Tesla Q1 Profit Fall: Political Backlash And Its Effect On The Company

Table of Contents

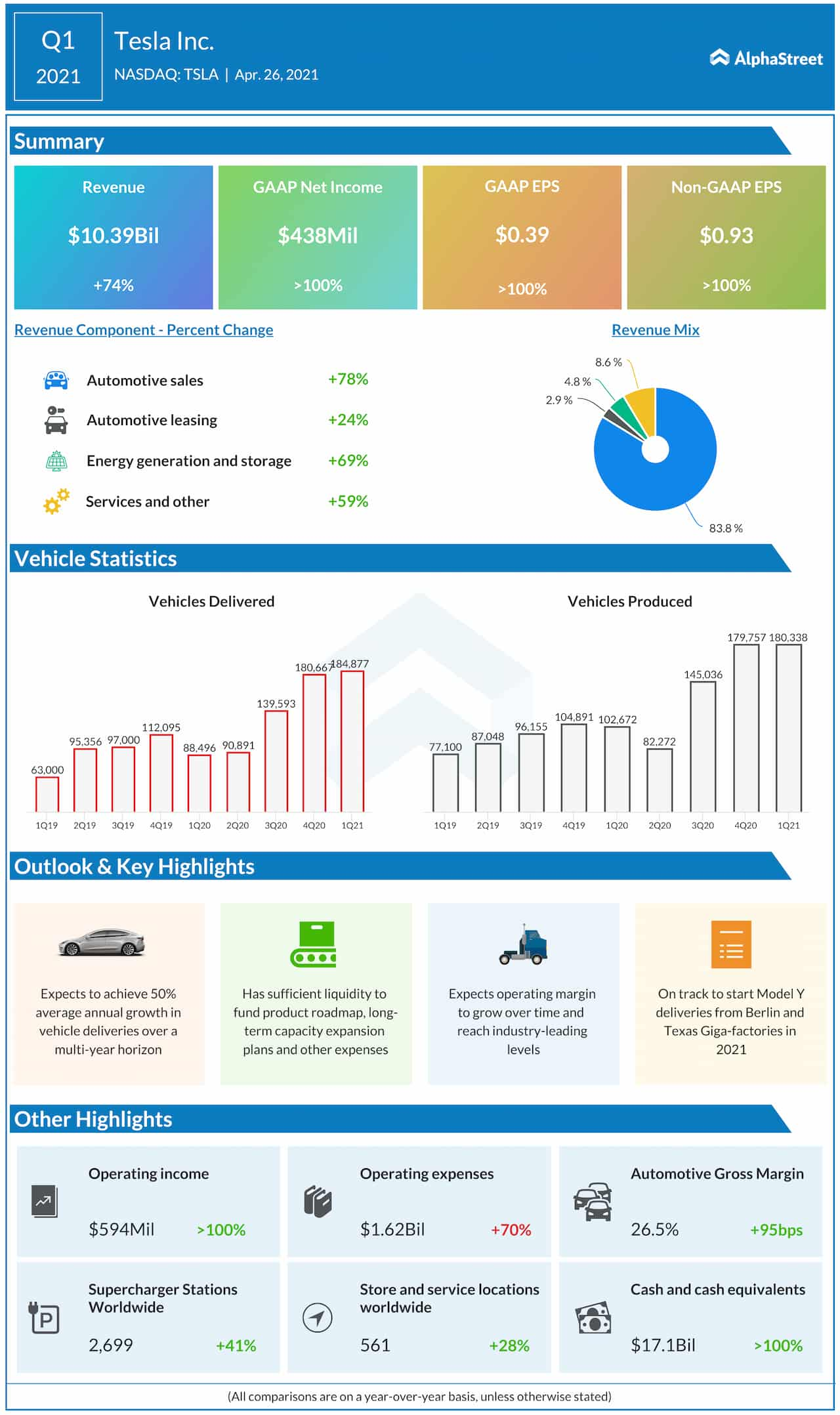

Price Wars and Profit Margins

Tesla's aggressive pricing strategies have been a defining feature of its recent performance, directly impacting its profit margins. This section explores the complexities of this approach and its implications for the company's future.

Aggressive Pricing Strategies

Tesla's recent price cuts, implemented across various models and markets, have undeniably boosted sales volume. However, this success comes at the cost of significantly reduced profit margins.

- Reasons behind the price cuts:

- Increased competition: The electric vehicle market is rapidly expanding, with numerous competitors vying for market share. Tesla's price cuts are a direct response to this intensifying competition, aiming to maintain its market dominance.

- Inventory management: High inventory levels often necessitate price reductions to clear stock and prevent losses. Tesla's aggressive pricing could also be a tactic to manage its inventory effectively.

- Market share dominance: Even with reduced profit per unit, Tesla aims to sell more units to increase its overall market share and cement its position as a leading EV manufacturer.

Data suggests a clear correlation between Tesla's price reductions and a surge in sales. However, the long-term sustainability of this strategy remains questionable. The question is whether the increased sales volume will compensate for the lower profit margins, allowing Tesla to maintain its financial health.

Impact on Competitor Dynamics

Tesla's price cuts have undeniably shaken up the electric vehicle market, triggering responses from competitors and significantly altering the dynamics of the industry.

- Competitor responses: Other EV manufacturers, facing pressure from Tesla's aggressive pricing, have responded with their own price adjustments, leading to a potential industry-wide price war. This dynamic is particularly visible in the competition between Tesla and established automotive giants like Volkswagen and Ford.

- Potential for a price war: A prolonged price war could severely impact the profitability of all players involved, potentially leading to consolidation or even bankruptcies within the industry. The long-term consequences of this competitive pressure on innovation and investment are still unfolding.

Geopolitical and Regulatory Challenges

Tesla's global operations make it highly susceptible to geopolitical instability and evolving regulatory landscapes. This section examines the specific challenges Tesla faces in key markets.

China Market Volatility

The Chinese market represents a significant portion of Tesla's global sales. However, navigating the complex political and regulatory environment in China poses considerable challenges.

- Trade disputes and tariffs: Fluctuations in US-China relations directly impact Tesla's operations in China, with potential trade disputes and tariffs significantly affecting profitability.

- Local competition: The Chinese EV market is highly competitive, with strong domestic players like BYD putting pressure on Tesla's market share.

- Regulatory changes: Shifting regulations in China, concerning everything from safety standards to data privacy, constantly require Tesla to adapt its strategies, which can be costly and time-consuming. Tesla’s market share in China has shown some fluctuation reflecting these challenges.

Regulatory Scrutiny in Other Markets

Tesla is not immune to regulatory challenges in other major markets like the US and Europe.

- Investigations and recalls: Tesla has faced numerous investigations and recalls related to safety concerns and quality control issues in various regions, resulting in significant financial and reputational costs.

- Stricter emission regulations: The tightening of emission regulations globally necessitates continuous investment in research and development, posing a strain on Tesla's resources and affecting profitability.

Political Backlash and Public Perception

Negative media coverage, political criticism, and public perception significantly influence Tesla's brand image and sales.

- Elon Musk's influence: Elon Musk's public statements and actions often attract media attention and political scrutiny, directly impacting public perception of Tesla and its products.

- Specific instances of political backlash: Recent examples of political backlash include controversies surrounding Tesla's Autopilot system and various safety-related incidents which have negatively impacted Tesla’s stock price and public trust.

Production and Supply Chain Issues

Tesla's ambitious production targets are constantly challenged by various bottlenecks and supply chain disruptions.

Production Bottlenecks

Maintaining efficient and consistent production is crucial for Tesla's financial health. However, the company faces several challenges.

- Raw materials: The availability and price volatility of raw materials used in Tesla's vehicles and batteries significantly impact production costs.

- Labor: Labor shortages and potential labor disputes can disrupt production and lead to increased costs.

- Logistics: Global supply chain disruptions can delay the delivery of essential components, hindering production and causing significant financial losses. Factory shutdowns and production slowdowns directly impact profitability.

Battery Supply and Costs

Tesla's reliance on battery technology for its electric vehicles makes the company particularly vulnerable to fluctuations in battery supply and costs.

- Battery supply chain disruptions: Disruptions in the battery supply chain can significantly impact Tesla's production capacity and increase its production costs.

- Battery technology dependence: Tesla's dependence on specific battery technologies and suppliers makes it susceptible to disruptions from a single supplier.

- Rising battery costs: The cost of batteries continues to be a major factor in determining the overall cost of Tesla vehicles, impacting profit margins. Strategies to mitigate these risks include diversifying suppliers and investing in battery technology innovation.

Conclusion

Tesla's Q1 profit fall underscores the complex challenges facing even industry leaders. The confluence of aggressive price wars, escalating geopolitical tensions, stringent regulatory scrutiny, and persistent production and supply chain issues have significantly contributed to this downturn. The impact of political backlash, both directly on Tesla's operations and indirectly through the influence of Elon Musk's public persona, cannot be ignored. Understanding these interwoven factors and successfully navigating these headwinds is paramount for Tesla’s future success. Stay informed about Tesla's performance and the evolving dynamics of the electric vehicle market to fully grasp the long-term implications of these challenges. Continue to follow our coverage for further analysis of Tesla Q1 profit and future trends.

Featured Posts

-

Niftys Ascent Analyzing The Positive Factors Driving Indias Market

Apr 24, 2025

Niftys Ascent Analyzing The Positive Factors Driving Indias Market

Apr 24, 2025 -

Fundraising Intensifies As Elite Universities Navigate Political Headwinds

Apr 24, 2025

Fundraising Intensifies As Elite Universities Navigate Political Headwinds

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025

Bold And The Beautiful Recap April 9 Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025 -

Tesla Q1 Earnings Net Income Down 71 Amidst Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Down 71 Amidst Political Headwinds

Apr 24, 2025 -

Analyzing A Startup Airlines Reliance On Deportation Flights

Apr 24, 2025

Analyzing A Startup Airlines Reliance On Deportation Flights

Apr 24, 2025