Strong Emerging Market Performance Contrasts With US Stock Decline

Table of Contents

Emerging Market Growth Drivers

Several powerful forces are fueling the robust growth observed in emerging markets, creating a compelling investment narrative.

Economic Diversification and Resilience

Emerging markets are demonstrating increased resilience and less reliance on single sectors. This diversification buffers them against global shocks.

- India's tech sector: The rapid growth of India's technology industry showcases a successful shift away from dependence on traditional sectors, making it less vulnerable to global commodity price fluctuations.

- Vietnam's manufacturing: Vietnam's robust manufacturing sector, attracting significant foreign direct investment (FDI), illustrates successful diversification and participation in global supply chains.

- Resilience to supply chain disruptions: Many emerging economies have shown impressive resilience to the global supply chain issues experienced in recent years, leveraging their own domestic capabilities and adapting more quickly to changing market conditions.

Government Policies and Infrastructure Investments

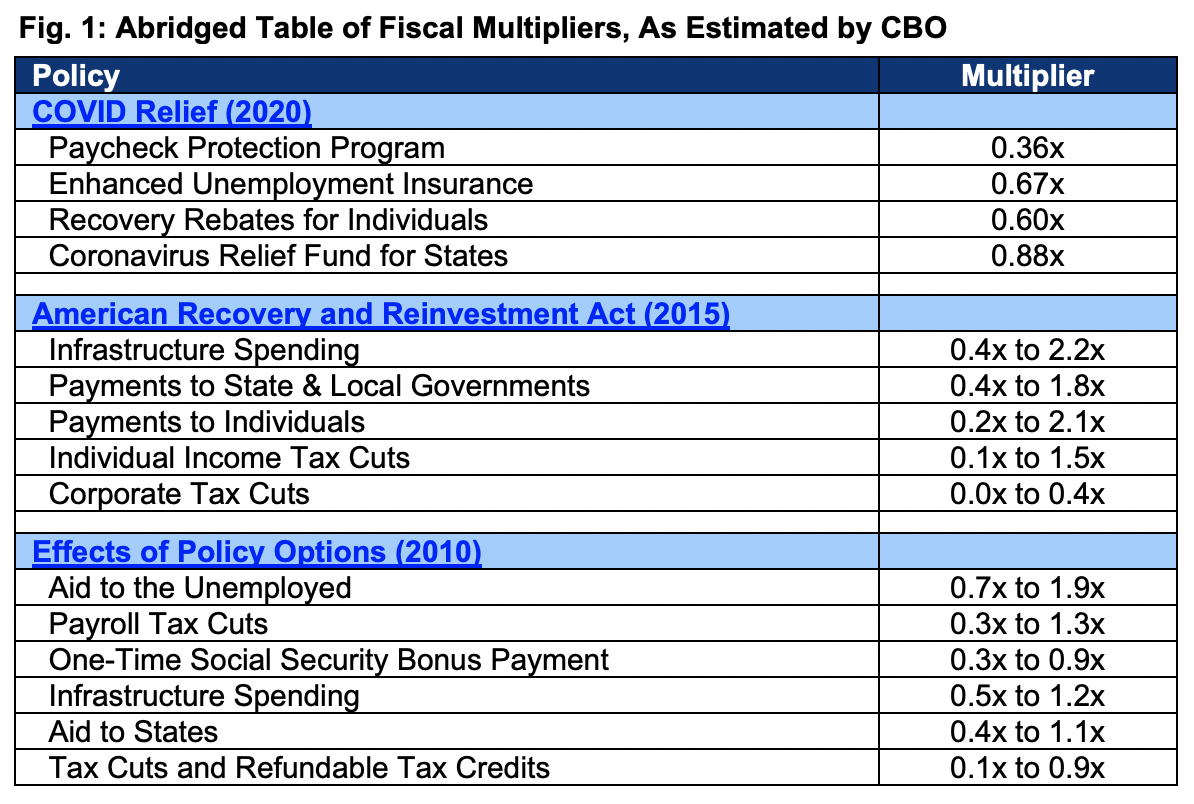

Proactive government policies in many emerging markets are playing a crucial role in stimulating economic growth.

- Infrastructure projects: Massive infrastructure investments in countries like China and Indonesia are creating jobs, boosting productivity, and attracting foreign investment. These initiatives are laying the foundation for long-term economic expansion.

- Pro-growth policies: Tax incentives, deregulation, and other pro-growth policies are fostering a more favorable business environment, encouraging both domestic and foreign investment. This increased investment translates into job creation and economic expansion.

Increased Domestic Consumption

A burgeoning middle class is driving significant growth in consumer spending across many emerging markets.

- Rising disposable incomes: Rapidly rising disposable incomes in countries like Brazil and Mexico are fueling strong domestic demand, creating a powerful engine for economic growth.

- Impact on GDP growth: Increased consumer spending is a major contributor to GDP growth in these economies, signifying a healthy and self-sustaining economic cycle.

Factors Contributing to US Stock Market Decline

In contrast to the positive trends in emerging markets, several factors are weighing down the US stock market.

Inflation and Interest Rate Hikes

Persistent inflation and the Federal Reserve's aggressive interest rate hikes are significantly impacting US stock valuations.

- Inflation and interest rate data: High inflation rates, coupled with the Federal Reserve's efforts to combat inflation by raising interest rates, have created a challenging environment for the US stock market.

- Rising borrowing costs: Rising interest rates increase borrowing costs for businesses, dampening investment and potentially slowing economic growth. This impacts corporate profitability and consequently, stock valuations.

Geopolitical Uncertainty

Geopolitical uncertainties are also contributing to the decline in investor confidence and market performance.

- Ukraine conflict impact: The war in Ukraine has created significant global uncertainty, impacting energy prices and supply chains, thereby influencing investor sentiment.

- US-China tensions: Ongoing tensions between the US and China are also adding to the global uncertainty, impacting investor risk appetite and market stability.

Recessionary Fears

Growing concerns about a potential US recession are further depressing stock market performance.

- Economic indicators: Several key economic indicators, such as inverted yield curves and slowing GDP growth, are fueling fears of a potential recession.

- Recession and stock market correlation: Historically, recessions are associated with significant declines in stock market valuations, further contributing to the current downturn.

Investment Implications and Opportunities

The contrasting performance of emerging markets and the US market presents both challenges and opportunities for investors.

Diversification Strategies

Diversifying investment portfolios to include emerging market assets can mitigate risk and potentially enhance returns.

- Emerging market investment vehicles: Investors can access emerging markets through various investment vehicles, such as exchange-traded funds (ETFs) and mutual funds.

- Risk tolerance: It's crucial to consider individual risk tolerance when making investment decisions, particularly in emerging markets, which tend to have higher volatility than developed markets.

Long-Term Growth Potential

Emerging markets present substantial long-term growth potential, offering potentially higher returns compared to developed markets.

- GDP growth projections: Many emerging markets are projected to experience strong GDP growth in the coming years, making them an attractive investment destination for long-term investors.

- Risk-reward profile: While emerging markets carry higher risk, the potential for higher returns can make them a compelling addition to a well-diversified portfolio for investors with a longer time horizon.

Conclusion: Navigating the Emerging Market Opportunity

The strong emerging market performance contrasts sharply with the US stock market decline, driven by diverse economic factors. Emerging markets benefit from economic diversification, government policies, and rising domestic consumption, while the US faces headwinds from inflation, geopolitical uncertainty, and recessionary fears. Investors can leverage this divergence by exploring emerging market opportunities and diversifying their portfolios with emerging market assets. Learn more about strong emerging market performance and discover how to strategically integrate these markets into your investment strategy to capitalize on this compelling trend.

Featured Posts

-

Canadas Fiscal Future A Vision Of Responsible Spending

Apr 24, 2025

Canadas Fiscal Future A Vision Of Responsible Spending

Apr 24, 2025 -

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

Apr 24, 2025 -

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Dies At 24

Apr 24, 2025

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Dies At 24

Apr 24, 2025 -

Apr 24, 2025

Apr 24, 2025