2025