Stock Market Valuation Concerns? BofA Offers Investors Reassurance

Table of Contents

BofA's Key Arguments for a Less-Bearish Outlook

BofA's recent report presents a less pessimistic view of current market valuations than some other analysts. Their analysis attempts to alleviate some of the anxiety surrounding high price-to-earnings (P/E) ratios and the cyclically adjusted price-to-earnings ratio (Shiller PE), commonly used metrics to gauge market valuation.

Addressing Overvaluation Concerns

BofA counters concerns about overvaluation with several key arguments:

- Strong Corporate Earnings Growth: BofA highlights robust corporate earnings growth as a significant factor mitigating the impact of high valuations. They point to data showing consistent earnings growth across various sectors, suggesting that current prices are supported by fundamental strength.

- Low Interest Rates: The report emphasizes the role of persistently low interest rates in supporting higher valuations. Low borrowing costs enable companies to invest more aggressively and bolster future earnings, justifying higher stock prices.

- Healthy Growth in Specific Sectors: BofA's analysis identifies specific sectors demonstrating strong growth despite seemingly high valuations. These sectors, driven by technological innovation or strong consumer demand, are considered less vulnerable to a market downturn.

Identifying Potential Growth Catalysts

Beyond addressing concerns, BofA identifies several factors that they believe will propel future market growth:

- Technological Advancements: The report emphasizes the ongoing wave of technological innovation as a major growth catalyst. Advancements in areas like artificial intelligence, cloud computing, and biotechnology are expected to fuel significant sector growth.

- Government Stimulus and Infrastructure Spending: BofA anticipates continued government spending on infrastructure projects and other stimulus measures as a positive force for economic growth and market performance. This injection of capital into the economy is expected to boost demand and stimulate investment.

- Global Economic Recovery: The bank predicts a gradual global economic recovery, underpinned by factors like increasing vaccination rates and the easing of pandemic restrictions. This global recovery is anticipated to create favorable conditions for sustained market expansion.

Analyzing BofA's Methodology and Assumptions

While BofA's report offers a reassuring perspective, it's crucial to critically examine its underlying methodology and assumptions.

Potential Limitations and Risks

Several potential limitations and risks associated with BofA's analysis should be acknowledged:

- Dependence on Continued Economic Growth: BofA's forecast relies heavily on the assumption of continued economic growth. A recession or a significant economic slowdown could easily invalidate their projections, leading to a more bearish market outlook. Stock market valuations are extremely sensitive to economic cycles.

- Geopolitical Risks: The analysis might not fully account for the potential impact of unforeseen geopolitical events. International conflicts, trade wars, or other geopolitical uncertainties could significantly disrupt global markets and negatively impact valuations.

- Inflationary Pressures: The assumptions about inflation's impact on future earnings and interest rates might prove inaccurate. Unanticipated inflationary pressures could erode corporate profits and necessitate higher interest rates, potentially dampening market performance.

Comparing BofA's View with Other Market Analyses

It is important to note that BofA's optimistic outlook isn't universally shared. Other prominent financial institutions offer varying perspectives on market valuations:

- More Cautious Outlooks: Some institutions, like Goldman Sachs, express more caution regarding specific sectors, such as technology, citing potential overvaluation in certain segments.

- Predictions of Market Corrections: Other analysts, including some at Morgan Stanley, predict a moderate market correction in the near future, suggesting that current valuations are unsustainable in the long term. These differing opinions underscore the complexity of assessing market valuations.

Conclusion: Stock Market Valuation Concerns? Finding Reassurance and Making Informed Decisions

BofA's report offers a reassuring perspective on current stock market valuation concerns, highlighting strong corporate earnings, low interest rates, and potential growth catalysts. However, it's crucial to remember the limitations of any single analysis. Their predictions depend heavily on continued economic growth and might not fully capture the potential impact of geopolitical risks or unexpected inflationary pressures. The differing opinions from other financial institutions emphasize the need for comprehensive due diligence. Therefore, before making any investment decisions, investors should conduct thorough research, considering multiple perspectives and seeking advice from qualified financial advisors. Don't rely solely on a single report; understanding the nuances of stock market valuation concerns requires a multifaceted approach. Remember that BofA's report is just one piece of the puzzle when assessing stock market valuation concerns.

Featured Posts

-

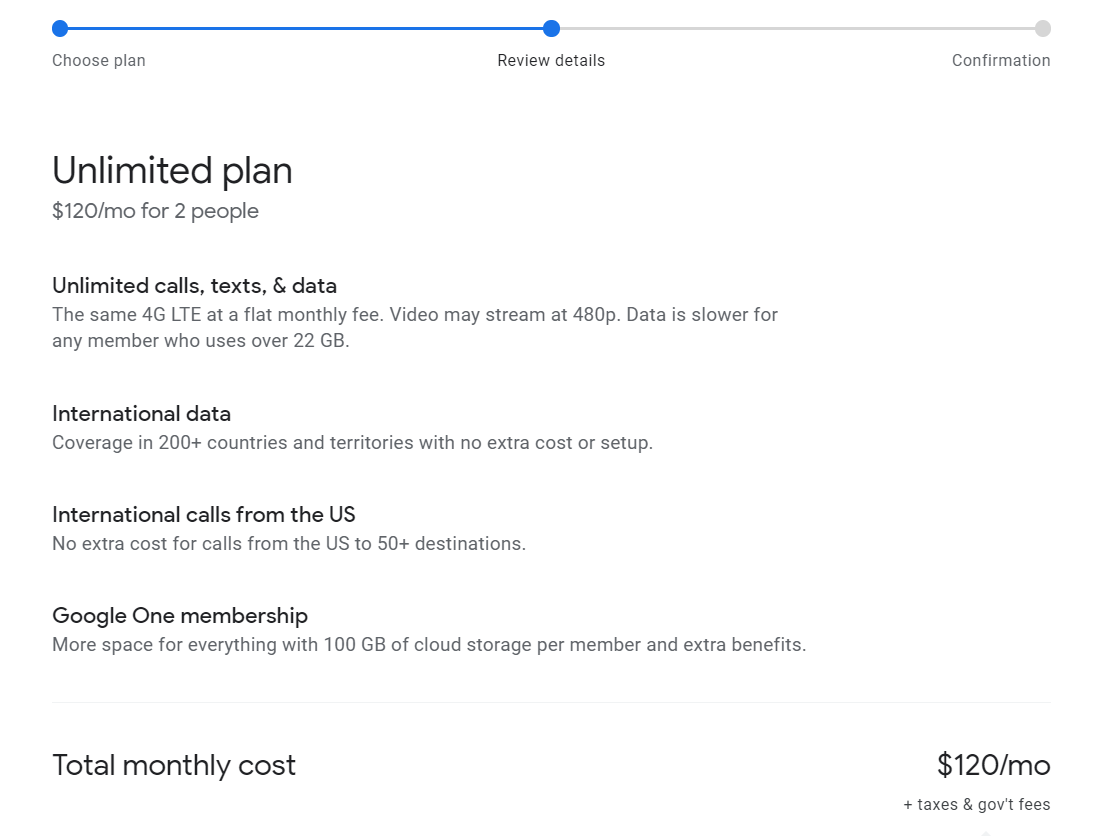

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025 -

Building A Fiscally Responsible Canada A Plan For The Future

Apr 24, 2025

Building A Fiscally Responsible Canada A Plan For The Future

Apr 24, 2025 -

Court Challenges Slow Trump Administration Immigration Efforts

Apr 24, 2025

Court Challenges Slow Trump Administration Immigration Efforts

Apr 24, 2025 -

The Bold And The Beautiful April 9 Recap Steffy Bill Finn And Liams Intense Confrontation

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Bill Finn And Liams Intense Confrontation

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025