Tesla's Q1 Earnings Decline: Musk's Role And Market Reaction

Table of Contents

Factors Contributing to Tesla's Q1 Earnings Decline

Several interconnected factors contributed to the disappointing Tesla Q1 earnings decline. These include aggressive price reductions impacting margins, persistent supply chain disruptions, and a rise in operating costs.

Price Reductions and Margins

Tesla's significant price cuts across its model lineup, implemented to boost sales volume and maintain market share in an increasingly competitive EV landscape, directly impacted profit margins. While sales volume may have increased, the reduced price per vehicle significantly lowered the overall revenue generated.

- Analysis of price cuts across different Tesla models: The Model 3 and Model Y experienced the most substantial price reductions, aimed at attracting a wider customer base and countering competition from emerging EV manufacturers.

- Comparison of Tesla's pricing strategy with competitors: Tesla's aggressive pricing strategy contrasts with some competitors who prioritize maintaining higher profit margins even with lower sales volumes.

- Impact on overall revenue generation: While precise figures vary depending on the model and region, the price cuts resulted in a noticeable decrease in revenue per vehicle sold, contributing significantly to the overall Tesla Q1 earnings decline.

Supply Chain Disruptions

Ongoing supply chain challenges continued to hamper Tesla's production and delivery timelines during Q1 2024. Shortages of crucial components, coupled with logistical bottlenecks, led to production slowdowns and delays in fulfilling orders.

- Impact of raw material costs: Fluctuations in the prices of battery materials like lithium and nickel added further pressure on Tesla's profitability.

- Challenges related to logistics and transportation: Global shipping delays and port congestion impacted the timely delivery of both components and finished vehicles.

- Comparison to previous quarters and industry trends: While supply chain issues are impacting the entire automotive industry, Tesla's reliance on specific suppliers may have made it more vulnerable to disruptions.

Increased Operating Costs

Tesla's Q1 report also revealed a rise in operating expenses, particularly in research and development (R&D). This increase reflects ongoing investments in new technologies and future product development, but it also contributed to the overall Tesla Q1 earnings decline.

- Breakdown of operating expenses across different departments: A detailed breakdown of spending across various departments would provide a clearer picture of cost drivers.

- Comparison with previous quarters and industry benchmarks: Comparing Tesla's operating expenses to previous quarters and to those of its competitors provides valuable context.

- Potential strategies to mitigate future cost increases: Exploring avenues for cost optimization and efficient resource allocation are crucial for Tesla to improve its profitability in the future.

Elon Musk's Role in the Earnings Decline

Elon Musk's leadership style and decisions, alongside his involvement with other ventures, played a significant role in shaping Tesla's Q1 performance and the subsequent market reaction.

Leadership Decisions and Their Impact

Musk's strategic decisions, including the aggressive price cuts, heavily influenced Tesla's Q1 results. His focus on other companies, particularly SpaceX and X (formerly Twitter), may have also diverted attention and resources from Tesla.

- Evaluation of major decisions made during the quarter: A thorough analysis of major decisions made during Q1 is crucial to assess their impact on the Tesla Q1 earnings decline.

- Assessment of communication strategies and investor relations: Musk's communication style, sometimes characterized by controversial tweets and statements, can impact investor confidence.

- Analysis of potential leadership challenges: The challenges of managing multiple large-scale ventures simultaneously may have affected Tesla's operational efficiency.

Public Perception and Investor Confidence

Musk's public statements and actions significantly influenced investor sentiment and market perception of Tesla. Negative news coverage and social media activity surrounding his other ventures impacted the overall confidence in Tesla's future.

- Examples of controversial tweets or public statements: Instances of controversial statements made by Musk during the quarter should be examined for their impact on Tesla’s stock.

- Analysis of media coverage and public opinion: A comprehensive analysis of media sentiment towards Tesla in Q1 will help gauge the impact of public perception on the company’s performance.

- Correlation between Musk's actions and stock price fluctuations: Examining the correlation between Musk’s activities and Tesla’s stock price will help understand the market’s reaction to his leadership.

Market Reaction to Tesla's Q1 Earnings Decline

The market reacted swiftly to Tesla's disappointing Q1 results, leading to significant stock price fluctuations and varied analyst opinions on the company's future prospects.

Stock Price Fluctuations

Tesla's stock price experienced a notable dip following the release of the Q1 earnings report. This negative reaction was amplified by concerns regarding the company's profitability and the impact of Musk's leadership.

- Analysis of short-term and long-term price trends: Observing both short-term volatility and long-term trends helps gauge investor sentiment.

- Comparison with market indices and competitor performance: Comparing Tesla's stock performance with other EV companies and the broader market provides valuable context.

- Investor sentiment analysis based on trading volume: Analyzing trading volume helps to understand the strength of the buying and selling pressure on Tesla’s stock.

Analyst Reactions and Future Outlook

Financial analysts offered varied opinions on Tesla's future performance following the Q1 earnings decline. Some expressed concerns about the company's profitability, while others remained optimistic about its long-term growth potential.

- Summary of key analyst reports and recommendations: Collating analyst reports and recommendations provides a balanced perspective on Tesla's future.

- Analysis of consensus forecasts for future earnings: Examining consensus forecasts helps gauge market expectations for Tesla’s future financial performance.

- Discussion of potential risks and opportunities for Tesla: Highlighting potential risks and opportunities facing Tesla is essential for a comprehensive outlook.

Conclusion

This article examined the multifaceted factors behind Tesla's Tesla Q1 Earnings Decline, including price reductions, supply chain challenges, increased operating costs, and the significant influence of Elon Musk's leadership and public image. The subsequent market reaction, including stock price fluctuations and varied analyst opinions, underscores the complexity of the situation. The Tesla Q1 Earnings Decline highlights the challenges facing even industry leaders in a rapidly evolving and competitive market.

Call to Action: Stay informed about the evolving situation surrounding Tesla's financial performance by regularly checking for updates on the Tesla Q1 Earnings Decline. Understanding these trends is crucial for investors and anyone following the electric vehicle market.

Featured Posts

-

Strong Emerging Market Performance Contrasts With Us Stock Decline

Apr 24, 2025

Strong Emerging Market Performance Contrasts With Us Stock Decline

Apr 24, 2025 -

Broadcoms V Mware Acquisition At And T Reports A 1 050 Price Hike

Apr 24, 2025

Broadcoms V Mware Acquisition At And T Reports A 1 050 Price Hike

Apr 24, 2025 -

Ai Transforms Repetitive Scatological Documents Into Insightful Podcasts

Apr 24, 2025

Ai Transforms Repetitive Scatological Documents Into Insightful Podcasts

Apr 24, 2025 -

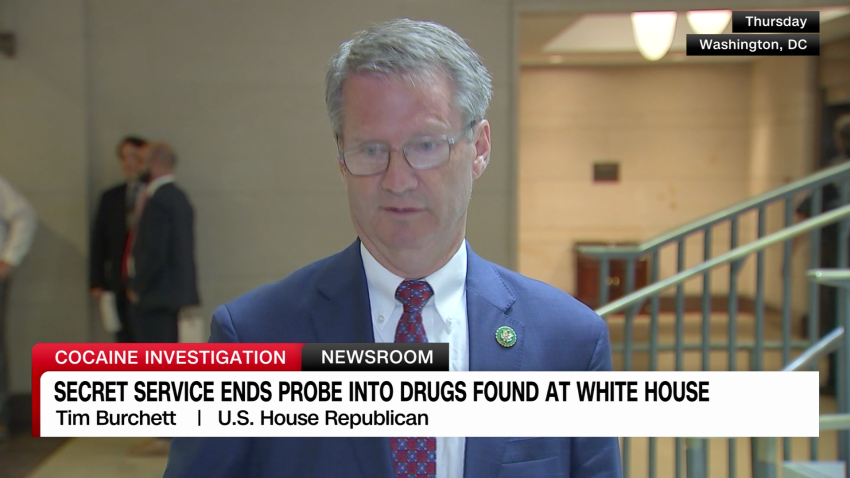

Secret Service Investigation Into White House Cocaine Incident Ends

Apr 24, 2025

Secret Service Investigation Into White House Cocaine Incident Ends

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025