The Impact Of Reduced Non-Essential Spending On Credit Card Companies

Table of Contents

Reduced Revenue Streams for Credit Card Companies

Reduced non-essential spending directly translates to lower revenue for credit card companies in several key ways.

Lower Transaction Volume

Less spending means fewer transactions processed by credit card companies, directly impacting their interchange fees – the fees merchants pay for each transaction. Non-essential spending categories like dining out, entertainment, and travel contribute significantly to credit card transaction volume. A recent study showed a 15% decrease in restaurant spending and a 20% drop in travel expenses in the last quarter, directly impacting credit card transaction volumes.

- Dining Out: Restaurants rely heavily on credit card transactions. Reduced dining out translates to fewer transactions for credit card companies.

- Entertainment: Movie tickets, concerts, and sporting events all contribute significantly to credit card usage. Reduced attendance leads to lower transaction volumes.

- Travel: Airfare, hotels, and rental cars are major sources of credit card transactions. A decrease in travel significantly impacts credit card companies' revenue.

These decreases in spending in key sectors have a direct and measurable impact on the bottom line of credit card companies, leading to significant revenue shortfalls.

Impact on Annual Fees and Other Revenue Sources

The impact extends beyond transaction fees. Premium credit cards often generate revenue through annual fees. As consumers face budget constraints, many are downgrading to less expensive cards or canceling them altogether, resulting in a loss of this crucial revenue stream.

- Travel Insurance: Premium cards often include travel insurance, a benefit many consumers might forgo during an economic downturn.

- Airport Lounge Access: Features like airport lounge access are often less appealing when budgets are tight.

- Concierge Services: Luxury services offered by premium cards see decreased usage during economic uncertainty.

Data from previous economic downturns shows a clear correlation between economic hardship and a decrease in premium card membership, indicating a further reduction in revenue for credit card companies.

Decreased Interest Income

Reduced non-essential spending also significantly impacts credit card companies' interest income.

Lower Credit Card Balances

Less spending leads to lower outstanding balances on credit cards, directly reducing the interest income credit card companies earn. Credit card interest accrues on the outstanding balance; lower balances mean lower interest payments.

- Interest Accrual Mechanics: Interest is typically calculated daily on the outstanding balance and added to the account.

- Repayment Behavior: Consumers may be more inclined to pay down balances completely or make larger minimum payments due to economic pressure.

This results in a decline in a major revenue source for credit card companies.

Increased Defaults and Delinquencies

As consumers struggle financially, the risk of increased credit card defaults and delinquencies rises sharply. This poses a significant challenge to credit card companies.

- Increased Delinquency Rates: Missed or late payments lead to increased delinquency rates, impacting the creditworthiness of cardholders and the profitability of credit card companies.

- Charge-Offs and Write-Downs: When borrowers default, credit card companies experience charge-offs, which reduce profitability and increase risk.

Historically, economic downturns have shown a strong correlation between increased unemployment and rising credit card default rates, indicating a significant threat to the financial health of credit card companies.

Strategic Responses from Credit Card Companies

Faced with the challenges of reduced non-essential spending, credit card companies are implementing several strategic responses.

Aggressive Marketing and Promotions

To stimulate spending, credit card companies are employing aggressive marketing and promotional strategies. These include:

- Cashback Rewards: Increased cashback offers incentivize consumers to spend more on their credit cards.

- 0% APR Periods: Promotional periods with 0% annual percentage rates entice consumers to make purchases and delay interest payments.

- Targeted Discounts: Partnerships with merchants to offer discounts to cardholders.

Product Diversification

Credit card companies are exploring opportunities to diversify their product offerings beyond traditional credit cards to reduce reliance on volatile spending patterns. This may involve:

- Financial Planning Services: Offering budgeting tools and financial advice to retain customers and provide additional revenue streams.

- Investment Products: Integrating investment options to cater to a broader range of customer financial needs.

- Payment Processing for Businesses: Expanding into merchant services to reduce reliance solely on consumer spending.

Cost-Cutting Measures

To offset reduced revenue, credit card companies are implementing various cost-cutting measures including:

- Workforce Reductions: Reducing staffing levels through layoffs or hiring freezes.

- Operational Efficiencies: Implementing technologies to automate processes and reduce operational costs.

- Negotiating Lower Fees with Merchants: Seeking to reduce interchange fees to maintain profitability.

Conclusion

Reduced non-essential spending significantly impacts credit card companies’ revenue streams, interest income, and overall profitability. The decrease in transaction volumes, lower credit card balances, and the potential for increased defaults pose serious challenges. In response, credit card companies are aggressively pursuing marketing initiatives, diversifying product offerings, and implementing cost-cutting measures to navigate this challenging economic climate. Stay informed about the evolving impact of reduced non-essential spending on credit card companies and understand how economic shifts affect the credit card industry’s future.

Featured Posts

-

Rep Nancy Mace And A South Carolina Voter Details Of A Public Confrontation

Apr 24, 2025

Rep Nancy Mace And A South Carolina Voter Details Of A Public Confrontation

Apr 24, 2025 -

Ice Blocks Columbia Student Mahmoud Khalil From Witnessing Sons Birth

Apr 24, 2025

Ice Blocks Columbia Student Mahmoud Khalil From Witnessing Sons Birth

Apr 24, 2025 -

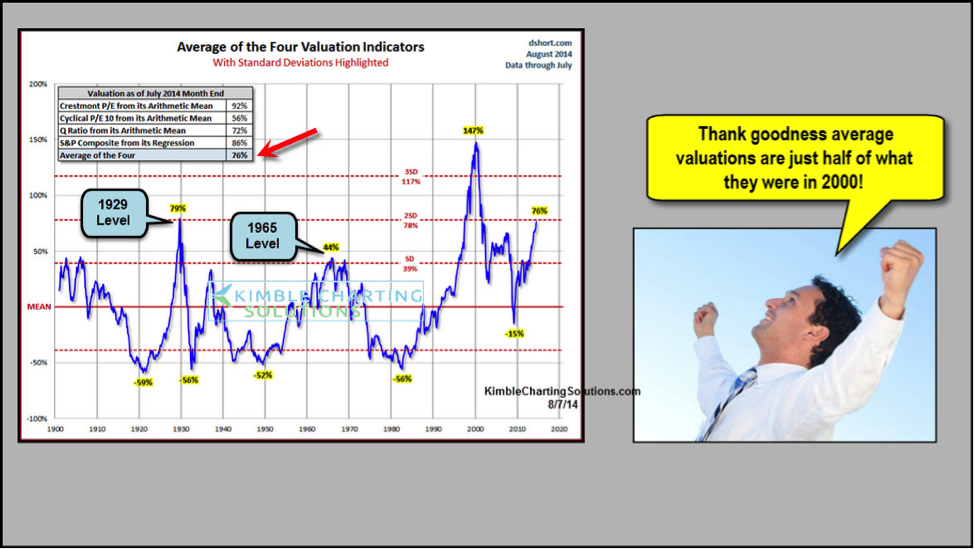

Addressing Investor Concerns Bof A On High Stock Market Valuations

Apr 24, 2025

Addressing Investor Concerns Bof A On High Stock Market Valuations

Apr 24, 2025 -

How Middle Management Drives Productivity And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Productivity And Employee Satisfaction

Apr 24, 2025 -

The Rise Of Wildfire Betting Examining The Los Angeles Case

Apr 24, 2025

The Rise Of Wildfire Betting Examining The Los Angeles Case

Apr 24, 2025