Tracking The Market: Dow, S&P 500, And Nasdaq - April 23rd

Table of Contents

Dow Jones Industrial Average Performance on April 23rd

Opening, High, Low, and Closing Prices

The Dow Jones Industrial Average (DJIA) opened at 33,820.14. Throughout the day, it experienced fluctuations, reaching a high of 33,905.72 and a low of 33,750.31 before closing at 33,851.75. Keywords: Dow Jones Industrial Average, Dow Jones Index, Dow performance, DJIA, stock market indices, stock market trends

Percentage Change and Volume Traded

The Dow showed a modest increase of approximately 0.09% on April 23rd. While this represents a relatively small daily gain, the volume traded was significantly higher than the average for the previous week, suggesting increased investor activity and potential underlying uncertainty.

- Specific details of the Dow's performance: A gain of 31.61 points.

- Significant contributing factors: The unexpected inflation data release fueled uncertainty regarding future interest rate hikes by the Federal Reserve. Concerns about potential recessionary pressures also played a role.

- Analysis of the Dow's behavior: The Dow exhibited a pattern of consolidation throughout the day, with relatively narrow price swings compared to previous sessions.

S&P 500 Performance on April 23rd

Opening, High, Low, and Closing Prices

The S&P 500 opened at 4,140.06, reached a high of 4,152.82, and a low of 4,133.19, eventually closing at 4,147.60. Keywords: S&P 500 index, S&P 500 performance, S&P 500 stocks, broad market index, market capitalization

Percentage Change and Volume Traded

The S&P 500 exhibited a slightly stronger performance compared to the Dow, closing with a gain of approximately 0.18%. Trading volume also showed a similar increase, mirroring the activity seen in the Dow.

- Specific details of the S&P 500's performance: A gain of 7.54 points.

- Sector-specific performance: The energy sector showed relatively strong performance due to rising oil prices, while the technology sector experienced some profit-taking, contributing to the overall index's slightly more modest gains than the previous day.

- Comparison with the Dow: The S&P 500 outperformed the Dow Jones Industrial Average on April 23rd, reflecting a broader market sentiment.

Nasdaq Composite Performance on April 23rd

Opening, High, Low, and Closing Prices

The Nasdaq Composite opened at 12,110.68, hit a high of 12,198.31, and a low of 12,080.96 before closing at 12,157.80. Keywords: Nasdaq Composite, Nasdaq performance, technology stocks, Nasdaq 100, growth stocks

Percentage Change and Volume Traded

The Nasdaq displayed the strongest percentage gain of the three major indices, closing at approximately 0.39% higher than its opening price. This positive performance was largely driven by the technology sector.

- Specific details of the Nasdaq's performance: A gain of 47.12 points.

- Performance of technology stocks: Large-cap technology stocks showed resilience, contributing significantly to the Nasdaq's positive performance.

- Comparison with the Dow and S&P 500: The Nasdaq outperformed both the Dow and S&P 500, highlighting the continued strength of the technology sector, even amidst broader market uncertainties.

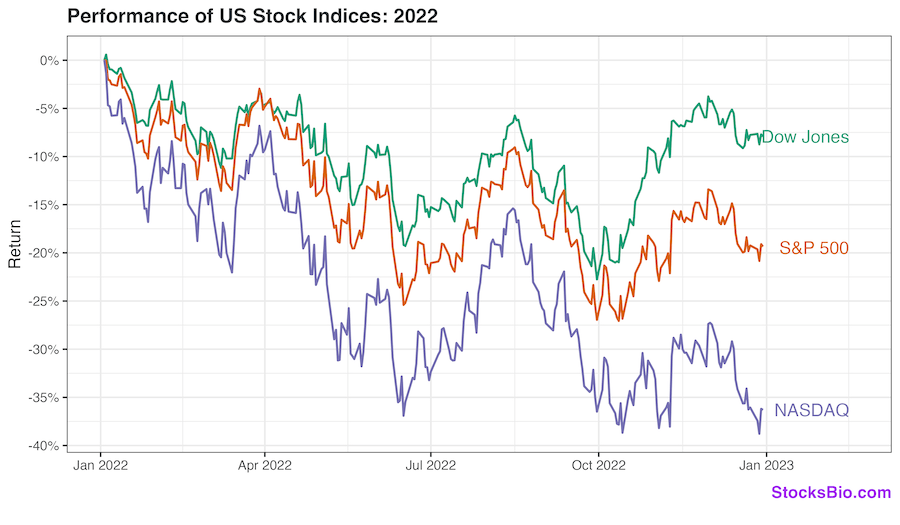

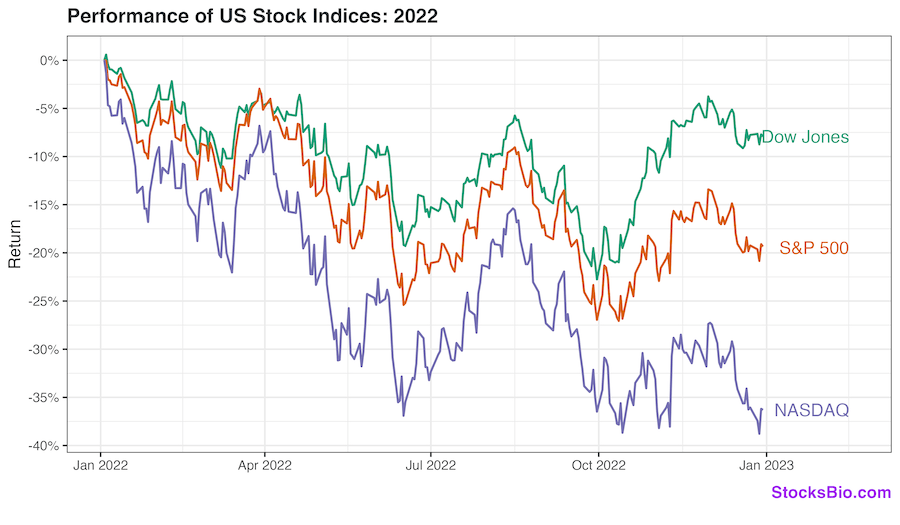

Correlation and Analysis of Dow, S&P 500, and Nasdaq on April 23rd

- Correlation between the three indices: All three indices showed positive movement on April 23rd, indicating a general positive market sentiment despite underlying uncertainties.

- Market interpretation: The market demonstrated a relatively bullish trend on April 23rd, overcoming early concerns stemming from the prior week's inflation data.

- Reasons for correlations or divergences: The relatively modest gains across all three indices suggest investors were cautiously optimistic, balancing positive earnings reports with anxieties about inflation and potential interest rate hikes.

Conclusion: Market Wrap-up: Dow, S&P 500, and Nasdaq - April 23rd

April 23rd saw a generally positive day for the US stock market, with the Nasdaq Composite leading the gains. All three major indices—Dow Jones Industrial Average, S&P 500, and Nasdaq Composite—showed modest increases, suggesting a cautiously optimistic market sentiment despite lingering concerns regarding inflation and potential recessionary pressures. The increased trading volume indicated heightened investor activity. While it’s impossible to predict future market movements with certainty, this day’s performance shows the resilience of the market even amidst economic uncertainty. For regular updates on market performance, return for future articles on “Tracking the Market: Dow, S&P 500, and Nasdaq.” Subscribe or follow us for daily or weekly updates!

Featured Posts

-

Sale Of Utac Chip Tester Under Consideration By Chinese Buyout Firm

Apr 24, 2025

Sale Of Utac Chip Tester Under Consideration By Chinese Buyout Firm

Apr 24, 2025 -

Trump Administration Immigration Policies Face Legal Challenges

Apr 24, 2025

Trump Administration Immigration Policies Face Legal Challenges

Apr 24, 2025 -

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025 -

Btc Price Increase Impact Of Trumps Policies On Cryptocurrency Market

Apr 24, 2025

Btc Price Increase Impact Of Trumps Policies On Cryptocurrency Market

Apr 24, 2025 -

Real Time Stock Market Data Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025

Real Time Stock Market Data Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025