Tariffs Drive China's LPG Imports Towards The Middle East

Table of Contents

Rising Tariffs on Traditional LPG Suppliers

Increased tariffs on LPG imports from key regions like the US and Australia have profoundly impacted China's energy landscape. These policies have made importing LPG from these traditional sources considerably more expensive, forcing a reassessment of China's LPG import strategy.

-

Quantifying the Impact: Tariff increases on US and Australian LPG have ranged from 15% to 25% in recent years, significantly increasing import costs for Chinese buyers. This added cost translates directly to higher LPG prices within the Chinese market.

-

Specific Tariff Policies: The Chinese government has implemented several specific tariff policies aimed at protecting domestic LPG producers and influencing import patterns. These policies often target specific volumes or types of imported LPG.

-

Price Increases and Import Decreases: The resultant increase in LPG prices in the Chinese market has led to a noticeable decrease in LPG imports from the US and Australia. Data from the past two years shows a significant decline in import volumes from these regions. For example, US LPG exports to China fell by X% in 2022 compared to 2021 (replace X with actual data if available).

-

Related Keywords: China LPG tariffs, US LPG exports to China, Australia LPG to China, LPG import costs China

The Middle East Emerges as a Key LPG Supplier

The Middle East has rapidly become a key LPG supplier to China, filling the void left by the decreased imports from traditional sources. Several factors contribute to this shift:

-

Competitive Pricing: Middle Eastern LPG often enjoys competitive pricing compared to other regions, making it an attractive alternative for Chinese importers. This competitive edge is further enhanced by lower transportation costs.

-

Geographical Proximity and Reduced Shipping Costs: The geographical proximity of Middle Eastern LPG producers to China significantly reduces shipping costs and transit times compared to imports from North America or Oceania. This factor plays a crucial role in the overall cost-effectiveness.

-

Increased Production Capacity: The Middle East boasts significant and growing LPG production capacity, enabling it to meet the increasing demand from China. Countries like Saudi Arabia and Qatar are key players in this increased production.

-

Political and Economic Stability: The relative political and economic stability of many Middle Eastern countries provides a reliable and consistent supply of LPG to China, further enhancing their attractiveness as trading partners.

-

Related Keywords: Middle East LPG exports, China Middle East trade, LPG shipping costs, Saudi Arabia LPG exports, Qatar LPG exports

Impact on China's Energy Security and Market Dynamics

This shift in LPG import sources has significant long-term implications for China's energy security and market dynamics:

-

Diversification of Supply Chain: The move towards Middle Eastern LPG sources contributes to a more diversified LPG supply chain for China, reducing reliance on any single region and mitigating potential risks associated with geopolitical instability or trade disputes.

-

Energy Security Implications: While diversification enhances security, complete reliance on any single region presents its own risks. China needs to continue to diversify its energy portfolio to ensure long-term energy security.

-

Impact on Domestic LPG Producers: Increased competition from Middle Eastern imports could impact domestic LPG producers in China, potentially leading to adjustments in production strategies and pricing.

-

Consumer Price Impacts: The interplay between import prices, tariffs, and domestic production will ultimately determine the final consumer price of LPG in China.

-

Related Keywords: China energy security, China LPG market, LPG price volatility, domestic LPG production China

Future Outlook for China's LPG Imports

Predicting the future of China's LPG import strategy requires considering several factors:

-

Trade Agreements: Future changes in trade agreements between China and various regions will significantly influence import patterns and pricing.

-

Renewable Energy Growth: The increasing integration of renewable energy sources in China's energy mix may moderate future LPG demand, although its role as a vital fuel source is expected to persist.

-

LPG Demand Forecast: Experts predict continued growth in China's LPG demand in the coming years, driven by industrial and residential consumption.

-

Continued Growth of Middle Eastern Exports: The Middle East is likely to maintain its position as a major LPG supplier to China, driven by cost-effectiveness and reliable supply.

-

Related Keywords: Future of China's LPG imports, China renewable energy, LPG demand forecast China

Conclusion

The imposition of higher tariffs on traditional LPG suppliers has driven a significant redirection of China's LPG imports towards the Middle East. This shift has major implications for China's energy security, market dynamics, and international trade relations. The increased reliance on Middle Eastern sources offers advantages in terms of price and geographical proximity, but it also necessitates careful consideration of potential geopolitical risks and the ongoing development of China's domestic energy sector and renewable energy goals.

Stay informed about the evolving dynamics of China's LPG imports and the increasing role of the Middle East in meeting China's energy needs. Further research into the impact of China's LPG import policies is crucial for understanding the future of the global LPG market and China's evolving energy strategy. Monitoring China's LPG market and the dynamics of China's LPG imports is essential for stakeholders across the global energy sector.

Featured Posts

-

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

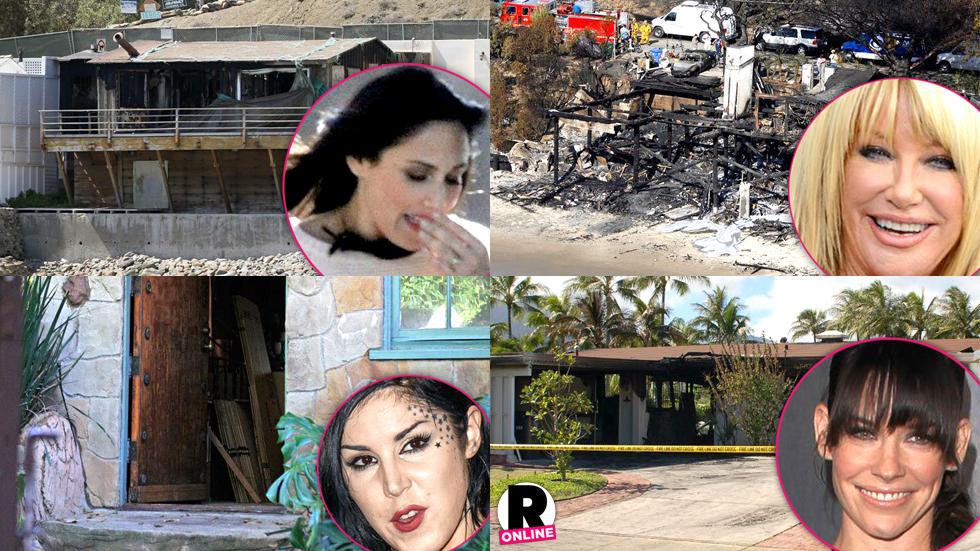

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 24, 2025 -

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025 -

Building A Fiscally Responsible Canada A Plan For The Future

Apr 24, 2025

Building A Fiscally Responsible Canada A Plan For The Future

Apr 24, 2025 -

Ftc Probe Into Open Ai Implications For The Future Of Ai

Apr 24, 2025

Ftc Probe Into Open Ai Implications For The Future Of Ai

Apr 24, 2025