Stock Market Today: Dow Jumps 1000 Points, Nasdaq & S&P 500 Surge On Tariff Hopes

Table of Contents

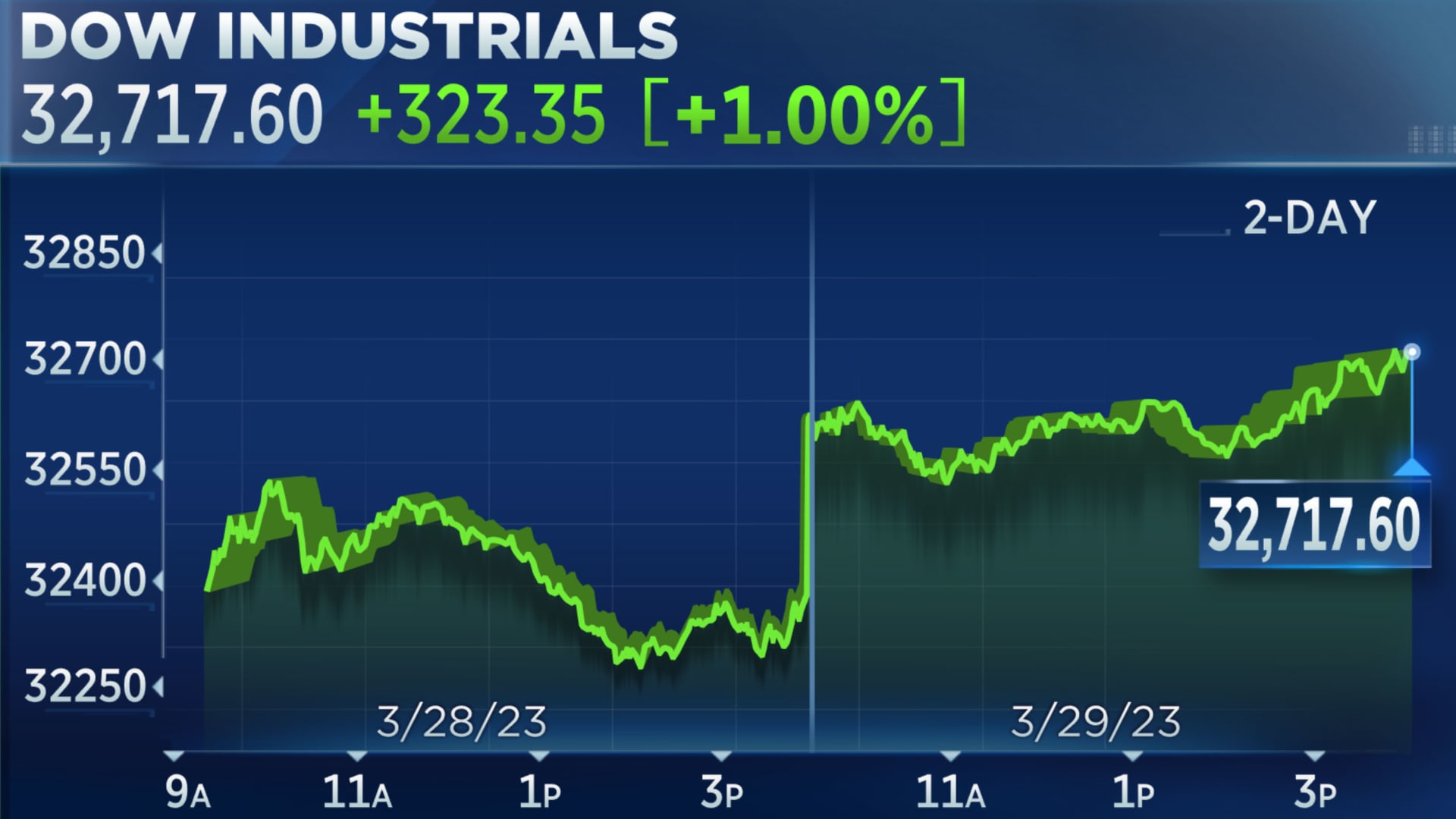

Dow Jones Industrial Average: A Historic Surge

The Dow Jones Industrial Average closed up a staggering 1000 points, representing a 3.7% increase—a truly historic surge. The closing value reached [Insert Closing Value Here]. This impressive rally was driven by broad-based gains across various sectors, but technology stocks led the charge.

- Technology Sector Boom: Companies like Apple, Microsoft, and Intel saw substantial gains, contributing significantly to the Dow's overall performance.

- Financial Sector Strength: The financial sector also performed exceptionally well, reflecting renewed confidence in the economic outlook.

- Industrial Gains: Industrial giants also experienced positive movement, showcasing a broader market recovery.

Here's a snapshot of some key Dow components and their performance:

- Apple (AAPL): [Insert Percentage Gain]

- Microsoft (MSFT): [Insert Percentage Gain]

- Boeing (BA): [Insert Percentage Gain]

This massive increase in Dow points signifies a significant market rally, signaling a potential shift in Stock Market Gains.

Nasdaq and S&P 500: Following the Upward Trend

The Nasdaq Composite and the S&P 500 followed the upward trend set by the Dow, also experiencing substantial gains. The Nasdaq Composite rose by [Insert Percentage and Point Gain Here], while the S&P 500 increased by [Insert Percentage and Point Gain Here].

- Tech-Heavy Gains: The Nasdaq's strong performance reflects the significant gains in the technology sector, which holds a substantial weighting in the index.

- Broad-Based Growth: The S&P 500, a broader representation of the US stock market, also showcased impressive growth, demonstrating a widespread market rally.

- Comparative Performance: While all three major indices experienced significant gains, the Dow's percentage increase was slightly higher than that of the Nasdaq and S&P 500.

These impressive performances across market indices clearly illustrate a positive shift in Stock Market Performance.

The Role of Tariff Hopes in the Market Rally

The driving force behind this extraordinary market rally is the renewed optimism surrounding international trade tariffs. Positive trade talks between the US and China, coupled with [mention specific news or developments, e.g., a potential easing of trade tensions or a proposed agreement], boosted investor confidence considerably.

- Reduced Uncertainty: The positive developments significantly reduced the uncertainty surrounding trade relations, a major factor impacting market volatility in recent months.

- Improved Investor Sentiment: This reduction in uncertainty led to improved investor sentiment, encouraging investors to return to the market and invest further.

- Long-Term Implications: The potential long-term implications of these developments are significant, potentially leading to increased global trade and economic growth. However, it's crucial to remain cautious as the situation remains dynamic. These developments are a key factor in reducing economic uncertainty and ending the trade war.

This demonstrates how trade tariffs and investor sentiment heavily influence market volatility.

Analyst Reactions and Predictions

Leading financial analysts have offered varied interpretations of the market surge. [Quote Analyst 1 and their perspective, citing their credentials]. [Quote Analyst 2 with a contrasting or supporting viewpoint, citing their credentials]. While many believe the upward trend is sustainable in the short term, several have cautioned against excessive optimism, highlighting potential risks such as [mention potential risks, e.g., geopolitical instability or unexpected economic data].

- Short-Term Optimism: Most analysts express short-term optimism, attributing the surge to improved trade relations.

- Long-Term Uncertainty: However, the long-term outlook remains less certain, with analysts highlighting potential headwinds.

- Cautionary Notes: Experts emphasize the need for cautious optimism, advising investors to diversify their portfolios and manage risks effectively.

This section highlights the importance of market analysis and stock market predictions based on the perspectives of financial analysts and the overall investor outlook.

Conclusion: Understanding Today's Stock Market Jump and What it Means for You

Today's Stock Market Today witnessed a remarkable surge, with the Dow, Nasdaq, and S&P 500 all experiencing significant gains driven primarily by positive developments in trade tariff negotiations. While this represents a positive development, it's crucial to maintain a balanced perspective, acknowledging the potential for future market volatility. The impact of these trade tariffs will continue to be a major factor shaping market performance.

Stay tuned for updates on the stock market and continue monitoring the impact of tariff negotiations on your investments. For further insights into market analysis and stock market predictions, consult reputable financial resources and consult with a qualified financial advisor before making any investment decisions. Remember to stay informed about the stock market today and its fluctuations.

Featured Posts

-

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025 -

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025 -

Decoding Niftys Rally Key Factors Driving Indias Market Buzz

Apr 24, 2025

Decoding Niftys Rally Key Factors Driving Indias Market Buzz

Apr 24, 2025 -

Stock Market Live Dow Soars Nasdaq And S And P 500 Follow Suit

Apr 24, 2025

Stock Market Live Dow Soars Nasdaq And S And P 500 Follow Suit

Apr 24, 2025 -

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025